“It is better to be late to enter a trend than to enter a wrong trade.” This is one of the things that a mentor trader said that stuck with me. This is the idea behind waiting for confirmation when taking trend reversals.

If you would come to think of it, trading trend reversals is already a very difficult task. Traders are often taking trades that are against the current trend direction. Taking trades with no confirmation is just like betting that price would reverse on a certain area without any indications that price will reverse. Often, traders would wait for price to show signs of reversal prior to taking a trade in their predicted direction. The disadvantage with taking this approach is that traders might be giving up some profits as they are waiting for price to move in their direction a bit, prior to taking the trade.

On the flip side, there are also traders who prefer to take trades as price enters the zone where they expect price to reverse. The argument is that they would rather have a high reward-risk trade setup at the expense of a lower win rate. Either way both approaches could work.

Atlas Momentum Forex Trading Strategy is a trend reversal strategy that makes use of trend reversal signals coming from two reliable indicators. It also requires traders to observe price action momentum in order to confirm a probable trend reversal. This results in a higher probability trade setup based on momentum price movements that have a high tendency to start a trend reversal.

BBands Stop v1

BBands Stop v1 is a trend following technical indicator which is based the historical movement of price in relation to a predetermined distance based on standard deviations.

This indicator is somewhat related to the Bollinger Bands because it also makes use of standard deviations to identify the distance which price should move in order to consider a probable trend reversal.

The indicator identifies the trend direction based on historical prices then plots a line opposite the direction of the trend based on its computation of the standard deviation of the average movement of price.

The line shifts to the opposite side of price action whenever price closes beyond the plotted line. This would indicate a trend reversal.

This indicator can be used as a trend direction filter, a trend reversal signal or a stop loss placement.

As a trend direction filter, traders could opt to trade only in the direction of the trend as indicated by the BBands Stop v1 line.

As a trend reversal entry signal, traders can use the shifting of the line above or below price action as a trend reversal entry signal.

Traders could also use it as a stop loss placement indicator by trailing the stop loss behind the BBands Stop v1 line.

Slope Direction Line

Slope Direction Line is a trend following technical indicator based on a modified moving average.

Moving averages are one of the most basic tools used to identify trend direction. Traders would usually look at the direction of the slope of a moving average line and the location of price action in relation to a moving average line to identify trend direction. Traders also use crossovers of different moving averages or a moving average and price to identify potential trend reversals.

Moving averages tend to be very effective tools for trending markets and trend reversal setups. However, moving averages could also be very ineffective in choppy markets. This is because moving averages could sometimes be very susceptible to market noise. Traders would often find ways to smoothen out moving averages by modifying it in order to make it more resistant to market noise.

Another disadvantage of moving average lines is that it tends to be very lagging. Traders could sometimes be too late to enter and exit trades because of trend reversal signals that are very lagging.

Slope Direction Line manages to smoothen out its moving average line while decreasing lag. This creates a moving average line that is less susceptible to market noise yet is very responsive to trend reversals.

This version of the Slope Direction Line also changes color depending on the direction of the trend. A light blue line would indicate a bullish trend, while a tomato line would indicate a bearish trend.

Trading Strategy

This trading strategy uses the confluence of the Slope Direction Line and the BBands Stop v1 indicator to identify potential trend reversals.

On the Slope Direction Line, trends are simply based on the location of price in relation to the Slope Direction Line, as well as the color of the Slope Direction Line.

The BBands Stop v1 indicator signal is simply based on the shifting of the BBands Stop v1 line.

Although trade signals are based on the confluence of the two indicators, we will not take every trade that is presented by the market. Instead, we will only take trades where there is a momentum candle at the beginning of the trend reversal.

Indicators:

- BBands_Stop_v1

- (T_S_R)-Big Trend

Preferred Time Frames: 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

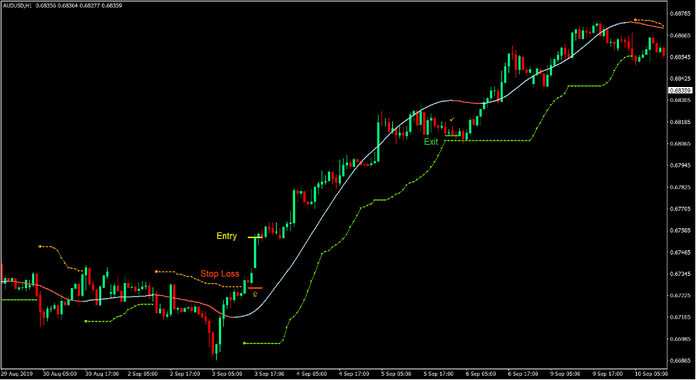

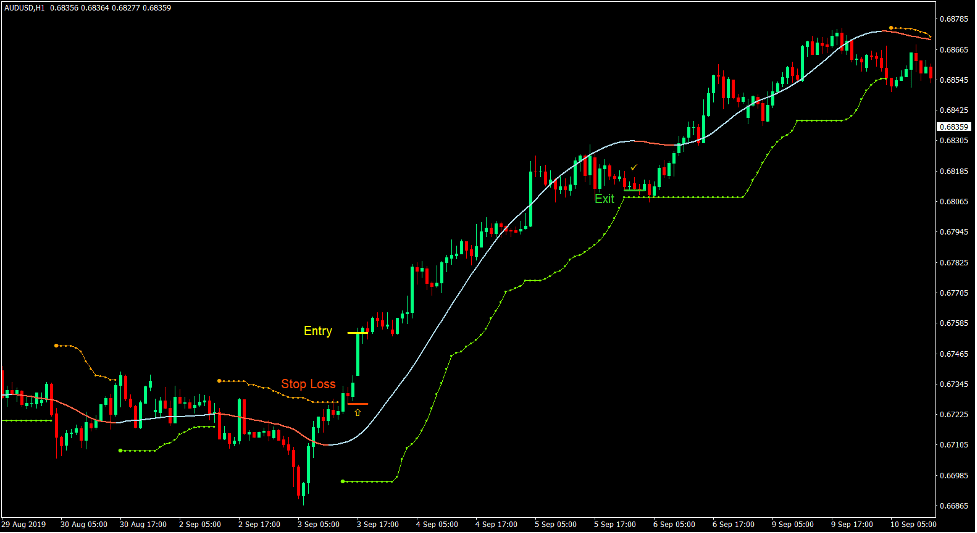

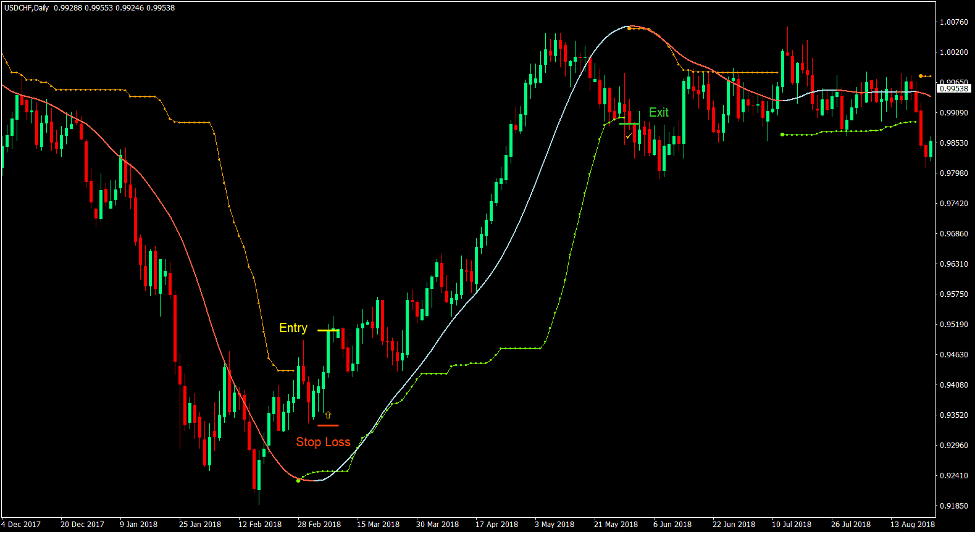

Buy Trade Setup

Entry

- The BBands Stop v1 line should shift below price action.

- Price action should cross above the Slope Direction Line.

- The Slope Direction Line should change to light blue.

- A bullish momentum candle should be formed.

- Enter a buy order upon the confirmation of these conditions.

Stop Loss

- Set the stop loss on the fractal below the entry candle.

Exit

- Close the trade as soon as price closes below the BBands Stop v1 line.

- Close the trade as soon as the Slope Direction Line changes to tomato.

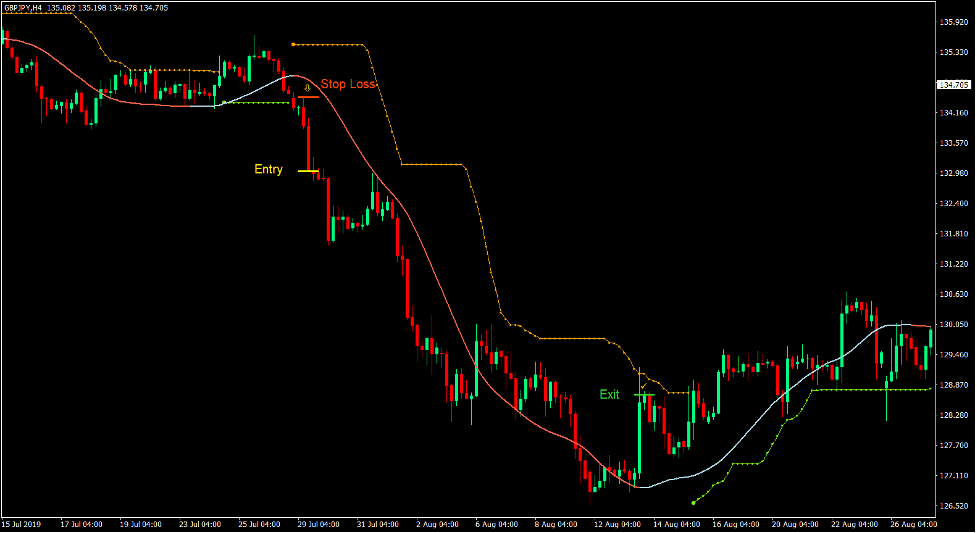

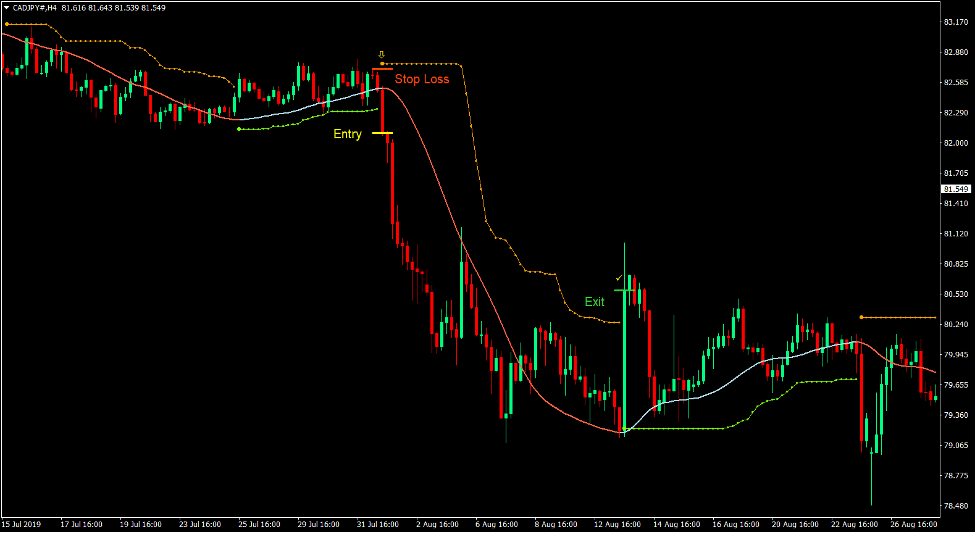

Sell Trade Setup

Entry

- The BBands Stop v1 line should shift above price action.

- Price action should cross below the Slope Direction Line.

- The Slope Direction Line should change to tomato.

- A bearish momentum candle should be formed.

- Enter a sell order upon the confirmation of these conditions.

Stop Loss

- Set the stop loss on the fractal above the entry candle.

Exit

- Close the trade as soon as price closes above the BBands Stop v1 line.

- Close the trade as soon as the Slope Direction Line changes to light blue.

Conclusion

This trading strategy is a robust trend reversal trading strategy. The confluence of these high probability trend following indicators give traders an edge when it comes to identifying potential trend reversals.

However, traders should not take signals from indicators as a final trade signal. Traders should confirm the trend reversal with price action. This strategy incorporates both price action and technical indicators in order to provide high probability trade setups.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: