Most traders often make the mistake of running after anything that glows in the quest of finding the “Holy Grail” of trading. Whether it is a new indicator or whatnot, traders would often try something new every now and then.

Now, there is nothing wrong with that. It is great to try perfecting your skill in trading, and this includes learning. Where traders often go wrong is when their strategies get overcomplicated. They pile in a bunch of indicators thinking that more is better. In some cases, it does work. However, for most traders, too much information could mean too much noise. This causes them to freeze whenever a trading opportunity comes.

Sometimes, the best strategies are those that are simple. Basic indicators are still widely used even by professional technical analysts and traders. Even big bank traders use the old school indicators that are readily available for retail traders.

The Stochastic Cross Reversal Forex Trading Strategy is one of the strategies that are based on a basic indicator. Although the indicators used have been modified to make things much easier for traders, the basic principles behind it remains the same.

Stochastic Cross Alert

The Stochastic Oscillators is one of the most basic technical indicators that traders use. This indicator was developed by Dr. George Lane back in the late 1950s. Even though this indicator seems pretty archaic, many professional traders know for a fact that it does work. In fact, this is one of my favorite “basic” indicators.

The Stochastic Oscillator is a momentum oscillating indicator. It plots two lines which oscillate from 0 to 100. One line oscillates faster than the other. The trend is considered bullish whenever the faster line is above the slower line. On the other hand, the trend is considered bearish whenever the faster line is below the slower line. Trends are reversing whenever the two lines crossover each other.

Where the lines crossover within the range is also important. The market is considered oversold whenever the two lines are below 20 and overbought whenever the two lines are above 80. Markets which are oversold have a strong tendency to reverse bullishly, while overbought markets have a high probability of reversing down. Crossovers taking place beyond these areas have a higher probability of resulting in a reversal compared to crossovers that occur randomly within the normal range.

The Stochastic Cross Alert indicator simplifies all this for traders. Knowing that these types of crossovers do work, the indicator simply provides signals whenever the lines crossover by printing an arrow on the chart pointing towards the direction of its indicated trend.

SEFC084 Bulls Bears Indicator

The SEFC084 Bulls Bears indicator is a trend following indicator which aids traders in identifying the current trend direction. It does this by printing bars which could either be positive or negative. Positive bars indicate a bullish market bias while negative bars indicate a bearish market bias. Bars shifting from positive to negative or vice versa is considered a trend reversal signal based on this indicator.

Trading Strategy

The Stochastic Cross Reversal Forex Trading Strategy is a trend reversal strategy which makes use of the potential reversals provided by the Stochastic Cross Alert indicator.

These signals start from an overextended market condition, either overbought or oversold. Mean reversal traders usually take this signal hoping that price would revert back to the mean. However, there are many cases wherein price would do more than just reverting back to the mean. It often results to the start of a fresh trend.

This strategy takes these signals in confluence with the SEFC084 Bulls Bears indicator and rides these new trends up to the end. The key to this strategy is in finding a strong confluence between the Stochastic Cross Alert indicator and the SEFC Bulls Bears indicator. Trend reversal signals which are generated at almost the same time have a very high probability of resulting in a trend. This is because this would usually happen only when there is momentum behind the reversal.

Indicators:

- Stochastic_Cross_Alert_SigOverlayM_cw-signals

- KPeriod: 30

- DPeriod: 12

- Slowing: 18

- SEFC084

- Period: 42

Preferred Time Frames: 15-minute, 30-minute, 1-hour, 4-hour and daily charts

Currency Pairs: major and minor pairs

Trading Session: Tokyo, London and New York; trade on the session of the currency pair traded when trading on the lower timeframes

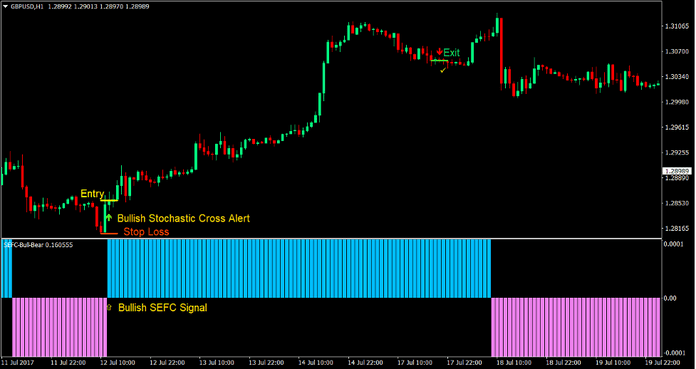

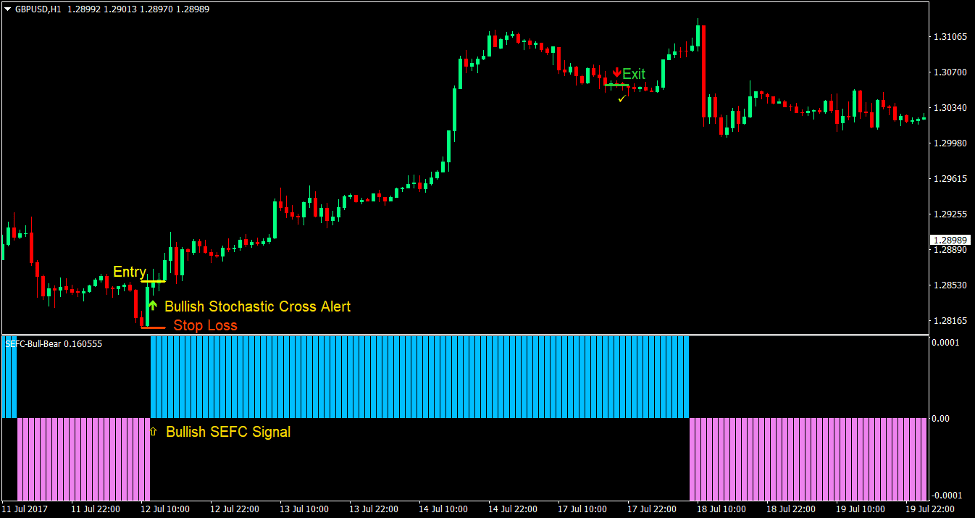

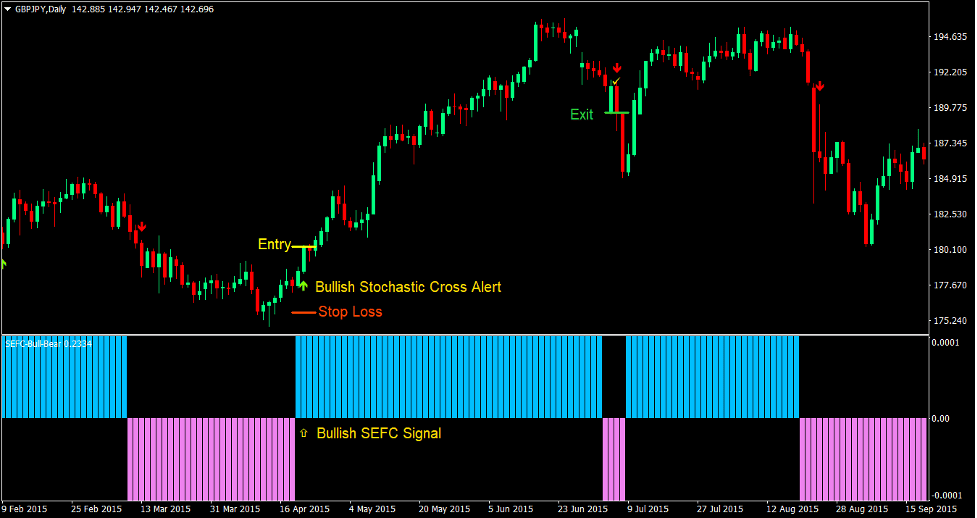

Buy Trade Setup

Entry

- The SEFC084 Bulls Bears indicator should shift from negative to positive indicating bullish trend reversal.

- The Stochastic Cross Alert indicator should print an arrow pointing up indicating bullish trend reversal signal.

- These bullish trend reversal signals should be closely aligned.

- Enter a buy order on the confluence of the above conditions.

Stop Loss

- Set the stop loss on the support level below the entry candle.

Exit

- Close the trade as soon as the SEFC084 Bulls Bears indicator becomes negative.

- Close the trade as soon as the Stochastic Cross Alert indicator prints an arrow pointing down.

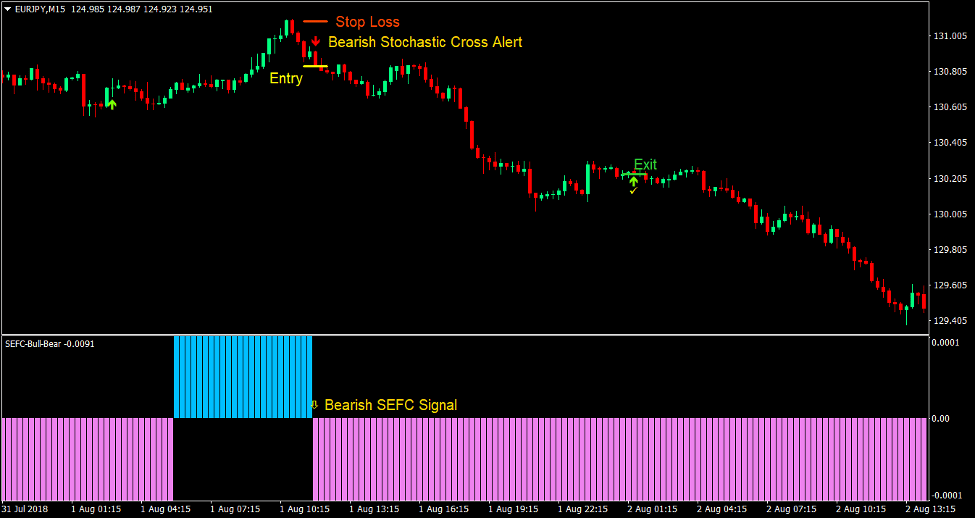

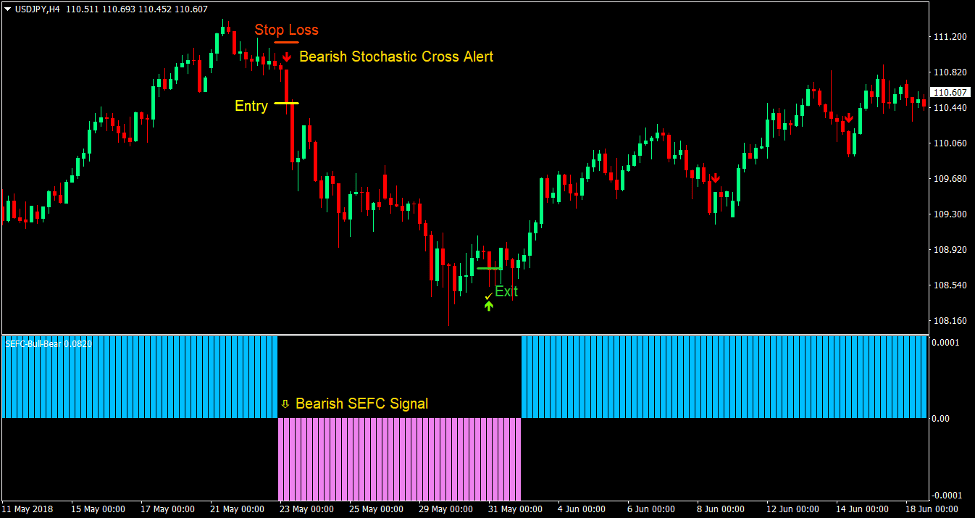

Sell Trade Setup

Entry

- The SEFC084 Bulls Bears indicator should shift from positive to negative indicating bearish trend reversal.

- The Stochastic Cross Alert indicator should print an arrow pointing down indicating bearish trend reversal signal.

- These bearish trend reversal signals should be closely aligned.

- Enter a sell order on the confluence of the above conditions.

Stop Loss

- Set the stop loss on the resistance level above the entry candle.

Exit

- Close the trade as soon as the SEFC084 Bulls Bears indicator becomes positive.

- Close the trade as soon as the Stochastic Cross Alert indicator prints an arrow pointing up.

Conclusion

Trading on trend reversals with momentum on an overbought or oversold condition is one of the best trading strategies. It has a high probability of resulting in a new trend thus allowing for a higher reward-risk ratio with a decent win rate.

This strategy does that. It provides trend reversal signals based on the Stochastic Oscillator and ensures that the signal has momentum based on the signal’s confluence with the SEFC084 Bulls Bears indicator.

This strategy works well. However, it is best to incorporate some price action technical analysis with this strategy. Trading on reversal signals and breaks from a support or resistance could produce good results.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: