Momentum trading is one of the most popular ways to trade the forex market. Many profitable retail traders use momentum trading strategies in order to capitalize on strong market movements.

Momentum trading strategies are popular because it allows traders to earn huge yields with the trade setups it provides. It is not uncommon to see trade setups that would produce trades more than three times the risk placed on a stop loss when using momentum trading strategies. This high reward-risk potential allows traders to profit big time over the long run.

Momentum trade setups could be very profitable. However, it also has its pitfalls. Momentum traders are often guilty of chasing price. Momentum traders would usually not hesitate to take a trade even when price is clearly overextended. This is one of the cardinal sins in trading, chasing price. Momentum traders also tend to take trades without considering where price is located on the price chart.

The key to trading momentum trading strategies is in taking trades that come from market congestions. This is because the market moves in cycles. These cycles are either market contractions or market expansions. Taking trades based on a sudden influx of volume pushing price in one direction indicates that the market is ending a market contraction phase and is starting to expand. This increased volatility, if it turns out to be one directional, would mean huge profits for momentum traders.

Keltner Bulls Bears Momentum Forex Trading Strategy is a strategy that systematically provides trade setups based on a sudden influx of momentum right after a contraction phase. It uses a couple of indicators that helps traders to filter out trades based on market bias and identify potential momentum breakouts.

Keltner Channel

The Keltner Channel is a versatile technical indicator which could be used for a variety of purposes. It is a trend following indicator which could be used to identify volatility, momentum and mean reversals.

The Keltner Channel indicator plots three lines on the price chart. The middle line is basically an Exponential Moving Average (EMA) line usually set at 10 or 20-period computations. The outer lines are deviations from the EMA line based on the Average True Range (ATR), which is usually set at twice the ATR. These lines create a channel or band like structure, much like the Bollinger Bands or Donchian Channel.

Because the midline of the Keltner Channel is a 20 bar EMA line, it is also a great tool to identify trend direction. Traders could identify trend direction or bias based on the slope of the 20 EMA line or the location of price in relation to the 20 EMA line.

The outer lines could be used in a couple of ways. First, it could be used to identify momentum breakouts. Momentum candles that close outside of the channel could indicate a potential momentum breakout market condition. Inversely, price action that is showing signs of price rejection pushing against the outer lines of the Keltner Channel could indicate a possible mean reversal market condition.

Aside from these two main uses of the Keltner Channel’s outer lines, traders could also identify volatility using these two lines. Because these lines are computed based on the ATR, traders could also identify if volatility is strong or weak.

BS Trend Indicator

BS Trend indicator is a market bias indicator developed to help traders identify the general directional bias of the market. It identifies market bias based on the trend.

It identifies whether market is a buyer’s or a seller’s market based on the trend. It then plots bars to indicate the market bias. The bars are either -0.0001 or 0.0001. Positive bars indicate a bullish market bias, while negative bars indicate a bearish market bias.

This indicator is mainly used as a market bias filter. Traders could filter out trade setups that are not in line with the BS Trend market bias.

Traders could also use it as a trade entry or exit trigger. Traders could interpret the shifting of the bars as a possible trend reversal and use it to enter or exit trades.

Trading Strategy

This trading strategy is a momentum breakout trading strategy based on the Keltner Channel indicator. However, not all trade setups should be traded right away. Trades should be filtered based on the market bias.

The BS Trend indicator will be used to identify market bias. Trades should be filtered based on the direction of the BS Trend indicator.

We then identify if the market is contracting of expanding based on the range of the Keltner Channel. If the Keltner Channel is contracted, then the market is in a contraction phase, which is a viable market condition for a momentum breakout.

Then, we should wait for momentum to pick up indicated by a momentum candle breaking outside of the Keltner Channel in the direction of the market bias.

Indicators:

- Keltner_Chanel

- BullBearRSI

Preferred Time Frames: 15-minute, 30-minute, 1-hour and 4-hour charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

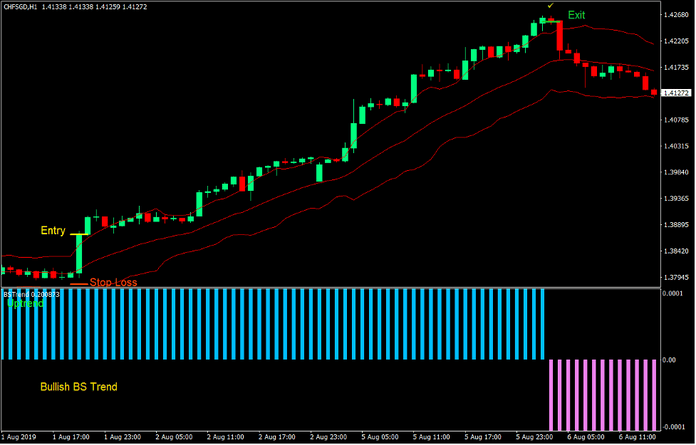

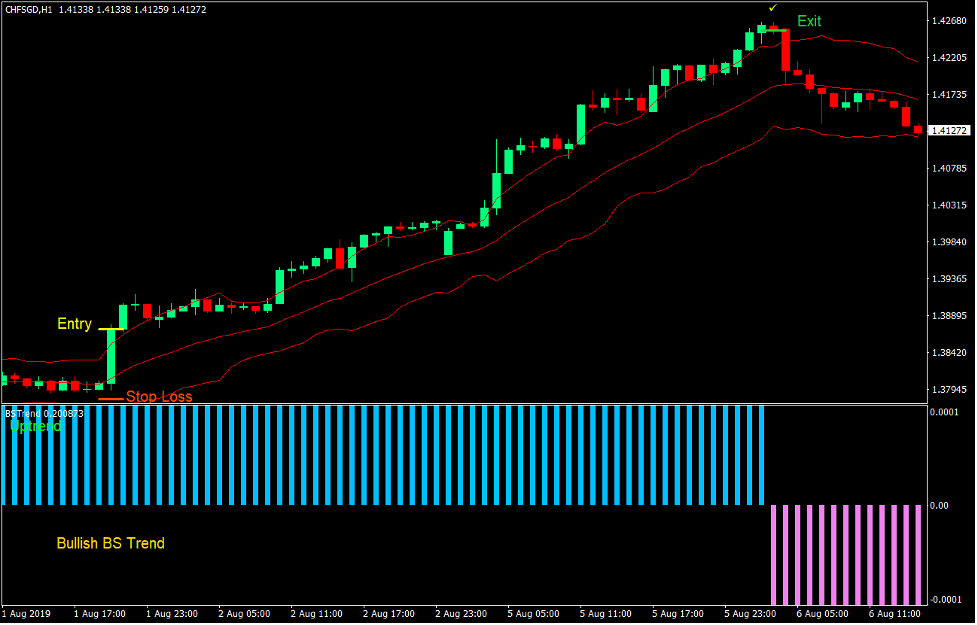

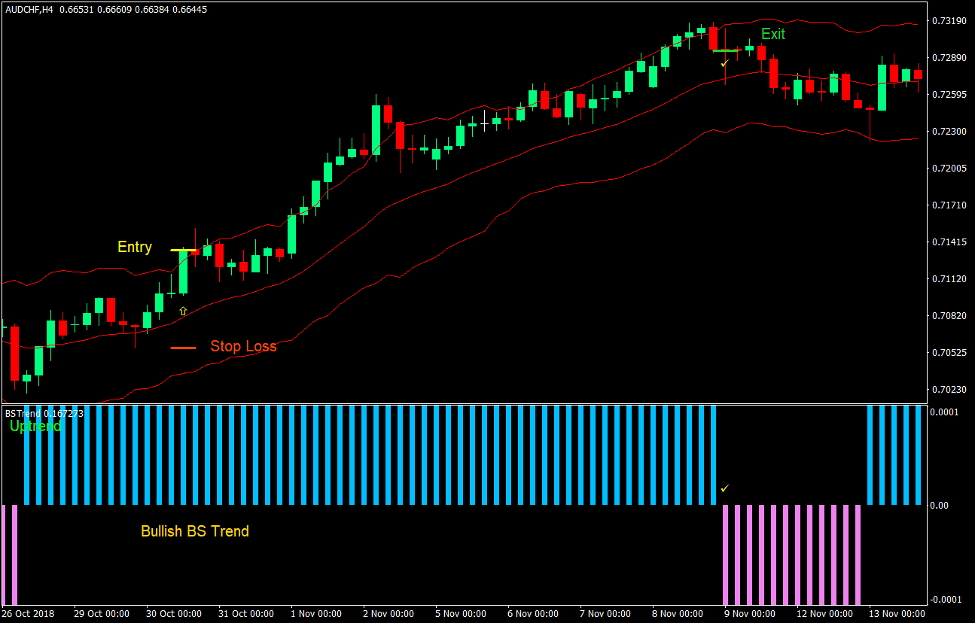

Buy Trade Setup

Entry

- The BS Trend indicator should be positive.

- The Keltner Channel should be contracted.

- The middle line of the Keltner Channel should start to slope up.

- A bullish momentum candle should close above the upper Keltner Channel line.

- Enter a buy order on the confirmation of the conditions above.

Stop Loss

- Set the stop loss on the fractal below the entry candle.

Exit

- Close the trade as soon as the BS Trend indicator shifts to negative.

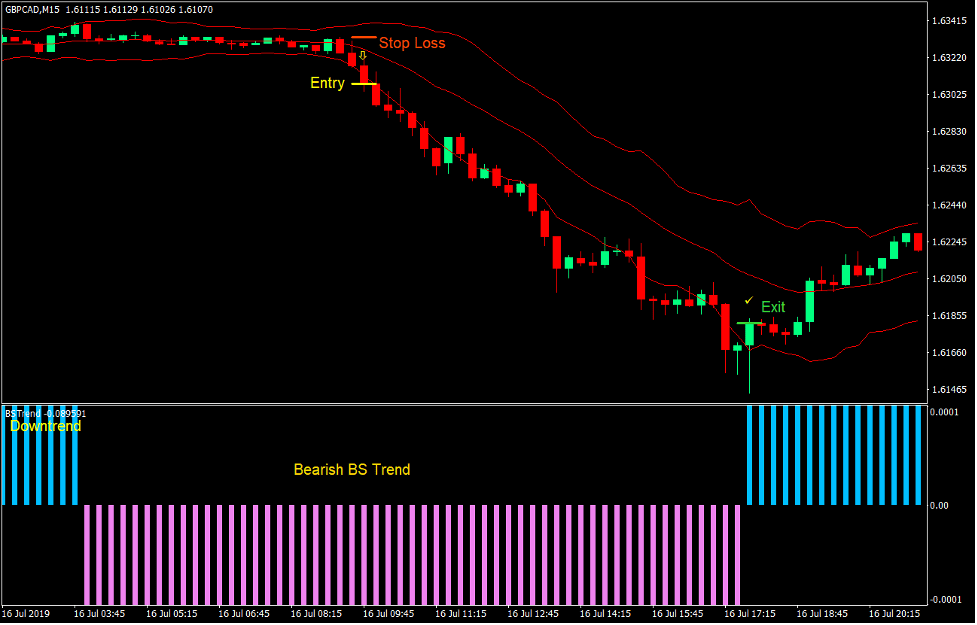

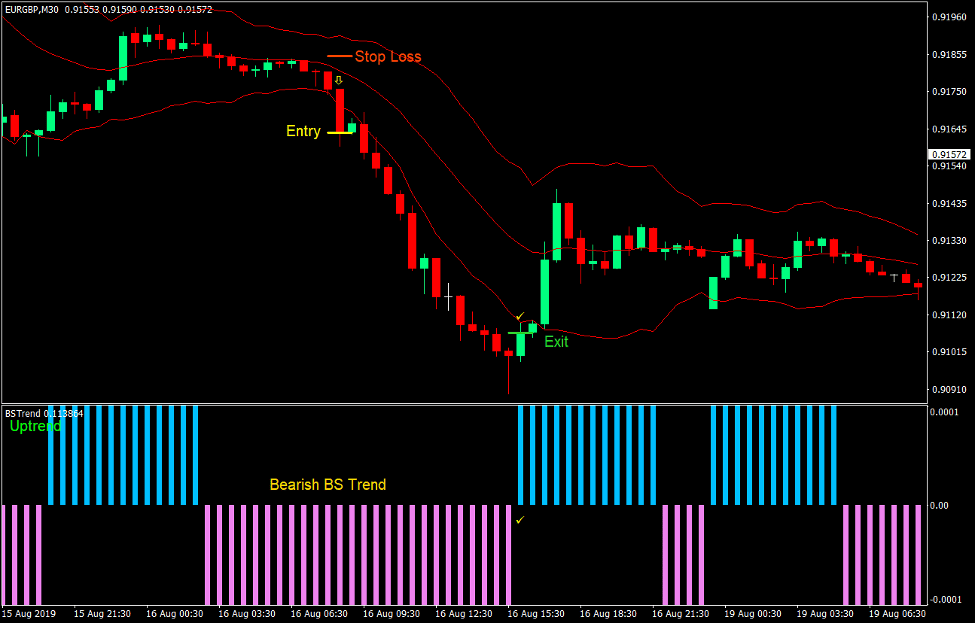

Sell Trade Setup

Entry

- The BS Trend indicator should be negative.

- The Keltner Channel should be contracted.

- The middle line of the Keltner Channel should start to slope down.

- A bearish momentum candle should close below the lower Keltner Channel line.

- Enter a sell order on the confirmation of the conditions above.

Stop Loss

- Set the stop loss on the fractal above the entry candle.

Exit

- Close the trade as soon as the BS Trend indicator shifts to positive.

Conclusion

This trading strategy provides traders a high reward-risk ratio strategy which could potentially provide profits consistently over the long run. It could provide setups that have the potential to produce yields that are more than twice or thrice the risk placed on the stop loss. This positive reward-risk ratio is the key to being consistently profitable using this strategy.

Traders could also incorporate this as a trade entry trigger while looking at support and resistance zones in order to increase the probability of the trade setup.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: