Market opens are one of the busiest times in a trading session. Traders have prepared their trading plans prior to the open and are ready to execute their trades. Everyone is waiting and watching, observing where the market would go and where momentum would pick up. Often, because there are still a lot of traders willing to make a trade, volume is enough to allow prices rally, run, breakout or start a trend. It is during the market open that most of the money is made throughout the trading day.

For this reason, there have been many market open trading strategies that have been developed. One is the London breakout type of strategy. However, it could also apply to other trading sessions with varying degree of strength.

One way to trade the open of the market is by looking for momentum. In this type of strategy, traders are observing price, waiting for key indications of a momentum breakout. Traders also have certain levels that they are looking at, expecting for a breakout.

Open Zone Breakout Forex Trading Strategy is a strategy that could be applied in such situations. It trades on breakouts from the high or low of a certain period assuming that these breakouts could gain momentum and push further.

SDX Zone Breakout

The SDX Zone Breakout indicator is a custom technical indicator used for breakout strategies based on the high and low of a certain period.

The indicator simply identifies the highs and lows within a certain range of candles. It then marks the point where a breakout should be expected. It also marks the probable Stop Loss and Take Profit placements on the price chart.

The SDX Zone Breakout indicator is a very malleable indicator. Traders could adjust it depending on their preference. Traders could adjust the time when the indicator should identify the breakout range based on the high and low of the period. Traders could also adjust the distance of the stop loss and take profit targets depending on their risk appetite and depending on the volatility of the currency pair. This allows traders to tweak the indicator based on the market session and the currency pairs they are planning to trade on.

Awesome Oscillator

The Awesome Oscillator (AO) is a popular trend following technical indicator. It is used to measure market momentum and identify trend direction and strength.

The Awesome Oscillator is calculated based on the difference between a 5 bar Simple Moving Average (SMA) and a 34 bar Simple Moving Average (SMA). However, these moving averages are not based on the close of the candle but rather based on the median of each bar.

The Awesome Oscillator is usually used to confirm trend direction and strength.

It is an oscillator that plots histogram bars. Its bars also change color depending on the direction of the trend. Positive bars generally indicate a bullish trend bias while negative bars generally indicate a bearish trend bias. Positive green bars indicate a strengthening bullish trend while positive red bars indicate a weakening bullish trend. On the other hand, negative red bars indicate a strengthening bearish trend while negative green bars indicate a weakening bearish trend.

Trading Strategy

This trading strategy uses the SDX Zone Breakout indicator to identify momentum breakouts from the range of the previous bars.

Traders should wait for the SDX Zone Breakout indicator to establish the range. If the range is a tight congestion zone, then a strong breakout might follow. If not, then it is best to avoid trading that pair as a wide range could also mean strong non-directional volatility.

We then wait for a breakout candle to breach and close beyond the solid line of the SDX Zone Breakout indicator.

These breakouts should be confirmed to have strong momentum based on the Awesome Oscillator. Trend direction will be based on whether AO is positive or negative, while trend strength will be based on the color of the AO bar.

The AO will also be used as an exit signal based on the weakening of the momentum. This will be based on the changing of the color of the AO bars.

Indicators:

- SDX-ZoneBreakout

- Awesome

Preferred Time Frames: 15-minute chart only

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York open

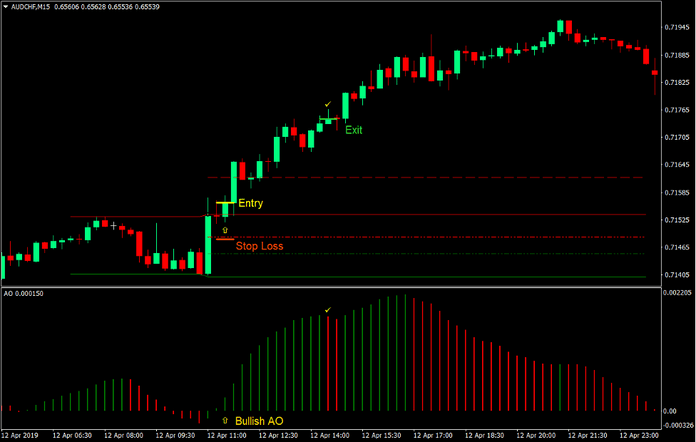

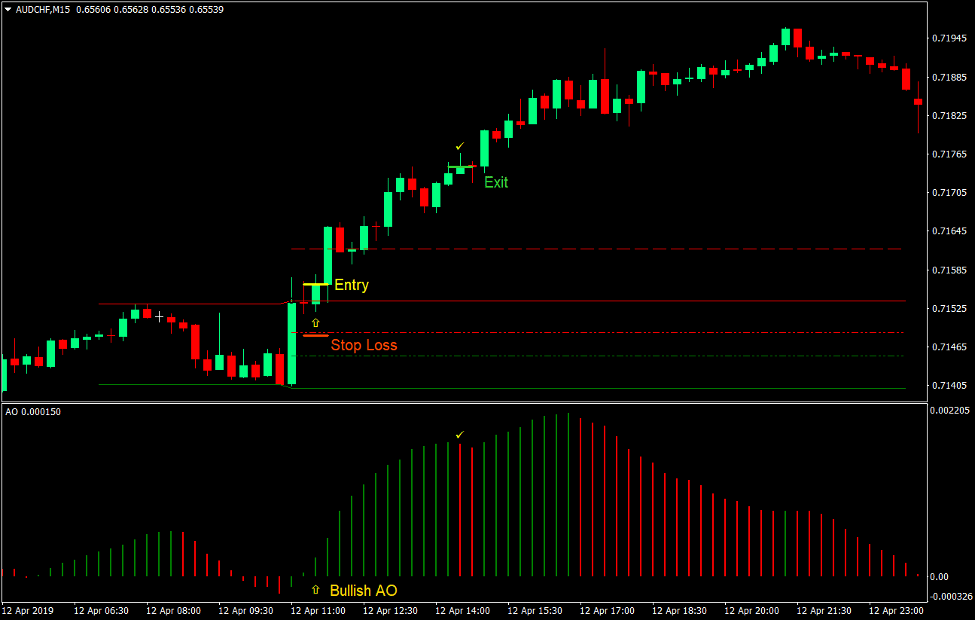

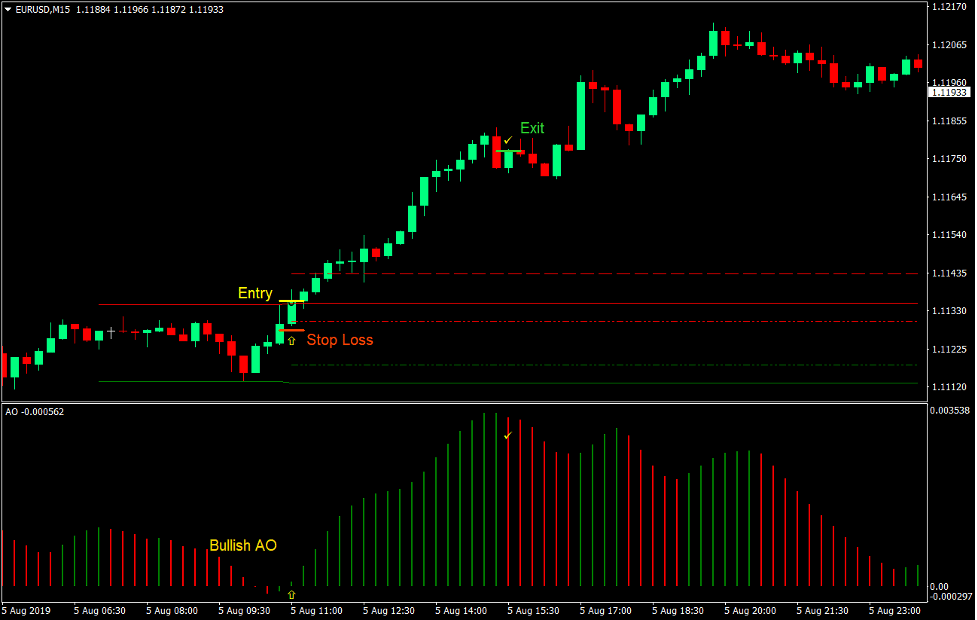

Buy Trade Setup

Entry

- The SDX Zone Breakout indicator should mark a tight zone.

- A strong bullish breakout candle should close above the solid red line of the SDX Zone Breakout indicator.

- The Awesome Oscillator indicator should print a positive green bar.

- Enter a buy order on the confirmation of the conditions above.

Stop Loss

- Set the stop loss below the entry candle.

- Set the stop loss below the dashed red line of the SDX Zone Breakout indicator.

Exit

- Close the trade as soon as the Awesome Oscillator bar changes to red.

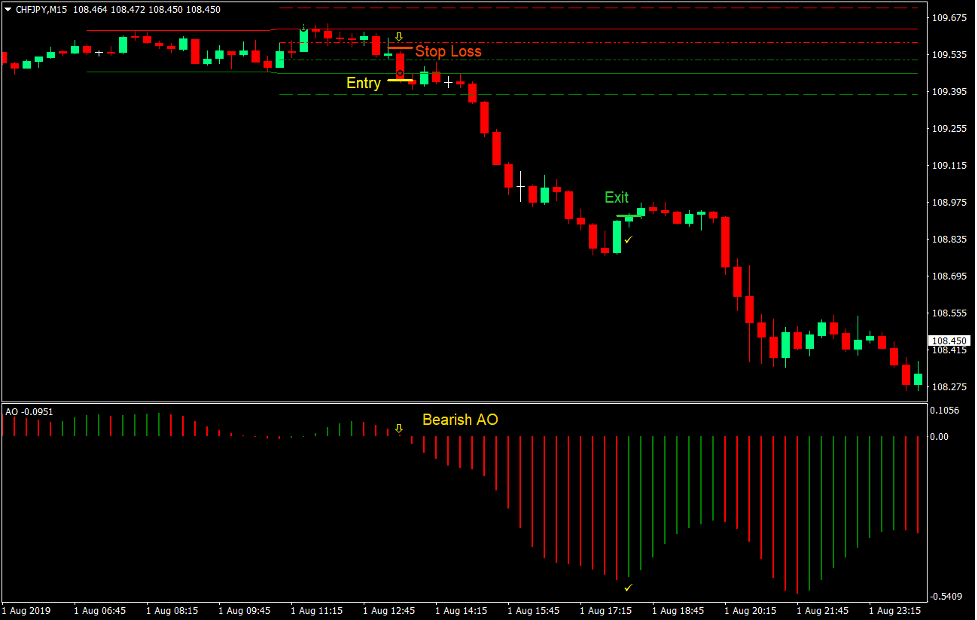

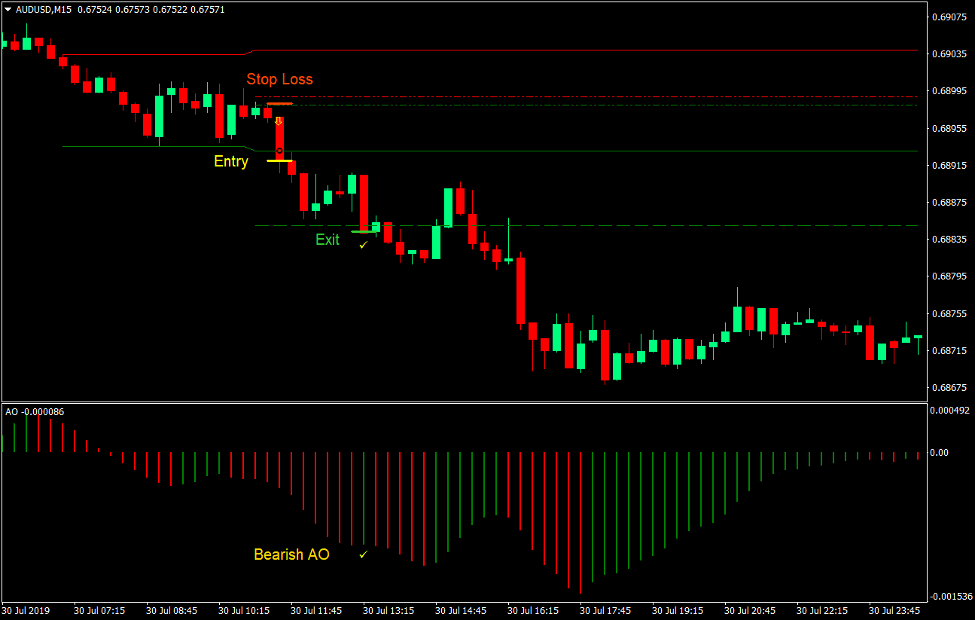

Sell Trade Setup

Entry

- The SDX Zone Breakout indicator should mark a tight zone.

- A strong bearish breakout candle should close below the solid green line of the SDX Zone Breakout indicator.

- The Awesome Oscillator indicator should print a negative red bar.

- Enter a sell order on the confirmation of the conditions above.

Stop Loss

- Set the stop loss above the entry candle.

- Set the stop loss above the dashed green line of the SDX Zone Breakout indicator.

Exit

- Close the trade as soon as the Awesome Oscillator bar changes to green.

Conclusion

This trading strategy works well as a market open breakout strategy, such as the London Breakout strategy.

To trade this strategy well, it is best to adjust the SDX Zone Breakout indicator according to the market session being traded. It would be good to market about 2 to 4 hours of candles prior to the open a market.

The stop loss placement should also be adjusted based on the volatility of the pair being traded. This could be based on the Average True Range of the currency pair. The take profit target marker could also be adjusted. However, it is best to disregard this as these types of breakouts often become market runs. Avoiding the take profit target marker and exiting the trade based on momentum allows us to capitalize on markets which would gain strong momentum.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: