Trading the markets is all about sentiments. It is about human nature and the psychology of the crowd. Whether it be stock trading, gold, oil, commodities, cryptocurrencies or forex. There will always be those who are optimistic about a certain commodity and those who are pessimistic about it. They are called the bulls and the bears. Whoever proves to be stronger at a certain period would win. As traders, it is not our job to guess which way the market is going. Our job is to get a feel of the market. Who is currently stronger? Is it the bulls or the bears?

The Bulls Bears Stop Forex Trading Strategy is a trading strategy centered around the idea of determining market sentiment. This strategy aims to profit from the forex market by objectively gauging the strength of the bulls and that of the bears. This gives us an indication which direction we should be taking in order to profit consistently from the forex market. As long as we have an idea which way the market wants to go, then the battle is half done.

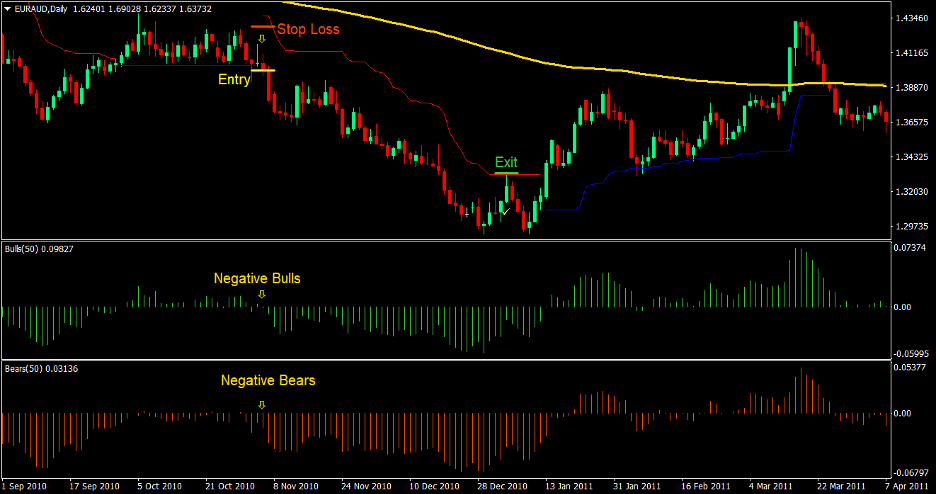

Bulls and Bears Power Indicators

The Bulls and Bears indicators are indicators which attempts to measure the strength of the Bulls and the Bears in a market. By doing so, we get to have a feel as to where the market is heading based on their respective strengths.

The Bulls and Bears indicator are simple oscillating indicators which measures the distance between the high and low and compares it with an Exponential Moving Average (EMA). Positive Bulls and Bears indicate that both the highs and the lows of price are rising compared to the average price. This means that the market sentiment is bullish. On the other hand, if the Bulls and Bears indicator are negative, this means that the highs and lows of price action is falling compared to the average price, which means that the market is bearish.

Chandelier Stops or Chandelier Exits

The Chandelier Stops indicator, also known as the Chandelier Exits, is a trailing stop indicator which assists traders in pinpointing the ideal placement of stop losses. It is much like the Parabolic Stop and Reverse indicator (PSAR) however it is a simpler version of it.

The Chandelier Stops indicator measures stop loss points based on the maximum value of the high and low. Other versions use the maximum value of the close. It then places a buffer in between the maximum value by computing the Average True Range (ATR) for a certain period and adding in above the maximum high or subtracting it from the maximum low. This allows traders to identify the safe distance in which to trail their stop losses. The argument is that if ever price would reverse by a multiple of the ATR, then the trend is assumed to have already reversed.

Trading Strategy

This trading strategy is a market sentiment strength-based strategy that attempts to determine the trend based on the strength of the Bulls and the Bears. It does this by using the Bulls and Bears Power indicators.

Trades are taken based on the direction of both the Bulls and Bears indicators. If the Bulls and Bears indicators are positive, then a buy trade could be triggered. On the other hand, if these indicators are negative, then a sell trade could be triggered.

The Chandelier Stops indicator, which is a trailing stop indicator, would be used as a trend direction indicator. This particular version of the Chandelier Stops only draws the line opposite to the direction of the trend. Whenever the trend is bullish, the indicator would only draw the lower line. When the trend is bearish, then it would only draw the upper line. This conveniently tells us which direction the trend is based on the indicator.

Lastly, although the above entry signals are of high quality, we will still be filtering out trades that are going against the grain of the long-term trend. To do this, we will be using the 200-period Exponential Moving Average (EMA). This moving average is a widely used long-term trend indicator. Trades should only be taken if the other three indicators are in agreement with the 200 EMA.

Indicators:

- 200 EMA (gold)

- ChandelierStops-v1

- Length: 28

- ATR Period: 18

- Kv: 3.5

- Bulls

- Period: 50

- Bears

- Period: 50

Timeframe: 4-hour and daily charts

Currency Pairs: major and minor pairs

Trading Session: Tokyo, London and New York

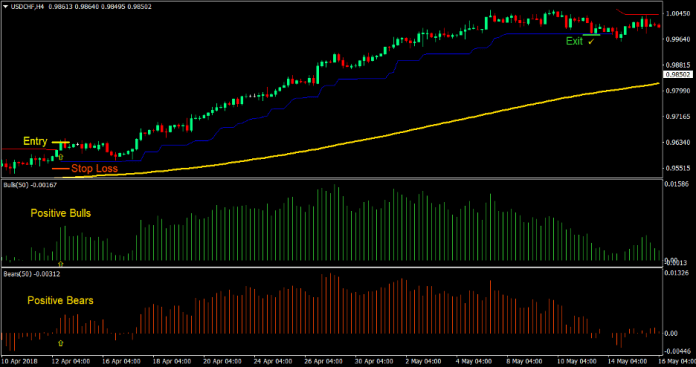

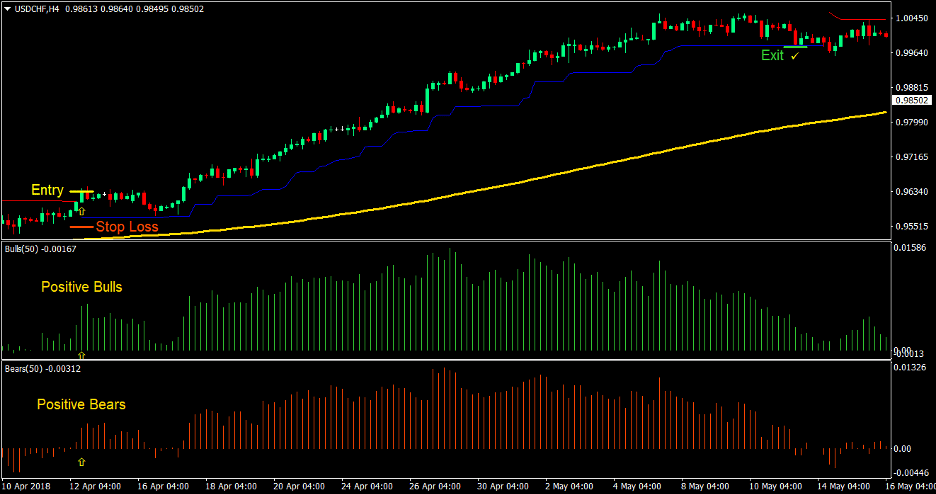

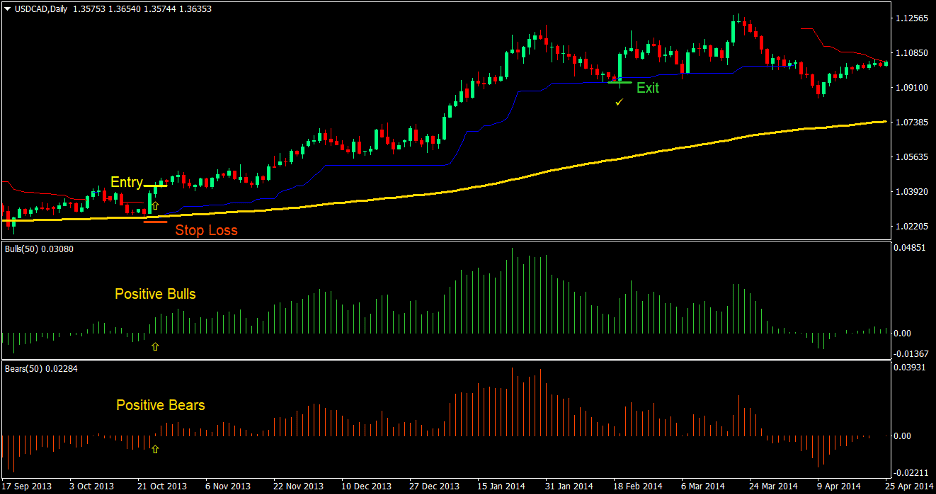

Buy Trade Setup

Entry

- Price should be above the 200 EMA indicating a bullish long-term trend

- The Bulls and Bears Power indicators should be positive indicating a bullish market sentiment

- The Chandelier Stops indicator should print a blue line below price action indicating a bullish trend

- Enter a buy order at the confluence of the above market conditions

Stop Loss

- Set the stop loss at the support level below the entry candle

Exit

- Trail the stop loss below the blue Chandelier Stops line until stopped out in profit

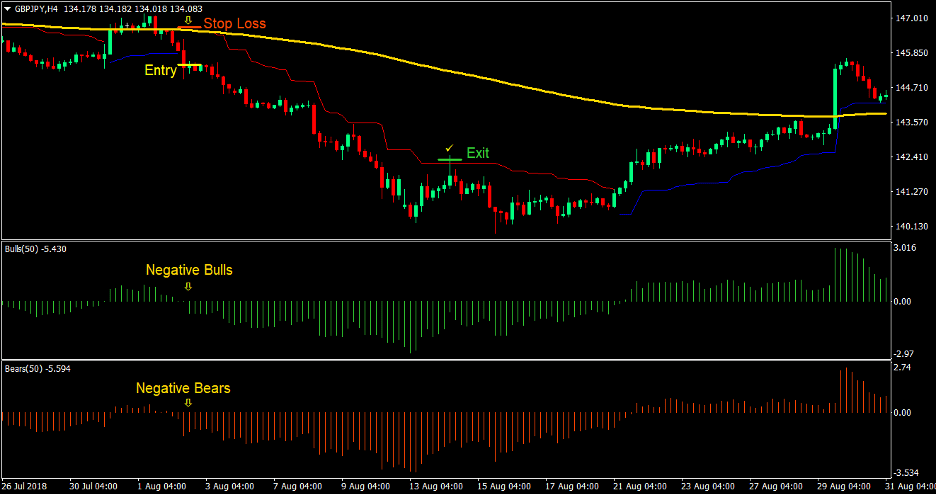

Sell Trade Setup

Entry

- Price should be below the 200 EMA indicating a bearish long-term trend

- The Bulls and Bears Power indicators should be negative indicating a bearish market sentiment

- The Chandelier Stops indicator should print a red line above price action indicating a bearish trend

- Enter a sell order at the confluence of the above market conditions

Stop Loss

- Set the stop loss at the resistance level above the entry candle

Exit

- Trail the stop loss above the red Chandelier Stops line until stopped out in profit

Conclusion

This trading strategy is a decently profitable trading strategy. It has a fairly decent win rate due to the fact that the trend is based on market sentiment and that trades are filtered in order to align with the long-term trend. By doing so, we are taking trades that are more likely to trend in the direction of our trade because there are lesser dynamic support and resistances that the trades have to overcome. This trading strategy also has a fair reward-risk ratio which could go up from 2:1 to 4:1 depending on the market condition.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: