Most traders would love to catch trades right at the beginning of the trend and exit at the end of the same trend. This allows traders to squeeze out as much profit out of a trend as possible. However, most traders can only dream of getting such trades. Many traders would trade a trend reversal strategy all the time without regard for the type of market condition they are in or whether the signal has a strong probability or not. Traders who do manage to master trend reversal strategies have the potential to earn so much profit from the forex market.

One of the ways traders increase their chances of getting the right trend reversal trade is by looking for divergences. Market swings have different strengths and momentum. This causes price swings to either be deep or shallow, high or low. These price swings have its corresponding peaks and troughs whenever an oscillating technical indicator is used on a price chart.

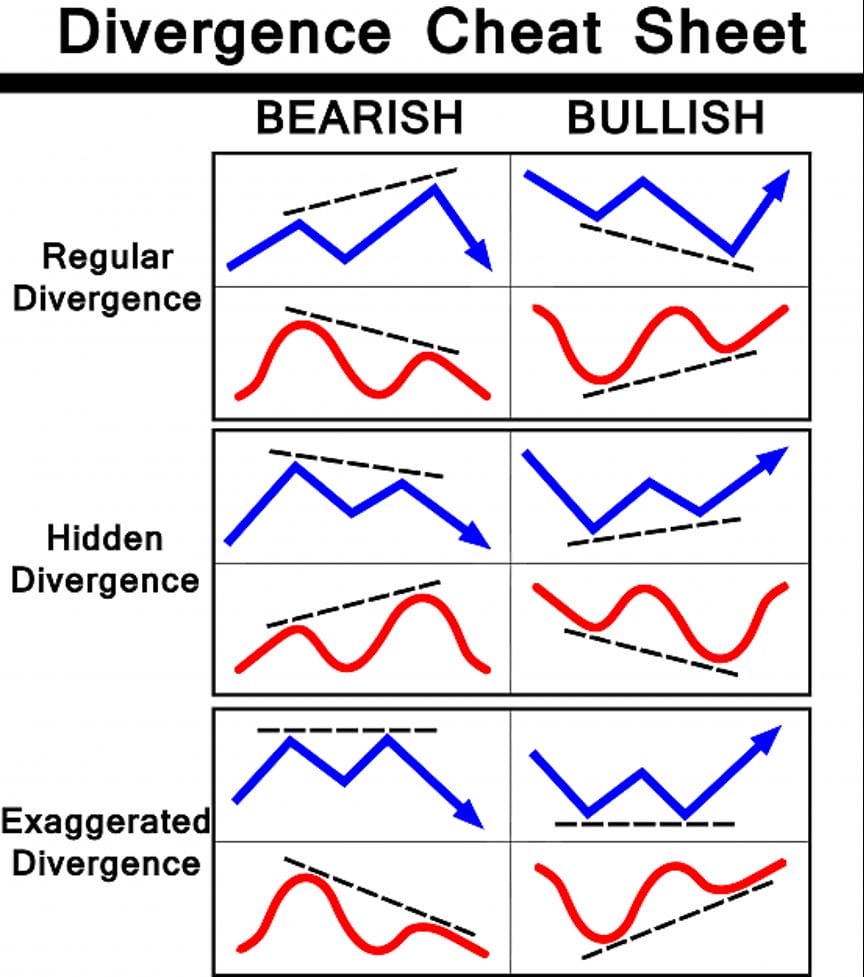

Divergence is the state wherein the height or depth of a price swing varies in intensity when compared with a corresponding oscillator.

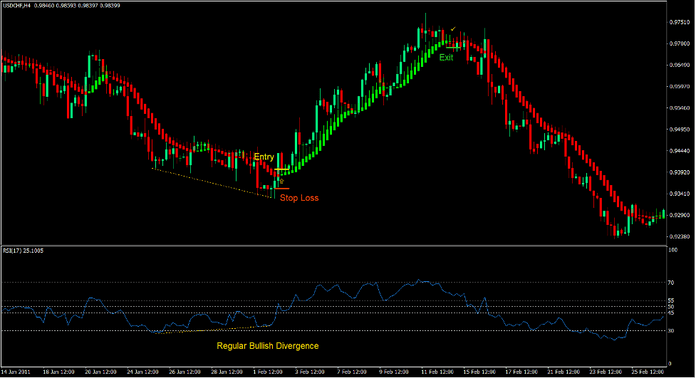

For example, a price swing might register a swing high which higher than the previous swing high, while its corresponding oscillator registers a peak which lower than the prior peak. This pattern is called a regular bearish divergence. This could mean that the swing high produced by price action is too high and price could start to reverse down anytime soon. This is just one of the divergence patterns. Below is a chart that shows the different divergence patterns.

Heiken Ashi Divergence Forex Trading Strategy is a trend reversal strategy that is based on the concept of divergences. It makes use of a Heiken Ashi Smoothed indicator to identify significant swing points and provide reliable trend reversal signals.

Heiken Ashi Smoothed Indicator

The Heiken Ashi Smoothed indicator is a trend following indicator which is based on the Heiken Ashi Candlesticks and the Exponential Moving Average (EMA).

Heiken Ashi literally means “average bars” in Japanese. Heiken Ashi Candlesticks are exactly that. It averages out the open and close of each candle, creating candlesticks that change colors only when the short-term trend or momentum has reversed.

The Heiken Ashi Smoothed indicator also produces bars that are averaged out. However, instead of producing bars that resemble candlesticks, it produces bars that resemble moving averages more closely.

The Heiken Ashi Smoothed indicator is a reliable trend following indicator which plots bars on the price chart. These bars follow price action quite closely. Its bars also change color depending on the direction of the trend. Lime bars indicate a bullish trend, while red bars indicate a bearish trend. Trend reversal signals are generated whenever the bars change color.

Relative Strength Index

Relative Strength Index (RSI) is a momentum indicator which is based on the magnitude of recent historical price changes.

It indicates trend direction by plotting an oscillating line on a separate window, which is based on the recent historical price changes on the price chart. This creates an oscillator that mimics the movement of price action.

The RSI line oscillates within the range of 0 to 100. It also has markers at level 30 and 70. These levels are thresholds wherein if the RSI line drops below 30, the market may be considered oversold, and if the RSI line is above 70, then the market may be considered overbought. However, momentum traders may interpret it the opposite way. An RSI line breaching above 70 may also indicate a bullish momentum, while an RSI line that drops below 30 may indicate a bearish momentum. This would depend on how price action behaves as the RSI line reaches these levels.

It also typically has markers at level 50. This level is the general indication of a bullish or bearish bias. RSI lines above 50 indicates a bullish bias, while RSI lines below 50 indicates a bearish bias. Many traders also add levels 45 and 55 to confirm trend direction. Lines crossing above 55 indicates a bullish trend with support at 45. On the other hand, lines dropping below 45 indicates a bearish trend with resistance at 55.

Trading Strategy

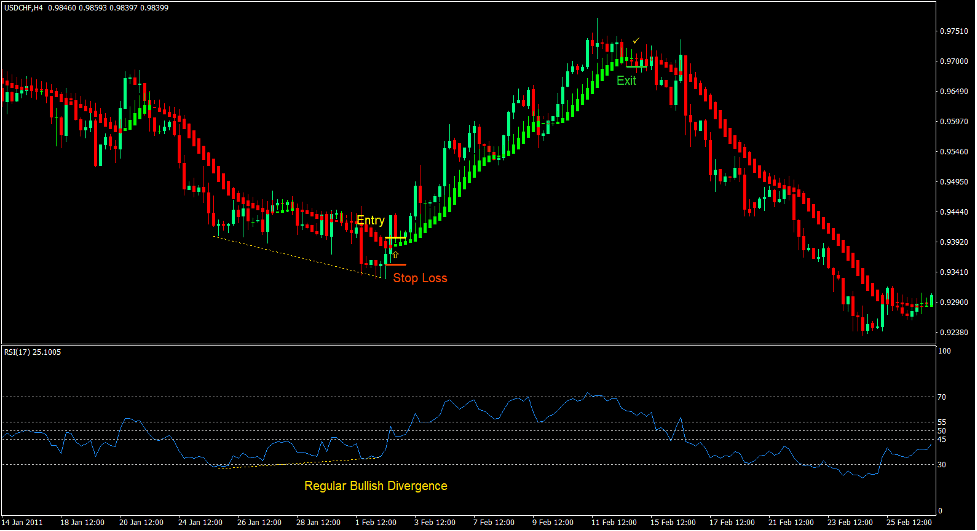

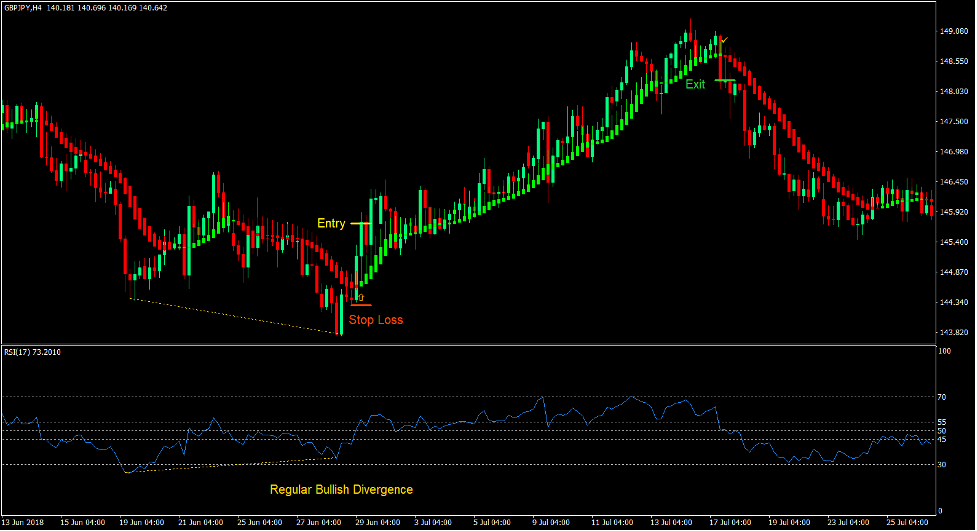

This strategy uses the Heiken Ashi Smoothed indicator to allow traders to easily identify swing highs and swing lows. These are based on the highs and lows that would cause the Heiken Ashi Smoothed indicator to temporarily reverse directions.

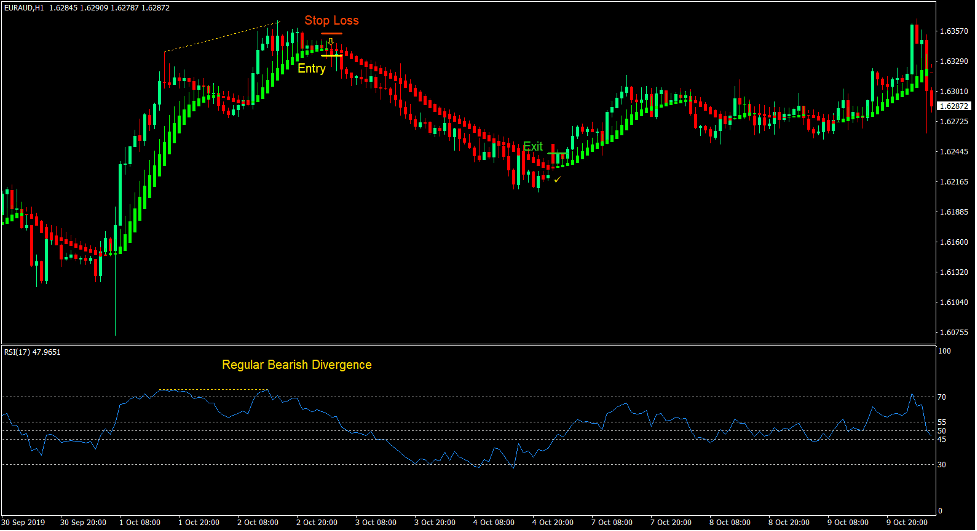

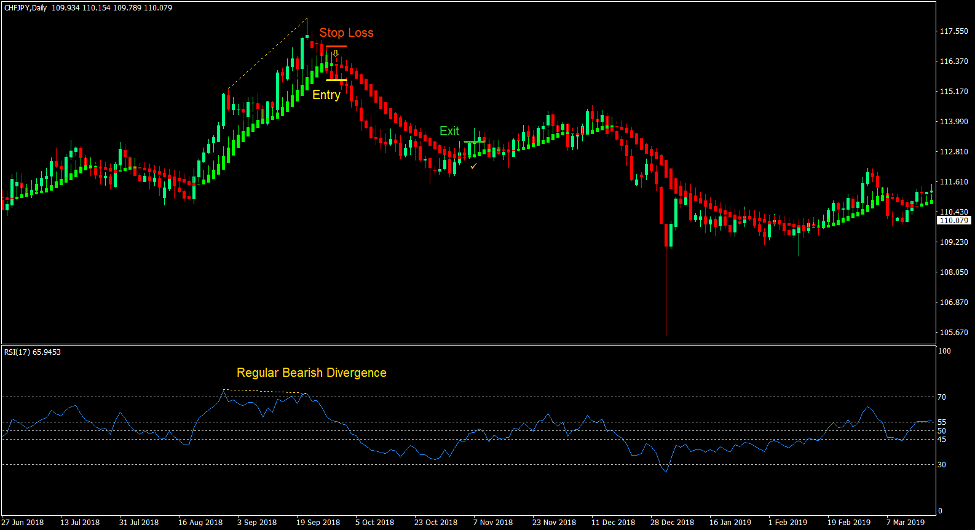

As soon as we identify the highs and lows, we then compare these swing points to the peaks and troughs on the RSI. Trades are considered whenever there is a valid divergence. Trade signals are generated as soon as the Heiken Ashi Smoothed indicator changes color indicating the change in trend direction.

Indicators:

- Heiken_Ashi_Smoothed

- Relative Strength Index

Preferred Time Frames: 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

Buy Trade Setup

Entry

- A valid bullish divergence should be present based on the swing lows of price action and the troughs of the RSI line.

- Enter a buy order as soon as the Heiken Ashi Smoothed bar changes to lime.

Stop Loss

- Set the stop loss below the Heiken Ashi Smoothed bars.

Exit

- Close the trade as soon as the Heiken Ashi Smoothed bars change to red.

Sell Trade Setup

Entry

- A valid bearish divergence should be present based on the swing highs of price action and the peaks of the RSI line.

- Enter a sell order as soon as the Heiken Ashi Smoothed bar changes to red.

Stop Loss

- Set the stop loss above the Heiken Ashi Smoothed bars.

Exit

- Close the trade as soon as the Heiken Ashi Smoothed bars change to lime.

Conclusion

Trading on divergences is a working trading strategy. There are a lot of traders who trade exclusively on price action and divergences based on the RSI line.

It is possible to profit from the forex market using divergences with RSI line alone. However, most new traders would find it difficult to identify valid swing highs and swing lows.

The addition of the Heiken Ashi Smoothed indicator simplifies the process of identifying these swing points visually. On top of this, the Heiken Ashi Smoothed indicator would also serve as a trend reversal signal which traders could use to enter the market.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: