Inside Bar Forex Swing Trading Strategy

The inside bar trading strategy is best for beginners because it is very comprehensive. It doesn’t require a lot of indicators. It just uses price actions and the candlestick patterns. This strategy has a small stop loss and can have a large profit. This strategy is effective on a daily timeframe.

We will first know what inside bar is. The Inside bar is a candlestick that forms within the trading range(or shadow) of the preceding bar. It is a two candlestick formation, one being the mother candlestick and the other which is the smaller candlestick is the baby candlestick. The mother candlestick can be either bullish(green) or bearish(read)

The inside bar can be bullish or bearish.

Inside bar will form when there is a price consolidation or indecision. This will form around the support or resistance area, pivots, daily high or low of candlesticks if you are trading in the 1hr or 4hr timeframe or at the Fibonacci levels. Always take note that when the price forms at this levels, then there must be a significant activity in the market.

Tips in Trading the Inside Bar:

The inside bar doesn’t have much significant if it just forms anywhere or the location on the trading chart does not correspond to support or resistance, pivot or Fibonacci levels.

Selling Rules:

- The market must be in a downtrend.

- Look for the inside bar formation and place a sell stop order 3-5 pips below the low of the inside bar.

- Place stop loss anywhere from 5-10 pips above the high of the inside bar.

- You can close the position on the third candlestick. Your candlestick count should include the inside bar(which should be number 1).

- Trailing stop is another option to exit the position.

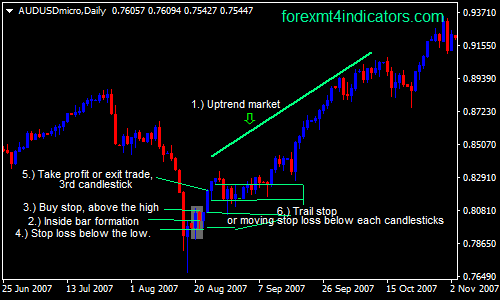

Buying Rules:

- The market must be an uptrend.

- Look for an inside bar formation then place a buy stop above the high of the inside bar.

- Place your stop loss anywhere from 5-10 pips below the low of the inside bar.

- Exit position on the third candlestick. The count should include the inside bar.

- Trailing stop is another option to exit position.

Another inside bar technique:

To capture the breakout of the of the high and low of the inside bar, you must place buy stop and sell stop order on both sides of the bar.

To do it, you must place a buy stop order a few pips above the high of the inside bar candlestick and place a stop loss few pips below the low of the inside bar candlestick. At the same time, place a sell stop order a few pips below the low of the inside bar candlestick and a place the stop loss a few pips above the high of the inside bar candlestick.

When the other order is triggered, then you can close the other order. For example, when buy stop is triggered, then exit the sell stop order.

DISADVANTAGES:

- There are false breakouts.

Note: Do not try inside day strategy on timeframes below 4 hours.

ADVANTAGES:

- Forex trading entries based on price action.

- Huge profits are possible if you trail the stop the trades.

- You only need 5 minutes a day to check the daily bars, because you can easily place orders and stop losses and go away.

- Easy to identify.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: