There are profitable traders and then there are traders who just seem to always get it right. It seems that whenever they open a trade price would always be going to the direction of their trade, or does it? If you would closely examine these traders’ trades you would notice that whenever a trade does not go their direction, they seem to be just holding on to the trade until price goes their direction. It seems that they are confident that price would sooner or later head to the direction of their trade. Why is it that way? This is because when they first opened the trade, they know that they are trading a confluence of trends, short-term, mid-term and long-term. So, whenever their short-term trades fail, they know that the long-term trend is still good and thus price would still be going back to the direction of their trade.

The Directional Tenkan Cross Forex Trading Strategy is not the type of strategy that advocates holding on to a trade too long. Instead, we will be banking on the confluence of the short-term, mid-term and long-term trend to take trades that have a very high probability of hitting our target prices. This allows us to catch trades that have high probabilities of trending strongly in our favor.

Tenkan-Sen Line

The Tenkan-Sen line is a component of the Ichimoku Cloud Indicator, which is one of the most profitable standalone technical indicators.

The Tenkan-Sen refers to the Conversion Line of the Ichimoku Cloud indicator. It is simply the average of the highest high and lowest low within a period. It also represents the short-term trend among the lines of the Ichimoku Cloud.

Moving Averages

Moving Averages are one of the simplest yet most powerful technical trading tools available to a trader. This is because moving averages are used to represent one of the most important characteristics of the market’s behavior – trend.

Different moving averages represent different trends. The shorter the period it averages out, the shorter the term it represents. Short-term moving averages typically have a period of 5, 10, 15 and 20. Mid-term moving averages on the other hand are usually at 30 and 50 periods, while long-term moving averages are typically 100 or 200-period moving averages.

There are many ways to interpret the trend using moving averages. Some would compare the location of a shorter-term moving average to a longer-term moving average. Some would look at the slope of the moving average. Probably the simplest way to observe for the trend using moving averages is by identifying the location of price action in relation to a moving average.

Average Directional Movement Index

Average Directional Movement Index (ADX) is one of my favorite trading indicators. It is an oscillating indicator which also determines trend direction and reversals. However, unlike other oscillating and trend following indicators, the ADX is quite unique. This is because it also measures the strength of a trend.

The ADX is composed of three lines. Two of the lines are called the Directional Movement Index (DMI). One is positive (+DMI) and the other is negative (-DMI). These two lines determine trend direction and reversal based on how the two lines are stacked. If the positive DMI is above the negative DMI, then the market is considered bullish. If the two lines are stacked inversely, then the market is considered bearish.

Then, we have the ADX line. The ADX line is non-directional. It does not determine trend direction, however what it does is that it measures the strength of the trend. If the ADX is below 30 then the market is considered not to be trending, while if it is above 30 then the market is considered to have a strong trend.

Trading Strategy

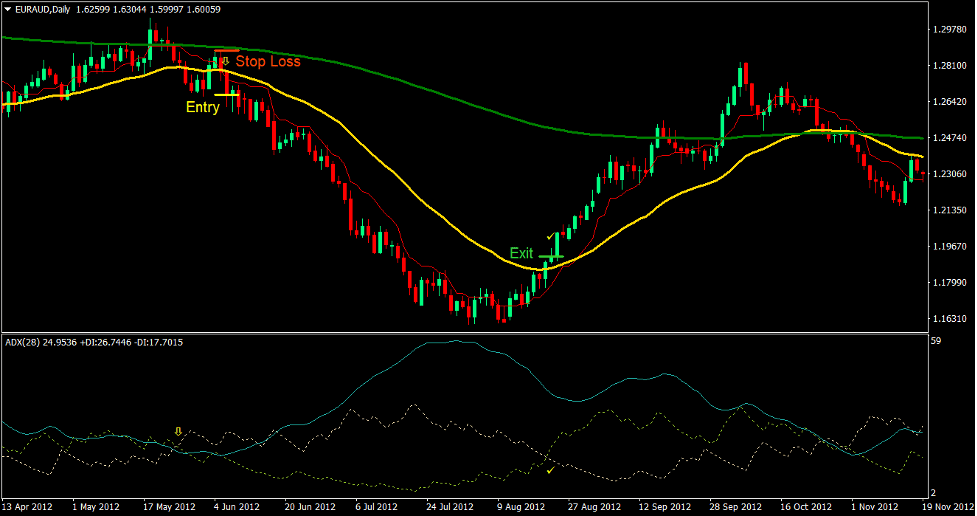

This strategy is a crossover strategy using the Tenkan-Sen of the Ichimoku Cloud indicator and a 32-period Exponential Moving Average (EMA). The Tenkan-Sen represents the short-term trend while the 32 EMA represents the mid-term trend. However, this crossover signal is still filtered out with a commonly used long-term trend, a 200-period Exponential Moving Average (EMA). Aligning the short-term, mid-term and long-term trend using this combination of average prices allows us to have trades that have higher win probabilities.

On top of that, we would also be aligning the crossover signal and the long-term trend filter with a confluence with the DMI crossover of the ADX indicator. This improves our win rate even further.

The ADX line then serves as a confirmation as this would usually rise as the market starts to trend. However, there will be trades wherein the ADX line starts in a contracting phase prior to rising. This is because of the natural cycle of the market, which is a cycle of contractions and expansions.

Indicators:

- Ichimoku Kinko Hyo

- Tenkan-sen: 9

- 32 EMA (gold)

- 200 EMA (green)

- Average Directional Movement Index

- Period: 28

Timeframe: 4-hour and daily charts

Currency Pairs: major and minor pairs

Trading Session: Tokyo, London and New York sessions

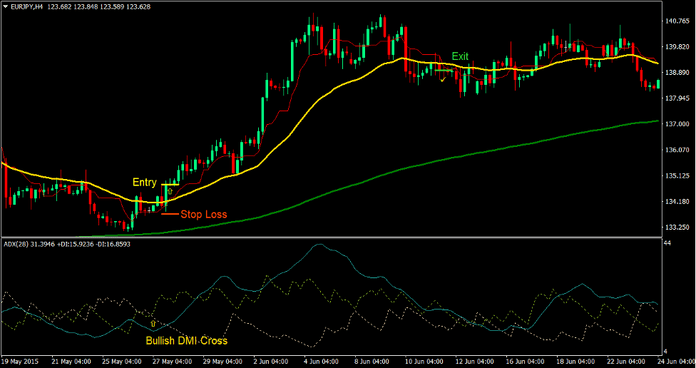

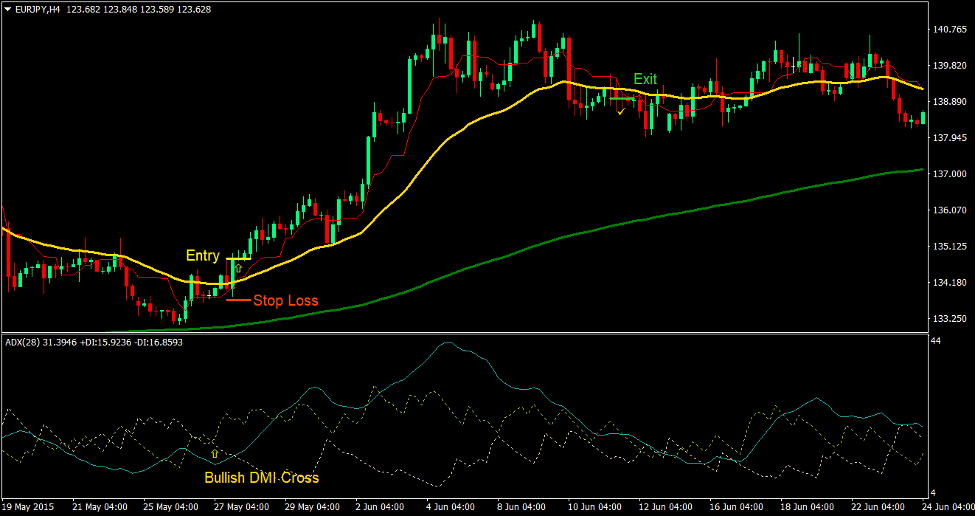

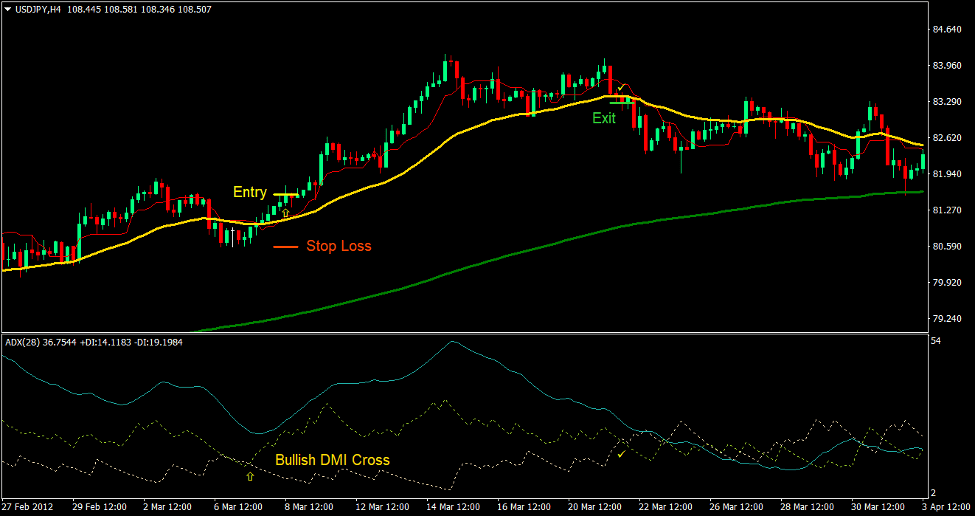

Buy Trade Setup

Entry

- Price should be above the 200 EMA indicating a bullish long-term trend

- The +DMI line of the ADX indicator should cross above the -DMI line indicating a bullish trend reversal

- The Tenkan-sen line should cross above the 32 EMA indicating a bullish trend reversal

- Enter a buy order on the confluence of the above conditions

Stop Loss

- Set the stop loss on the support level below the entry candle

Exit

- Close the trade as soon as the Tekan-sen line crosses below the 32 EMA

- Close the trade as soon as the +DMI line crosses below the -DMI line

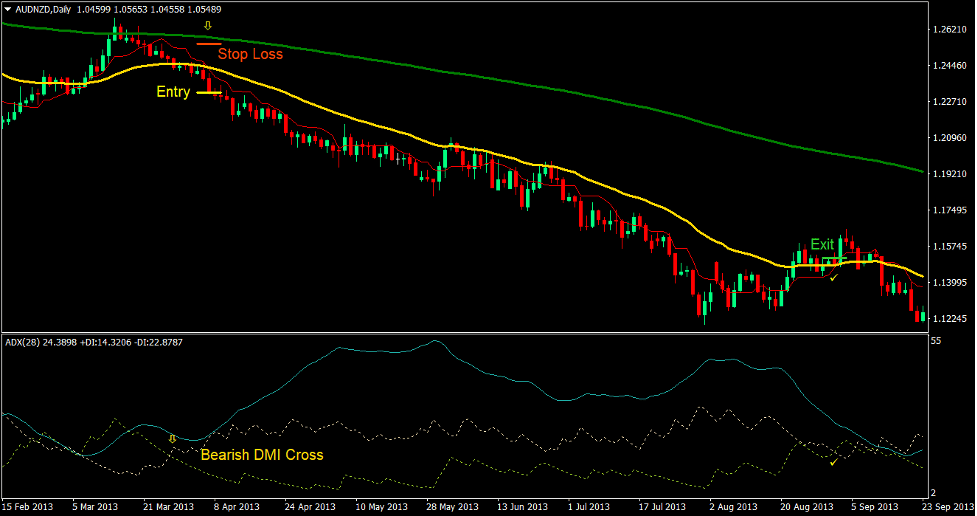

Sell Trade Setup

Entry

- Price should be below the 200 EMA indicating a bearish long-term trend

- The -DMI line of the ADX indicator should cross above the +DMI line indicating a bearish trend reversal

- The Tenkan-sen line should cross below the 32 EMA indicating a bearish trend reversal

- Enter a sell order on the confluence of the above conditions

Stop Loss

- Set the stop loss on the resistance level above the entry candle

Exit

- Close the trade as soon as the Tekan-sen line crosses above the 32 EMA

- Close the trade as soon as the -DMI line crosses below the +DMI line

Conclusion

This strategy is a crossover strategy with a relatively higher probability compared to most crossover strategies. This is due to the alignment among the short-term, mid-term and long-term trends, plus the DMI lines of the ADX indicator.

If you would look at it on an even higher timeframe, you would notice that these trade setups are actually retracements on the higher timeframe. Some traders could be trading these setups as retracements on a higher timeframe, but trading it as crossover strategies on a lower timeframe gives us a more accurate entry point.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: