The London session’s open is full of opportunities. This is due to the inherent characteristics of the London open which allows traders to make the most bang for their buck. The London Box Reversal trading strategy is one which makes profits out of the forex market caused by reversals during the London open.

Prior to the London open, the Tokyo market usually establishes or sets the tone for the trading day ahead. It could either be a directional move which results to a trending market, a flat and quiet market forming a range, or a continuation of the previous trading day’s direction.

Most of the time, traders from London would also take cues from traders in Tokyo as to where they feel the intraday move would be. However, the London open is a different beast in itself. Due to its sheer size, trading volume and volatility, the market could also make a drastic reversal during the London open. There are many instances wherein the trend established during the Tokyo session is completely ignored during the London open and reverses instantly. However, there are clues that could give us an idea if the market could reverse.

As said earlier, the Tokyo session would usually establish a range in which the market moves during that session. This is marked by the intraday high and low during the Tokyo session. Whenever price reaches these areas, price could react in a couple of ways. It could either breakout or bounce off since these intraday lows and highs are natural supports and resistances. This strategy makes money during times when the market would bounce off from these supports and resistances.

Forex Breakout Box

The Forex Breakout Box is a custom indicator made specifically for the London open’s potential to breakout of or bounce off from the Tokyo session’s range.

It marks the highest high and lowest low during the Tokyo session. These points mark the extremes of the Tokyo session’s range. The indicator that draws a crimson colored box marking the Tokyo session’s range. It then extends this area by creating another two boxes to identify the London session, one blue and another orange.

Trading Strategy Concept

This custom indicator is useful in most cases for GBP and EUR pairs. It could either be used for breakouts and reversals. For this strategy, we would focus mostly on reversals.

Often, as the market forms a range during the Tokyo session, the market would sometimes have a hard time breaking out of the Tokyo range. It would often have one or two visits on the area of the high. Then, as the London market opens, the market’s direction becomes clear. You would often see the market reverse almost instantly as the London session opens. For this strategy however, we will make use of a window of two hours. This means that the reversal setup should take shape within that span of time from the London open.

The reversal pattern is basically a pin bar which shows a rejection of the top or bottom of the box, relatively close to the start of the session. When zoomed out or placed on a higher timeframe, it would also usually form a variety of reversal patterns such as double tops and bottoms or triple tops and bottoms. As soon as we identify a pin bar pattern within the allotted window, we then take the trade as a reversal and aim for the other end of the range.

Indicators:

- forex-breakout-box

Timeframe: 5-min timeframe; zoom out to 15-minutes to check for a possible reversal pattern (optional)

Currency Pair: any EUR and GBP pairs; preferably EURUSD, GBPUSD, EURJPY and GBPJPY

Trading Session: London open only

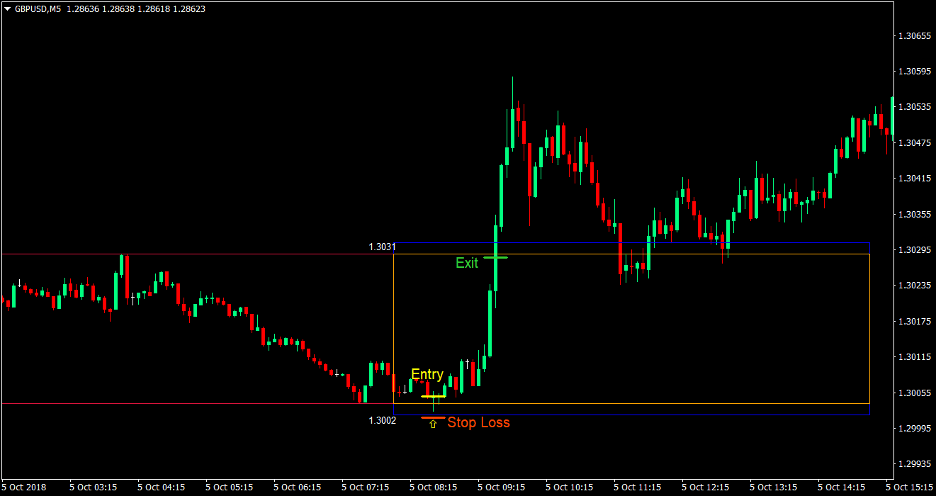

Buy (Long) Trade Setup

Entry

- Observe the market’s behavior during the end of the Tokyo session preferably showing inability to breakout our of a range

- Wait for price to touch the bottom of the orange rectangle

- Wait for price to form a bullish pin bar with the tail touching the support level

- Place a buy order as soon as the bullish pin bar forms

Stop Loss

- Set the stop loss below the entry candle and below the lower line of the blue rectangle

Take Profit

- Set the target take profit a few pips below the upper line of the orange rectangle

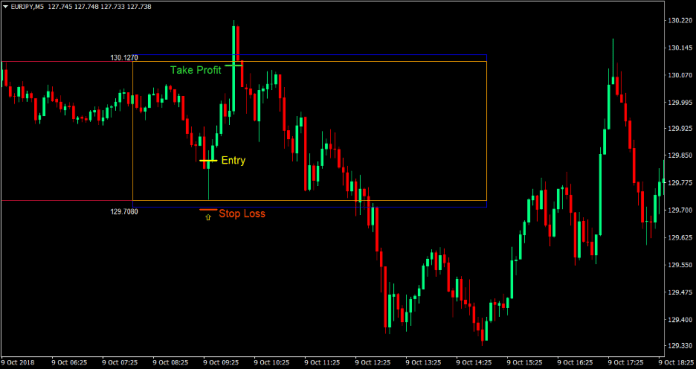

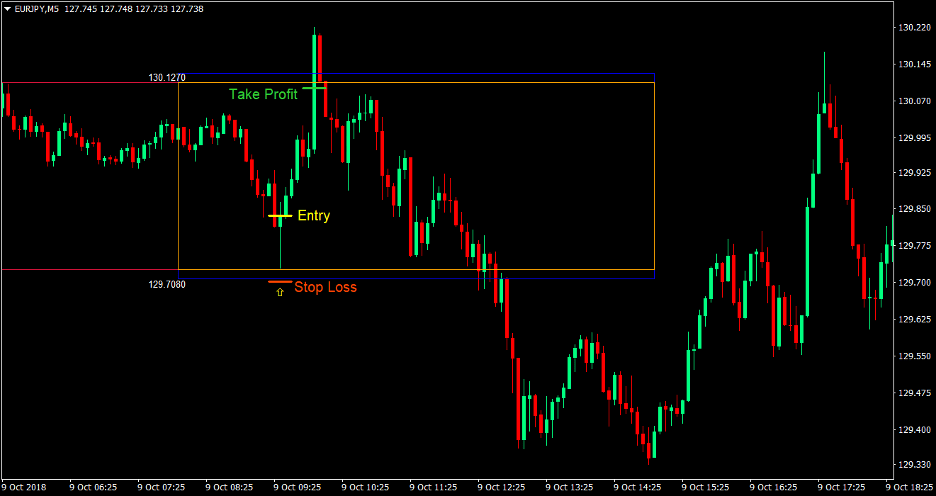

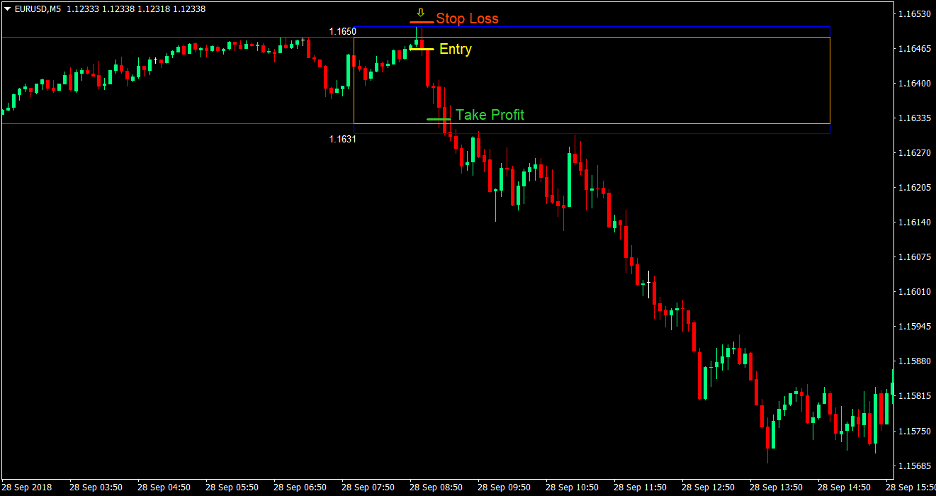

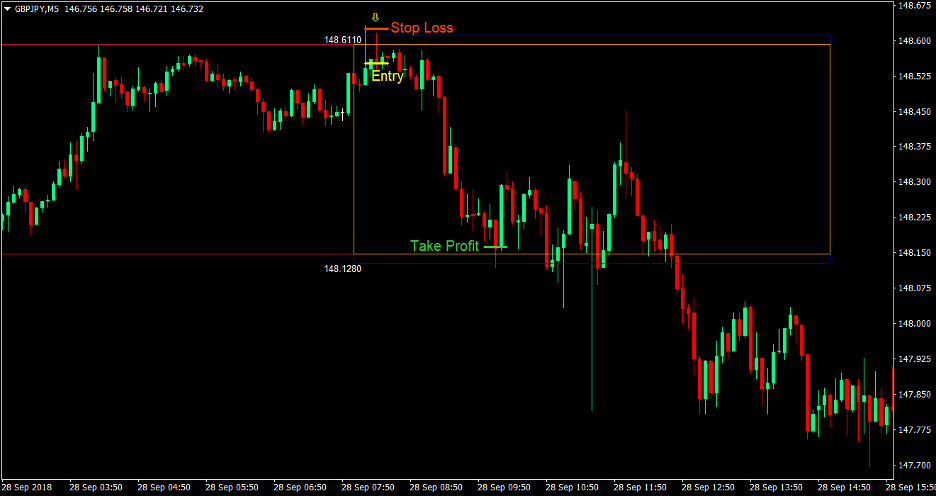

Sell (Short) Trade Setup

Entry

- Observe the market’s behavior during the end of the Tokyo session preferably showing inability to breakout our of a range

- Wait for price to touch the top of the orange rectangle

- Wait for price to form a bearish pin bar with the tail touching the resistance level

- Place a sell order as soon as the bearish pin bar forms

Stop Loss

- Set the stop loss above the entry candle and above the upper line of the blue rectangle

Take Profit

- Set the target take profit a few pips above the lower line of the orange rectangle

Conclusion

This strategy is the complete opposite of the usual London breakout strategy. Most traders would just take breakouts from the range formed during the Tokyo session. However, there are other traders who would actually trade the reversal using it as a basis for a range bound market setup.

The key to this strategy is that the reversal occurs at the beginning of the London open. This would indicate that traders in London are disagreeing with the positions taken by traders in Tokyo. This would also usually occur when there is a market whisper of a fundamental news that has leaked to the media which occurs on the London open. This would often cause a sudden reversal of direction, however this shouldn’t come as a shock to seasoned traders because this is usually preceded by the Tokyo market lacking volume to push the trade out a ranging condition. This could also lead to a reversal on the higher timeframe, which could mean bigger profits if the trade is held on even past the range.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: