Crossover strategies seem to be one of the most popular types of trading strategies. However, many traders have also experienced drawdowns when using crossover strategies. The key to being profitable with crossover strategies is in filtering out low probability crossover entries and taking only higher probability trade setups. All trading strategies, crossover strategies included, do experience a period of drawdowns. To overcome this, traders must be able to catch those some of those high yielding trades which do occur once in a while.

The Four Average Cross Forex Trading Strategy is a high probability trading strategy which makes use of entries based on high probability indicator signals. These signals also do tend to have a higher tendency to trend strongly, allowing traders to catch some of those high yield trades.

FRAMA Indicator

FRAMA stands for Fractal Adaptive Moving Average. This type of moving average is modified moving average developed by John Ehlers. The unique characteristics of FRAMA lies in its consideration of price ranges.

The FRAMA Indicator, compared to other moving averages, tends to follow price closely, yet also manages to stay flat whenever the market is in a ranging market condition. This makes it very suitable to crossover strategies since crossover strategies experience drawdown periods during ranging market conditions. By staying flat during such conditions, the FRAMA tends to produce less signals whenever the market is ranging.

Four Average Indicator

The Four Average Indicator is an oscillating indicator which produces signals based on moving averages.

Being a moving average band-based indicator, this custom oscillating indicator is inherently a high probability indicator. Trend direction could be identified by observing the location of price in relation to a moving average. It could also be identified based on the location of a moving average in relation to another, or the stacking of a set of moving averages. You could test this for yourself by placing multiple moving averages with different period lengths on a chart. You would notice that when a moving average is stacked properly and fanning out, the market does tend to be trending strongly. The Four Average Indicator is based on this concept.

Having multiple moving averages point towards the same trend direction, trade setups using the Four Average Indicator do seem to have a higher probability.

Trading Strategy

The Four Average Cross Forex Trading Strategy is based on the confluence of signals using the crossover of the FRAMA indicator and a 28-period Simple Moving Average (SMA), and the signals produced by the Four Average Indicator.

The FRAMA and 28 SMA crossover is a simple crossover strategy which is based on the mid-term. However, when combined with the Four Average indicator, trading setups tend to have a higher probability. This is because the signals produced by the Four Average indicator is also based on a crossover. Not just any crossover, but a crossover based on four moving averages.

Indicators:

- FRAMA

- Period FRAMA: 21

- 28 SMA

- fouraverage-indicator

- PeriodFA: 65

Timeframe: 1-hour, 4-hour and daily timeframes

Currency Pairs: major and minor pairs

Trading Session: Tokyo, London and New York

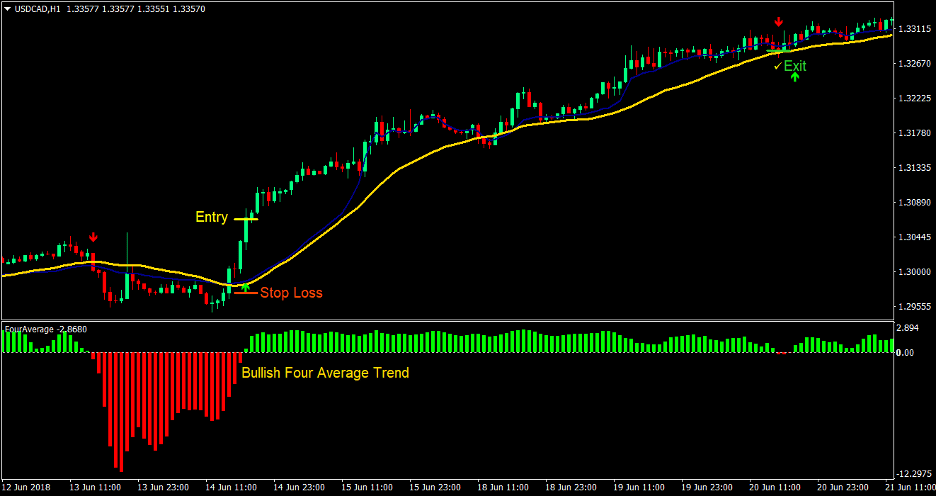

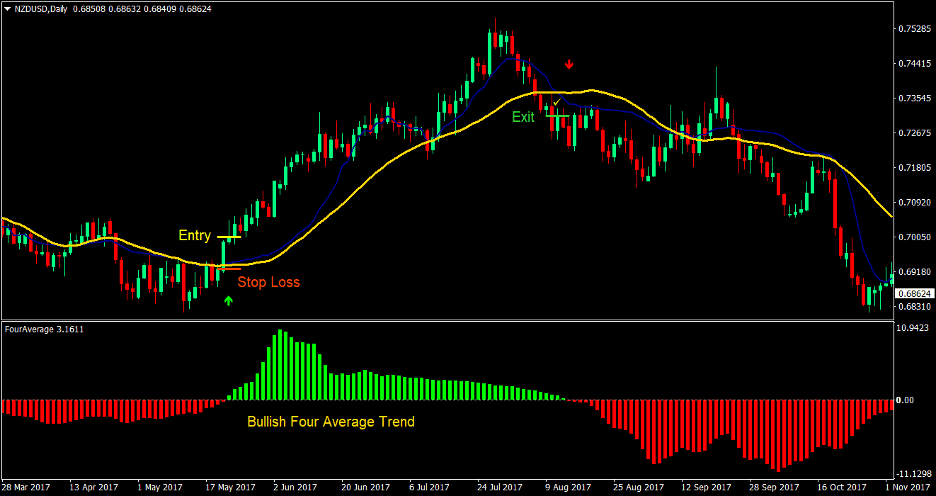

Buy Trade Setup

Entry

- The FRAMA line should cross above the 28 SMA indicating a possible bullish trend reversal

- The Four Average Indicator should change to a positive lime bar and should print an arrow pointing up indicating a possible bullish trend reversal

- The above-mentioned entry signals should be somewhat aligned

- Enter a buy order on the confluence of the above conditions

Stop Loss

- Set the stop loss below the moving averages

Exit

- Close the trade if the FRAMA line crosses below the 28 SMA

- Close the trade if the Four Average indicator changes to a red bar and prints an arrow pointing down

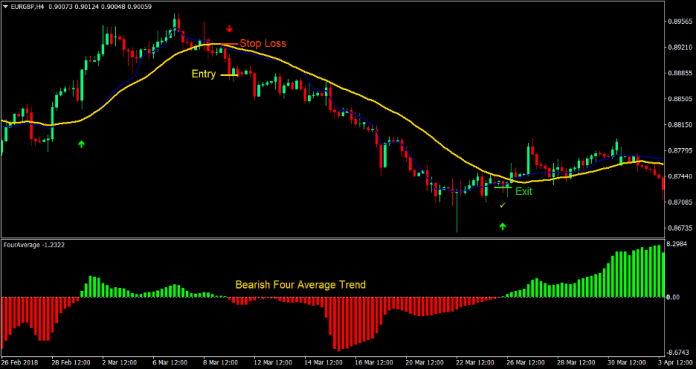

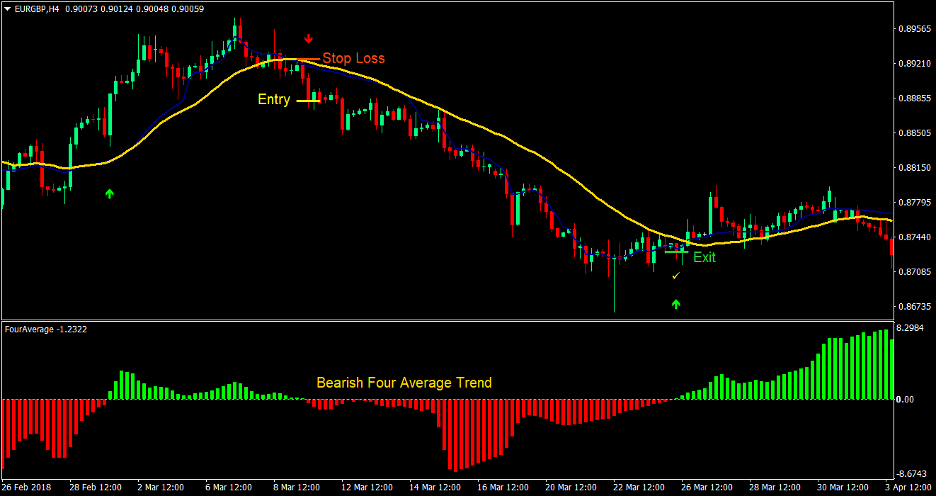

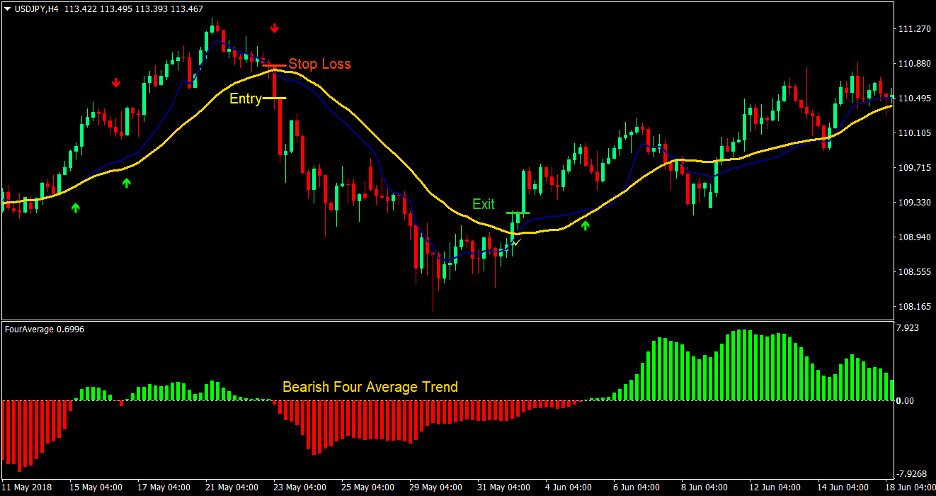

Sell Trade Setup

Entry

- The FRAMA line should cross below the 28 SMA indicating a possible bearish trend reversal

- The Four Average Indicator should change to a negative red bar and should print an arrow pointing down indicating a possible bearish trend reversal

- The above-mentioned entry signals should be somewhat aligned

- Enter a sell order on the confluence of the above conditions

Stop Loss

- Set the stop loss above the moving averages

Exit

- Close the trade if the FRAMA line crosses above the 28 SMA

- Close the trade if the Four Average indicator changes to a lime bar and prints an arrow pointing up

Conclusion

This trend following crossover strategy is one which allows traders to make use of high probability trend indicators as a basis for entries. By doing so, trade setups with lower probabilities tend to be filtered out.

Although this strategy is not perfect, it does have a tendency to produce high yielding trades quite often as compared to most crossover strategies which are not filtered for better probabilities. These high yield trades allow traders to be in profit more often than not.

This strategy would also benefit from some basic price action knowledge, such as reversal breakouts of a trendline since the signals produced by this strategy would usually coincide with such price action trade setups.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: