This trading strategy trades on the confluence between a long-term trend and mean reversal signals. This is because trading in the direction of the long-term trend generally has a higher win probability compared to trading against the trend. The question is when to enter the trend. One of the most logical way to enter a trending market is on the pullbacks. This allows us to enter a trade in the direction of the trend but with a better entry price. Markets do often oscillate in a rising or dropping pattern whenever it is in a trend and these swings provide an opportunity. The subtle imbalances such as overbought and oversold indications provide us the opportunity to time the market entry more accurately.

Commodity Channel Index

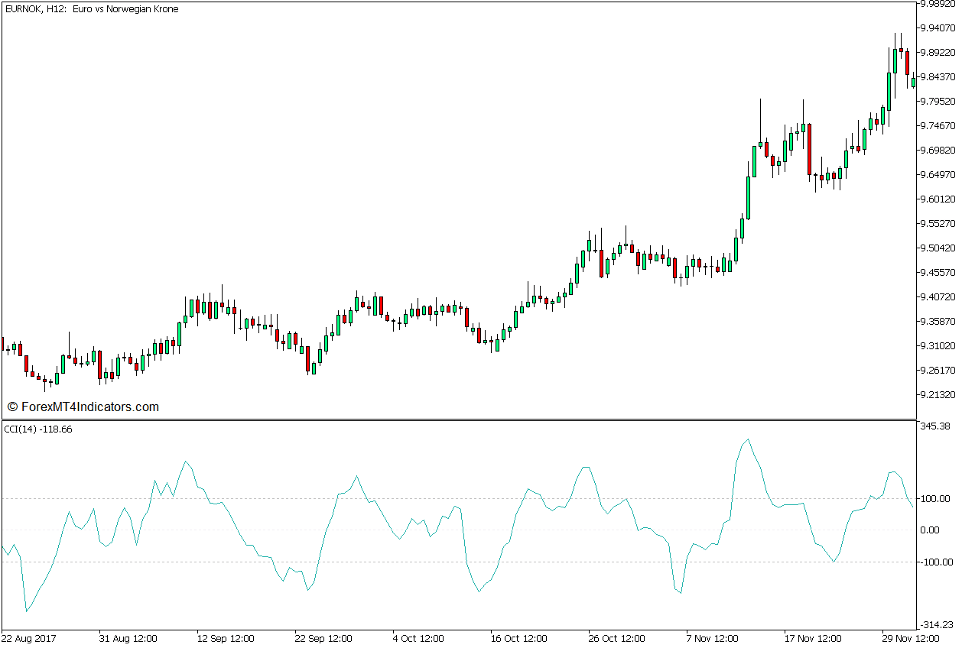

The Commodity Channel Index (CCI) is a momentum-based oscillator type of indicator. It detects momentum direction, overbought and oversold price levels, as well as potential mean reversals.

The CCI Indicator calculates for the deviation of price from the statistical average price. It does so by calculating for the Typical Price, which is the average of the high, low, and close of price. It then goes to calculate for the Simple Moving Average (SMA) of the Typical Price. On each period, the SMA of the Typical Price is subtracted from the current Typical Price. The difference is then smoothened further by calculating for its Simple Moving Average. The resulting SMA is then multiplied by 0.015. The final CCI value is then calculated by dividing the product of the prior step by the difference between the current Typical Price and its Simple Moving Average.

The CCI Indicator plots a line which oscillates around zero. It also has markers at levels -100 and 100. CCI lines dropping below -100 indicate an oversold market, while CCI lines breaching above 100 indicate an overbought market, both of which are prime conditions for a mean reversal.

Aside from being a mean reversal indicator, the CCI can also be used for identifying divergences when compared with price action.

Despite its name, the Commodity Channel Index can be applied to various tradeable instruments aside from commodities, such as forex currency pairs.

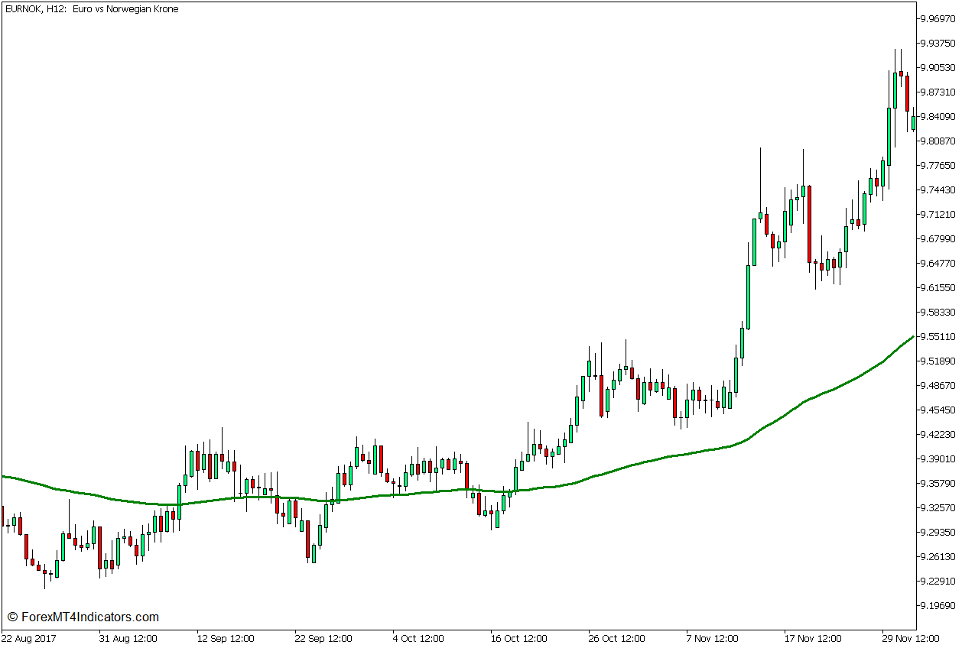

100 Exponential Moving Average

The 100 Exponential Moving Average (EMA) line is an effective long-term trend indicator.

The 100-period moving average is one of the most popular mid- to long-term moving average indicator which traders use to identify trend direction.

Traders identify trend direction based on where price action generally is in relation to the 100 MA line. The trend is bullish whenever price action is generally above the 100 MA, and bearish whenever price action is generally below the 100 MA.

Another method traders use to identify trend direction is by looking at the slope of the 100 MA line. Because moving averages move towards where the bulk of price action is, the slope of moving average lines also tend to curl towards where price action is. As such, traders can confirm the direction of the trend based on the slope of the moving average line. The trend is bullish whenever the 100 MA line is sloping up, and bearish whenever the 100 MA line is sloping down.

Among the various methods of calculating for moving averages, the Exponential Moving Average (EMA) is one of the most effective. It is very responsive to recent price movements, yet at the same time it also retains its smoothness, which makes it less susceptible to market noise. This is because the Exponential Moving Average method places more weight on the most recent price data. This creates a moving average line which is very responsive to price movements, yet at the same time has a smoothening factor within its calculation.

Trading Strategy Concept

This trading strategy is a trend continuation strategy which trades in confluence with a mean reversal signal. However, instead of taking the mean reversal signals in any direction, trades are taken exclusively in the direction of the long-term trend.

The 100 EMA line is used to identify the direction of the long-term trend. This is based on where price action generally is in relation to the 100 EMA line, as well as the slope of the line. Trades are then filtered based on the direction of the trend, avoiding trades than move against the 100 EMA line.

We then wait for deep pullbacks which should cause the CCI to either be oversold or overbought based on its line dropping below -100 or breaching above 100.

Trades are then taken whenever there is a confluence of a momentum candle moving in the direction of the trend and the CCI line crossing back within the range of -100 to 100, confirming the mean reversal signal.

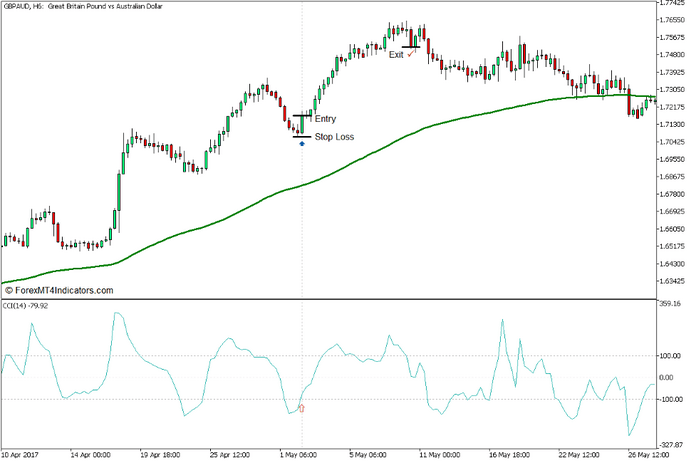

Buy Trade Setup

Entry

- Price action should generally be above the 100 EMA line.

- The 100 EMA line should slope up.

- Price action should be in an uptrend based on a rising swing pattern.

- Wait for price action to pullback causing the CCI line to drop below -100.

- Open a buy order as soon as the CCI line crosses above -100.

Stop Loss

- Set the stop loss on the support below the entry candle.

Exit

- Close the trade as soon as price action shows signs of a bearish reversal.

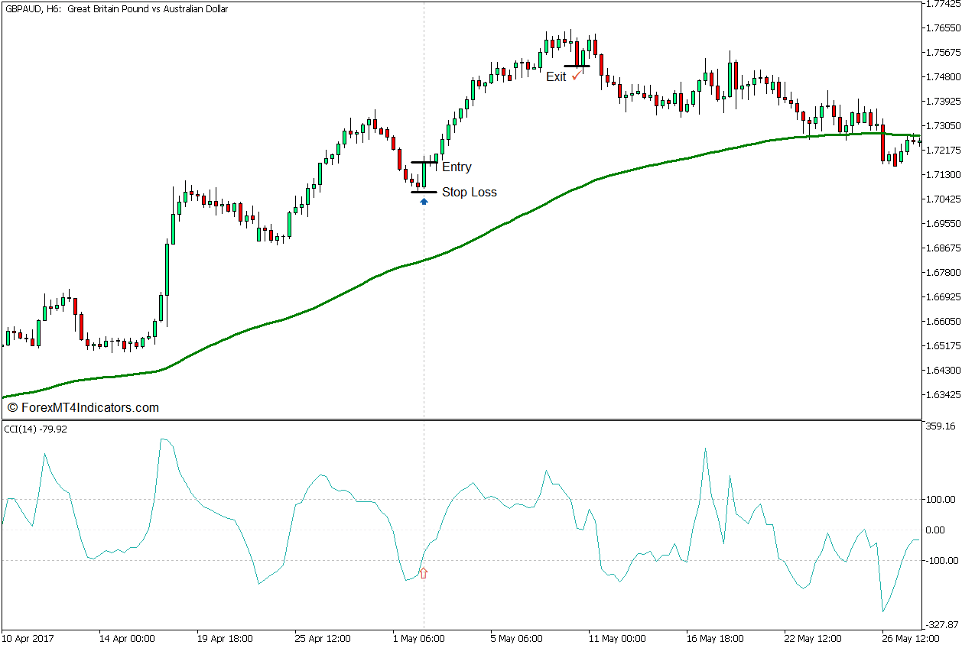

Sell Trade Setup

Entry

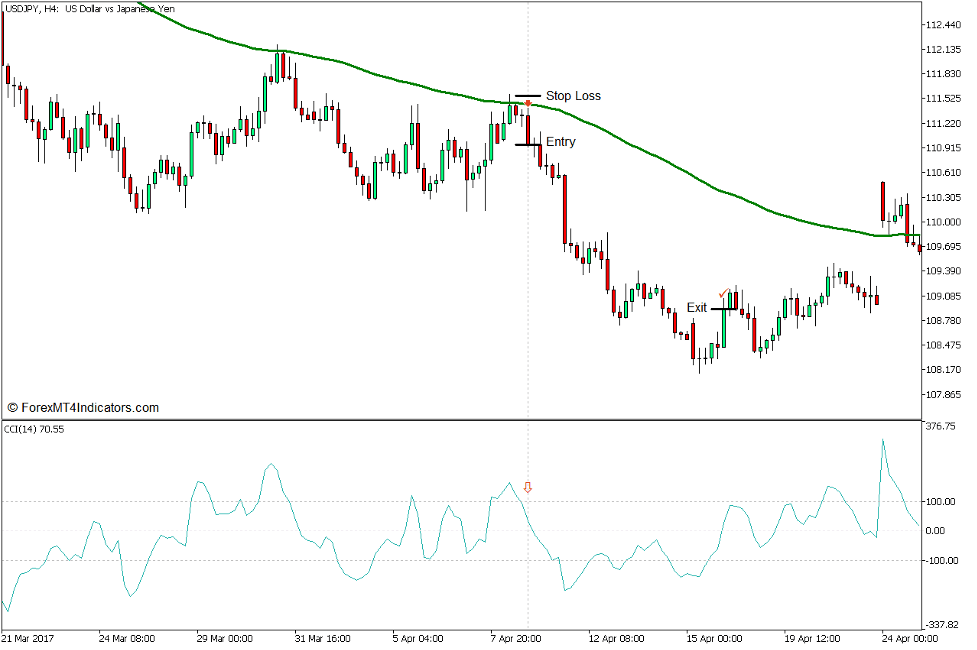

- Price action should generally be below the 100 EMA line.

- The 100 EMA line should slope down.

- Price action should be in a downtrend based on a dropping swing pattern.

- Wait for price action to pullback causing the CCI line to breach above 100.

- Open a sell order as soon as the CCI line crosses below 100.

Stop Loss

- Set the stop loss on the resistance above the entry candle.

Exit

- Close the trade as soon as price action shows signs of a bullish reversal.

Conclusion

This trading strategy does tend to have a high win probability compared to most trend following strategies. It also provides trade setups which typically have positive profit factors because trades often produce profits which are higher than the risk.

However, this strategy should also not be traded blindly in a mechanical manner. Traders should use this strategy only in markets with clear trends and wide price swings and pullbacks.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: