Many traders preach against trying to catch peaks and troughs. In a way they do have a point. Catching peaks and troughs is difficult. It is just as hard to predict where price will stop and reverse, just as it is difficult to catch a falling knife. In a way, this is what many traders who do not have a systematic method of identifying potential reversal points do.

However, if you come to think of it, forex trading is also about buying currency pairs when prices are at a low and selling when prices are at a high. Buy low, sell high. This is the mantra of a trader. Catching troughs and peaks is a vital part of it.

So, how do we meet these two concepts in the middle? One thing that traders do is that they trade as soon as the market is showing signs that it is reversing.

High Low Divergence Forex Trading Strategy uses divergences in order to find such signs, which leads to trading opportunities.

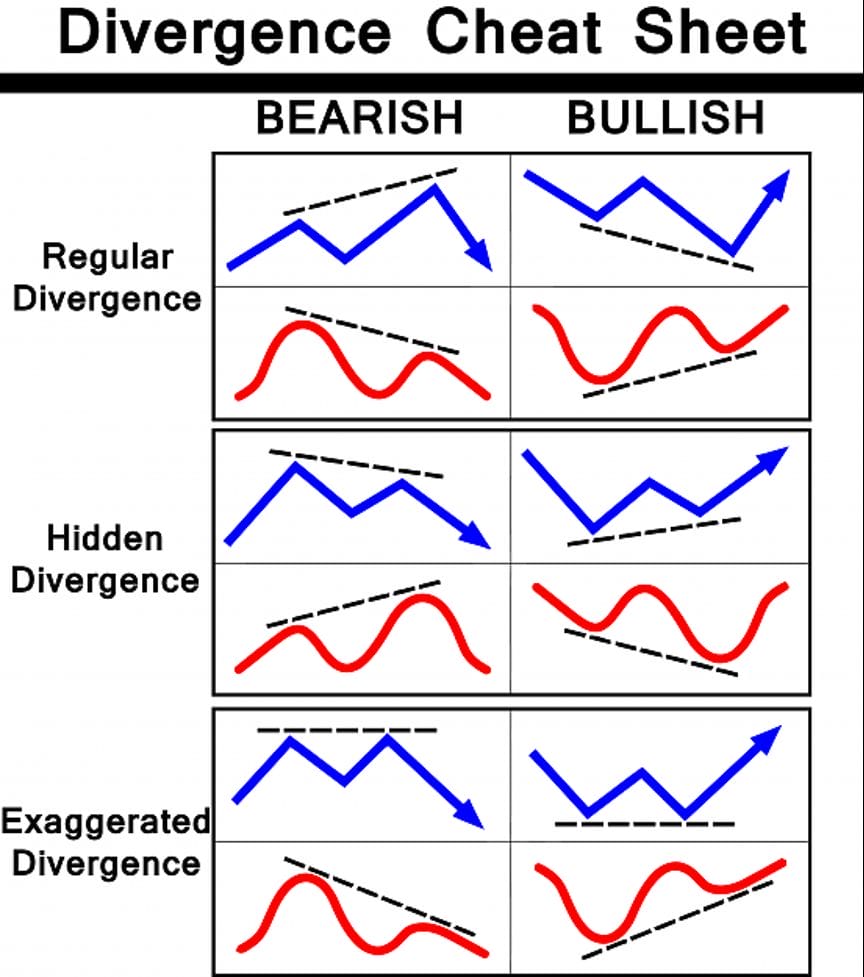

Divergences are basically a point in a price chart when the depth or height of a peak or trough of price action would vary from the height or depth of a peak or trough of an oscillator. These conditions indicate that there is tension in the market. Either price action is showing that the market is due for a sharp reversal and the indicator has not followed yet, or the oscillator has detected that price should be reversing deeply and price action has not executed such reversal yet. Either way, one would be giving out and it is an opportunity.

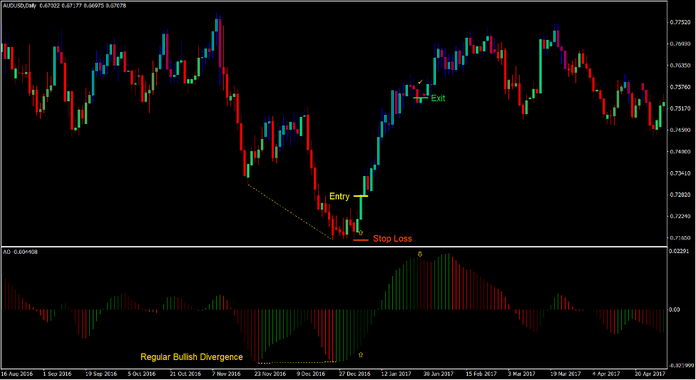

Below is a chart of what various divergences look like.

Awesome Oscillator

The Awesome Oscillator (AO) is a trend following technical indicator which is based on the crossover of modified moving averages.

The AO is computed based on the difference between a 5-period Simple Moving Average (SMA) and a 34-period Simple Moving Average (SMA). However, instead of using the regular close of each period, the AO uses the median of each period as a basis for computing the SMAs.

The difference is then plotted as a histogram bar on the oscillator window. The AO indicates trend direction based on whether the bar is positive or negative and trend strength based on the color of the bars.

Positive green bars indicate a strengthening bullish trend while positive red bars indicate a weakening bullish trend. On the other hand, negative red bars indicate a strengthening bearish trend, while negative green bars indicate a weakening bearish trend.

The shifting of the bars from positive to negative indicates a trend reversal, while the changing of the colors of the bars could indicate the start of a weakening trend leading to a trend reversal.

Gann Hi Lo Activator Bars

The Gann Hi Lo Activator Bars is a momentum and trend following indicator which is based on the short-term.

This indicator is a simple indicator which indicates the short-term trend by overlaying bars on the price candles. These bars change color depending on the direction of the short-term trend or momentum. Blue bars indicate a bullish momentum while red bars indicate a bearish momentum.

The Gann Hi Lo Activator Bars is very useful for anticipating short-term trend reversals and picking exact entry points. It can either be used as an initial indication of a probable trend reversal or an actual entry trigger for a trend reversal setup.

Trading Strategy

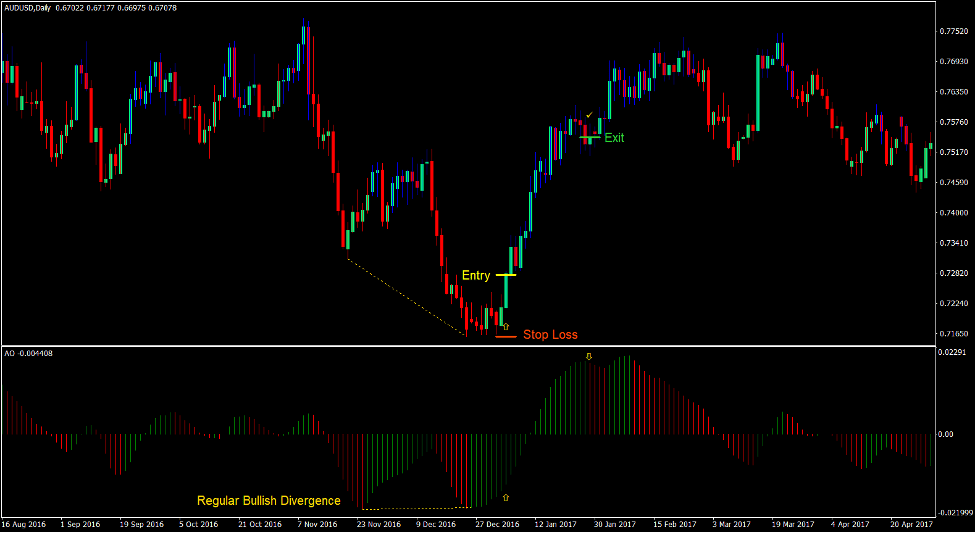

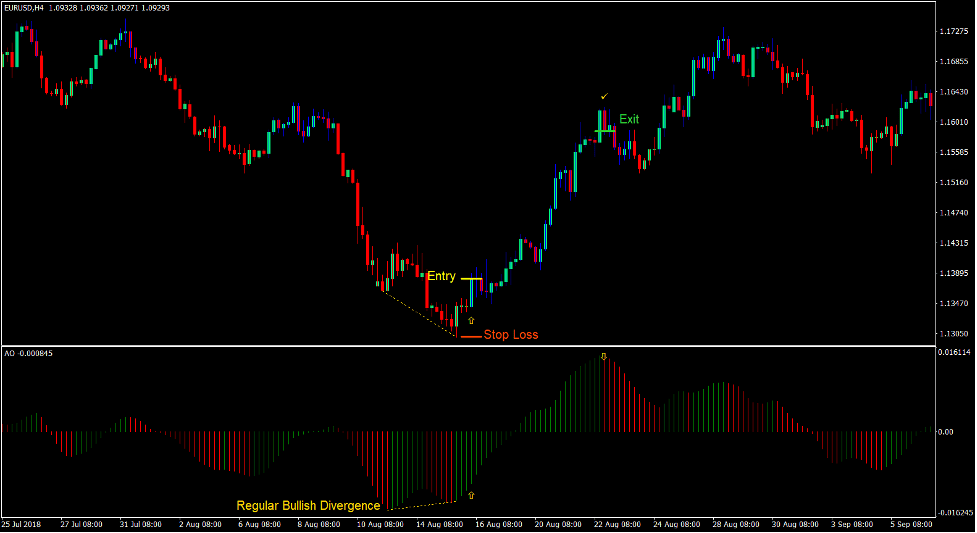

This trading strategy trades on divergences between the Awesome Oscillator and price action, while at the same time confirming the short-term trend or momentum using the Gann Hi Lo Activator Bars.

First, we must identify divergences based on the peaks and troughs of both price action and the Awesome Oscillator. Then, we wait for the color of the Awesome Oscillator bars to change indicating the weakening of the current trend direction.

Then, on the Gann Hi Lo Activator Bars, we wait for the color of the bars to change indicating the direction of the trend reversal.

As soon as we find confluences between these conditions, we could then take a trend reversal trade setup.

Indicators:

- Gann HiLo activator bars

- Awesome

Preferred Time Frames: 30-minute, 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

Buy Trade Setup

Entry

- A bullish hidden or regular divergence must be observable based on price action and the Awesome Oscillator.

- The Awesome Oscillator bars should change to green.

- The Gann Hi Lo Activator Bars should change to blue.

- Enter a buy order on the confirmation of these conditions.

Stop Loss

- Set the stop loss on the fractal below the entry candle.

Exit

- Close the trade as soon as the AO changes to red.

- Close the trade as soon as the Gann Hi Lo activator bars change to red.

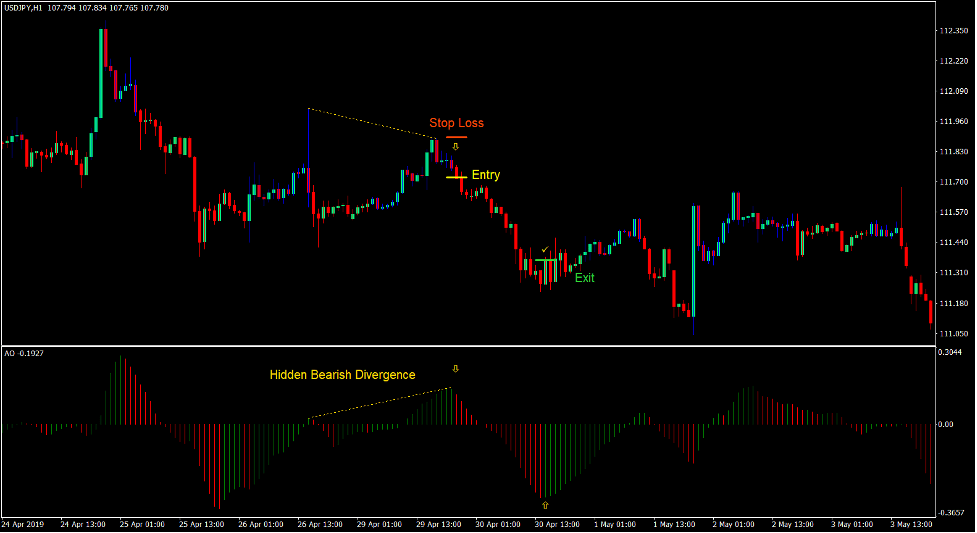

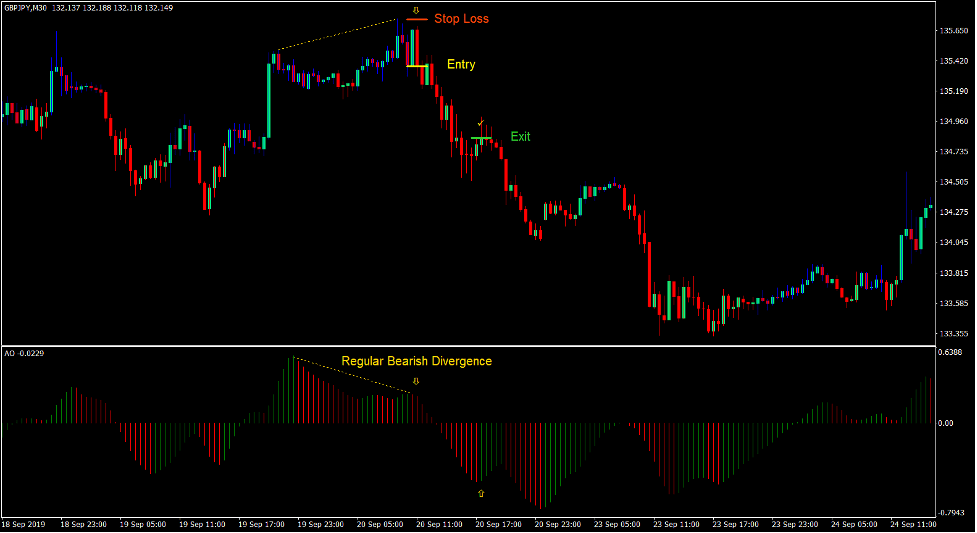

Sell Trade Setup

Entry

- A bearish hidden or regular divergence must be observable based on price action and the Awesome Oscillator.

- The Awesome Oscillator bars should change to red.

- The Gann Hi Lo Activator Bars should change to red.

- Enter a sell order on the confirmation of these conditions.

Stop Loss

- Set the stop loss on the fractal above the entry candle.

Exit

- Close the trade as soon as the AO changes to green.

- Close the trade as soon as the Gann Hi Lo activator bars change to blue.

Conclusion

Many profitable traders use divergences to profit from the market. This is because divergences would usually produce highly profitable trades with relatively high probabilities.

Many traders who aim for reasonable targets can get as high as 60% accuracy using divergences. In most cases, divergence setups in a single chart would usually produce at least one profitable trade in every three opportunities. With a correct risk management and risk-reward ratios, divergences can provide setups which can produce consistent profits.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: