Simple ZigZag Swing Trading Forex Trading Strategy

In trading, price is king. We as traders are at the mercy of the whims and fancies of price. If price goes up and we are short, we can’t do anything about it. If price goes down and we are long, too bad for us. Sadly, price moves wherever it wants anytime it wants and it is often difficult to predict. Or is it?

Some traders subscribe to the Random Walk theory, the idea that price moves in a random manner and is therefore unpredictable. It holds to the idea that that the chances of price moving up or down are of the same probability distribution. If we look at the charts, this sometimes do seem to be the case. Price would move up and down, zig and zag all across the chart. But if this is the case then trading must be a futile endeavor. Why trade if there is no clear advantage that could let you earn from the market?

ZigZag Indicator – Pointing Traders to the Right Direction

The very characteristic of price that makes it confusing, zigging and zagging across the chart, could also be very useful in determining probable turning points.

The ZigZag indicator is an indicator that draws lines on the forex chart, connecting swing highs and lows, forming what seems to be zigzagging lines. It is based on sudden fluctuations in price that goes against the current flow of the market. At the same time, it also tries to eliminate minor fluctuations in order to lessen noise.

There are many ways to use the ZigZag indicator. Practically any strategy that makes use of swing highs and lows could benefit from the ZigZag indicator as it basically traces swing points objectively.

However, one of the ways to use the indicator is to make use of the swing points as entry points. Swing points are often a start of a move. Moves that could last long enough and move far enough for traders to profit from.

Trading Strategy Concept

Knowing that the ZigZag indicator helps determine swing points, we will be making use of these swing points as entry points with the hope that the swing point could be a start of a good profitable move in price. Swing lows will be the entry point for long trades and swing highs will be the entry point for short trades.

However, we will not be entering on the direction of just one ZigZag indicator confirmation. We will be making use of two ZigZag indicators. One will be the regular ZigZag indicator connected by lines and tries to eliminate the minor fluctuations. The other will be marked by arrows pointing up or down and could allow for more swing points to be pointed out.

As for the entry points, what we will be looking for would be the confluence of the two ZigZag indicators. This would increase the probability of having a profitable trade setup and filter out low probability swing points.

On the other hand, our exit will be based on the ZigZag indicator that prints more swing points. This could get us out of the trade pretty early on a long move but will help us avoid staying on a trade that could already reverse.

It will be like an arrow pointing which way to go, when to enter the market and when to exit the market as it is about to reverse.

Indicators:

- ZigZag

- zigzagarrows

Currency Pair: any

Timeframe: 4-hour chart

Trading Session: any

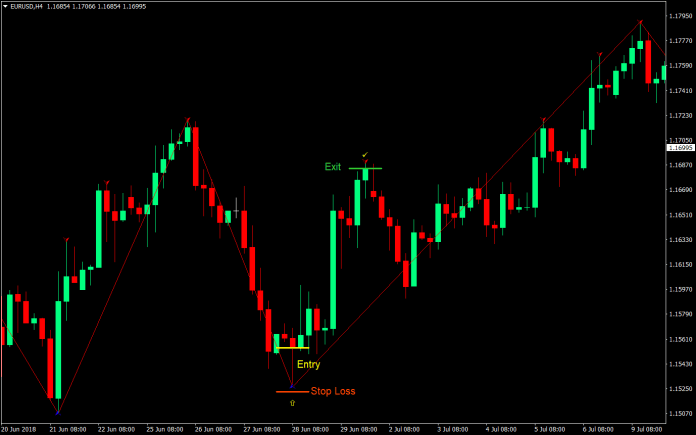

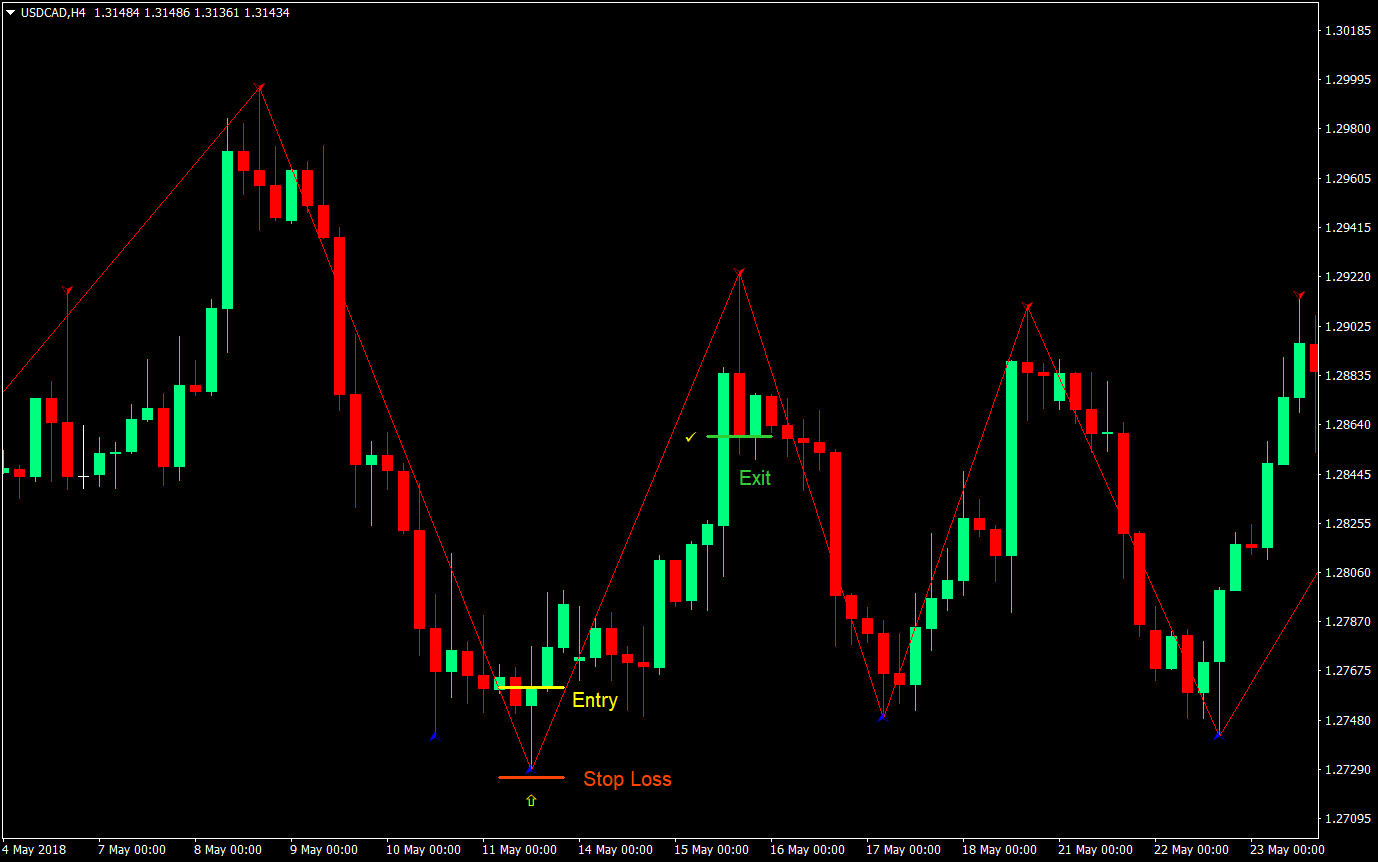

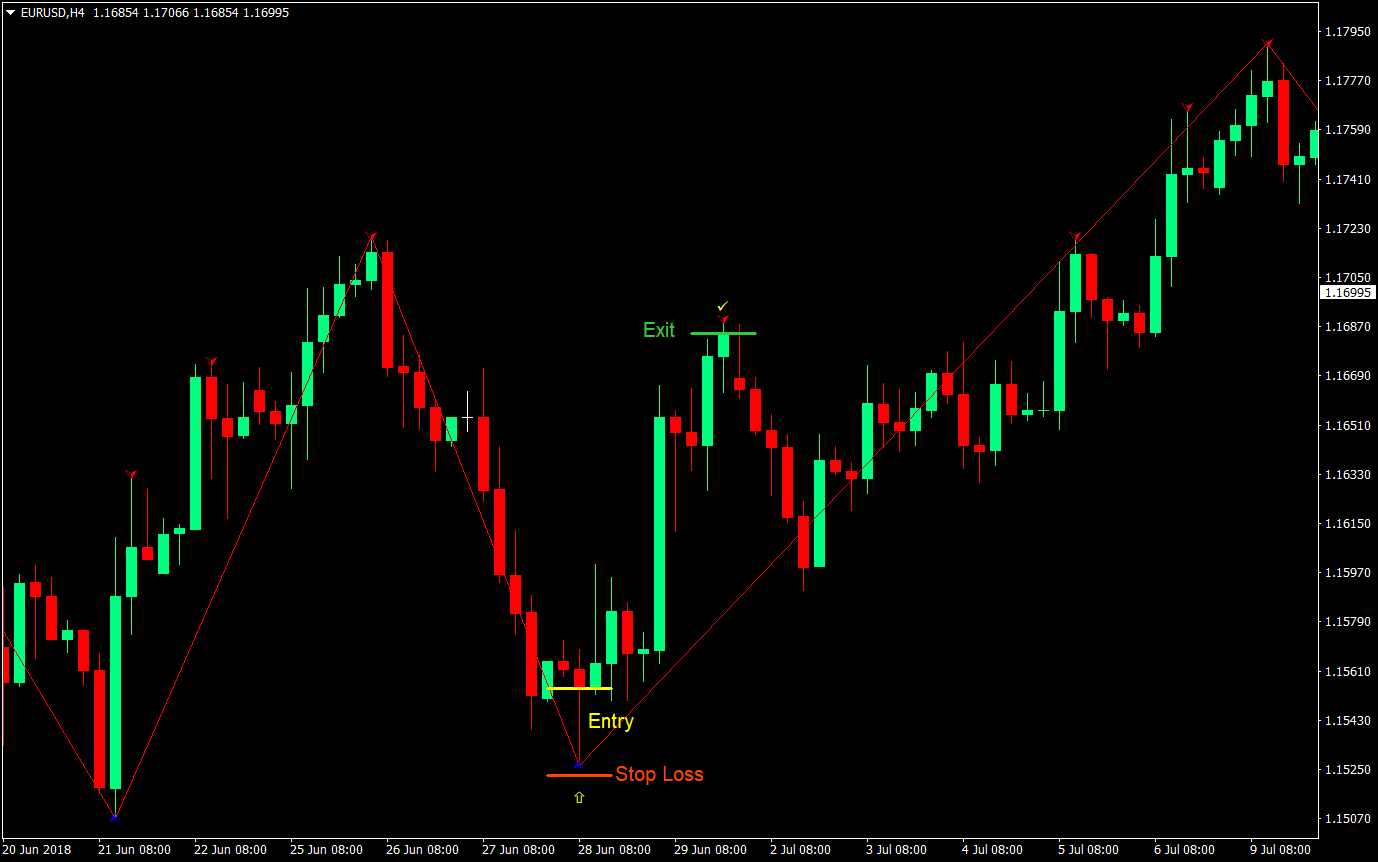

Buy (Long) Trade Setup Rules

Entry

- The ZigZag indicator determines the current candle as a swing low and connects a line to its low

- The zigzagarrows indicator agrees with the ZigZag indicator determining the current candle as a swing low and prints a blue arrow pointing up

- Enter a buy market order at the close of the candle

Stop Loss

- Set the stop loss below the low of the candle

Exit

- Close the trade as soon as a red arrow pointing down appears, which could be a swing high

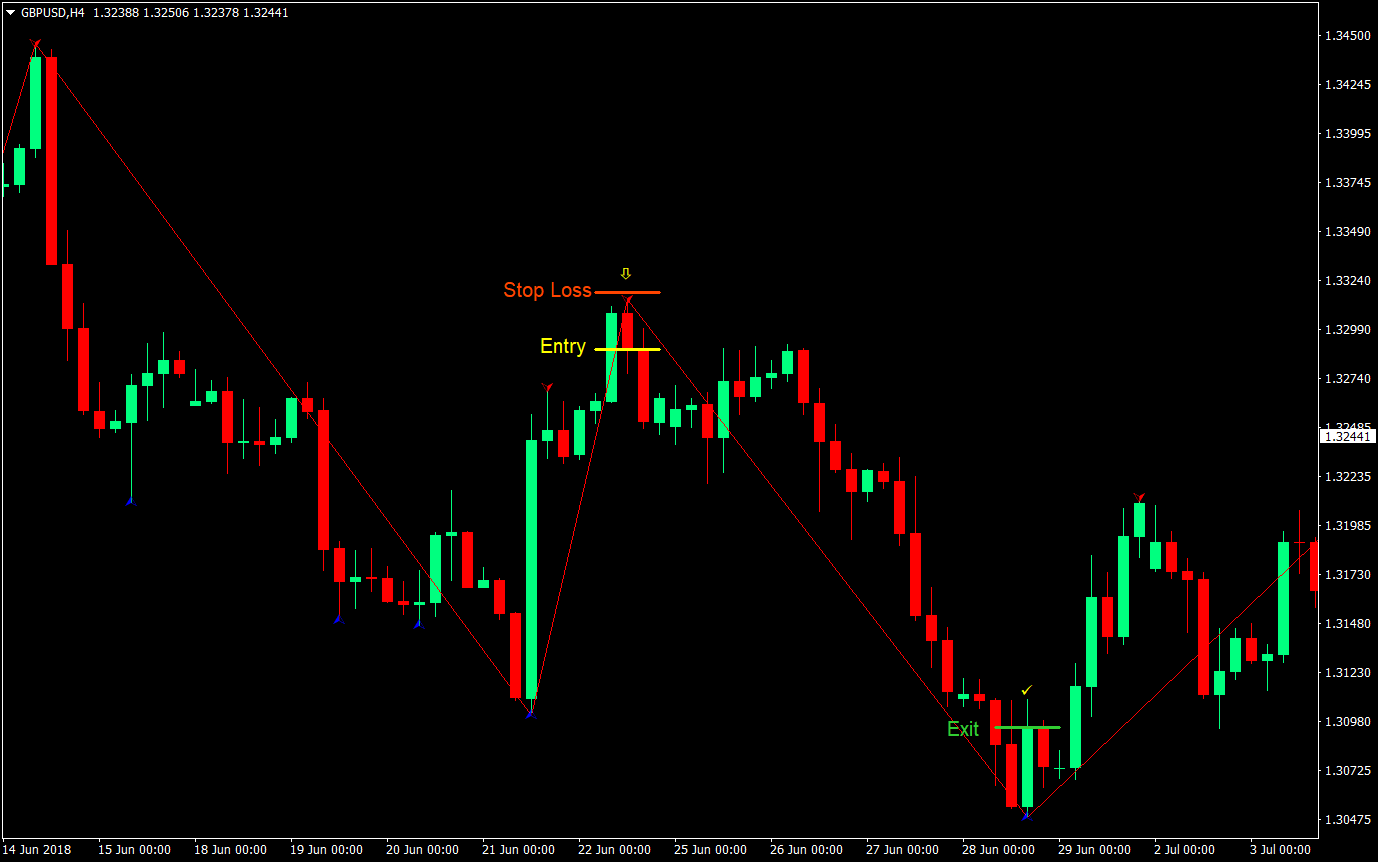

Sell (Short) Trade Setup Rules

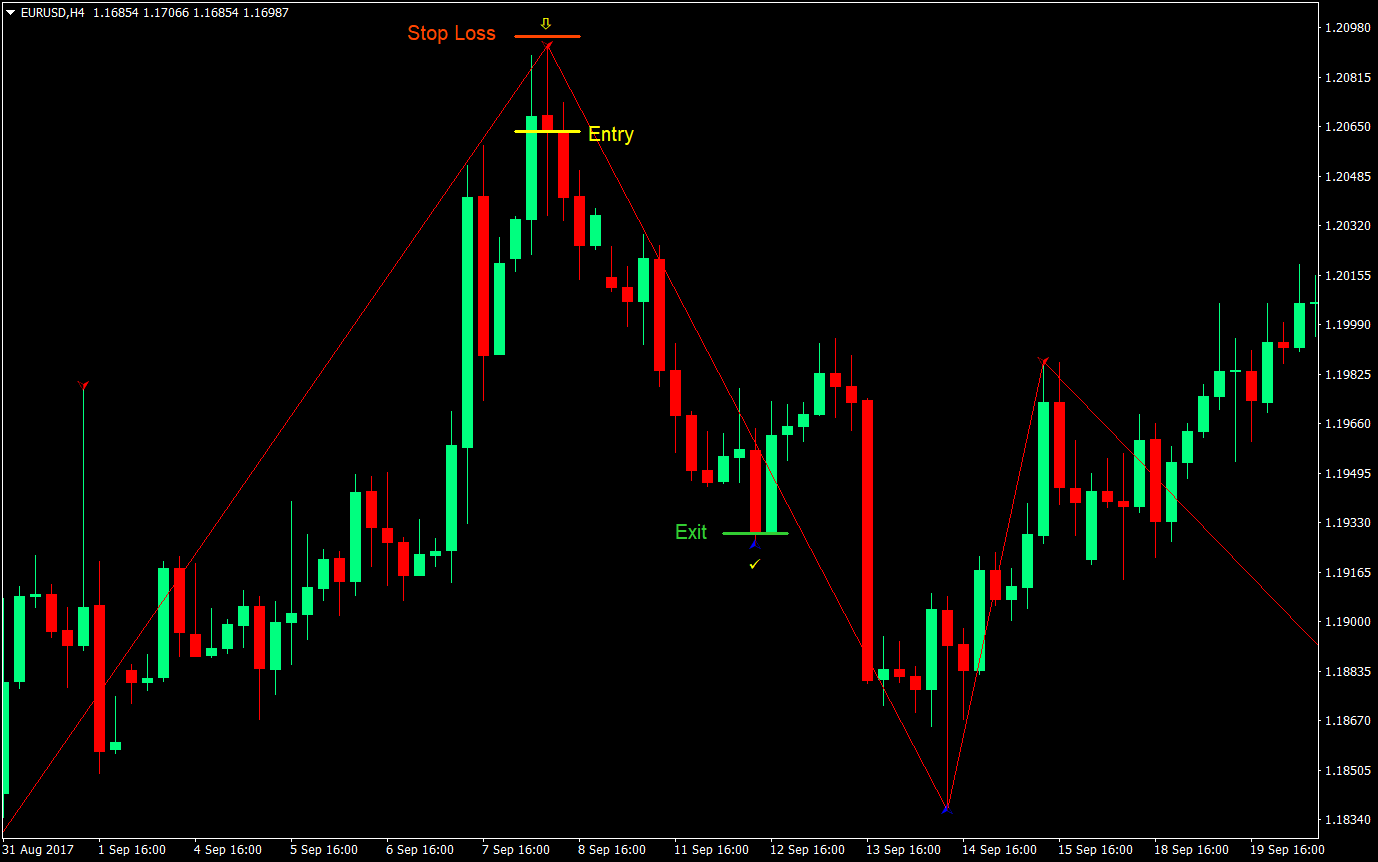

Entry

- The ZigZag indicator determines the current candle as a swing high and connects a line to its high

- The zigzagarrows indicator agrees with the ZigZag indicator determining the current candle as a swing high and prints a red arrow pointing down

- Enter a sell market order at the close of the candle

Stop Loss

- Set the stop loss above the high of the candle

Exit

- Close the trade as soon as a blue arrow pointing up appears, which could be a swing low

Conclusion

This strategy is a basic strategy of entering at swing highs and swing lows, which many traders attempt to do. The difference is that the swing points are objectively determined by the ZigZag indicators.

Although the ZigZag indicator is not predictive, we still get to improve our chances of a successful trade by having a confluence of two indicators.

If you’d like to improve your chances further, you could add this in confluence to an area of interest where price could bounce off based on your thesis.

Often times, these entry points should result to a profit. However, some setups would result to a short-lived move yielding a profit lower than the risk. Worst case scenario, you could close at a loss. However, there will be trades that could be a start of a fresh trend that lasts long. These trades would be your money maker yielding much of your profit and covering for the trades when you were just grinding out on small profits and some losses.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: