Gap and Go Momentum Forex Trading Strategy

There are traders who claim to trade just on the first hour or so of a trading session, and even though they spend that little time trading they still make a lot of money doing the same strategy again and again. I thought this was impossible. Your profits should be relative to your efforts, right? Wrong! In trading, this isn’t the rule of thumb. What trading needs is a sound and profitable trading strategy, and a trader who has enough discipline to stick to the rules and make himself or herself available when opportunities present themselves.

Question is, what kind of strategy could allow you to do just that, trading just for an hour every session and still make money. While there is no one absolute answer, one of the viable strategies that I’ve found are momentum strategies. This is done by looking for gaps at the open of a trading session.

Gaps as Momentum

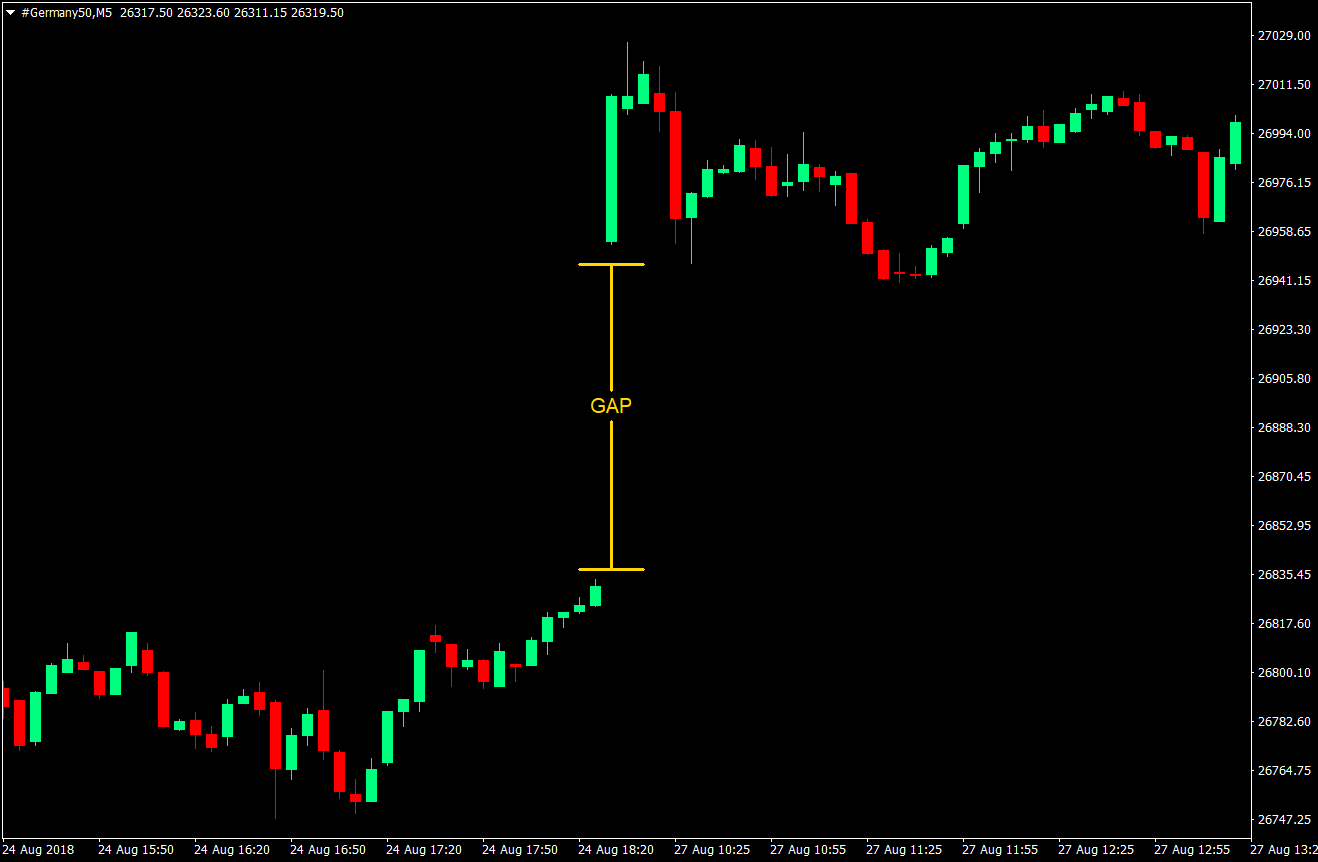

What are gaps? Gaps are basically a jump in price coming from the close of a market to the next open of the market. For example, the forex market closes every weekend and reopens as the first market session opens the next week. Some markets open and close every day, such as the stock market and some indices. At times, when the market opens, there is a huge discrepancy between the close of the previous session and the open of the next session. That is a gap.

So, how do gaps occur? While it is true that markets do have a scheduled close and open, market participants don’t stop assessing the value of the market. Maybe during the night a fundamental news was released, news that could affect a certain market or currency. Traders who learned of that news prior to the open of the next session would have their own assessments of what price should be. Some of them might even leave instructions to their brokers. Some might even find ways to make a trade on certain stocks even when the market is closed. These assessments and actions affect price. As the market opens the next day price would suddenly jump as traders would start trading at a different price point and hit bids or offers left by other traders prior to the close, which are way too far from the price of the previous close.

Now, if you’d look at the anatomy and logic behind a gap, it is actually a momentum or trending move which occurred while the market was still close but was just not plotted on the chart because no transactions were officially consummated that could be plotted. Since gaps are momentum or trending market movements, it is also highly likely that if price didn’t overextend itself to much, it could still continue a bit further.

Still, there is a notion among many traders that gaps always get filled because price would always come back to the average. But this is not always the case. Gaps could sometimes be a start of a fresh trending market environment. Given that there are two opposing poles on gaps, we would have to look out for clues of whether gaps would get filled or continue a bit due to momentum.

Trading Strategy Concept

This strategy is based on the idea that gaps are momentum moves that took place when the market was closed.

To implement this strategy, we will be looking for gaps at the open of a trading session. Although gaps could also occur intraday due to big fundamental news spikes, it is uncommon. It is easier to find gaps during the open of a session. Because of this, it is preferred to trade this strategy on markets that open and close every day in order to find more opportunities. This could be the DAX or other indices that have an exact open and close, or certain stocks that have enough volume and volatility.

The gap should be clearly observable on the 5-minute chart. If the market does gap, we look for a candle that has a long wick pushing against the gap. The wick represents the portion of the market that expected for the gap fill that didn’t occur. This candle with long wicks should also take place within the first two 5-minute candle. After that, we couldn’t consider it as a valid trading setup. This is because the gap might have moved right away without the slight retrace represented by the wick, or the momentum isn’t that strong, and the gap could start filling up.

Indicators: none

Currency Pair or Market: preferably DAX, indices and high volatility stocks

Timeframe: 5-minute chart only

Trading Session: any market open

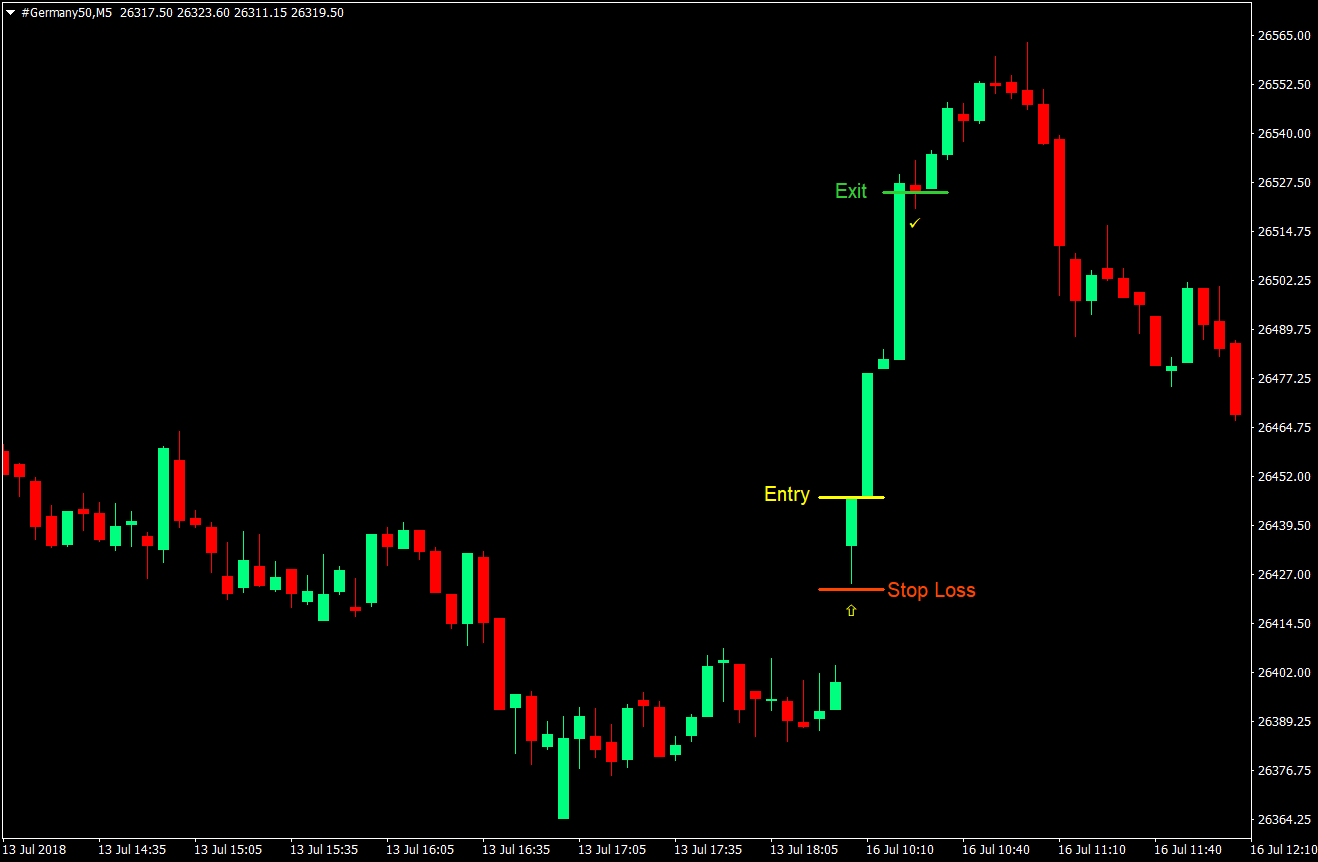

Buy (Long) Trade Setup

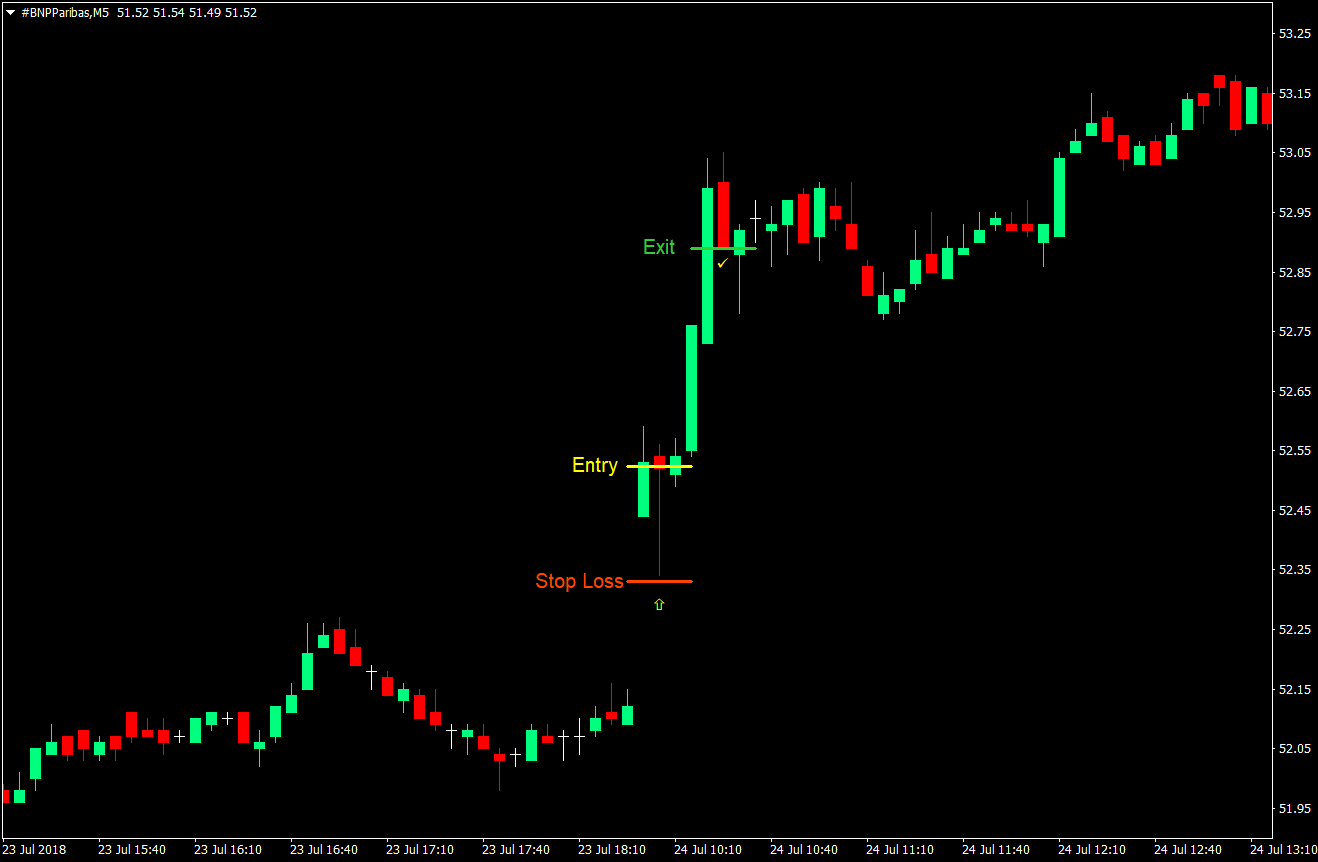

Entry

- The market should gap up at the open of the session

- A candle with a significant wick at the bottom and little to no wick at the top should form within the first two 5-minute candle

- Open a buy market order at the close of the candle

Stop Loss

- Place the stop loss immediately below the wick of the candle

Exit

- Close the trade on the first bearish candle

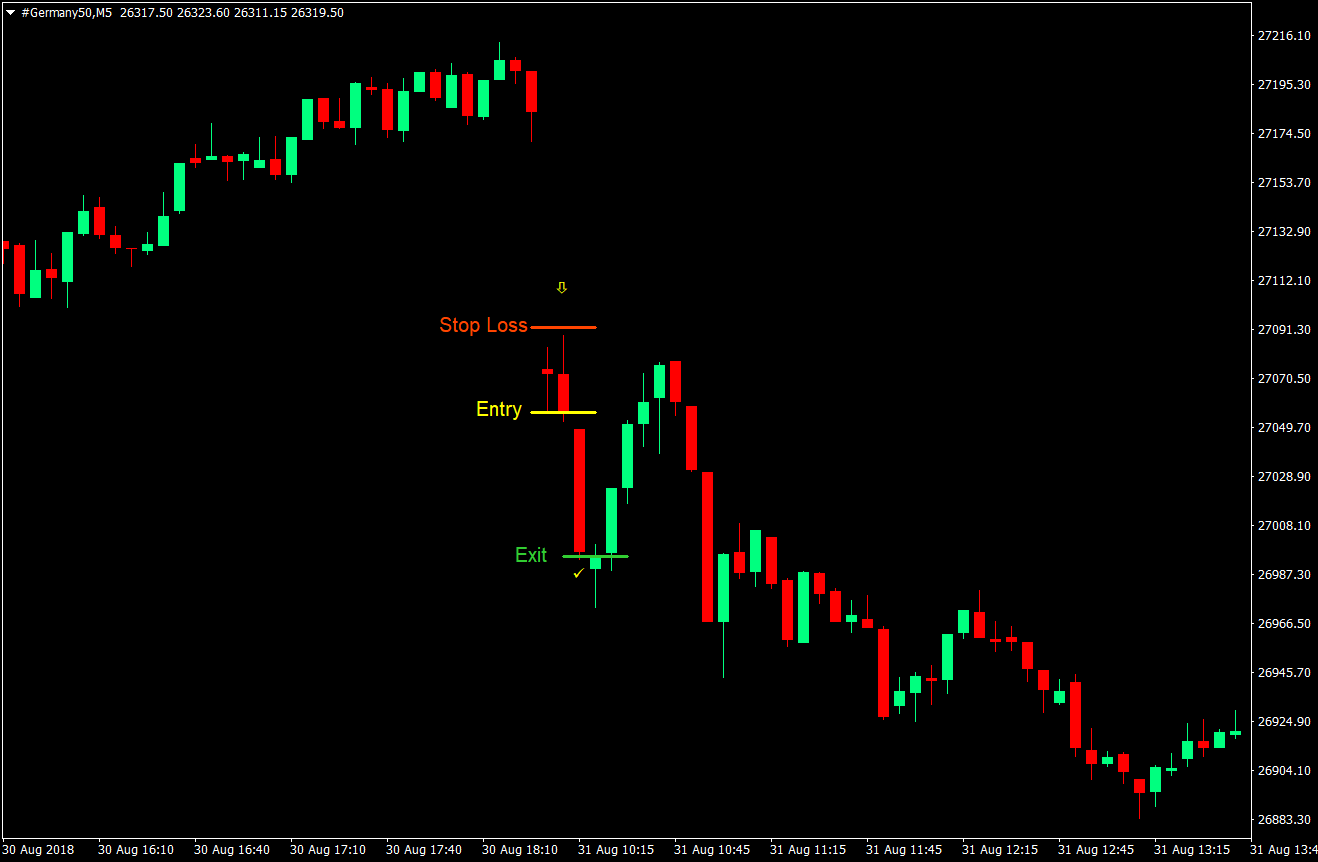

Sell (Short) Trade Setup

Entry

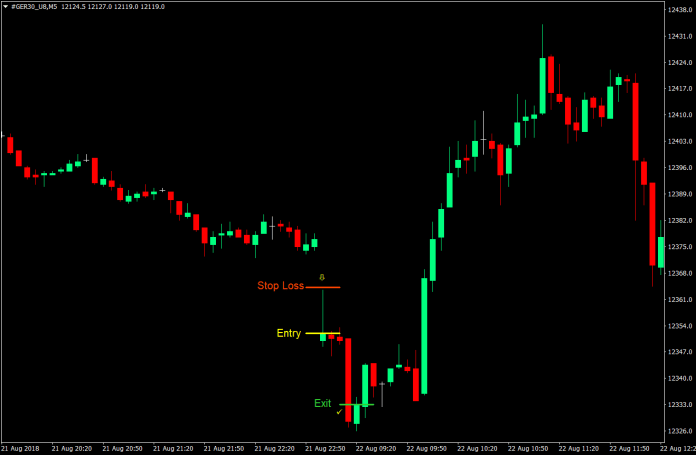

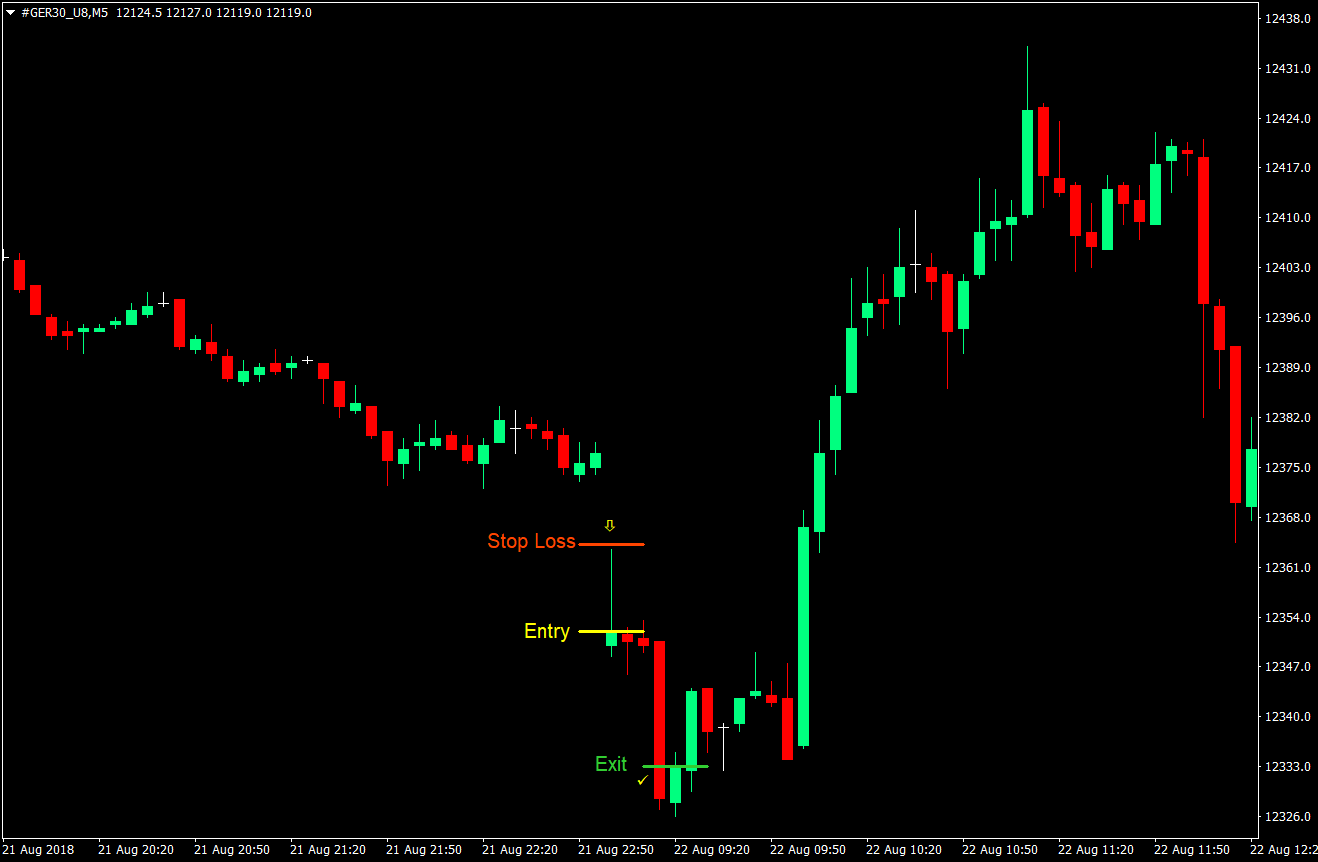

- The market should gap down at the open of the session

- A candle with a significant wick at the top and little to no wick at the bottom should form within the first two 5-minute candle

- Open a sell market order at the close of the candle

Stop Loss

- Place the stop loss immediately above the wick of the candle

Exit

- Close the trade on the first bullish candle

Conclusion

This is a very short-term day trading strategy done on the 5-minute chart. In fact, you should be finished within the first hour of the trading session.

With this in mind, the trade should be assessed on a candle by candle price action. What we are after is the short continuation move coming from the momentum on the gap. As soon as the short continuation of the momentum expires as signified by the first opposing candle, we exit the trade.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: