Vortex Trend MT5 Indicator has garnered significant attention for its potential to empower traders with valuable insights into trend direction and strength. This comprehensive guide delves into the intricacies of the Vortex Trend MT5 Indicator, equipping you with the knowledge to harness its power and potentially elevate your trading endeavors.

Demystifying The Vortex Indicator

The Vortex Indicator, the foundation upon which the Vortex Trend MT5 Indicator is built, boasts a rich history dating back to 2010. Credited to Etienne Botes and Douglas Siepman, the indicator draws inspiration from the works of Welles Wilder (creator of the Relative Strength Index – RSI) and Viktor Schauberger, a pioneer in the field of implosion technology. Despite its intricate calculations, the core principle behind the Vortex Indicator remains remarkably straightforward, offering valuable insights into positive and negative trend movements.

Decoding The Components

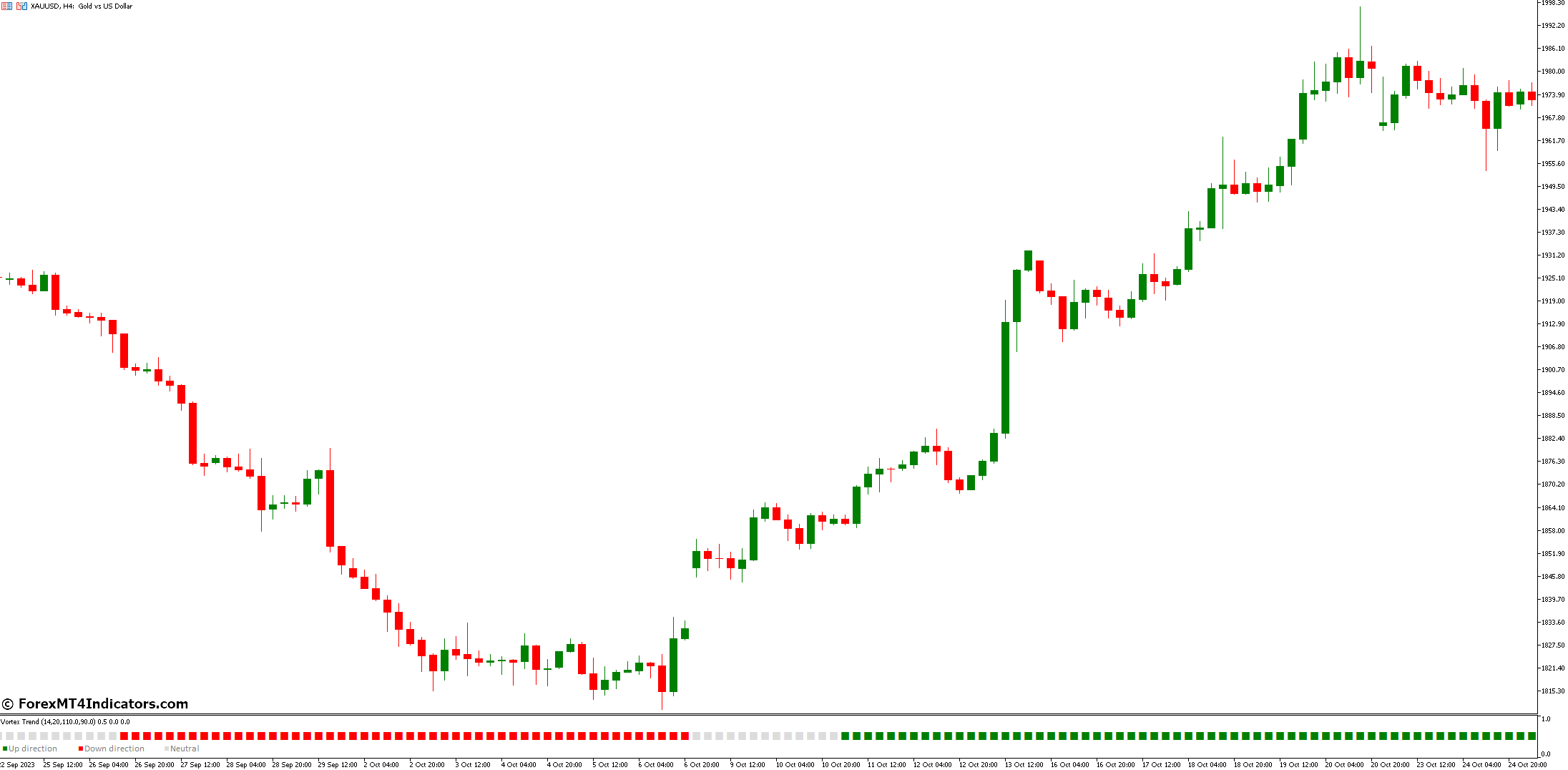

The Vortex Trend MT5 Indicator, an advanced iteration of the original Vortex Indicator, presents two crucial components: the Positive Trend Indicator (VI+) and the Negative Trend Indicator (VI-). These lines, visualized within the MT5 platform, oscillate based on calculations involving the highs and lows of price bars over a designated period (typically 14 days).

Interpreting the movements of these VI lines is key to utilizing the indicator effectively. When the VI+ line crosses above the VI-, it often signifies a bullish signal, suggesting a potential uptrend. Conversely, a bearish signal is generated when the VI- line crosses above the VI+, indicating a possible downtrend.

Identifying Trends With Confidence

While crossover signals offer valuable initial insights, relying solely on them can be a recipe for missed opportunities or potential pitfalls. Seasoned traders often employ confirmation strategies to bolster their confidence in the indicator’s signals. These strategies may involve:

- Price action: Observing candlestick patterns and price movements alongside the indicator’s signals can provide valuable confirmation.

- Volume analysis: Increased volume alongside a crossover signal can strengthen the underlying trend’s legitimacy.

- Support and resistance levels: Identifying these crucial levels in conjunction with the indicator’s signals can pinpoint potential entry and exit points for trades.

Unveiling the Advantages and Disadvantages

Like any other technical analysis tool, the Vortex Trend MT5 Indicator possesses its own set of advantages and disadvantages:

Advantages

- Simplicity: The indicator’s core concept and interpretation are relatively straightforward, making it accessible to traders of varying experience levels.

- Trend confirmation: The indicator can effectively serve as a confirmation tool for existing trends identified through other technical analysis methods.

- Early trend identification: Under appropriate conditions, the indicator’s signals may offer an early glimpse into potential trend formations.

Disadvantages

- Lagging indicator: Being a lagging indicator, the Vortex Trend MT5 Indicator reacts to past price movements, potentially leading to delayed signals.

- False signals: Like any other indicator, the Vortex Trend MT5 Indicator is susceptible to generating false signals, particularly in volatile market conditions.

- Dependence on other tools: While valuable, the indicator’s effectiveness often hinges on its integration with other technical analysis tools and confirmation strategies.

Unveiling the Power of Backtesting and Paper Trading

Backtesting involves applying your trading strategy to historical price data to assess its potential effectiveness. This allows you to identify strengths, weaknesses, and potential areas for improvement without risking real capital. Several MT5 platforms and online resources offer backtesting functionalities. Paper trading involves simulating real-world trading scenarios using a virtual account with fake funds. This enables you to practice implementing your strategy, managing emotions, and fine-tuning your approach before venturing into the live markets.

Both backtesting and paper trading are invaluable tools for honing your skills and building confidence before putting your strategy to the test with real capital.

Real-World Examples

While theoretical frameworks are essential, witnessing the practical application of the Vortex Trend MT5 Indicator can solidify its potential value. Here are a couple of illustrative examples:

Example 1: Bullish Trend Confirmation

Imagine a scenario where the price of an asset has been steadily rising, accompanied by higher highs and lows. The VI+ line then crosses above the VI-, generating a bullish signal. This confirms the existing uptrend, potentially offering an entry point for a long trade.

Example 2: Identifying A Potential Reversal

In another instance, the price of an asset has been exhibiting signs of weakness, with lower highs and lows. The VI- line subsequently crosses above the VI+, generating a bearish signal. This suggests a potential trend reversal, prompting the trader to either exit a long position or consider initiating a short trade, always adhering to proper risk management.

How to Trade with Vortex Trend Indicator

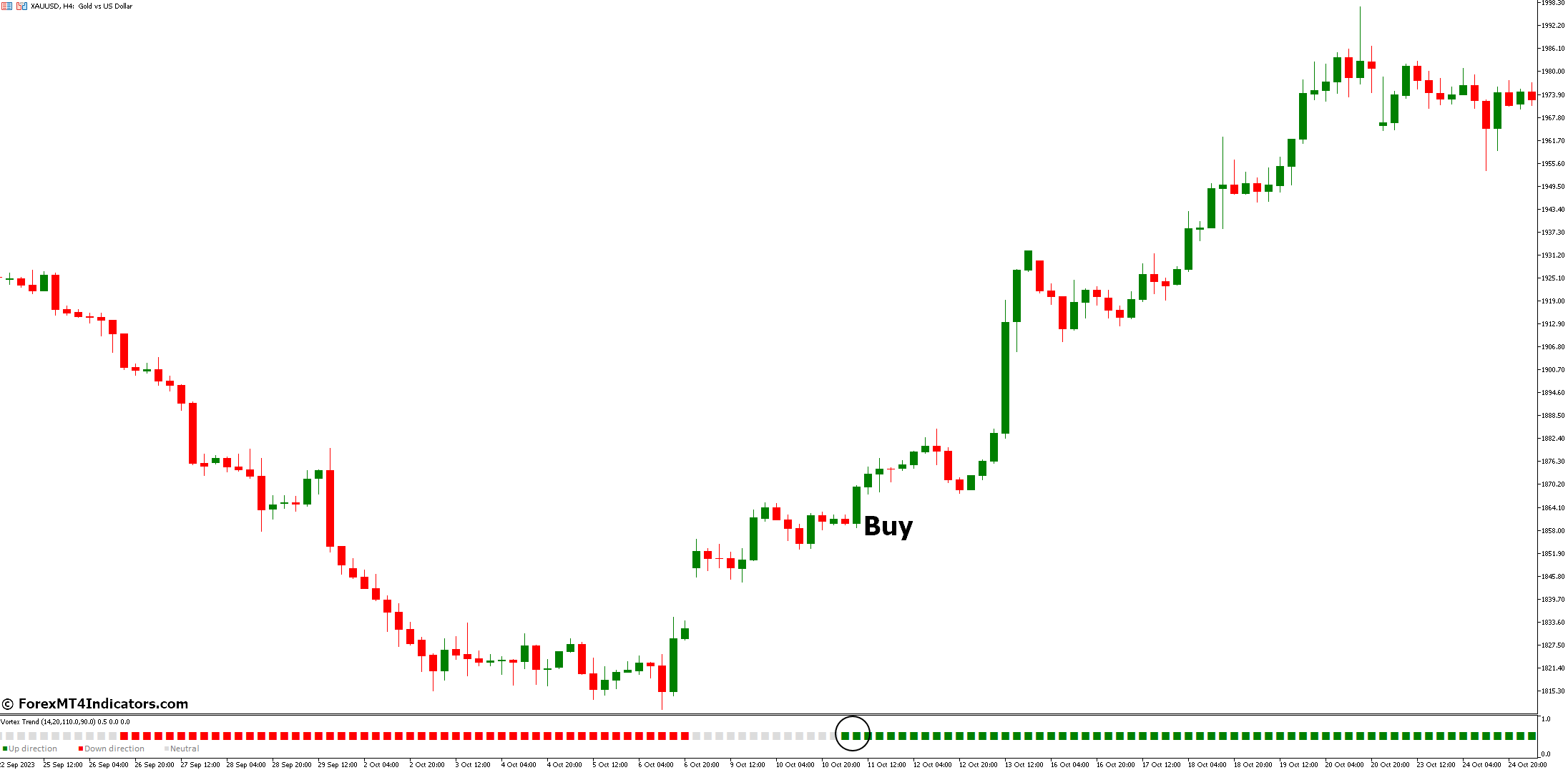

Buy Entry

- VI+ line crosses above VI- line.

- Price action shows higher highs and lows, indicating an uptrend.

- Additional confirmation from other technical indicators (optional).

- Consider entering the trade slightly above a recent swing high.

- Place a stop-loss order below the recent swing low.

- Target a profit level based on your risk-reward ratio and market conditions.

- Consider using trailing stop-loss orders to lock in profits as the price moves in your favor.

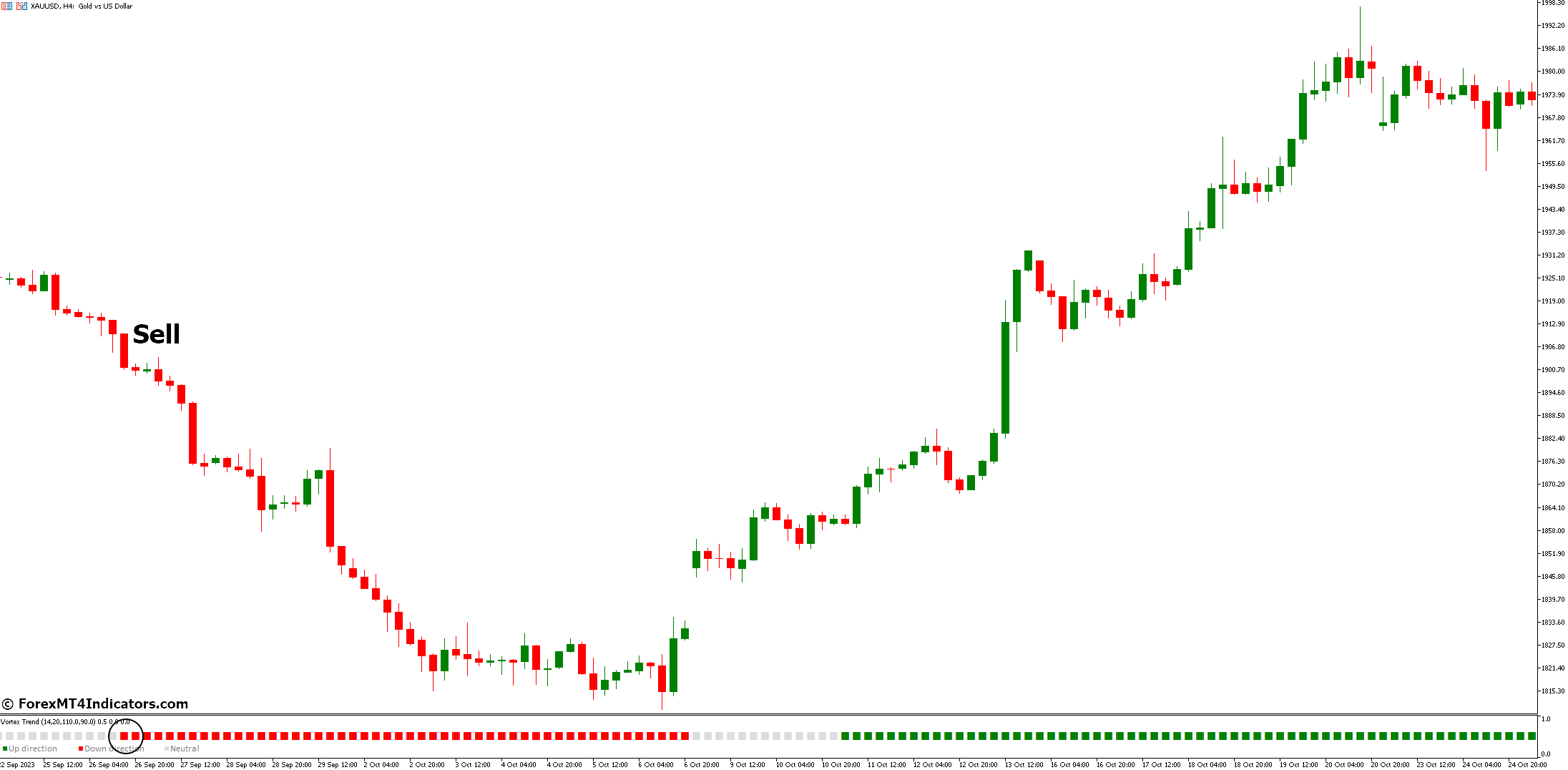

Sell Entry

- VI- line crosses above VI+ line.

- Price action shows lower highs and lows, indicating a downtrend.

- Additional confirmation from other technical indicators (optional).

- Consider entering the trade slightly below a recent swing low.

- Place a stop-loss order above the recent swing high.

- Target a profit level based on your risk-reward ratio and market conditions.

- Consider using trailing stop-loss orders to lock in profits as the price moves in your favor.

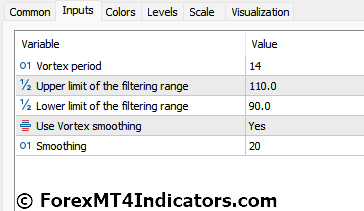

Vortex Trend Indicator Settings

Conclusion

Vortex Trend MT5 Indicator, when used appropriately and in conjunction with other tools and strategies, has the potential to empower traders with valuable insights into trend direction and strength. However, it’s essential to approach this indicator, and any other technical analysis tool for that matter, with caution, a healthy dose of skepticism, and a commitment to responsible trading practices.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

(Free MT5 Indicators Download)

Click here below to download: