Wildhog Regular Divergence Forex Trading Strategy

How do we catch reversals right from the start? Or is it even possible?

Catching bottoms or peaks and trading reversals is a dangerous game, especially in a strongly trending market. It would be like stepping in front of a freight truck and hoping it would bounce off you. Chances are you would be crushed by the truck.

However, there are traders who are extremely adept to trading reversals and can catch peaks or bottoms and ride it out as the market reverses. These traders often are able to cash in on huge profits that would make them very profitable in the end. Its not that they are super traders but its just that they know a strategy or two on how to catch market reversals.

Regular Divergences – A Sign of a Probable Reversal

There are many ways to trade reversals. One of the better ways to trade reversals is through regular divergences. It isn’t perfect, but with the right filters, it does work.

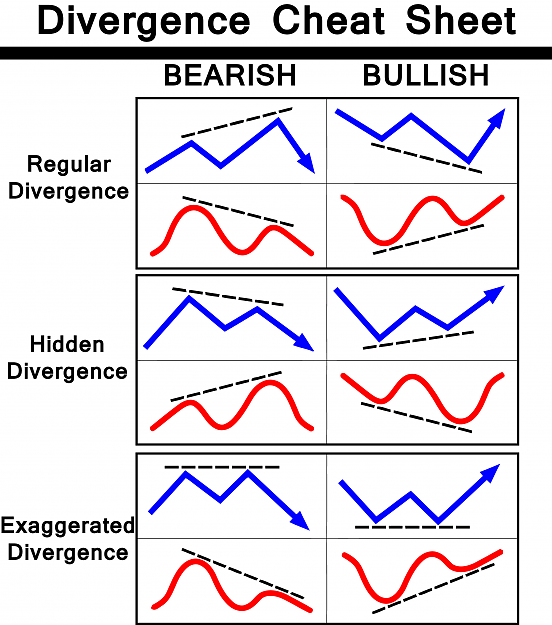

Divergences are basically discrepancies between price movement and an oscillating indicator. Price action moves in a manner where in it moves up and down the chart forming swing highs and swing lows. Usually an oscillating indicator would track the swing highs and lows with its own peaks and troughs on another window. However, there are instances when the height or depth of a peak or trough of an oscillator would differ from that of the swing highs and lows on the price chart. This is what we call divergences.

Because divergences are discrepancies between price and an oscillating indicator, which is somehow a mathematically computed basis of whether price is relatively cheap or expensive, it is somehow an indicator of a probable market reversal. For example, on the price chart, price did go higher, but on the oscillating indicator that peak would be considered cheap compared to the previous peak, one way or another, one of the two will give way. If it is price that follows the oscillating indicator, then it would result to a reversal.

There are two types of divergences, hidden and regular divergences. In my experience, hidden divergences are usually minor reversals wherein the direction of the divergence still agrees with the big picture trend. On the other hand, regular divergences have a higher tendency to appear at the end of the trend where price action could already be losing steam and could reverse. This is not a hard and fast rule but just my personal observation. With that said, although hidden divergences tend to have a high probability, regular divergences tend to cause a stronger reversal.

Below is a cheat sheet of the types of divergences.

Trading Strategy Concept

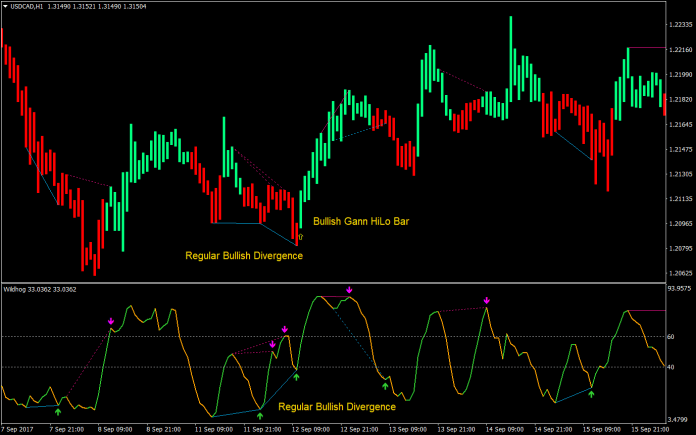

This strategy aims to catch big reversals right from the start using a custom indicator that could detect divergences, the Wildhog NRP Divergence. Although this indicator could detect both regular and hidden divergences, we will only be making use of regular divergences.

In order to increase the probability of a successful regular divergence setup, we will be combining this strategy with another custom indicator that tends to determine the short-term trend by printing bars over the candlesticks, the Gann HiLo activator bars. With this template, we will have green bars representing a bullish short-term trend and red bars representing a bearish short-term trend.

Often, the Wildhog NRP Divergence indicator would detect regular divergences prior to the actual reversal. However, the reversal still isn’t confirmed. This is where the Gann HiLo activator bars come into play. If the reversal occurs right after the detection of a regular divergence and the reversal starts with a strong momentum, the Gann HiLo activator bars would immediately change color.

To trade this strategy, we will take regular divergence setups that were detected by the Wildhog NRP Divergence indicator if the candle right after the divergence would cause the Gann HiLo activator bars to change color.

Indicators:

- Wildhog NRP Divergence

- Gann HiLo activator bars

Timeframe: 15-minute and 1-hour charts

Currency Pair: any

Trading Session: any

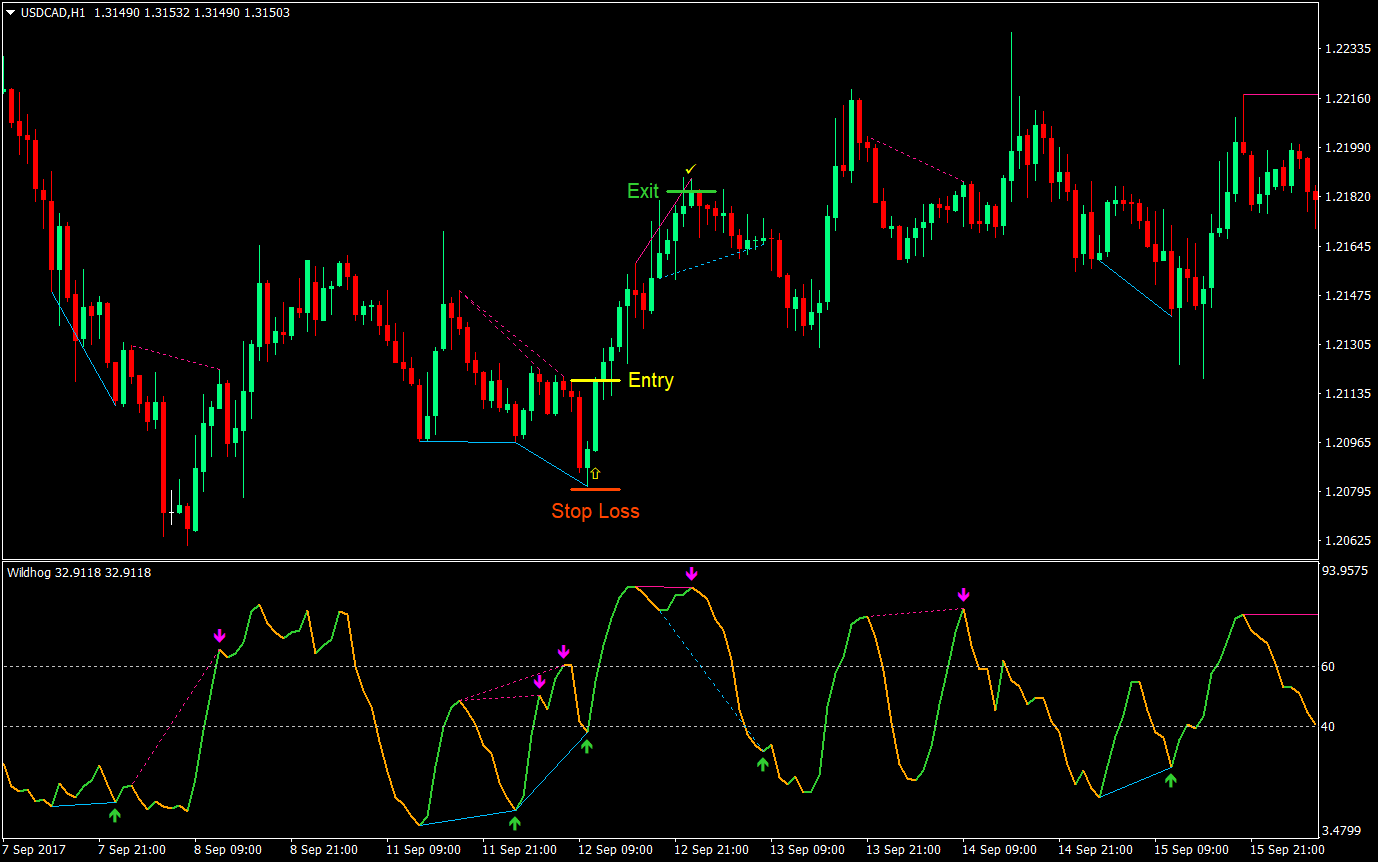

Buy (Long) Trade Setup

Entry

- The Wildhog NRP Divergence should detect a regular bullish divergence indicated by a sky blue solid line below the price action and the oscillating indicator, as well as a green arrow pointing up.

- The bar right after the divergence should cause the Gann HiLo activator bars to immediately change from red to green.

- As the above rules are met, enter a buy order at the close of the candle.

Stop Loss

- Set the stop loss at the fractal below the entry candle.

Exit

- Close the trade if an opposing divergence is detected by the Wildhog NRP Divergence indicator; or

- Close the trade if the Gann HiLo activator bars becomes red

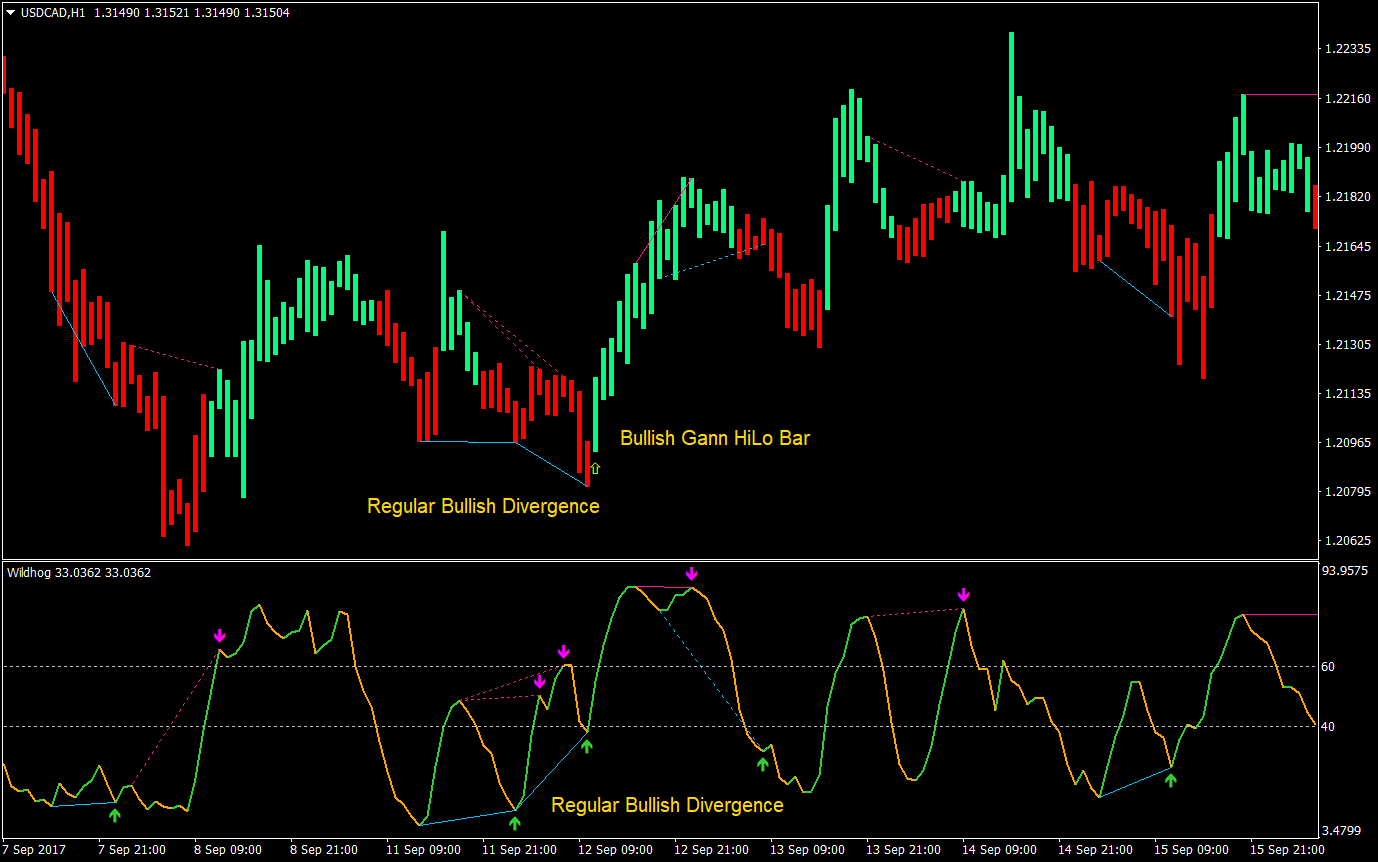

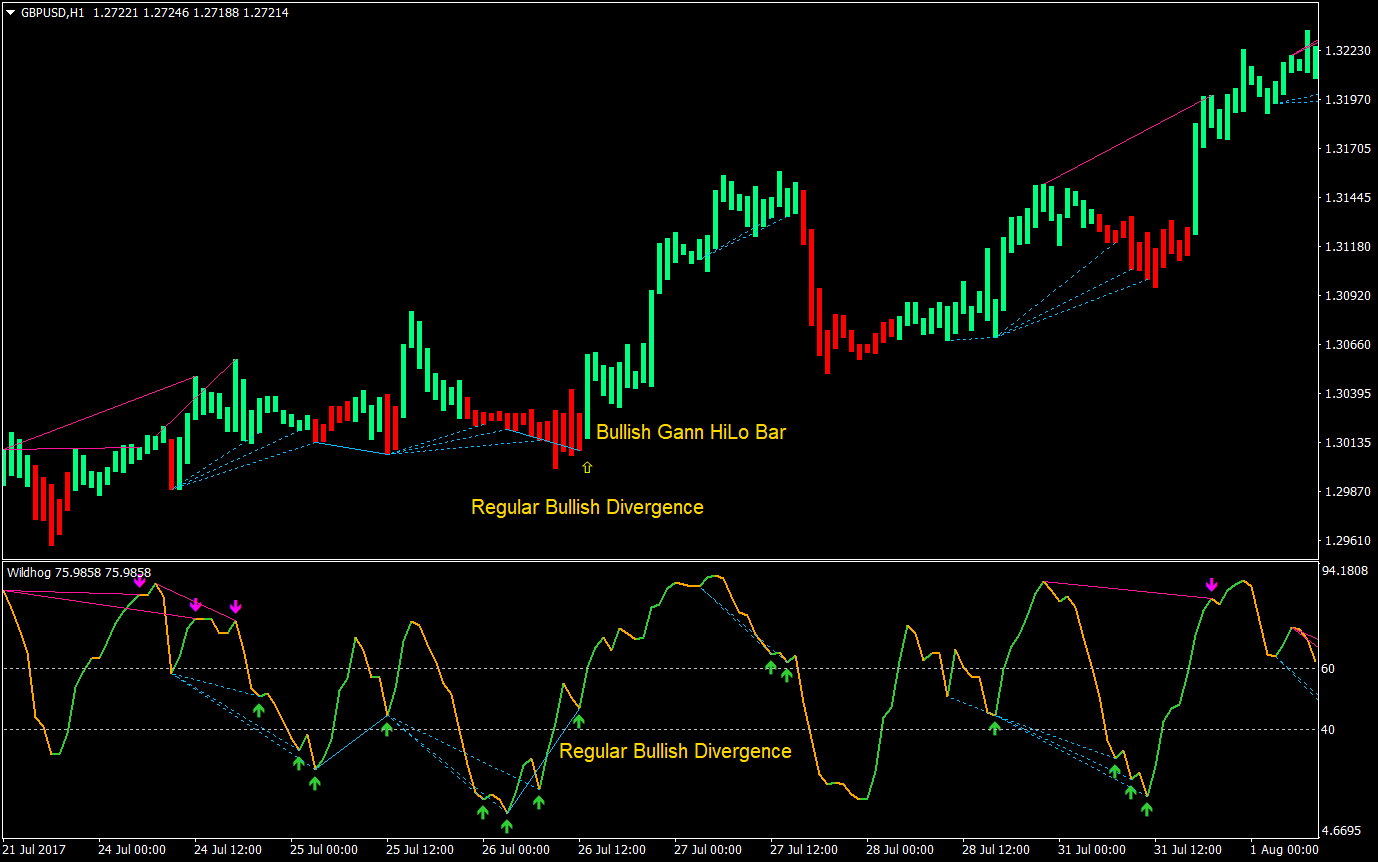

Buy Trade Sample 1

Buy Trade Sample 2

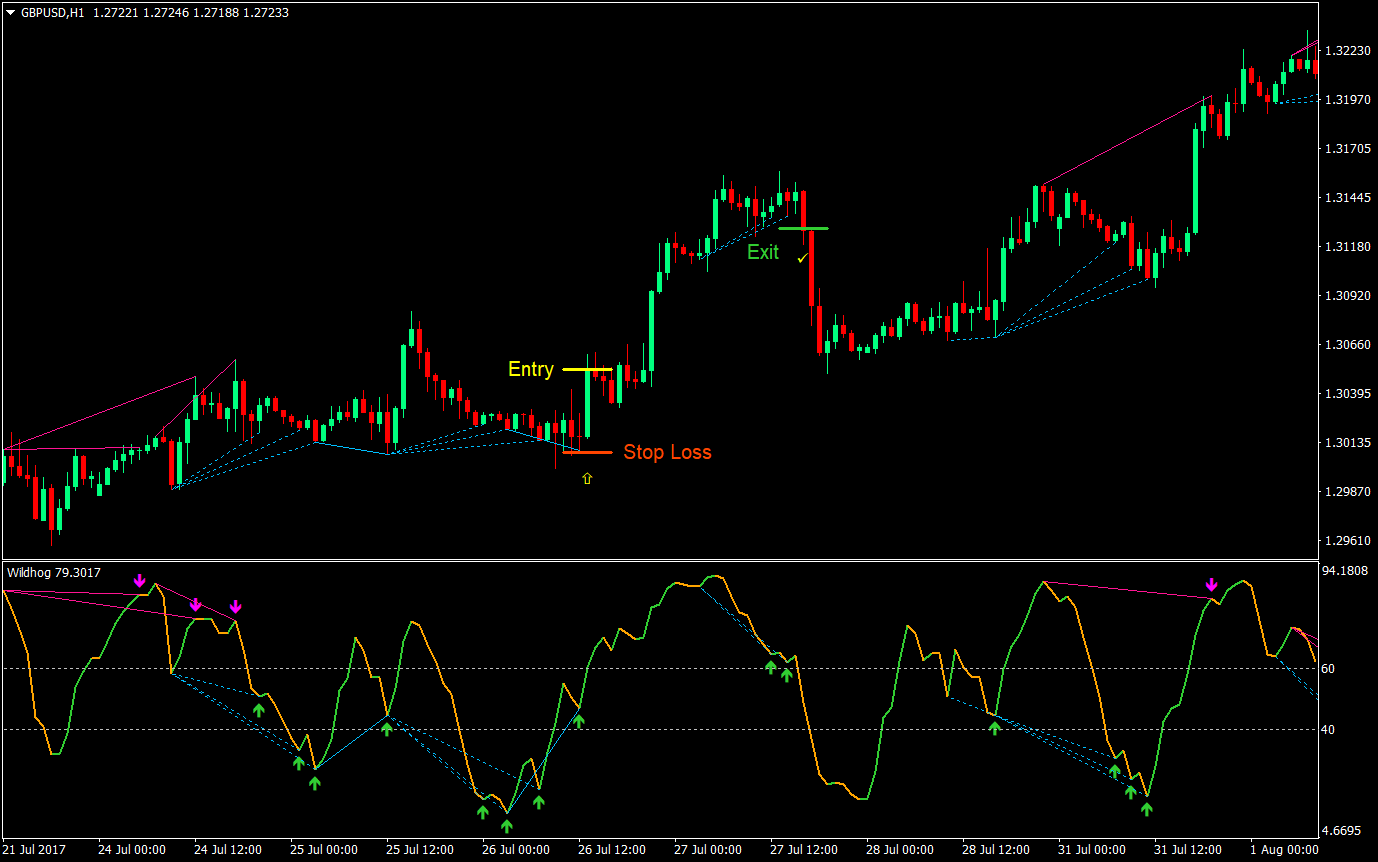

Sell (Short) Trade Setup

Entry

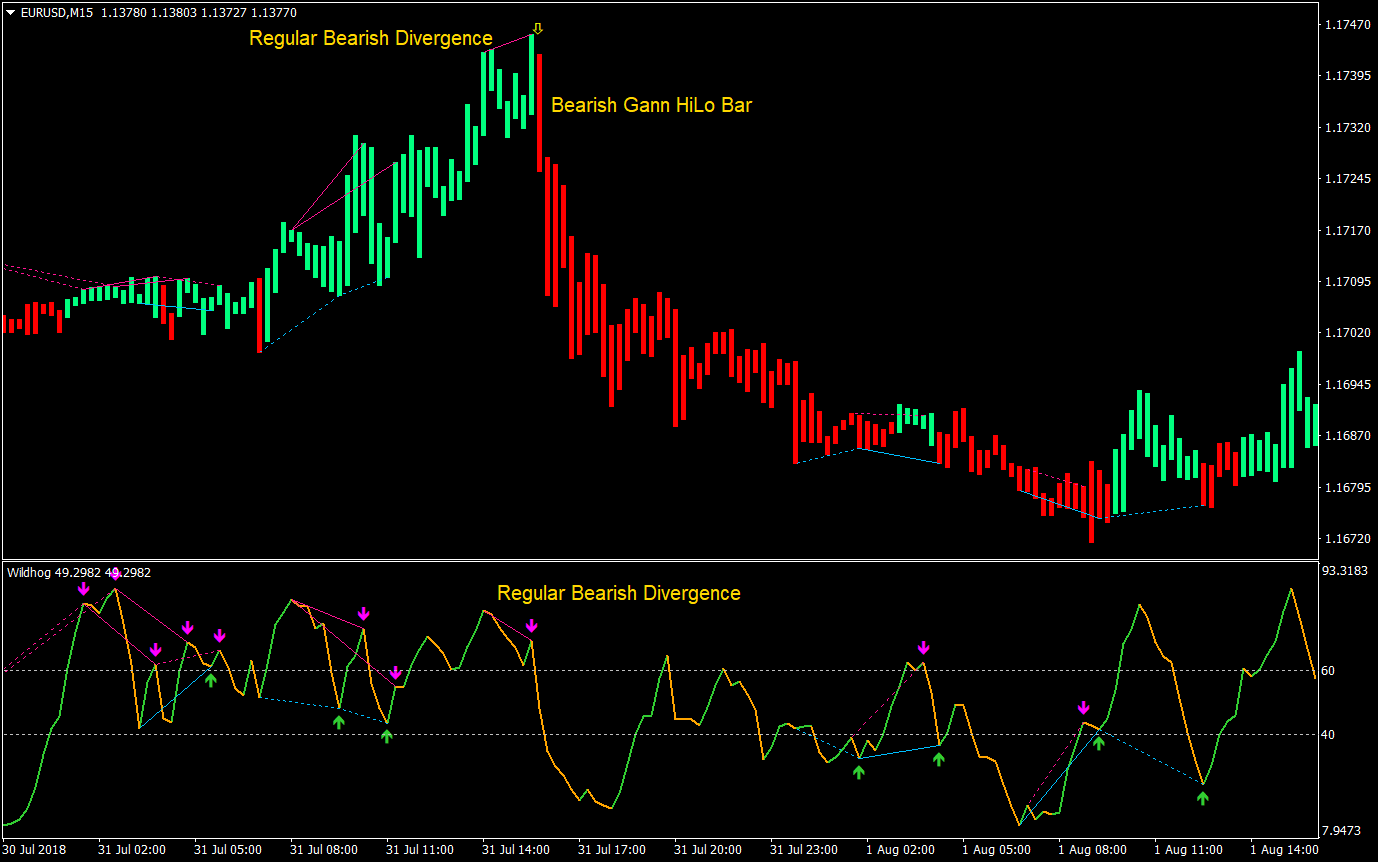

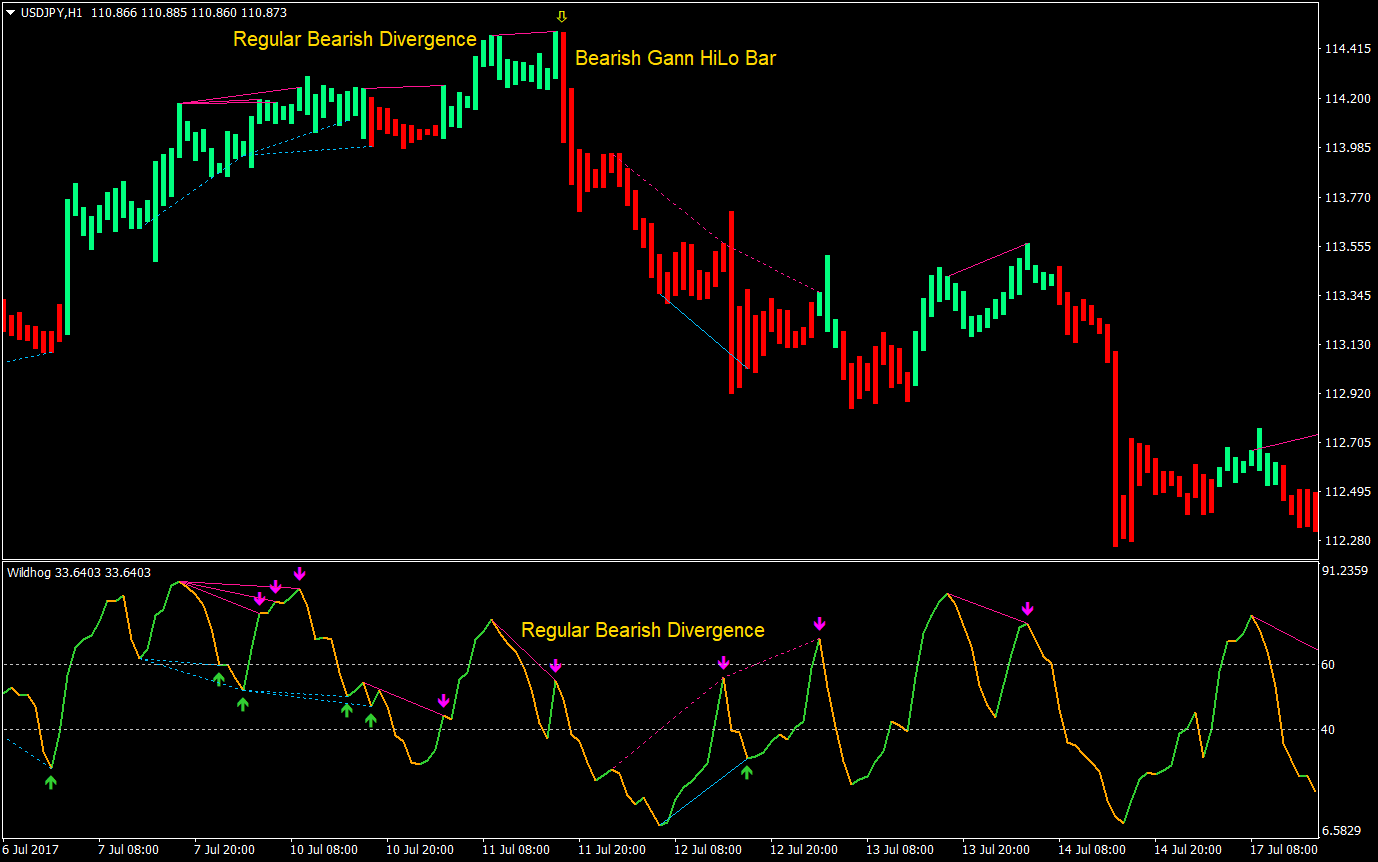

- The Wildhog NRP Divergence should detect a regular bearish divergence indicated by a pink solid line above the price action and the oscillating indicator, as well as a magenta arrow pointing down.

- The bar right after the divergence should cause the Gann HiLo activator bars to immediately change from green to red.

- As the above rules are met, enter a sell order at the close of the candle.

Stop Loss

- Set the stop loss at the fractal above the entry candle.

Exit

- Close the trade if an opposing divergence is detected by the Wildhog NRP Divergence indicator; or

- Close the trade if the Gann HiLo activator bars becomes green

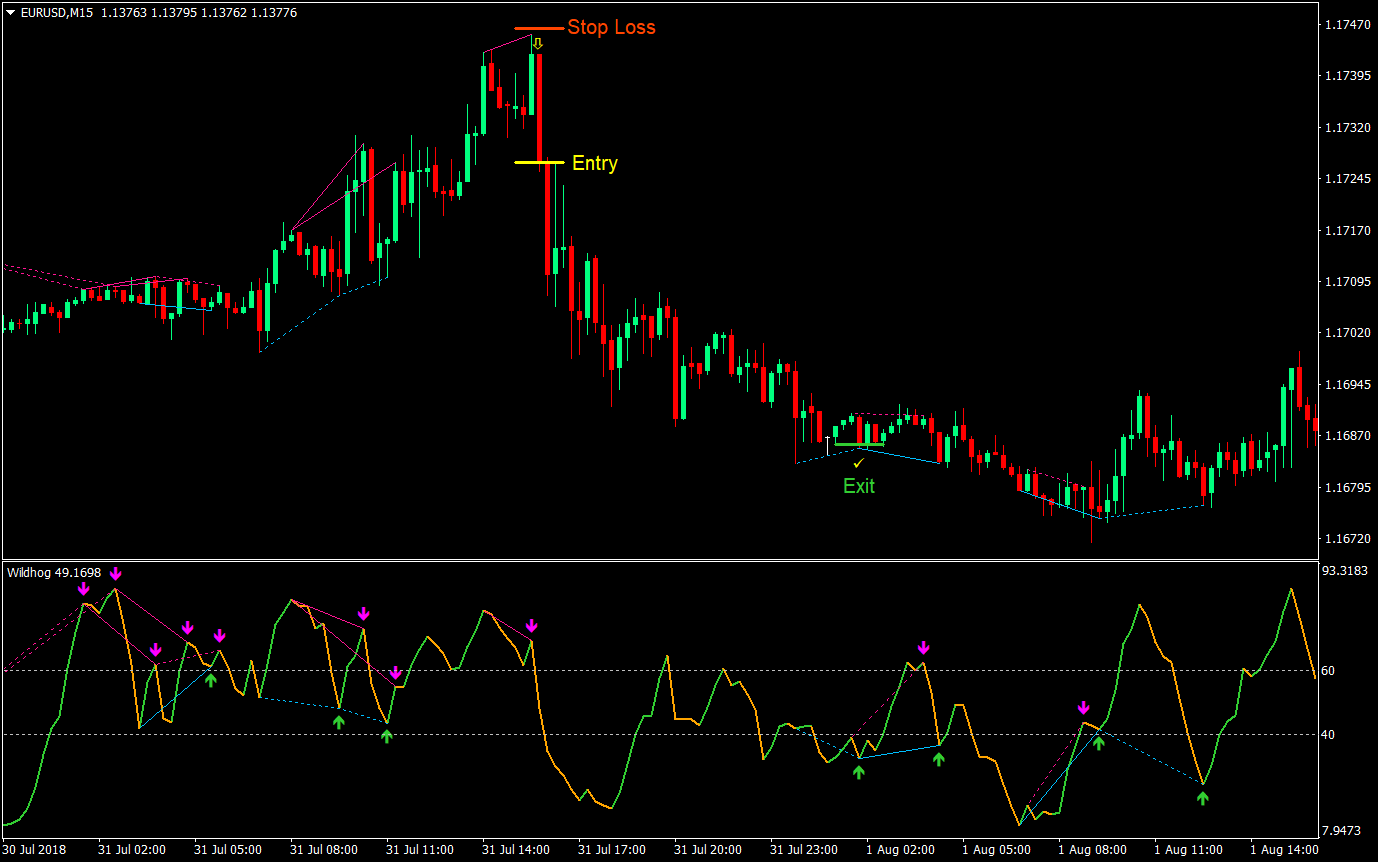

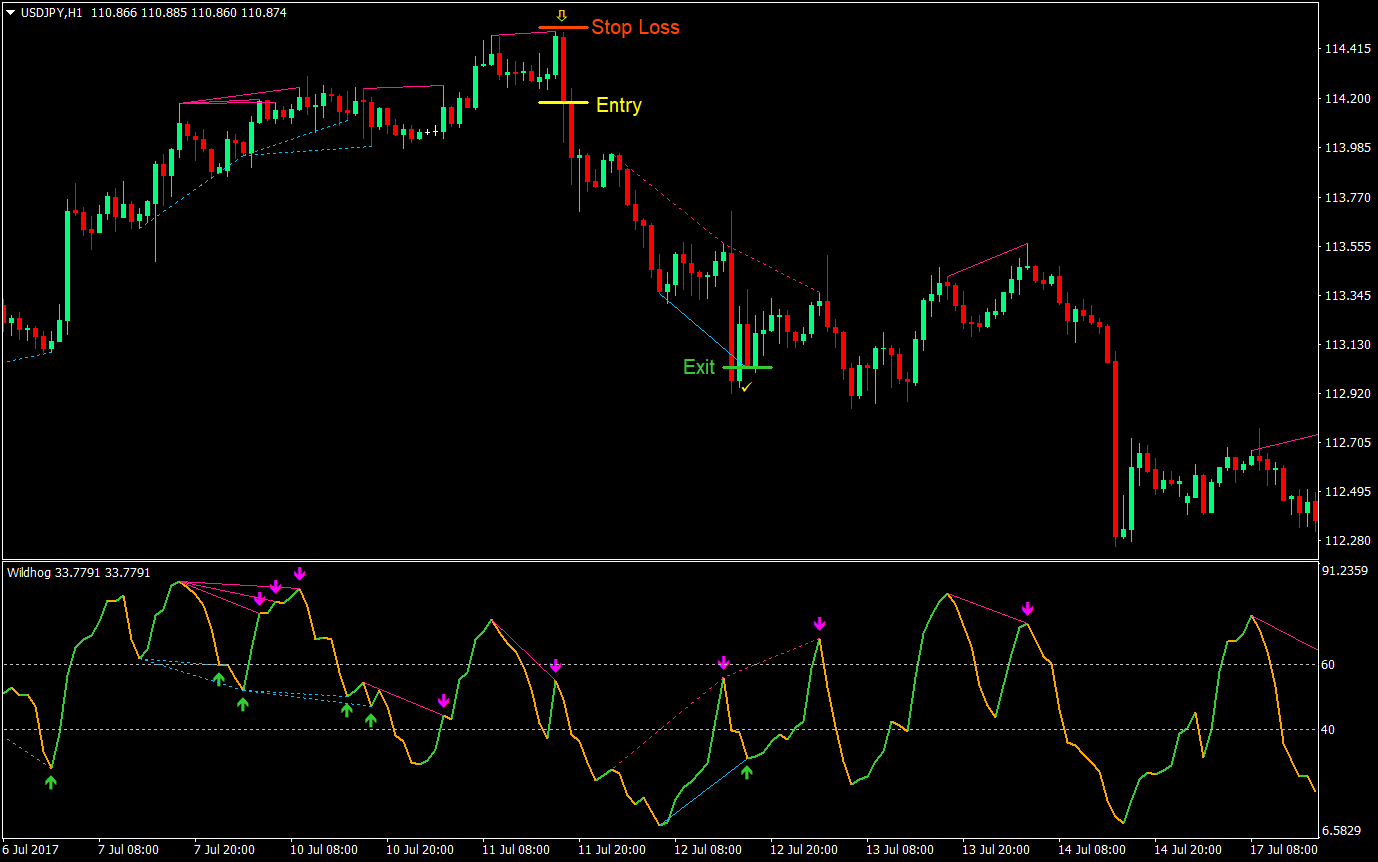

Sell Trade Sample 1

Sell Trade Sample 2

Conclusion

Catching peaks and bottoms are typically low probability trade setups. However, with this strategy, the probability of a successful reversal setup is increased because of the combination of a regular divergence setup and the confirmation of the Gann HiLo activator bars.

Divergences are a proven trading strategy. Many traders have become consistently profitable using divergences as the focal point of their trading strategy. Some traders even claim that they usually have a successful trade or two within three tries of successive divergence setups. That might not seem too appealing but given that divergences have very high reward-risk ratio, this is still incredibly profitable.

Having the Wildhog NRP Divergence indicator makes things a lot simpler as it takes the subjectivity of detecting a divergence from the trader and instead shows what it detects.

It would be best if this strategy is combined with a feel for price action as successful reversal trade setups typically occur at the end of the trend. As the trend becomes over extended and starts to roll over, this is when a probable reversal may occur.

Trade wisely!!!

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: