Колебания рынка и его неустойчивое поведение часто застают врасплох многих трейдеров, особенно тех, кто только начинает торговать. С другой стороны, проницательные и опытные трейдеры будут следить за этими рыночными колебаниями. Фактически, некоторые опытные трейдеры будут торговать только на рынках с сильными рыночными колебаниями. Это потому, что без волатильности и рыночных колебаний трейдеры не смогут получить никакой прибыли.

Итак, как же сделать рыночные колебания своими друзьями? Нам следует понять, что не все рыночные колебания хаотичны. Хотя рынки могут развернуться без предупреждения, существуют явные признаки, которые могут показать нам, куда движется рынок.

Некоторые трейдеры судят о направлении тренда на основе движения цены, в то время как другие используют технические индикаторы. Оба типа стратегий подойдут разным трейдерам. Оба имеют преимущества и недостатки. Торговля по ценовому действию позволяет трейдерам совершать сделки с гораздо меньшей задержкой по сравнению с теми, кто использует индикаторы. С другой стороны, трейдеры, использующие индикаторы, с меньшей вероятностью совершают субъективные ошибки при принятии решений. Это связано с тем, что индикаторы представляют собой точные цифры и данные, которые можно легко включить в правила торговой стратегии.

Торговая стратегия MACD Trend Forex — это простая в использовании стратегия, основанная на одном из самых простых, но очень эффективных технических индикаторов. Он объективен и имеет конкретные правила, которым трейдеры могут легко следовать.

2 линии MACD

Схождение и расхождение скользящих средних (MACD) является основным индикатором для многих трейдеров. Вероятно, это один из самых простых, но в то же время один из наиболее широко используемых торговых индикаторов. Его используют технические аналитики, институциональные трейдеры «крупных банков», его используют рыночные аналитики. Почему бы нам не использовать его как розничным трейдерам?

MACD — это индикатор колеблющегося импульса, полученный на основе скользящих средних. Он измеряет расстояние между двумя экспоненциальными скользящими средними (EMA). Затем он отображается в виде колеблющейся линии, называемой линией MACD. Затем на основе линии MACD формируется еще одна экспоненциальная скользящая средняя (EMA). Эта линия тогда будет называться «сигнальной линией». Затем линия MACD вычитается из сигнальной линии, и ее разница отображается в виде гистограммы. Положительные гистограммы или линия MACD, находящаяся выше сигнальной линии, указывают на бычье направление тренда. С другой стороны, отрицательные гистограммы или линия MACD, находящаяся ниже сигнальной линии, указывают на медвежье направление тренда.

MACD имеет множество применений. Трейдеры, занимающиеся возвратом к среднему значению, предполагают, что линии MACD всегда будут возвращаться к среднему значению. По этой причине они будут воспринимать пересечение линий MACD и сигнальной линии как торговый сигнал. С другой стороны, трейдеры, торгующие импульсом, воспримут пересечение линии MACD с положительной на отрицательную или наоборот как торговый сигнал, поскольку это предполагает, что тренд развернулся на основе разворота скользящих средних, на основе которых получена линия MACD.

Двухлинейный MACD — это модифицированный MACD, который гораздо более плавный и имеет тенденцию давать торговые сигналы более высокого качества по сравнению с обычным MACD.

Индикатор уровня

Индикатор Уровни — это пользовательский индикатор, созданный на основе модифицированной скользящей средней. Он отображает две линии красного и зелено-желтого цвета. Эти линии представляют собой модифицированные скользящие средние, сдвинутые вверх и вниз.

Область между красной и зелено-желтой линиями действует как область динамической поддержки и сопротивления, в зависимости от того, где находится цена по отношению к двум линиям. В условиях трендового рынка цена будет иметь тенденцию отскакивать от этой области. Однако, как и в случае с поддержкой и сопротивлением, пересечение ценой этих линий можно считать прорывом.

Торговая стратегия

Эта торговая стратегия представляет собой простую стратегию разворота импульса MACD, основанную на пересечении линии MACD средней линии. Однако в качестве дополнительного подтверждения мы также будем использовать пересечение цены индикатора Уровный.

Это слияние разворота импульса MACD и прорыва цены через линии Уровного указывает на то, что рынок разворачивается.

Показатели:

- 2line_MAC

- Период быстрой MA: 18

- Период медленной средней: 36

- Период сигнала MA: 12

- Уровный

Таймфрейм: 15-минутные, 1-часовые, 4-часовые и дневные графики

Валютные пары: основные и второстепенные пары

Торговая сессия: Токио, Лондон и Нью-Йорк; желательно торговая сессия одной из валют пары при торговле на 15-минутном графике

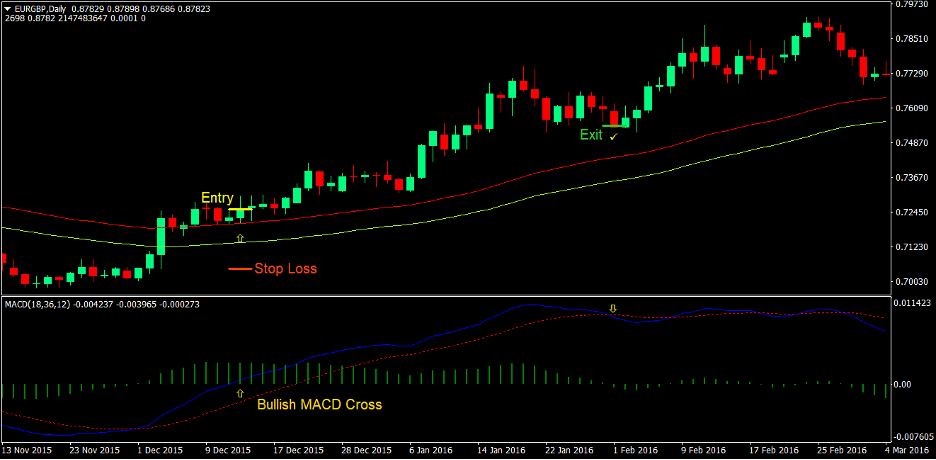

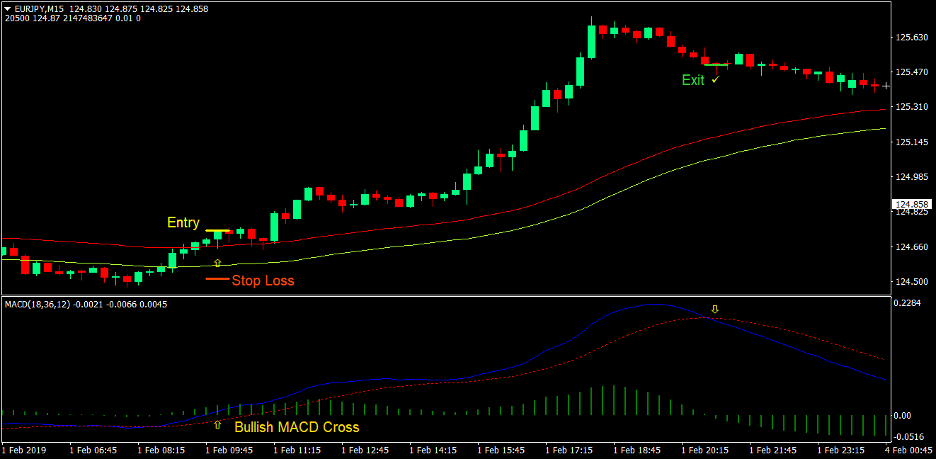

Купить торговую настройку

Запись

- Цена должна пересечь и закрыться выше красной линии уровня, указывая на прорыв бычьего сопротивления.

- Двухлинейный индикатор MACD должен отображать положительную гистограмму, указывающую на бычий тренд.

- Синяя линия MACD должна пересечь выше нуля, указывая на разворот бычьего тренда.

- Эти бычьи сигналы должны в некоторой степени совпадать.

- Введите ордер на покупку при стечении вышеперечисленных условий.

Stop Loss

- Установите стоп-лосс на уровне поддержки ниже входной свечи.

Выход

- Закройте сделку, как только синяя линия MACD пересечет пробитую красную сигнальную линию.

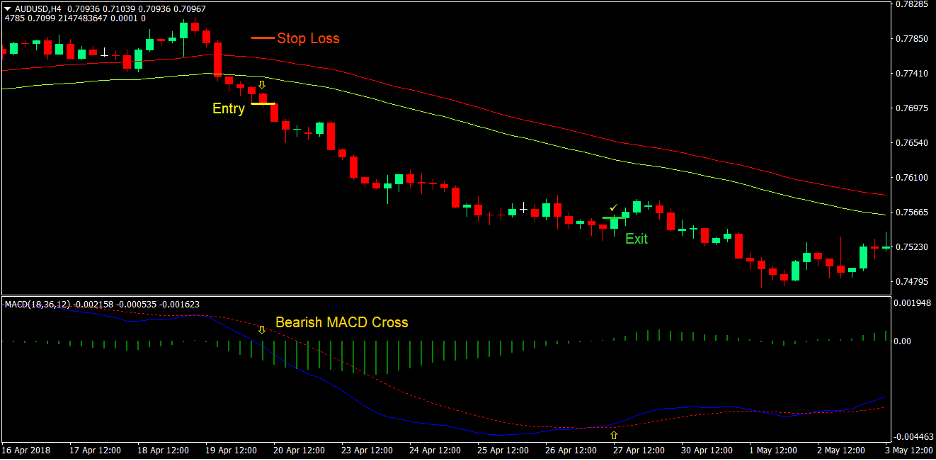

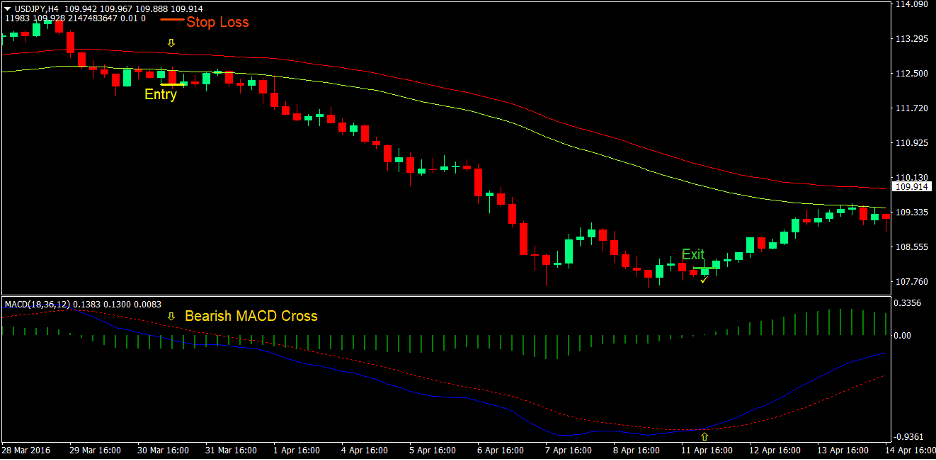

Настройка торговли на продажу

Запись

- Цена должна пересечь и закрыться ниже зелено-желтой линии Уровни, указывая на прорыв медвежьей поддержки.

- Двухлинейный индикатор MACD должен отображать отрицательную гистограмму, указывающую на медвежий тренд.

- Синяя линия MACD должна пересечь ниже нуля, указывая на разворот медвежьего тренда.

- Эти медвежьи сигналы должны быть в некоторой степени совмещены.

- Введите ордер на продажу при стечении вышеперечисленных условий.

Stop Loss

- Установите стоп-лосс на уровне сопротивления выше входной свечи.

Выход

- Закройте сделку, как только синяя линия MACD пересечет пробитую красную сигнальную линию.

Заключение

Стратегия разворота импульса MACD — это базовая стратегия, используемая многими трейдерами. Фактически, сигнал MACD сам по себе должен обеспечить прибыльную торговую стратегию в сочетании с хорошей стратегией управления торговлей. Добавление подтверждения пробоя линий Уровня обеспечивает еще более высокую вероятность торговой установки.

Эта стратегия работает лучше всего при использовании на рынке, который имеет сильную тенденцию к тренду. Избегайте использования этой стратегии на младших таймфреймах при низкой волатильности. Эта стратегия также работает лучше всего, когда перед свечой входа есть импульсная свеча или произошел прорыв диагональной поддержки или сопротивления.

Рекомендуемые брокеры MT4

XM Broker

- Бесплатно $ 50 Чтобы начать торговать мгновенно! (Прибыль, которую можно вывести)

- Бонус на депозит до $5,000

- Безлимитная программа лояльности

- Удостоенный наград форекс-брокер

- Дополнительные эксклюзивные бонусы В течение года

>> Зарегистрируйте учетную запись брокера XM здесь <

Брокер ФБС

- Торговля 100 бонусом: Бесплатные 100 долларов, чтобы начать свое торговое путешествие!

- 100% Бонус на первый депозит: Удвойте свой депозит до 10,000 XNUMX долларов США и торгуйте с увеличенным капиталом.

- Кредитное плечо до 1: 3000: Максимизация потенциальной прибыли с помощью одного из самых высоких доступных вариантов кредитного плеча.

- Награда «Лучший брокер по обслуживанию клиентов в Азии»: Признанное превосходство в поддержке и обслуживании клиентов.

- Сезонные Акции: Наслаждайтесь разнообразными эксклюзивными бонусами и рекламными предложениями круглый год.

>> Зарегистрируйте брокерский счет FBS здесь <

Нажмите здесь, чтобы загрузить: