Trend reversals are lucrative trading opportunities wherein traders can cash in on huge gains in a single trade. Trend reversals can produce trade setups with exceptionally high returns relative to the risk placed on the trade. This is because trend reversal strategies imply that traders can take a trade as the market reverses and attempt to exit it as the trend is about to end.

Yes, trading trend reversals can be very profitable. However, actually trading it is easier said than done. Many traders try to guess where the market will reverse and trade according to their assumptions. Guessing is a very risky thing to do in trading.

Instead of guessing the location where price might reverse, it would be prudent to wait for systematic indications of a trend reversal.

One of the simplest systematic method in detecting trend reversals is through the use of moving average crossovers. Moving average crossovers are scenarios wherein two moving average indicators cross over each other. These conditions indicate that the trend could be reversing because the average price is reversing its trajectory.

Not all trend reversal signals are the same. Some setups which have confluences with other indications pointing the same direction tend to be more effective.

Confluences with momentum tend to be very good trend reversal signals. This is because momentum often causes price to move in the direction of the momentum candle. These momentum signals often result in a new trend.

Momentum Moving Average Cross Forex Trading Strategy, we will be exploring a custom moving average crossover strategy and how it works when traded with momentum price action signals.

Custom Moving Averages

Custom Moving Averages is a simple trend following technical indicator based on a modified moving average.

The Custom Moving Averages indicator plots a modified moving average on the price chart, which tends to follow price action quite closely.

This moving average line is very modifiable. The type of moving average and its underlying computation can be modified depending on the strategy used by the trader. Traders can also shift the moving average forward or backward, which some traders could also use.

The moving average line can be used just as with other moving average lines. Trend direction can be identified based on the slope of the line, as well as the general location of price action in relation to the line. Trend reversal signals can also be identified based on crossovers with other moving average lines or crossovers with price action itself.

Detrended Price Oscillator

The Detrended Price Oscillator (DPO) is a unique technical indicator because unlike most oscillators, it is not intended to determine long-term trends. Instead, it was developed in order to identify the peaks and troughs of price action.

As the name suggests, the DPO is an oscillator which attempts to lessen the influence of the long-term trend in its indications. Instead, it mimics the movement of price action quite closely, mirroring its peaks and troughs.

It plots a line which oscillate around its median zero. Traders can still use the crossing of its line over zero as an indication of momentum. However, it is mainly used to identify the peaks and troughs of price swings as price becomes overbought or oversold.

Trading Strategy

This trading strategy is a simple trend reversal trading strategy which makes use of the crossover of moving averages in confluence with momentum price action signals.

The crossover signal used in this trading strategy is that between a 36-period Exponential Moving Average (EMA) line and the line plotted by the Custom Moving Averages indicator set at default settings.

The Detrended Price Oscillator serves as a confirmation that the trajectory of the price swings has shifted, based on the crossing over of its line over its median, zero.

A momentum candle should also be identified as the two moving average lines cross over. This would indicate that the trend reversal signal is based on a strong momentum.

Indicators:

- Moving Average

- Period: 36

- MA Method: Exponential

- Custom Moving Averages (default settings)

- Detrended Price Oscillator

- MA Period: 28

Preferred Time Frames: 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

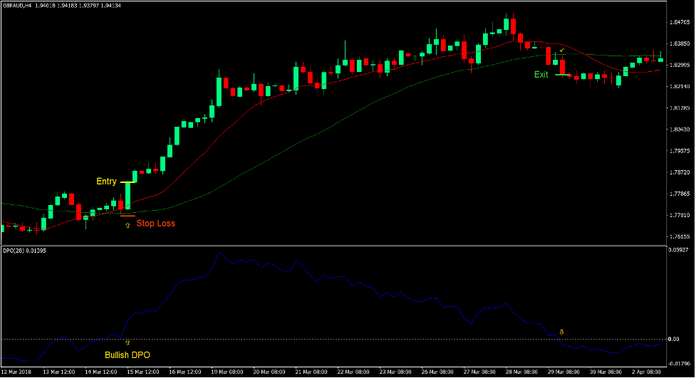

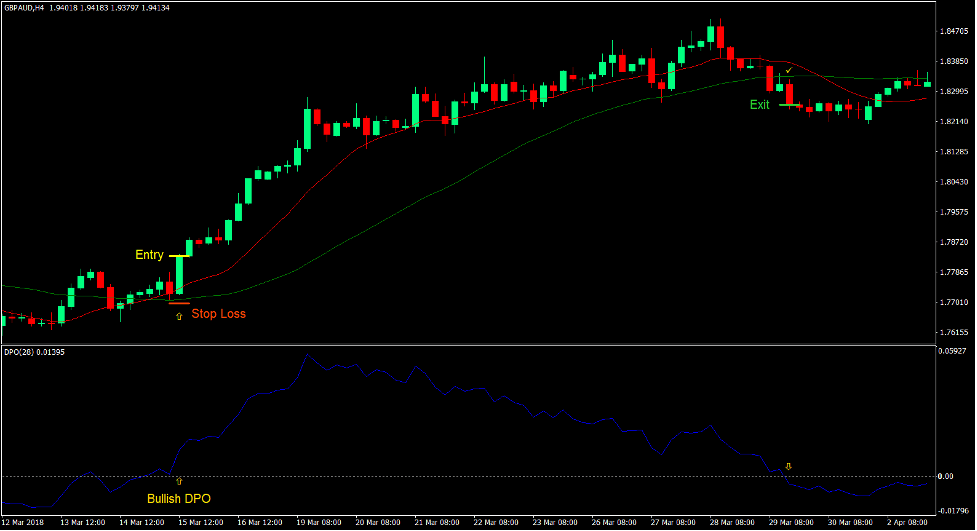

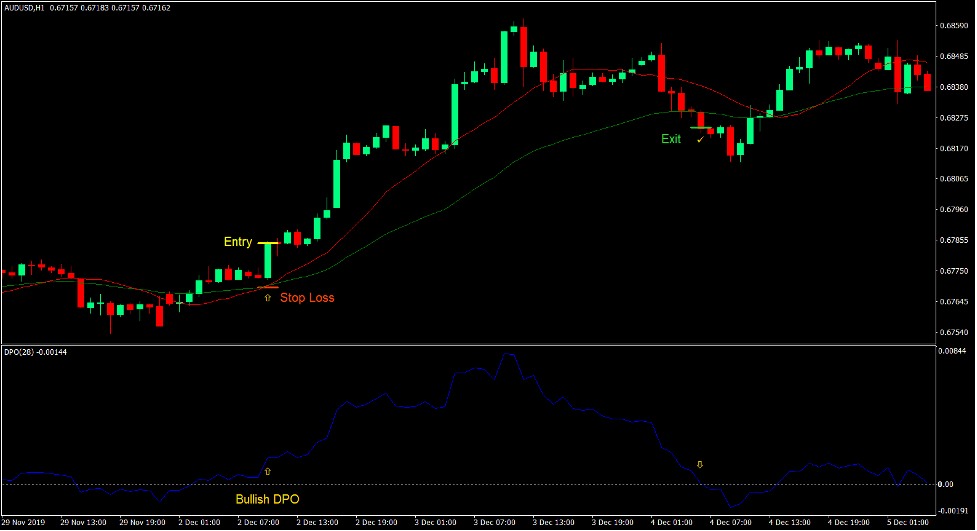

Buy Trade Setup

Entry

- The Custom Moving Average line should cross above the36 EMA line.

- A bullish momentum candle should be formed.

- The DPO line should cross above zero.

- Enter a buy order on the confirmation of these conditions.

Stop Loss

- Set the stop loss on a support below the entry candle.

Exit

- Close the trade as soon as the DPO line crosses below zero.

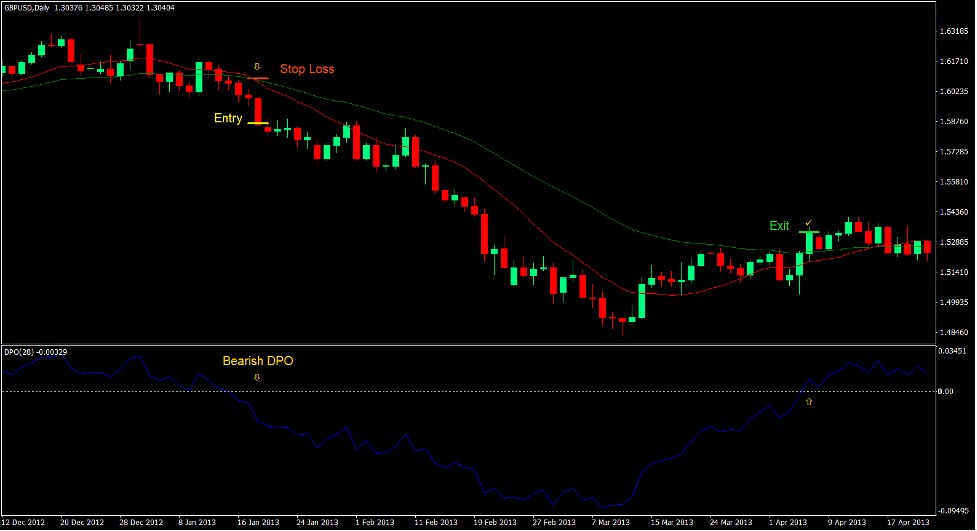

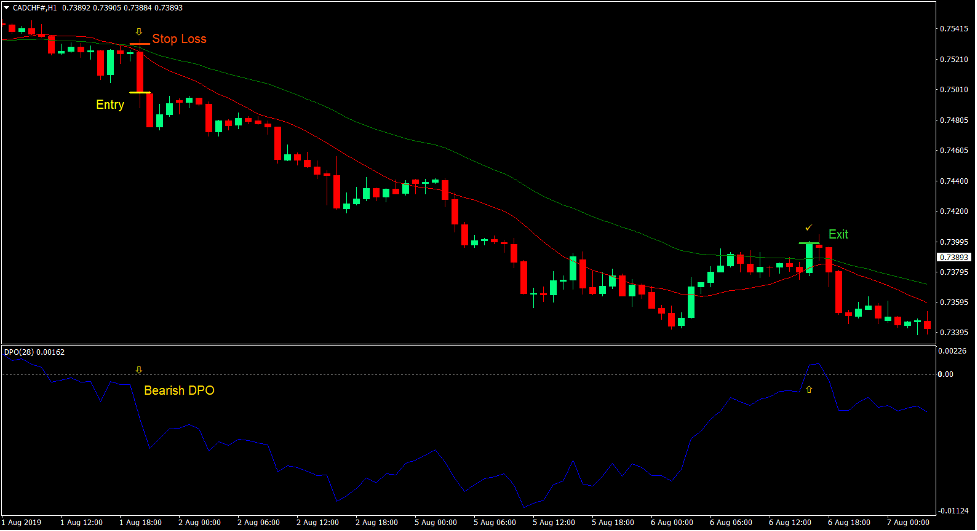

Sell Trade Setup

Entry

- The Custom Moving Average line should cross below the36 EMA line.

- A bearish momentum candle should be formed.

- The DPO line should cross below zero.

- Enter a sell order on the confirmation of these conditions.

Stop Loss

- Set the stop loss on a resistance above the entry candle.

Exit

- Close the trade as soon as the DPO line crosses above zero.

Conclusion

This simple trading strategy is one which is similar to the type of trading strategy which many trend reversal traders use. Crossover strategies are a staple type of trend reversal strategy used by many profitable traders.

Crossover strategies could be effective when used with the right complementary technical indicator to confirm its trend reversal signals. In this case, we are using the DPO, which tends to work well with this setup.

It is also best to cycle between timeframes to identify which timeframe the market is trending on. Once the right timeframe is identified, we could then use this strategy to profit from the market based on trend reversal signals.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: