Which one would you prefer, high probability trades that are traded only a few times, or relatively lower probability trades that could be taken multiple times in a day? There is no right or wrong answer with this question. It all boils down to what type of trader you are. If you are the type of trader who is patient enough to wait for a setup, then you could go for that one high probability trade. On the other hand, if you are the type of trader who wants speed and action, then you could opt to take as many trades as you can.

The Gioteen Norm Forex Trading Strategy however is the type that would only allow for very few trades, yet these trades are relatively high probability trades. These trades are based on deep retraces that occur only once in a while. However, these trades are where momentum trend trading and trend reversal meet. This are trend reversals on the mid-term but still adhere to the trend of the long-term.

The Gioteen Norm Indicator

The Gioteen Norm indicator is a custom oscillating indicator that represents normalized price. It is a rather simple oscillating indicator which is unbounded and oscillates with a midline of zero. This allows the indicator to mimic the movement of price action quite closely.

The Gioteen Norm’s trend direction could be based on whether its current level is at negative or positive. If price came from negative territory and has crossed to the positive territory, it would be considered a probable start of a bullish trend. On the other hand, if price came from the positive territory going down, then it may be the start of a bearish trend.

The Signal Line Indicator

The Signal Line indicator is another rather simple trend following indicator. It is based on a modified moving average that is somehow smoothened out.

Moving averages could be used as trend indicators using different methods. Some simplistically determine the trend based on the location of price in relation to the moving average. Others base it on the stacking of two or more moving averages. Another rather simple way of determining trend using indicators is by determining the direction of its slope. If the moving average is sloping up, then the trend would be bullish. If the moving average is sloping down, then the trend is considered bearish.

The Signal Line indicator determines trend based on the slope of its line. If it is sloping up, it starts painting a lime line. On the other hand, if it starts sloping down, it changes to red.

Trading Strategy Concept

This strategy is a deep retrace strategy which aligns with the long-term trend with entry signals based on the confluence of the Gioteen Norm indicator and the Signal Line indicator.

To determine the long-term trend, we will be using the 200-period Exponential Moving Average (EMA), which is a commonly used long-term trend indicator. The 200 EMA is usually rather flat due to the length of the period it covers. Although we could technically determine the direction of the trend based on the slope of the 200 EMA, we will just be using the location of price and the Signal Line in relation to the 200 EMA as a determinant of trend direction. Only trade setups that agree with the direction of the long-term trend will be considered.

The entries will be based on the changing of the color of the Signal Line indicator and the crossing over of the Gioteen Norm indicator’s line over the midline. If these indicators are in agreement with the long-term trend, then we have a trade setup.

Indicators:

- 200 EMA (gold)

- oT_S_Ra-Signal_Line

- Gioteen-Norm

Timeframe: preferably 1-hour and 4-hour charts

Currency Pair: major and minor pairs only

Trading Session: Tokyo, London and New York sessions

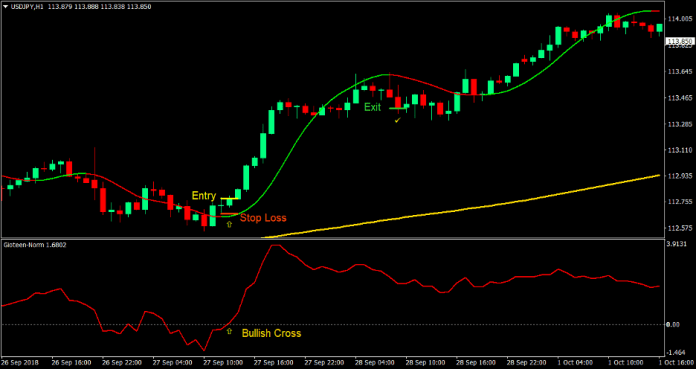

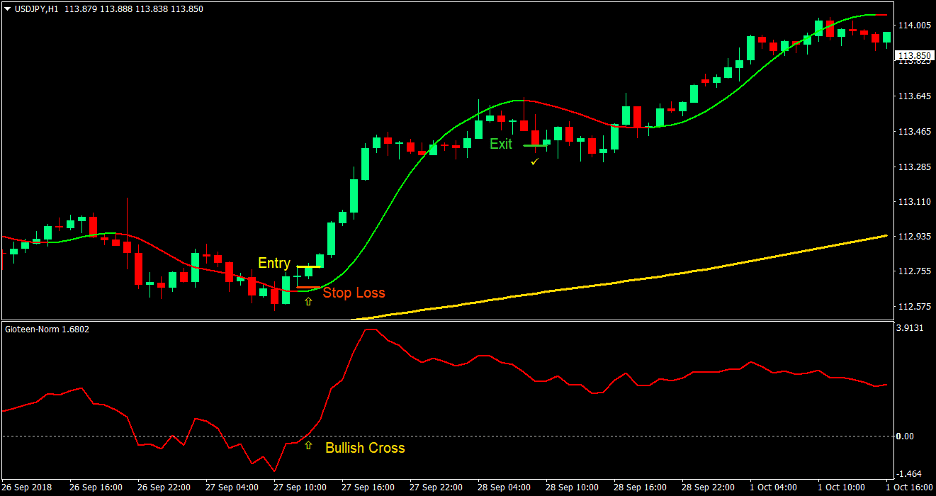

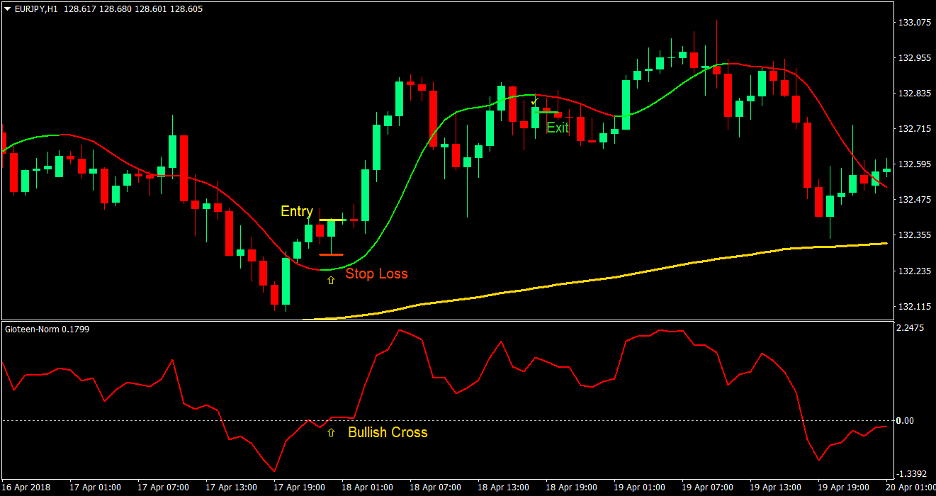

Buy (Long) Trade Setup

Entry

- Price should be above the 200 EMA indicating a bullish long-term trend

- The Signal Line should be above the 200 EMA

- The Gioteen Norm indicator’s line should cross above zero indicating the probable resumption of the bullish trend

- The Signal Line should change to lime indicating the change to a bullish trend

- Enter a buy order at the confluence of the above conditions

Stop Loss

- Set the stop loss at the lowest low of the last two candles

Exit

- Close the trade as soon as the Signal Line changes to red indicating the end of the bullish trend

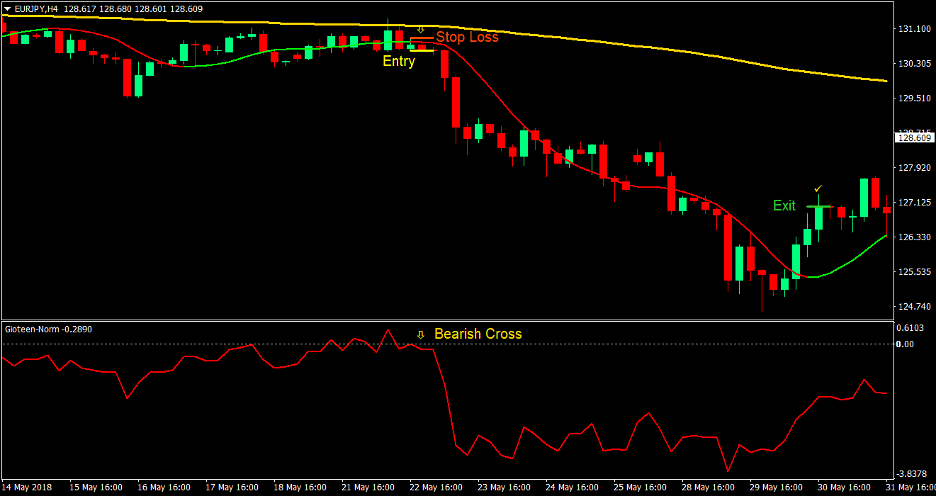

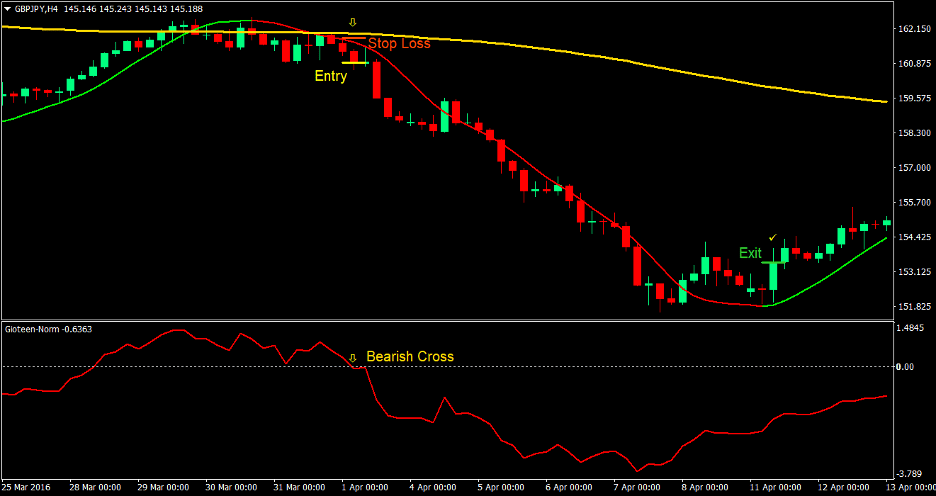

Sell (Short) Trade Setup

Entry

- Price should be below the 200 EMA indicating a bearish long-term trend

- The Signal Line should be below the 200 EMA

- The Gioteen Norm indicator’s line should cross below zero indicating the probable resumption of the bearish trend

- The Signal Line should change to red indicating the change to a bearish trend

- Enter a sell order at the confluence of the above conditions

Stop Loss

- Set the stop loss at the highest high of the last two candles

Exit

- Close the trade as soon as the Signal Line changes to lime indicating the end of the bearish trend

Conclusion

This strategy is a high probability strategy with trades that occur only once in a while. This is because the Gioteen Norm indicator’s line wouldn’t usually retrace deep enough to temporarily be on the opposite side of the midline, while still being in agreement with the long-term trend. However, when trade setup do occur, the are usually high probability trade setups that could yield high returns. Returns could be as high as 4:1 or even more.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: