Momentum breakouts are prime trading conditions wherein traders can find good trading opportunities. This is because momentum breakouts tend to cause price to move in one general direction and could often result in a trend.

Momentum trading is a technical trading technique wherein traders would buy or sell a tradeable instrument based on the strength of a trend. Basically, traders trading momentum strategies are trading with a strong force behind a price move. These strong price movements often cause price to move in the same direction and could often result in a trending market.

Momentum outside of trading is a result of mass and speed. In trading, mass and speed can be identified based on volume and the distance traveled by price within a short period.

One way to identify strong momentum is by observing for momentum candles. Momentum candles are long, full-bodied candles with little to no wicks. This indicates that price moved in one direction within that candle period. This is often accompanied by high volume trading within that candle.

In this strategy, we will be looking at using a couple of technical indicators in order to confirm momentum.

Dynamic Price Channel

Dynamic Price Channel is a custom channel type indicator which is based on the Average True Range (ATR).

The ATR is basically the average range of price candles within a predetermined period.

The Dynamic Price Channel incorporates the ATR with moving averages in order to identify trend, volatility, momentum and mean reversals.

The Dynamic Price Channel plots moving average line as its main line and is represented by a dashed yellow line. This line could either be a Simple Moving Average (SMA), Exponential Moving Average (EMA), or a Smoothed Moving Average (SMMA). Traders can select the option in the parameters tab of the indicator.

Then, six lines radiate from the moving average line. Three above and three below. These lines are plotted a distance away from the middle line, which is the moving average line, based on a factor of the ATR.

The indicator can be used as a volatility indicator. Traders can identify volatility based on the contraction and expansion of the bands away from the middle line.

It can also be used to identify trend direction, based on how the middle line is sloped and based on whether certain lines act as a dynamic support or resistance in the direction of the trend.

It can also indicate overbought or oversold markets based on how price reacts against the outer bands. If price action is showing signs of price rejection on the outer bands, then the market could either be overbought or oversold. These conditions are prime for a mean reversal.

On the other hand, the same outer lines can be used to determine strong momentum. If price action is showing signs of strong momentum breakout against the outer lines, the market could be gaining strong momentum which could result in a trend.

Relative Strength Index

The Relative Strength Index (RSI) is a versatile technical indicator which is a part of the oscillator family of indicators. It can be used to determine trends, momentum and overbought or oversold price conditions.

The RSI plots a line that oscillates within the range of 0 to 100. It also typically has markers at level 50, which is the midline. If the RSI line is above 50, then the market bias is bullish, while if the line is below 50, then the market bias is bearish.

It also has markers at level 30 and 70. An RSI line dropping below 30 could indicate an oversold condition, while an RSI line above 70 could indicate an overbought condition. Both conditions are prime for a mean reversal.

However, momentum traders may also view a breach above 70 as a bullish momentum indication, and a drop below 30 as a bearish momentum indication. It is a matter of how price action is responding as the RSI line breaches these levels.

Traders also add level 45 and 55 to support a trending market indication. The level 45 acts as a support level in a bullish trending market, while the level 55 acts as a resistance in a bearish trending market.

Trading Strategy

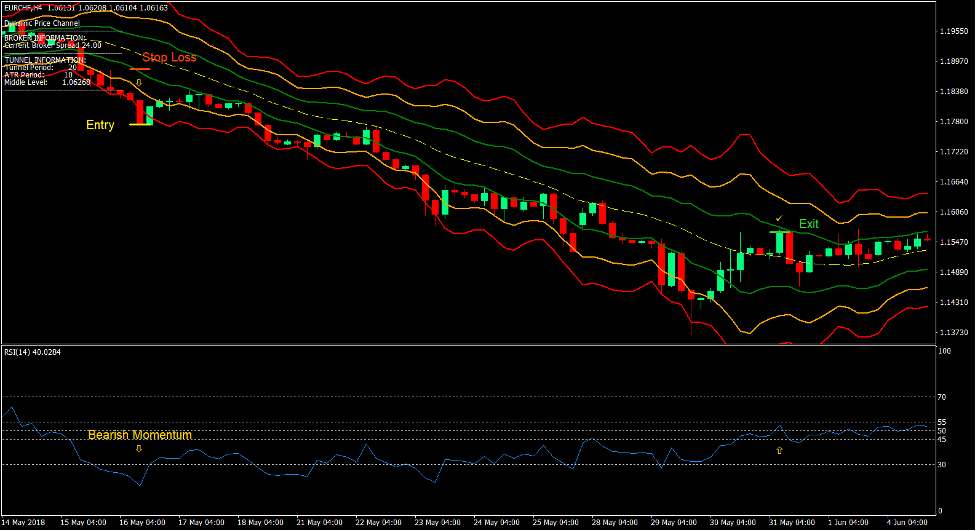

Dynamic Channel Momentum Breakout Forex Trading Strategy is a momentum breakout strategy which trades on confluences between the momentum breakout signal coming from the Dynamic Price Channel indicator and the RSI.

On the Dynamic Price Channel, momentum is identified based on a strong momentum candle breaking beyond the outer lines of the Dynamic Price Channel. This is represented by the red lines above and below the middle yellow line.

On the RSI, momentum is confirmed based on the RSI line breaching above 70 in the case of a bullish momentum or below 30 in the case of a bearish momentum.

Confluences between the two momentum signals tend to be high probability momentum signals which could result in a trend.

Indicators:

- Dynamic_Price_Channel

- Relative Strength Index

Preferred Time Frames: 1-hour and 4-hour charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

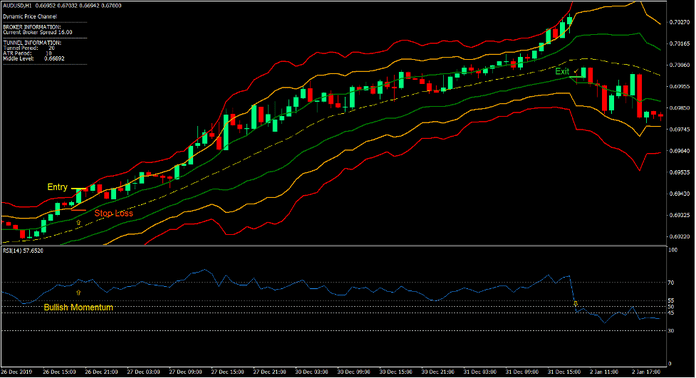

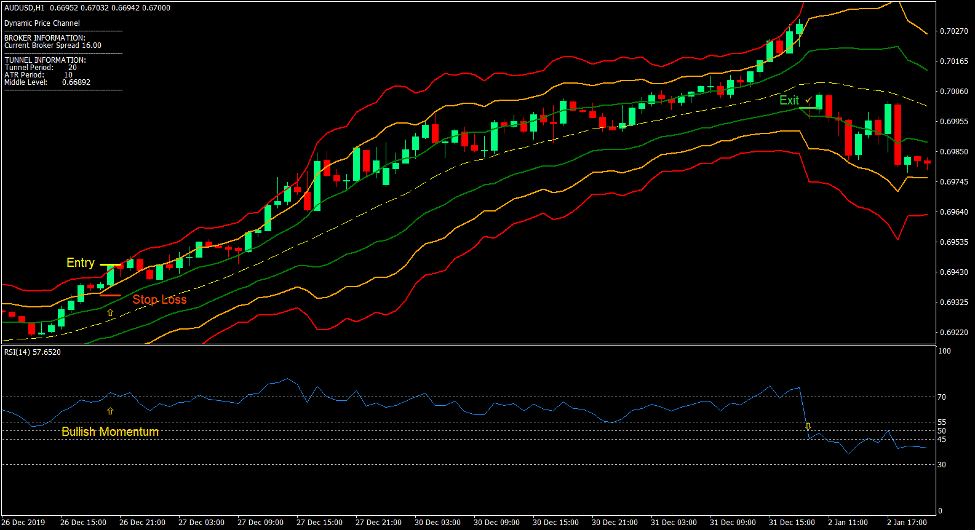

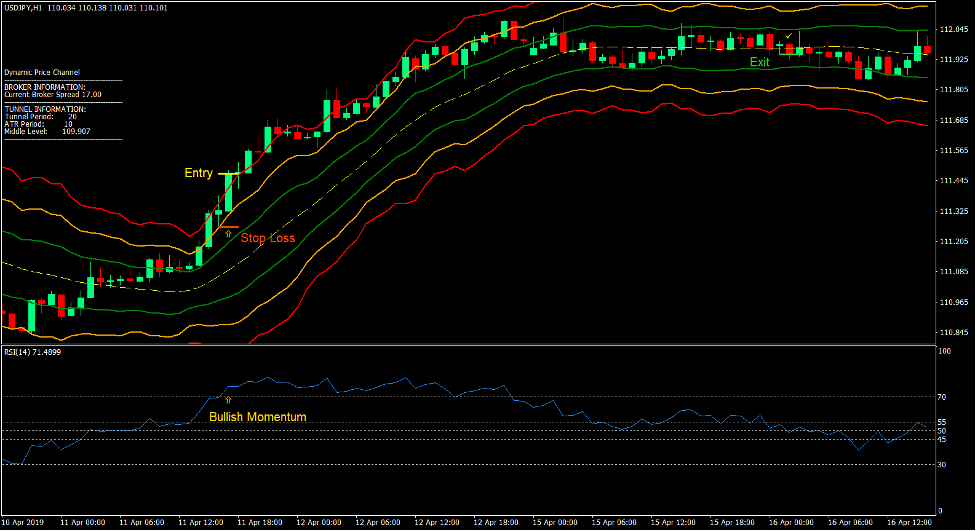

Buy Trade Setup

Entry

- A bullish momentum candle should breach above the upper red line of the Dynamic Price Channel.

- The RSI line should breach above 70.

- Enter a buy order on the confluence of both signals.

Stop Loss

- Set the stop loss on a support level a little below the entry candle.

Exit

- Close the trade as soon as the RSI line drops below 50.

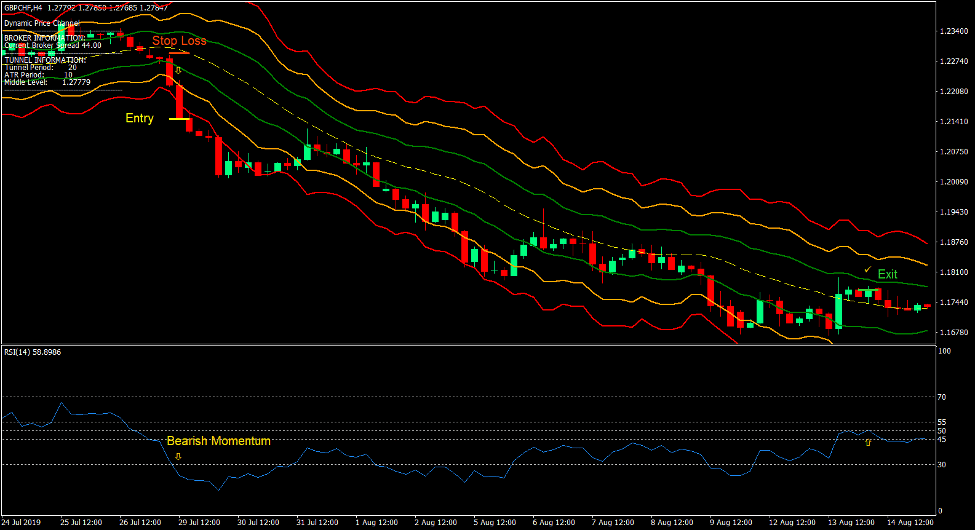

Sell Trade Setup

Entry

- A bearish momentum candle should breach below the lower red line of the Dynamic Price Channel.

- The RSI line should drop below 30.

- Enter a sell order on the confluence of both signals.

Stop Loss

- Set the stop loss on a resistance level a little above the entry candle.

Exit

- Close the trade as soon as the RSI line breaches above 50.

Conclusion

This momentum breakout strategy produces momentum trade setups which are based on two high quality momentum signals.

There are many professional traders who trade using this method with varying parameters and with confluences coming from multiple time frames. However, as a standalone momentum signal, this strategy could already produce high quality trade setups.

It is also important to note that these trade setups tend to work well whenever the breakouts came from a tight market congestion.

Traders can practice with this strategy as a part of an overall momentum strategy with multiple timeframe confluences.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: