Один старший трейдер однажды сказал мне: «Лучше опоздать и оказаться правым, чем первым и ошибиться». Именно по этой причине многие трейдеры теряют деньги чаще, чем выигрывают. Они попытаются ворваться даже при малейшем намеке на изменение тренда. Они первыми войдут в сделку и первыми потеряют деньги, если сделка не окажется трендовой. Однако зрелые трейдеры учатся ждать подходящего момента, вместо того, чтобы нападать на каждый движущийся тик. Они будут ждать, пока их правила будут проверены одно за другим, а затем, когда они увидят, что изменение тренда подтверждено, они войдут в сделку, зная, что они вошли в торговую установку с высокой вероятностью.

Есть много способов торговать на развороте тренда. Некоторые торговые схемы основаны на краткосрочных движениях рынка, тогда как другие торгуются на долгосрочных тенденциях. Хотя обе стратегии хорошо работают для разных трейдеров, торговля по средне- и долгосрочному тренду, как правило, проще для большинства новых трейдеров.

Кросс-форекс-торговая стратегия MACD HAMA — это основанная на правилах стратегия разворота тренда, которая торгует на средне- и долгосрочных тенденциях. Тенденции более зрелые и имеют тенденцию подтверждаться в среднесрочных и долгосрочных тенденциях, что позволяет трейдерам добиться высокой степени успеха при торговле на рынках.

Схождение и расхождение скользящих средних

Схождение и расхождение скользящих средних (MACD) — это осциллятор, следующий за трендом, который определяет направление тренда на основе импульса.

Он указывает направление тренда, показывая взаимосвязь между двумя скользящими средними, обычно экспоненциальной скользящей средней (EMA). MACD вычитает долгосрочную скользящую среднюю из краткосрочной скользящей средней, а затем отображает разницу в виде гистограмм в отдельном окне. Отрицательные гистограммы указывают на медвежий тренд, а положительные гистограммы указывают на бычий тренд. Торговые сигналы генерируются всякий раз, когда гистограммы переходят от положительного к отрицательному или наоборот. В некотором смысле гистограммы представляют собой пересечение двух скользящих средних.

MACD также имеет третью скользящую среднюю, сигнальную линию, которая обычно представляет собой простую скользящую среднюю (SMA). Эта сигнальная линия затем сравнивается с гистограммами. Торговые сигналы также генерируются на основе пересечения гистограмм и сигнальной линии. Это особенно хорошо работает, когда сигнал возникает далеко от средней линии, поскольку это может указывать на состояние перекупленности или перепроданности рынка, что может вызвать разворот рынка.

Скользящая средняя Heiken Ashi

Скользящая средняя Heiken Ashi — это разновидность свечей Heiken Ashi. Однако, хотя эти два показателя имеют практически одно и то же название, во многих аспектах они сильно различаются. Свечи Heiken Ashi представляют собой обычные свечи, показывая максимумы и минимумы текущей свечи. Однако в нем есть свечи, которые меняют цвет в зависимости от направления краткосрочного тренда. Это позволяет трейдерам использовать лучшее из обоих миров, видеть ценовое движение, зная при этом направление краткосрочного тренда.

Скользящая средняя Heiken Ashi (HAMA), также известная как сглаженная Heiken Ashi, не представляет собой свечи. Вместо этого он представляет собой экспоненциальную скользящую среднюю (EMA). Это достигается путем печати свечей, которые меняют цвет в зависимости от направления скользящей средней. Если вы посмотрите на HAMA визуально, вы заметите, что он хорошо показывает тенденции. Он имеет тенденцию быть более плавным и точным по сравнению с другими индикаторами следования за трендом.

Торговая стратегия

Эта стратегия представляет собой стратегию следования за трендом, основанную на двух индикаторах высокой вероятности, которые работают на средне- и долгосрочных тенденциях. MACD и HAMA хорошо работают при определении направления тренда. Однако при использовании в качестве отдельного индикатора вы обнаружите, что время от времени в нем возникают некоторые ошибки. Использование этих двух взаимодополняющих индикаторов вместе увеличивает вероятность успешной сделки.

Показатели:

- MA_in_Color

- МА Период: 28

- ХАМА_

- MACD

Таймфрейм: 4-часовые и дневные графики

Валютные пары: основные и второстепенные пары

Торговая сессия: Токийские, лондонские и нью-йоркские сессии

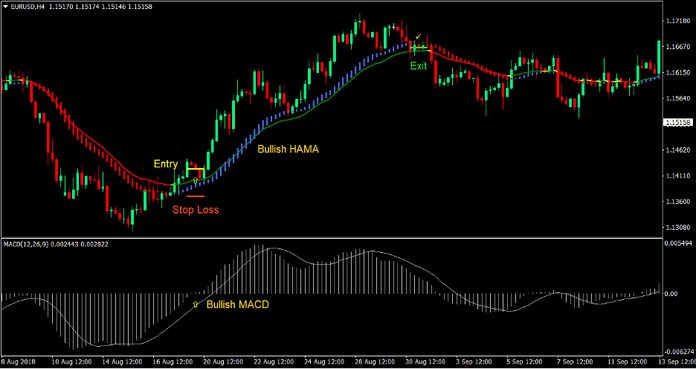

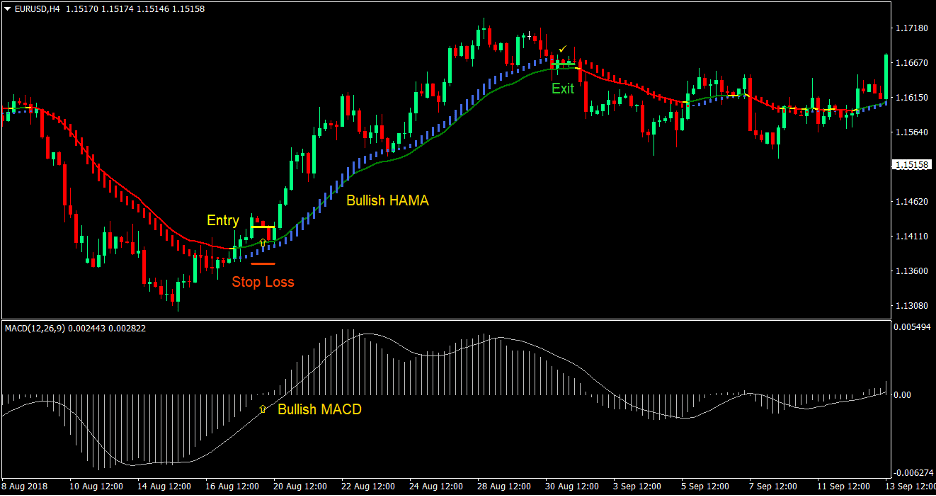

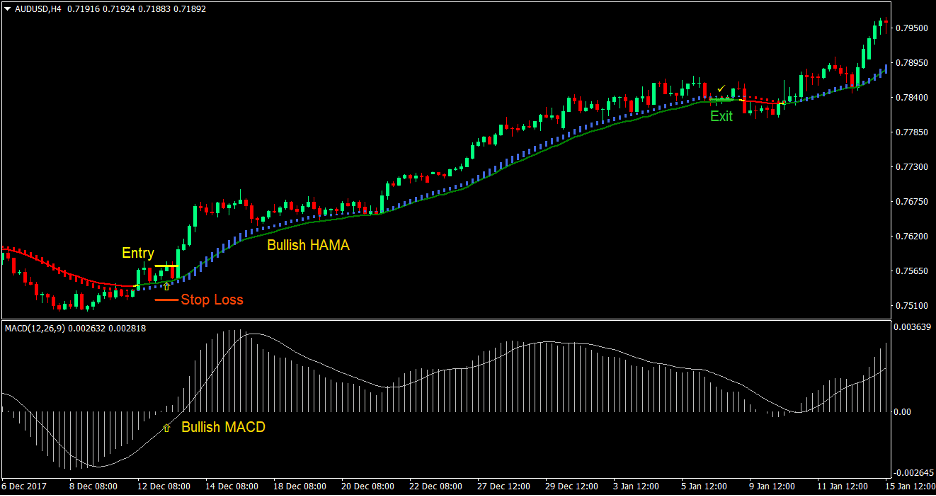

Купить торговую настройку

Запись

- Гистограммы MACD должны пересечься выше нуля, указывая на разворот бычьего тренда.

- Индикатор MA in Color должен измениться на зеленый, указывая на разворот бычьего тренда.

- Индикатор HAMA должен изменить цвет на синий, указывая на разворот бычьего тренда.

- Сигналы разворота должны в некоторой степени совпадать.

- Введите ордер на покупку при стечении вышеуказанных условий.

Stop Loss

- Установите стоп-лосс на уровне поддержки ниже свечи входа.

Выход

- Закройте сделку, как только гистограмма MACD опустится ниже нуля.

- Закройте сделку, как только индикатор MA in Color станет желтым.

- Закройте сделку, как только индикатор HAMA станет красным.

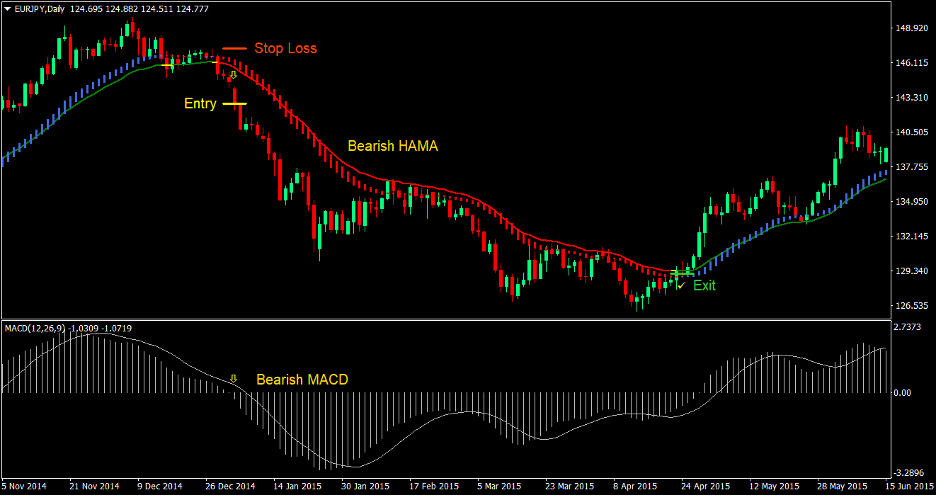

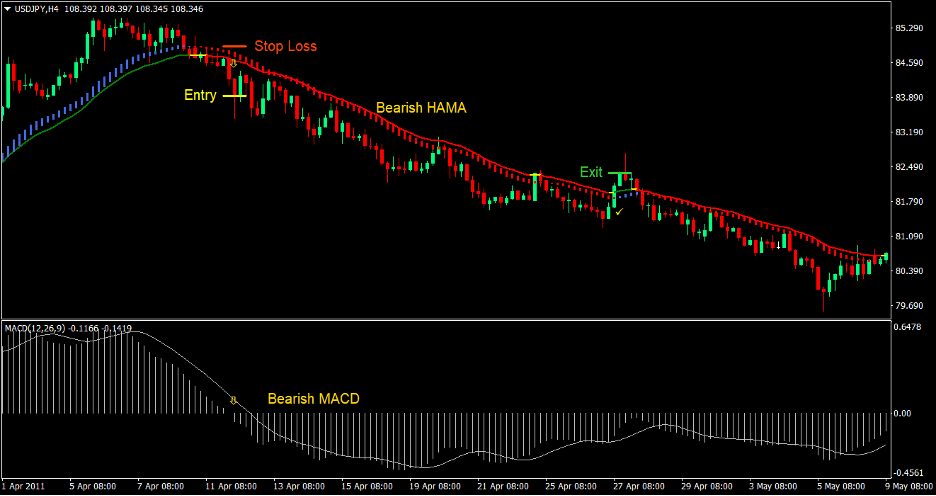

Настройка торговли на продажу

Запись

- Гистограммы MACD должны пересечься ниже нуля, указывая на разворот медвежьего тренда.

- Индикатор MA in Color должен измениться на красный, указывая на разворот медвежьего тренда.

- Индикатор HAMA должен изменить цвет на красный, указывая на разворот медвежьего тренда.

- Сигналы разворота должны в некоторой степени совпадать.

- Введите ордер на продажу при стечении вышеуказанных условий.

Stop Loss

- Установите стоп-лосс на уровне сопротивления выше свечи входа.

Выход

- Закройте сделку, как только гистограмма MACD поднимется выше нуля.

- Закройте сделку, как только индикатор MA in Color станет желтым.

- Закройте сделку, как только индикатор HAMA станет синим.

Заключение

Это стратегия высокой вероятности, основанная на паре технических индикаторов высокой вероятности. Большинство торговых сигналов, генерируемых этой стратегией, должны приносить прибыль, при условии, что трейдер также обладает отличными навыками управления торговлей. Это включает в себя перемещение стоп-лоссов в безубыток, скользящие стоп-лоссы для обеспечения прибыли и установку стоп-лоссов на правильном расстоянии.

Рекомендуемые брокеры MT4

XM Broker

- Бесплатно $ 50 Чтобы начать торговать мгновенно! (Прибыль, которую можно вывести)

- Бонус на депозит до $5,000

- Безлимитная программа лояльности

- Удостоенный наград форекс-брокер

- Дополнительные эксклюзивные бонусы В течение года

>> Зарегистрируйте учетную запись брокера XM здесь <

Брокер ФБС

- Торговля 100 бонусом: Бесплатные 100 долларов, чтобы начать свое торговое путешествие!

- 100% Бонус на первый депозит: Удвойте свой депозит до 10,000 XNUMX долларов США и торгуйте с увеличенным капиталом.

- Кредитное плечо до 1: 3000: Максимизация потенциальной прибыли с помощью одного из самых высоких доступных вариантов кредитного плеча.

- Награда «Лучший брокер по обслуживанию клиентов в Азии»: Признанное превосходство в поддержке и обслуживании клиентов.

- Сезонные Акции: Наслаждайтесь разнообразными эксклюзивными бонусами и рекламными предложениями круглый год.

>> Зарегистрируйте брокерский счет FBS здесь <

Нажмите здесь, чтобы загрузить: