Octopus Reversal Swing Forex Trading Strategy

Reversal strategies are probably one of the trickiest types of strategies. Traders are often trapped in a trade that doesn’t actually reverse or end up entering the market at the wrong time. Then, as you get shaken out of the trade, either through a stop loss or manually closing it, you see the market reverse. You not only lost money but you’ve also lost the opportunity to make money.

Reversal strategies are particularly tricky because it goes against the grain of a predominant trend. It is like seeing a cargo ship running at full speed and guessing exactly where it will stop. Unless you are an expert at that, it would be a tall order. The ship’s heavy weight and momentum would keep pushing it forward for quite some time before it could actually stop. That is what trends are like. Taking reversal trades on a trending market is like stepping in front of that cargo ship.

However, getting reversal trades right is also very rewarding. Because market reversals have the probability of being the start of a new trend, it also has the potential to travel the furthest distance. In forex, this means you’d have the most potential to earn more pips, or bps in other trading instruments.

So, how do we get reversal strategies right? How do we get to enjoy earning more pips while increasing the probability of a profitable trend reversal trade setup?

The answer, waiting for confirmation. Waiting for confirmation could mean different things to different traders. It could mean waiting for the reversal pattern to complete, waiting for a break or a certain level, waiting for a retest, or waiting for indicators to line up and point the same direction. Either way, with the right setup and strategy, waiting for confirmation dramatically increases the probability of a successful trend reversal setup.

Trading Strategy Concept

Reversal patterns and other forms of trend reversal setups do work, but it is somehow a bit subjective. With this strategy, we will be using a simple crossover setup with the confirmation of a couple of indicators that work well together.

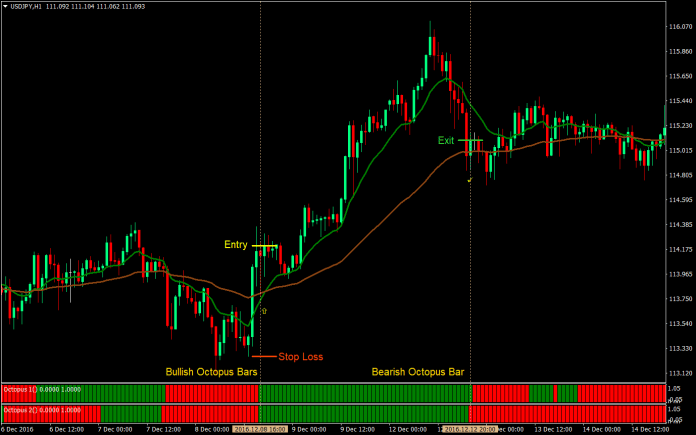

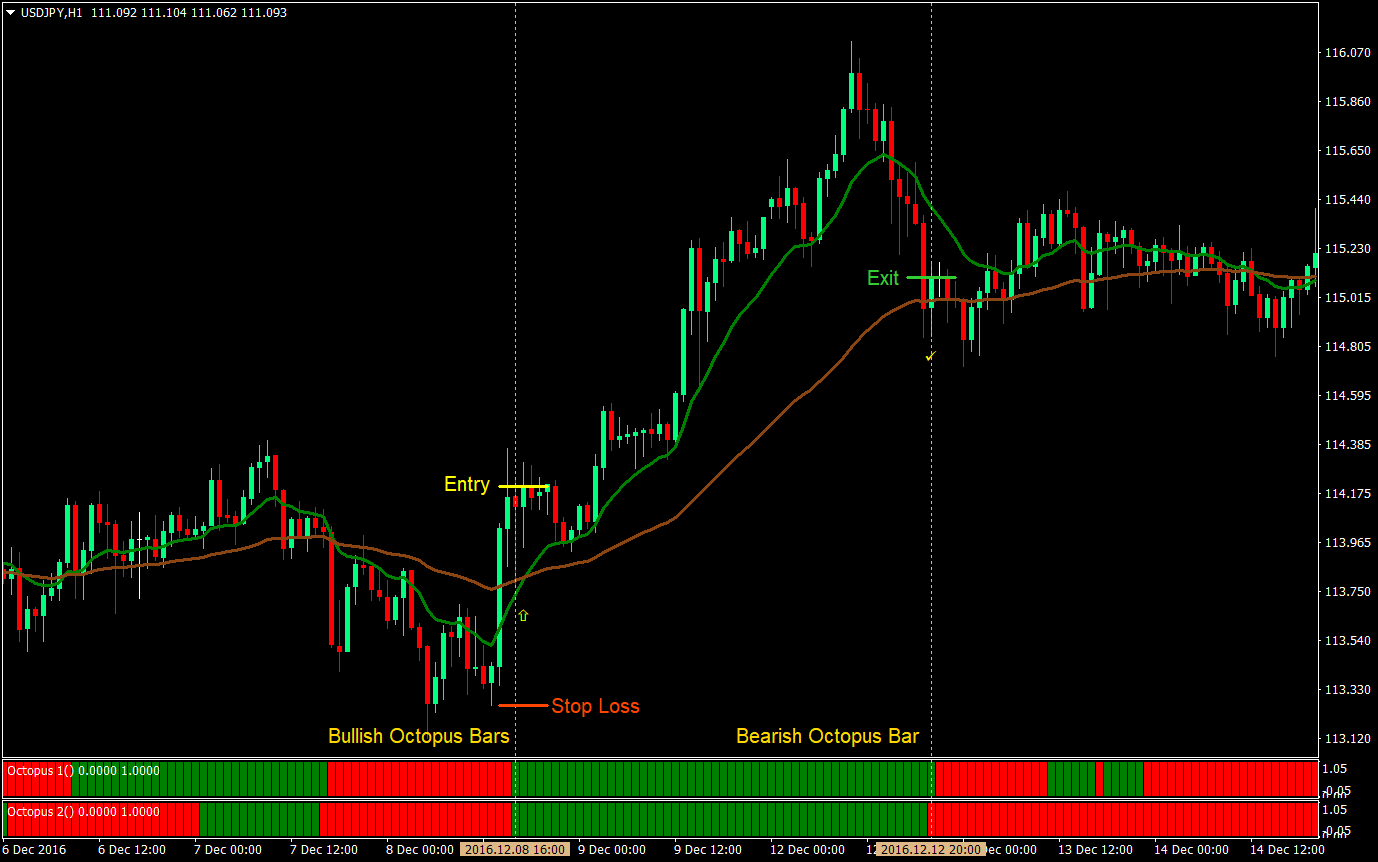

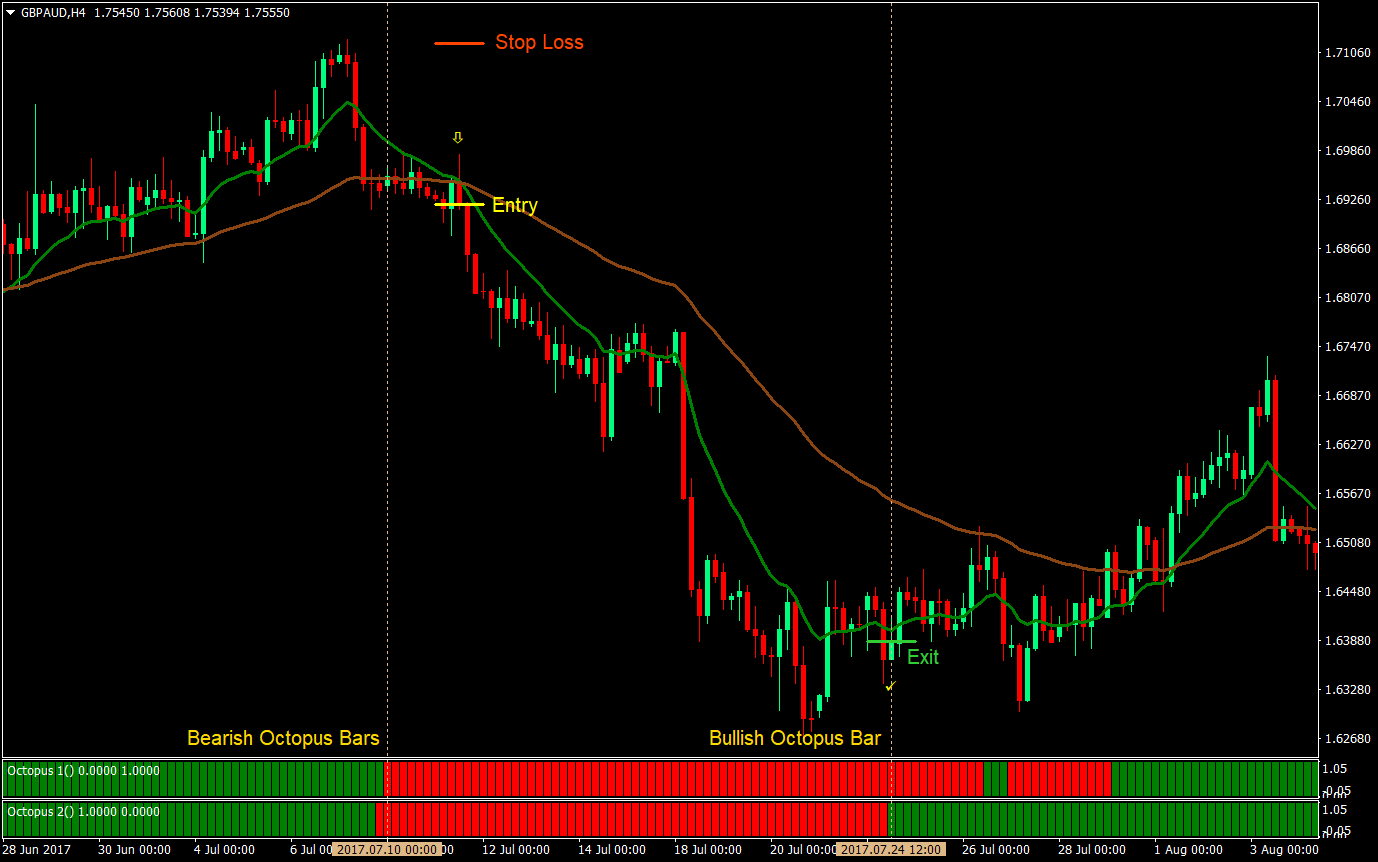

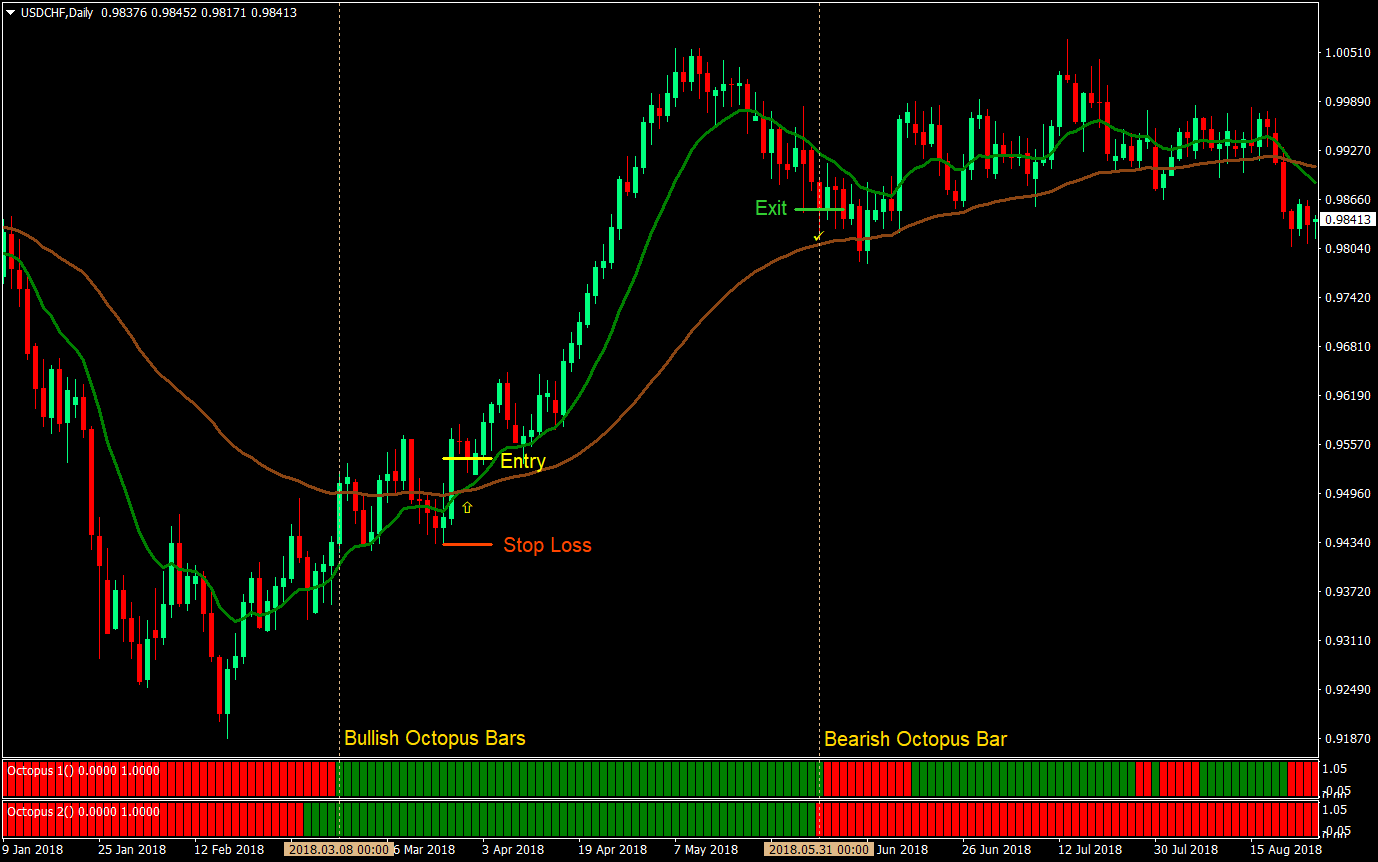

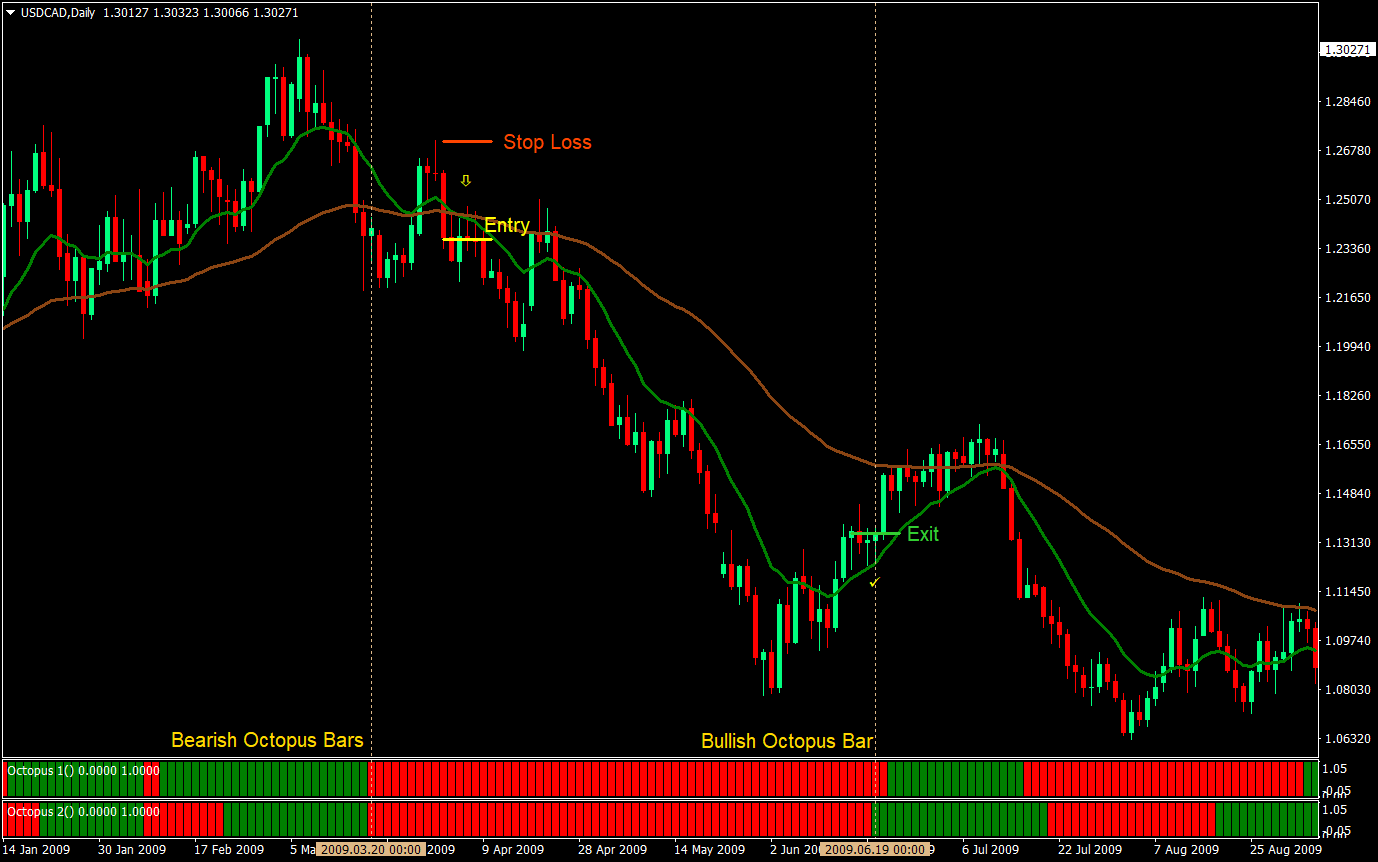

The indicators we would be using are the Octopus 1 and Octopus 2 custom indicator. These are indicators that attempts to point the trend direction bias of the market. These two indicators will serve as our primary trend direction filter. Green bars indicate a bullish market while red bars indicate a bearish market. To qualify as a trade setup, both indicators should point the same direction.

Then, for our actual entry point, we will be using the crossover of two Exponential Moving Averages (EMA), a 13-period and 55-period EMA. The crossover should be in agreement with the Octopus 1 and Octopus 2 indicator.

Indicators:

- Octopus 1 (default parameters)

- Octopus 2 (default parameters)

- 13-period EMA (green)

- 55-period EMA (brown)

Timeframe: 1-hour, 4-hours and daily timeframe

Currency Pairs: any

Trading Session: any

Buy (Long) Trade Setup

Entry

- The Octopus 1 and Octopus 2 custom indicators should be printing green bars indicating that the market has bullish tendencies

- Wait for the 13-period EMA to cross above the 55-period EMA

- Enter a buy market order at the close of the candle corresponding to the crossover

Stop Loss

- Set the stop loss at the swing low below the entry candle

Exit

- Manually close the trade at the close of the candle corresponding to the change of color of any of the Octopus custom indicators from green to red

Sell (Short) Trade Setup

Entry

- The Octopus 1 and Octopus 2 custom indicators should be printing red bars indicating that the market has bearish tendencies

- Wait for the 13-period EMA to cross below the 55-period EMA

- Enter a sell market order at the close of the candle corresponding to the crossover

Stop Loss

- Set the stop loss at the swing high above the entry candle

Exit

- Manually close the trade at the close of the candle corresponding to the change of color of any of the Octopus custom indicators from red to green

Conclusion

This reversal strategy is a variation of a crossover strategy. What sets this strategy apart is the Octopus custom indicators. Because of the filtering of these indicators, the trade setups tend to have a higher probability of success.

One weakness of most crossover strategies is that most typically close the trade at an opposing crossover signal. This is usually a little too late. It means you have given up a big chunk of the profits you’ve gained, and sometimes it is even at a loss. Because of this, the profits could sometimes not be sufficient enough to cover for the losses. This strategy’s exit however is also based on the Octopus indicator. Because we are exiting the trade on the reverse indication of any of the Octopus indicators, we are exiting the trade earlier than the actual crossover. This allows us to retain much of the profit while having the ability to let the profits run if the market trends strongly.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: