Trending markets are very tricky. In a way, trending markets should be the easiest type of market that traders could trade. This is because in a trending market, momentum is usually on your side. Price tends to move in one general direction. Traders should easily know which direction the market is most likely moving to. This gives them the answer to a question that has only two options, which is up or down, buy or sell.

However, many traders still fail even when trading during a trending market. It is usually not that they got the trend direction wrong because most traders usually get that right. However, many traders fail to answer the second question correctly, which is when they should take a trade. Trading is not only a matter of making the right decision to buy or sell, it is also about timing. Even if a trader gets the trend direction right, if the trade was taken either at or near the end of the trend, then the trade would still result in a loss.

So, when should we take a trade? Although there is no one definite answer to this, but a good middle ground would be at a point where the market has retraced, yet it has also shown signs of resuming the trend direction. Imagine looking at a chart and seeing price trending up. You would know that you would want to buy, but you should also wait for a discount.

Heiken Ashi Moving Average

The HAMA indicator, which is short for Heiken Ashi Moving Average, is a trend following indicator which is a combination of the Heiken Ashi Candlesticks and moving averages.

The Heiken Ashi Candlesticks is a new way of charting wherein price candles are plotted not based on their true open and close prices but based on their average movements. The highs and lows are retained, form the wicks of the candle. This allows traders to identify the swing highs and swing lows effectively. However, the open and close of each candle is based on the average movement of price. This creates candlesticks that change color only when the momentum of price has shifted.

The Heiken Ashi Moving Average, more popularly known as Heiken Ashi Smoothed, is a variation of the Heiken Ashi Candlesticks, which is more closely related to the Exponential Moving Average. It does not resemble price action, instead it moves much like a moving average. It also plots bars with wicks. However, these bars and wicks does not represent price action. These bars shadow price action closely much like a good moving average does.

It also changes color only when the trend has clearly reversed. Blue bars indicate a bullish trend, while red bars indicate a bearish trend.

HAMA is a very reliable trend following indicator. It reliably indicates the trend direction and tends to produce good trend reversal signals based on the changing of the color of its bars.

ASC Trend

The ASC Trend indicator is a custom momentum indicator which is more of short-term trend reversal signal indicator.

The ASC Trend indicator conveniently plots arrows pointing the direction of the trend reversal.

Traders can use this indicator as a trend reversal entry trigger. Traders can confirm a trade setup and enter a trade based on the arrows plotted by the ASC Trend indicator, while being in confluence with another longer-term trend indicator.

Trading Strategy

Heiken Ashi Moving Average ASC Trend Forex Trading Strategy is a simple trend following strategy which utilizes the reliability of the HAMA indicator in identifying trend direction, as well as the accuracy of the ASC Trend indicator in identifying momentum-based entry signals.

In this strategy, trend direction is based on the color of the HAMA bars, as well as its relationship with the 50-period Exponential Moving Average (EMA) line. Trends are identified based on the location of the HAMA bars in relation to the 50 EMA line.

Then, as soon as we identify the trend direction, we wait for price to retrace towards the HAMA bars. The entry signal is then identified based on the arrow plotted by the ASC Trend indicator.

Indicators:

- ASCTrend1i

- HAMA_

- 50 EMA

Preferred Time Frames: 15-minute, 30-minute, 1-hour and 4-hour charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

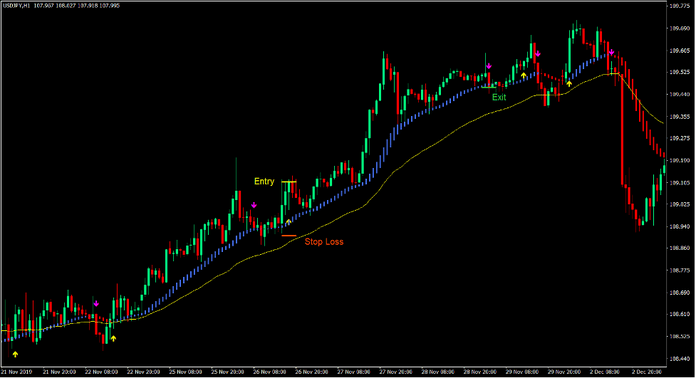

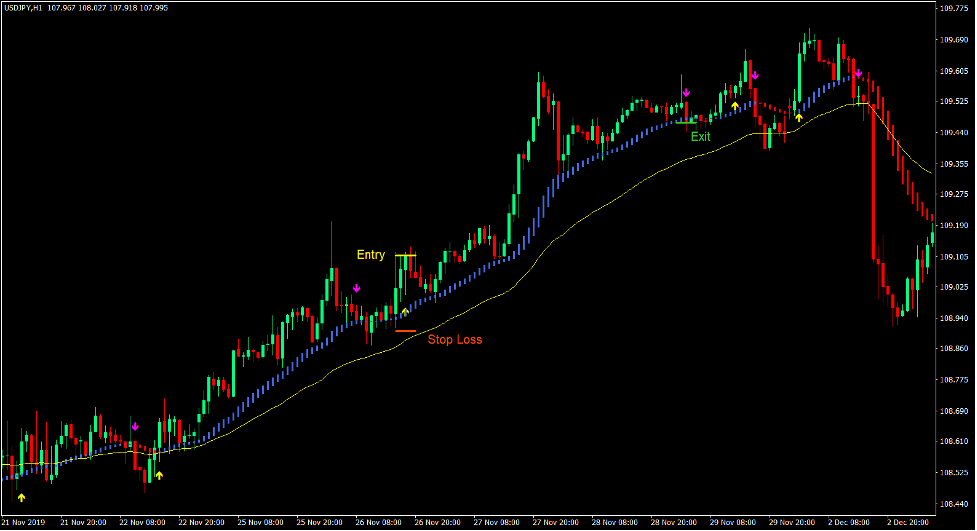

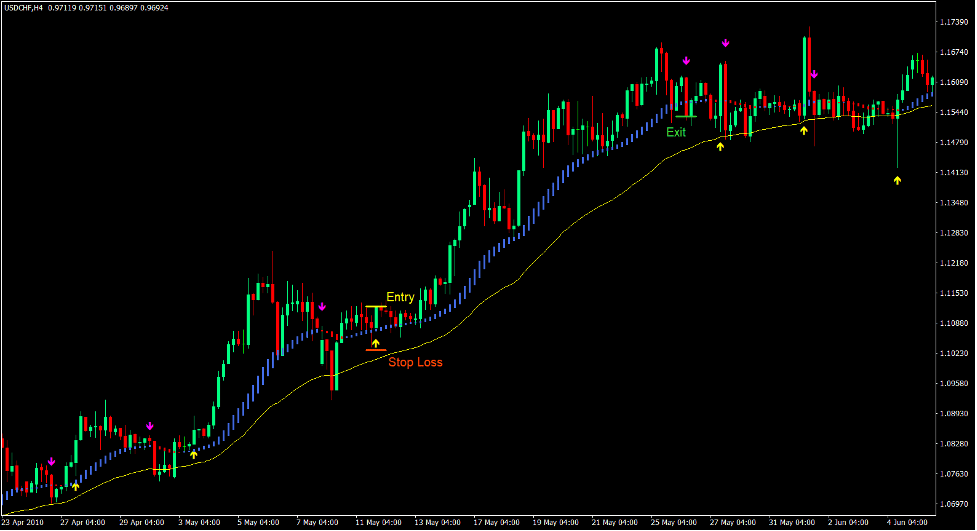

Buy Trade Setup

Entry

- The HAMA bars should be above the 50 EMA line.

- The HAMA bars should be blue.

- Price should retrace towards the HAMA bars.

- The ASC Trend indicator should plot an arrow pointing up.

- Enter a buy order on the confirmation of these conditions.

Stop Loss

- Set the stop loss on the support below the entry candle.

Exit

- Close the trade as soon as the ASC Trend indicator plots an arrow pointing down.

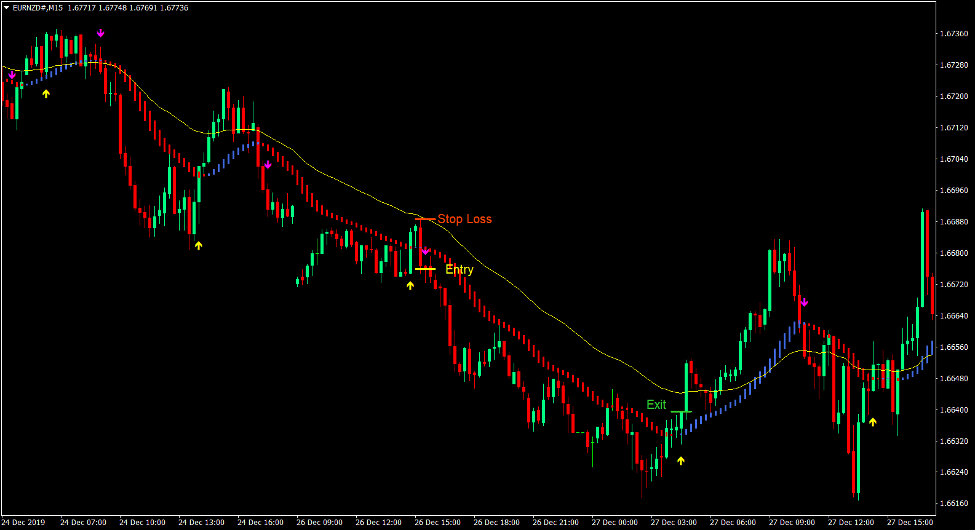

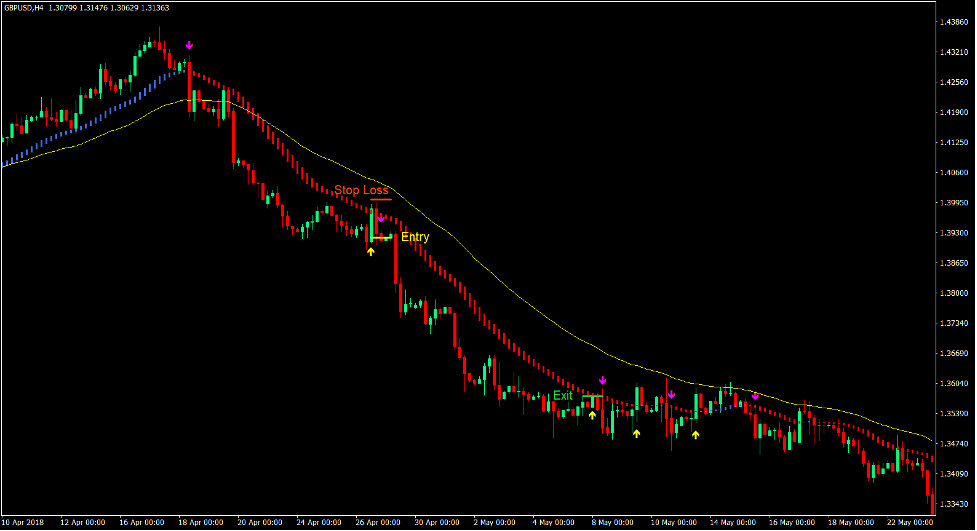

Sell Trade Setup

Entry

- The HAMA bars should be below the 50 EMA line.

- The HAMA bars should be red.

- Price should retrace towards the HAMA bars.

- The ASC Trend indicator should plot an arrow pointing down.

- Enter a sell order on the confirmation of these conditions.

Stop Loss

- Set the stop loss on the resistance above the entry candle.

Exit

- Close the trade as soon as the ASC Trend indicator plots an arrow pointing up.

Conclusion

This trading strategy is an excellent trend following strategy which could produce yields with a relatively high risk-reward ratio.

HAMA bars tend to stay with the trend and would usually not be affected to errant price spikes. This allows traders to hold on to trades much longer until the end of a trend. The open-ended nature of the trade setups produced by this strategy allows traders to earn more whenever trends last longer.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: