The forex market is a very dynamic market. It never stays stagnant. In fact, it is one of the most volatile markets that traders can trade with over $5.1 trillion volume being traded daily. This sheer size in trading volume and transaction count causes the forex market to be constantly moving every second. Every transaction made by the thousands of traders around the world have an impact on price movements. This makes price movements seem so erratic at times. Some may even argue that price movements are impossible to predict.

Although most of the time price movements can be very difficult to predict, there are certain market conditions that are easier to decipher. One of these types of market is the trending market. During trending market conditions, prices tend to move in one general direction. There may be instances where price would retrace back to its mathematical mean, but it would usually bounce back towards the direction of the trend after reaching its average price.

Given that price is moving in one general direction during trending markets, this also means that traders have a statistical advantage if they would trade that market in the direction of the trend. This eliminates the question of which direction to trade that particular forex pair. The only question left to answer is when to trade.

We have mentioned earlier that price would usually bounce from its mathematical mean after a retracement. This means that moving averages are good areas to anticipate price to bounce. Moving averages or a pair of moving averages can be used as a dynamic area of support or resistance where traders can take trades in the direction of the trend.

Kijun-sen Dynamic Bounce Forex Trading Strategy is a trading strategy that trades in the direction of the trend using the concept of a dynamic area of support or resistance.

Kijun-sen

The Kijun-sen is a type of moving average line which is a part of the Ichimoku Kinko Hyo trading system or indicator. It is a vital part of the Ichimoku Kinko Hyo system because it is used to represent the mid-term trend direction. It is also used to identify trend reversal entry signals when paired with the Tenkan-sen line.

The Kijun-sen line is basically median of price within a 26-period coverage. It then plots a line connecting these median points. This creates a line that follows price action quite closely and is characteristically very jagged.

The Kijun-sen line is a great tool for traders to identify trend bias. Traders can identify the direction of the trend bias just by looking at how the Kijun-sen line is sloping.

When paired with another moving average line or the Tenkan-sen line, this indicator can also be used to identify high probability trend reversal points based on crossovers.

It can also be used as a dynamic area of support or resistance because price tends to bounce off its area after a retracement.

Awesome Oscillator

The Awesome Oscillator (AO) is a trend following technical indicator used to identify trend direction or trend bias and measure the strength or momentum of a trend.

The AO is computed as the difference between a 5-period Simple Moving Average (SMA) and a 34-period Simple Moving Average (SMA). However, instead of using the usual close of each period as a basis for the computation, it uses the median of each candle. The resulting figures are then plotted as histogram bars.

The direction of the bars indicates the trend direction bias, while the color of the bars indicates the strength of the momentum. Positive green bars indicate a strengthening bullish trend, while positive red bars indicate a weakening bullish trend. On the other hand, negative red bars indicate a strengthening bearish trend, while negative green bars indicate a weakening bearish trend.

Trading Strategy

This strategy is a trend following strategy that uses the area between the Kijun-sen+ line and a 30-period Exponential Moving Average (EMA) as a dynamic area of support or resistance.

First, traders should identify a trending market. This is based on how the lines are sloped and the characteristics of price action. The Awesome Oscillator should also serve as a trend bias confirmation based on whether the bars are consistently positive or negative.

Then, we wait for price to retrace towards the area between the two lines. As price is retracing towards the said area, the AO should temporarily reverse color indicating a weakening of the trend.

Then, as price bounces off the area with strong momentum based on price action and candlestick patterns, the AO should indicate the strengthening of the trend. This would confirm a valid trade setup.

Indicators:

- Kijun-sen+

- 30 EMA line

- Awesome

Preferred Time Frames: 30-minute, 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

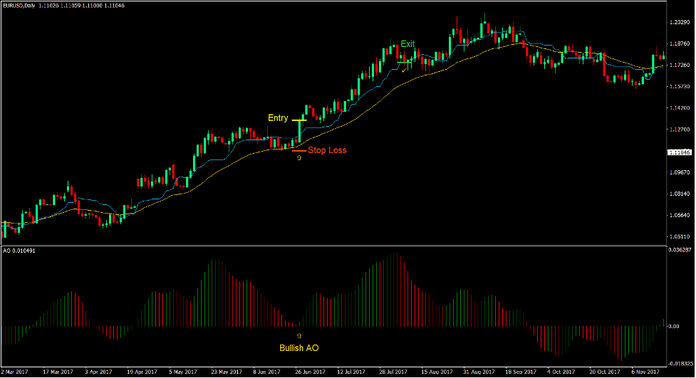

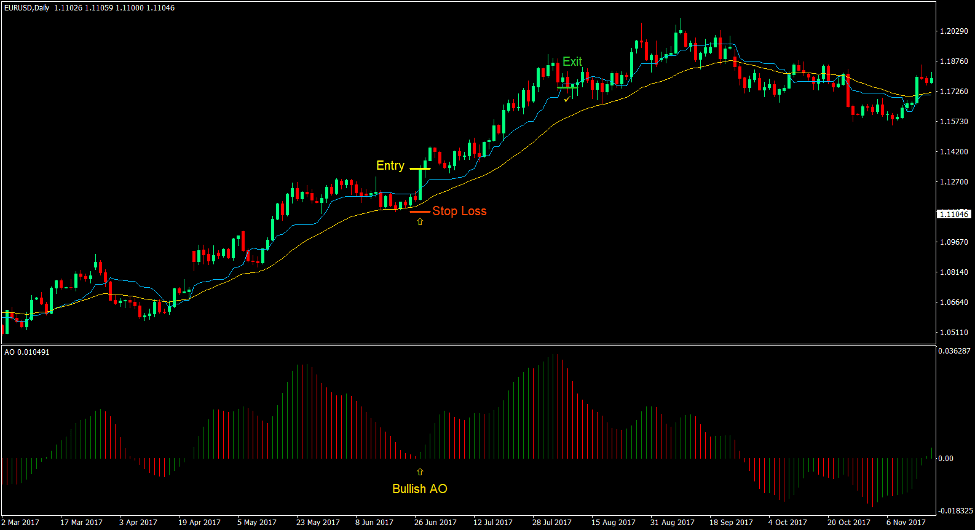

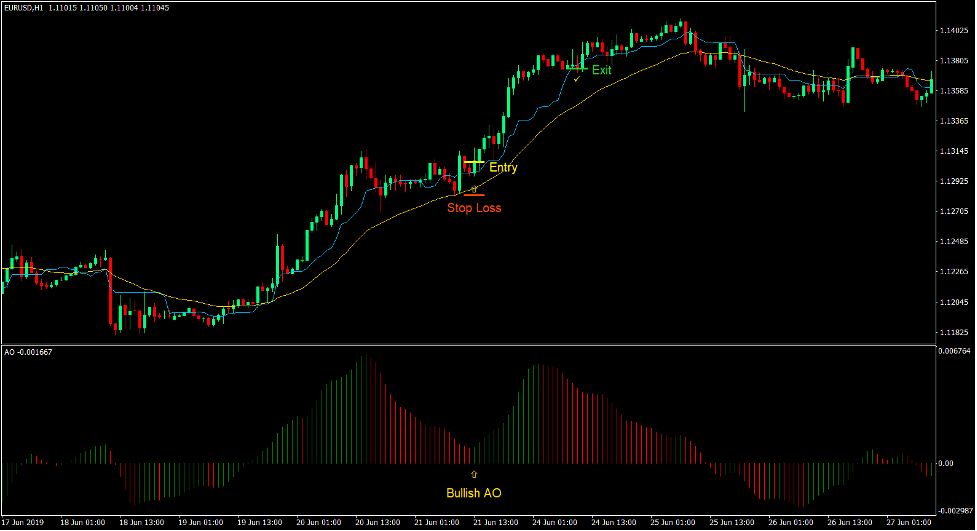

Buy Trade Setup

Entry

- The Kijun-sen+ line should be above the 30 EMA line.

- The 30 EMA line should slope up.

- The swing points of price action should be rising.

- The AO should be positive.

- Price should retrace towards the area between the Kijun-sen+ line and the 30 EMA line causing the AO to change to red.

- Price should bounce off the dynamic area of support with strong momentum.

- Enter a buy order as soon as the AO changes to green.

Stop Loss

- Set the stop loss on the support level below the entry candle.

Exit

- Close the trade as soon as a candle closes back inside the dynamic area of support.

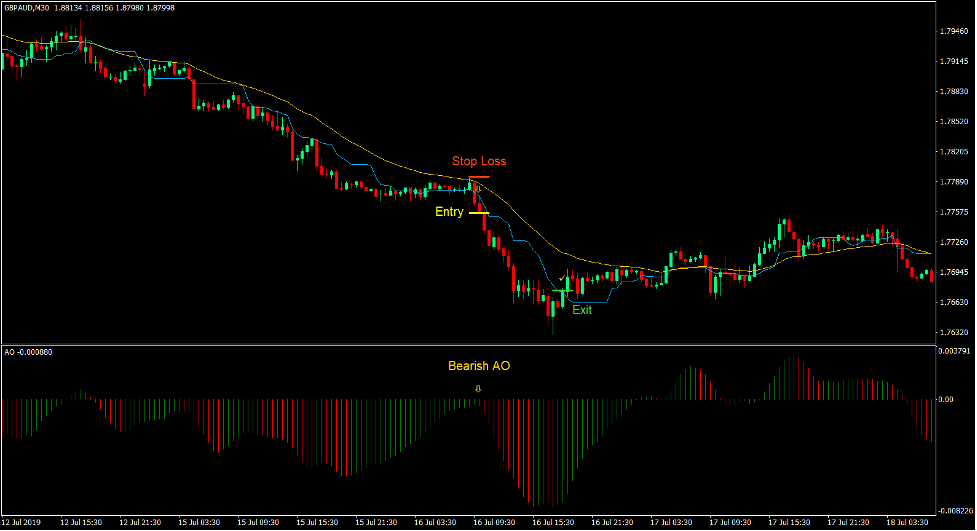

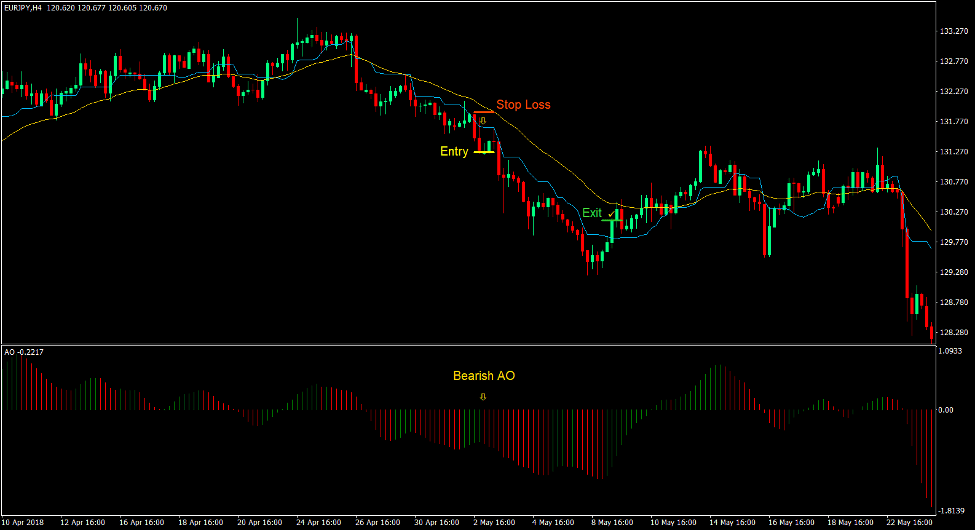

Sell Trade Setup

Entry

- The Kijun-sen+ line should be below the 30 EMA line.

- The 30 EMA line should slope down.

- The swing points of price action should be dropping.

- The AO should be negative.

- Price should retrace towards the area between the Kijun-sen+ line and the 30 EMA line causing the AO to change to green.

- Price should bounce off the dynamic area of resistance with strong momentum.

- Enter a sell order as soon as the AO changes to green.

Stop Loss

- Set the stop loss on the resistance level above the entry candle.

Exit

- Close the trade as soon as a candle closes back inside the dynamic area of resistance.

Conclusion

Trend following strategies that revolve around taking trades as price retraces to a mathematical mean just seems to work very well. This is because traders are doing two things that are vital for a good trend following strategy. First, we are trading with a strong trend. Second is that we are not chasing price, but instead we are allowing the market to give us a better entry price.

Using price action already works well as an entry signal. However, adding the confirmation of the AO increases the probability of trading with a strong trend or momentum.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: