Trend reversal strategies are unique market scenarios which offer traders an opportunity to earn much. Often, trend reversal trade setups could run far and earn a lot of pips in the process.

Trend reversal strategies have a potential to produce huge gains because it is often the start of a fresh trend. Fresh trends often result in trends that lasts longer, giving price ample time to move in one direction.

Trading trend reversals is good, that is if you have the skills to catch one. Sometimes, trading on trend reversals could prove to be very difficult. It is because traders are often trading against an established long-term trend.

There are ways to improve accuracy trading on trend reversals. Some traders use price action. That is good, however, it takes skill and practice to master that. Others use technical indicators.

Although not all technical indicators are well suited for trend reversal trading, some indicators tend to have a high accuracy when used as a component of a trend reversal strategy.

The Kijun Tenkant Reversal Forex Trading Strategy is one which uses high probability technical indicators as a focal point in trading trend reversals.

Kijun Tenkant

Kijun Tenkant is a technical indicator based on the Ichimoku Kinko Hyo or Ichimoku Cloud indicator.

The classic Ichimoku Kinko Hyo indicator uses multiple average lines to determine trend direction on the short-term, mid-term and long-term. It is composed of the Chikou Span, Tenkan-sen, Kijun-sen and the Senkou Span, with the Senkou Span being composed of the Up Kumo and Down Kumo. Each of these lines and dynamic areas represent a different trend and provide different signals.

Although different traders could interpret the Ichimoku Kinko Hyo indicator differently, classic Ichimoku Kinko Hyo traders trade only when all the lines are in confluence pointing the same direction. The Ichimoku Kinko Hyo indicator is probably one of the few indicators that could return a profit as a standalone indicator.

The Kijun Tenkant indicator is an indicator which uses only the Tenkan-sen and the Kijun-sen lines in order to produce trade signals. These lines are the main entry signals of the Ichimoku Kinko Hyo indicator. It also represents a medium-term trend.

Although waiting for all the lines to align is a good idea, traders are often left with fewer trading opportunities. Trading on the signals provided by the Kijun-sen and Tenkan-sen allows for more trading signals with higher probable yields.

MA Angle Indicator

Traders often use the moving average to identify trend direction.

Some traders use the location of price in relation to the moving average line. Other traders use a stack of moving averages to visually decipher if the market is trending.

One of the more popular ways to identify the trend based on a moving average is by looking at its slope. Moving averages that are sloping up indicate an uptrend, while moving averages that are sloping down indicate a downtrend. Flat moving averages indicate a non-trending market condition, while steeper slopes indicate a strong trend.

The MA Angle indicator objectively identifies the angle or the slope of a moving average and plots this information as an oscillating indicator. It plots positive bars to indicate a bullish trend and negative bars to indicate a bearish trend.

It also anticipates if the market is trending or not. Bullish trends have green bars while bearish trends have red bars. Non-trending market conditions on the other hand have yellow bars.

Trading Strategy

This trading strategy trades on confluences between trend reversal signals coming from the Kijun Tenkant indicator and the MA Angle indicator.

On the Kijun Tenkant indicator, the red line representing the Tenkan-sen line should cross the blue line representing the Kijun-sen line. These crossovers are indicative of a medium-term trend reversal.

On the MA Angle indicator, the bars should cross over the midline indicating a trend reversal. The color of the bars should also be considered when taking a trade. The bars should be green on a buy trade setup or red on a sell trade setup. This is to ensure that the market has a high propensity to trend and is not flat.

Indicators:

- KijunTenkant

- Kijun: 30

- MAAngle

- MAPeriod: 30

Preferred Time Frames: 1-hour and 4-hour charts

Currency Pairs: major and minor pairs

Trading Session: Tokyo, London, and New York sessions

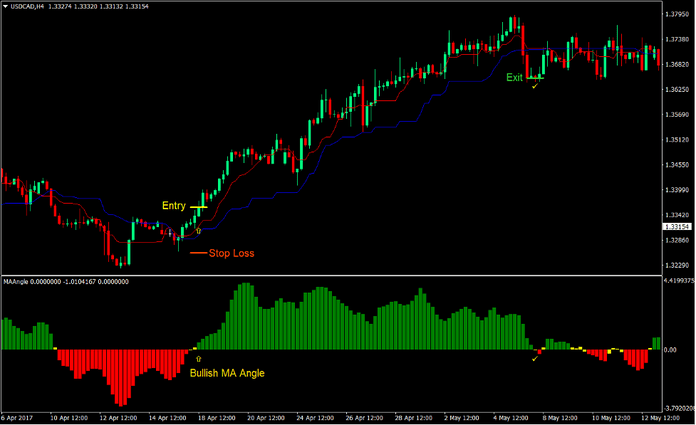

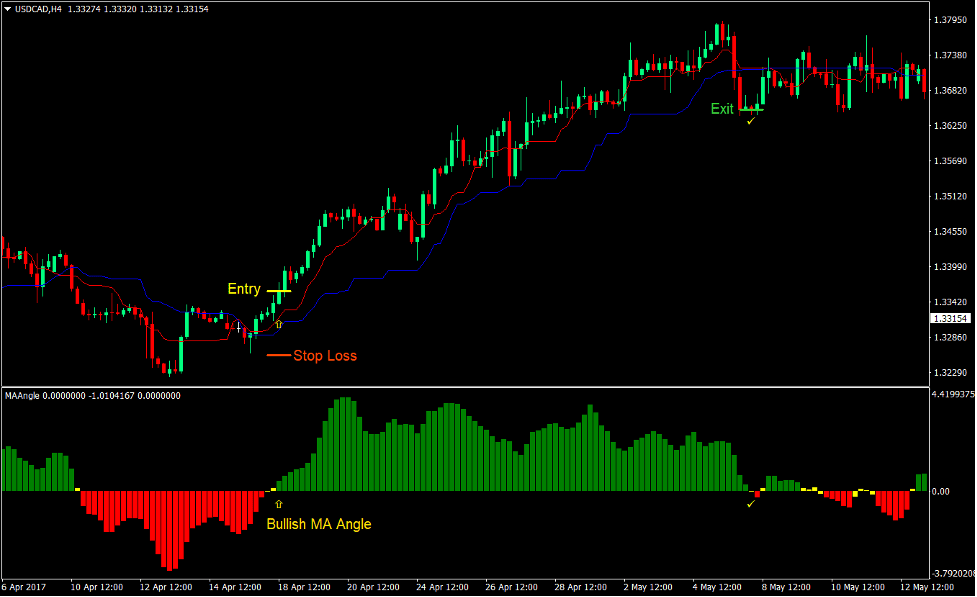

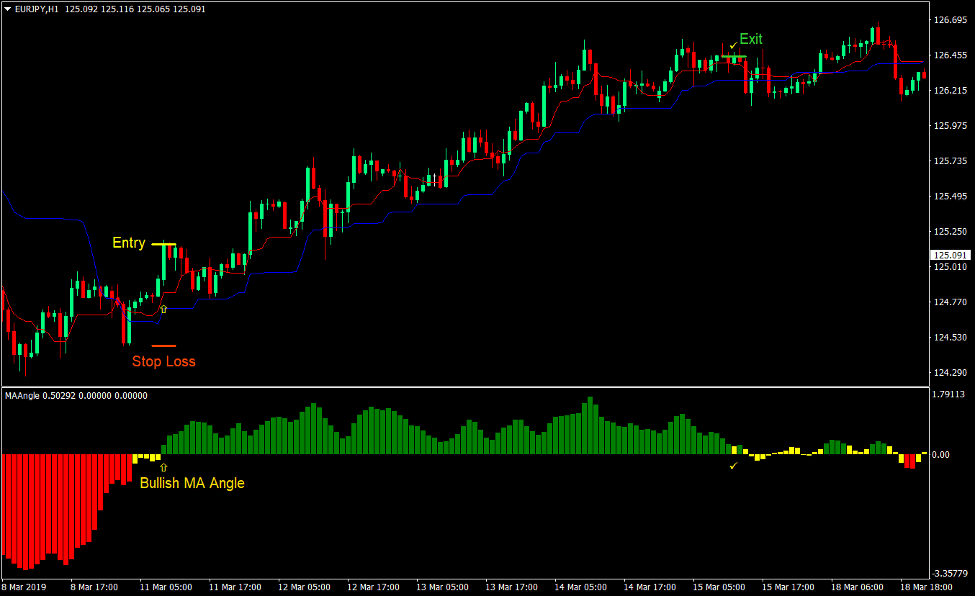

Buy Trade Setup

Entry

- Price should cross above the Tenkan-sen and Kijun-sen line.

- The Tenkan-sen line should cross above the Kijun-sen line.

- The MA Angle bars should cross above zero and should be green.

- These bullish signals should be closely aligned.

- Enter a buy order on the confirmation of the conditions above.

Stop Loss

- Set the stop loss on the fractal below the entry candle.

Exit

- Close the trade as soon as the MA Angle indicator bar changes to yellow or crosses below zero.

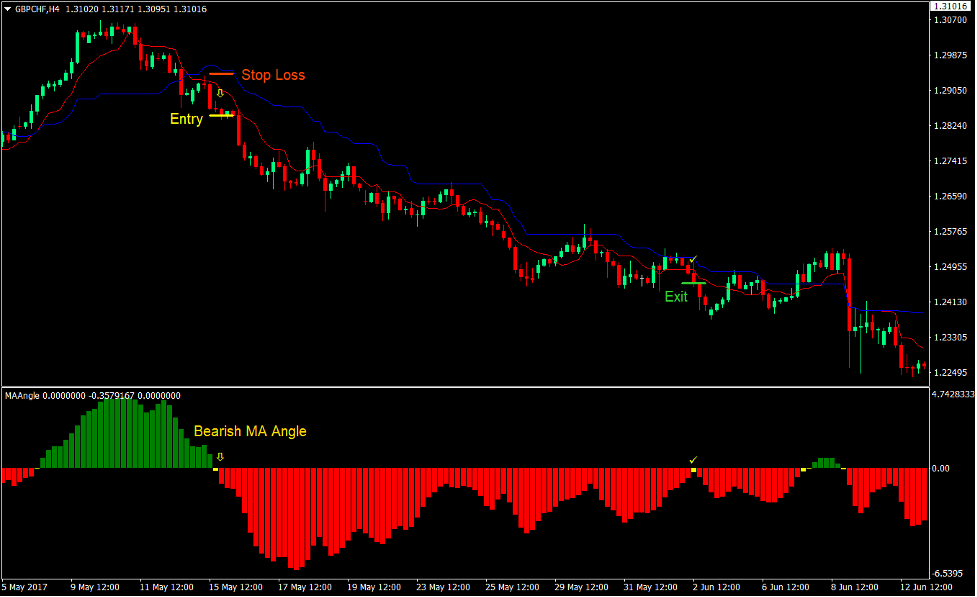

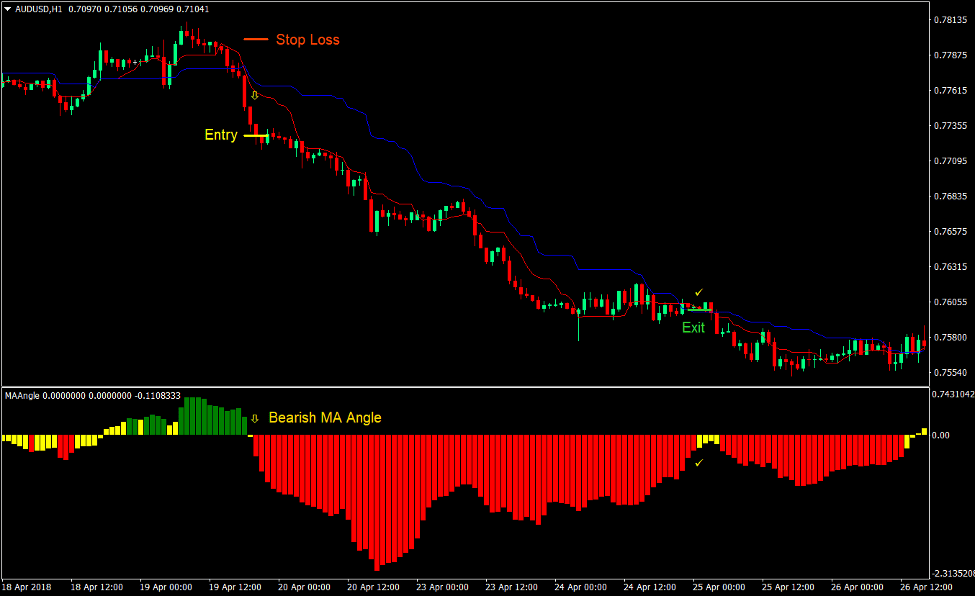

Sell Trade Setup

Entry

- Price should cross below the Tenkan-sen and Kijun-sen line.

- The Tenkan-sen line should cross below the Kijun-sen line.

- The MA Angle bars should cross below zero and should be red.

- These bearish signals should be closely aligned.

- Enter a sell order on the confirmation of the conditions above.

Stop Loss

- Set the stop loss on the fractal above the entry candle.

Exit

- Close the trade as soon as the MA Angle indicator bar changes to yellow or crosses above zero.

Conclusion

This is a simple trading strategy which many traders could easily follow and execute. However, even with its simplicity, it is still able to provide trades that are very profitable and could produce high yields.

Although this trading strategy works well on the entries, it is still very important to have a sound trade management strategy. Traders should be able to exit trades profitably or move stop losses at an appropriate distance in order to protect gains.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: