20 SMA with RSI Forex Swing Trading Strategy

20 SMA is a good strategy for beginners because it is easy to comprehend. It best works on a 4-hour and daily timeframe. This strategy is a trend following method that uses 20 SMA to determine the direction of the trend and RSI to determine the strength of the trend.

Indicators needed:

- SMA 20

- RSI: should be set to 5 days, 50 RSI level.

Uptrend and Downtrend:

Uptrend: The price is above the 20 SMA.

Downtrend: The price is below the 20 SMA.

RSI Description:

When the RSI reached the peak above the 50 level and turns down, then the market is going down or the uptrend is weakening. Sell opportunities could then be considered.

The end of the downtrend will be determined when RSI level reached the peak below the 50 level and starts to go up. Buy opportunities could then be considered.

Trading Rules:

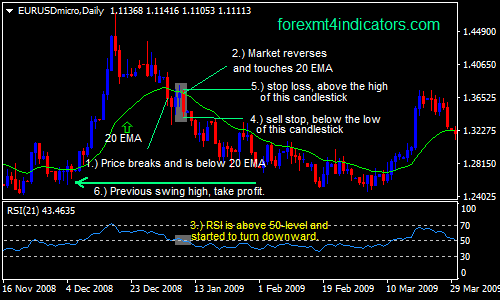

Sell Entry:

- Price has to be below the 20SMA indicating a downtrend.

- The price must retrace or rally back up and touch the 20SMA line.

- Once 20SMA line is touched, look down to see if the 5day RSI has peaked above 50level and has started to turn down-confirming a weakening upward momentum.

- Place a sell stop order under the low of the candlestick (after it closes).

- This candlestick should coincide with the RSI starting to turn down.

- Place Your stop loss above the high of that candlestick.

- Your target profit would be 1:3 ratio. It is 3 times what you risk. You can also take profit when the opposite trading signal appears.

Buy Entry:

- Price must be above the 20 SMA indicating an uptrend.

- The price must pull back down and touch the 20SMA line.

- Once 20SMA line is touched, look at the 5day RSI, it must reach the bottom below 50 RSI level and has started to turn up confirming a weakening downward momentum.

- Place a buy stop order above the high of the candlestick (after it closes).

- This candlestick should coincide with the RSI starting to turn up.

- Place Your stop loss below the low of that candlestick.

- Your target profit would be 1:3 ratio. It is 3 times what you risk. You can also take profit when the opposite trading signal appears.

ADVANTAGES:

- Comprehensive

- Good for a trending market.

- Stop loss is quite small.

- A great risk to reward ratio as well.

DISADVANTAGES:

- Not good in ranging markets.

- Sometimes price may not rally or pullback to touch the 20SMA line until very later on and by that time that price movement would have been already exhausted and the market may be looking to reverse direction.

- Moving averages indicators are lagging indicators. The market has already made a big move before it will retrace.

HOW TO IMPROVE YOUR TRADE ENTRY:

You must buy using reversal candlestick patterns that form when the price touches the 20SMA line. Look for reversal candlesticks like:

Harami

Engulfing pattern

Dark Cloud Cover

Evening Star Doji

Shooting Star/Hammer.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: