Countertrend traders are some of the most amazing types of forex traders. They would often get in front of a steaming trend believing that price would bounce back after they enter the market. Most would get their trades crushed by such a trend. However, some would get the precise entry right at the exact point where the market would reverse. I wonder what sort of magic these traders use to forecast such a trend reversal.

Guessing the exact points where price would reverse is very difficult. I’ve done this myself a few times, however, most of the time there would be an extra move against your trade prior to it moving in your direction.

Although it is difficult to catch countertrend trades right at the apex of the trend, it is a bit easier to spot a trend reversal based on a few clues. One of the most popular clues that traders use are divergences.

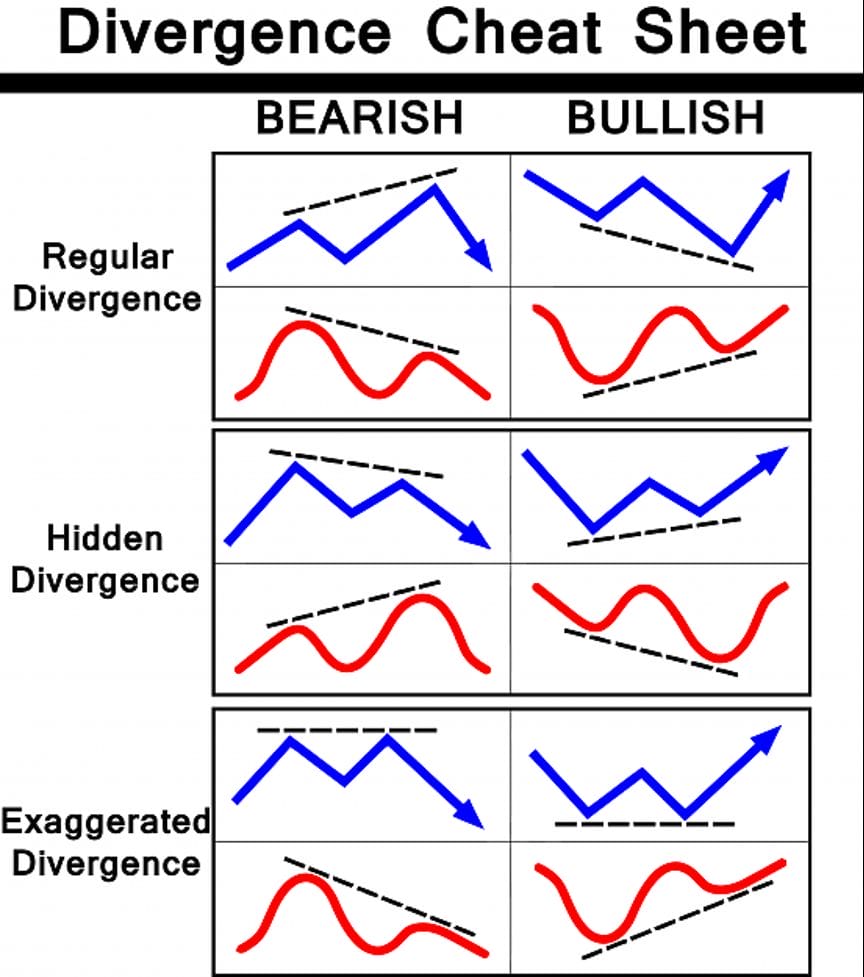

Divergences are basically price action and an oscillator indicator disagreeing with regards to the depth or height of a swing low trough or a swing high peak.

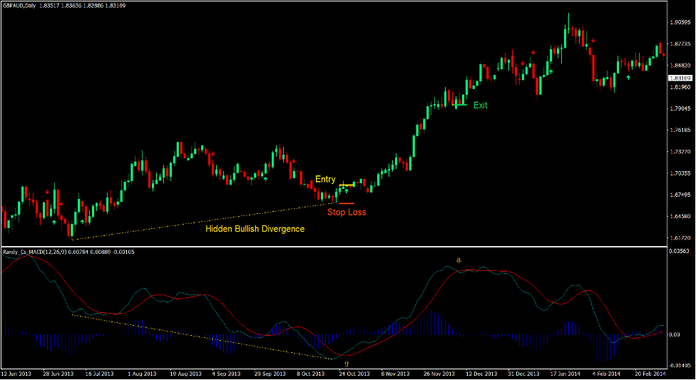

For example, price action might be showing a shallow swing low, but an oscillator is showing a deep trough compared to the prior swing points, then this would be considered a hidden bullish divergence. Another example would be price action showing a high swing high peak, but its corresponding oscillator is showing a low swing high peak compared to the prior swing highs, then that would be considered as a regular bearish divergence.

Divergences indicate a tension between the strength of a price action market swing and its corresponding oscillator. These tensions would be resolved with one of the two following the other. This often results in a strong price swing as price action reacts to such tension.

There are several divergence patterns that traders often use. Below is a cheat sheet of the various divergence patterns.

Randy CS MACD

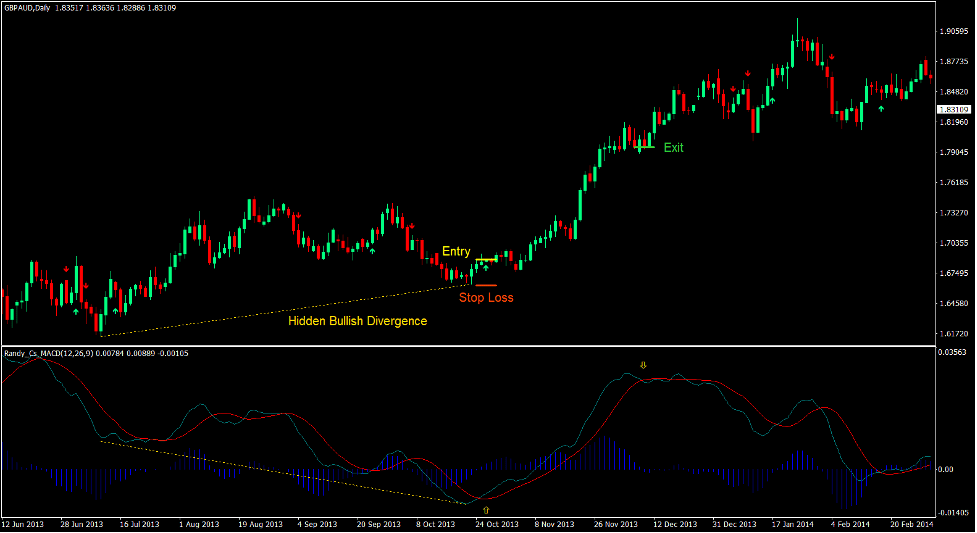

Randy CS MACD is a modified version of the classic MACD indicator which smoothens out the oscillations of its lines and automatically plots divergences whenever it detects one.

The classic Moving Average Convergence and Divergence (MACD) indicator is a popular oscillator used by many traders. It is computed based on the difference between two modified moving averages. The results are then plotted as an oscillating line on a separate window. Then, another line is derived from the original line, which is basically a moving average of the prior line. Crossovers between the two lines indicate a probable trend or momentum reversal.

Some versions of the MACD plot a histogram bar indicating the difference between the two lines. The shifting of the histogram bars over zero indicates a possible trend reversal.

Randy CS MACD simply smoothens out the oscillations of the MACD lines. It also detects divergences and plots lines connecting the swing highs or lows of price action and the peaks or troughs of the oscillator.

EMA Crossover Signal

EMA Crossover Signal is a trend reversal signal indicator based on the crossing over of moving averages.

There are many ways traders identify a trend reversal. One of the most popular ways traders identify a trend reversal is using moving averages. Traders would place two moving average lines on a price chart with varying speeds. One reacts faster to price movements compared to the other. Traders would then wait for the two lines to crossover. Such crossovers would indicate a trend reversal.

Simple Moving Averages (SMA) could also be used in moving average crossover setups. However, SMAs tend to be very lagging. Traders then developed the Exponential Moving Average (EMA), which is more responsive to price movements while still maintaining its smoothness. This makes the EMA line a good moving average crossover tool.

The EMA Crossover Signal indicator plots arrows pointing the direction of the new trend based on the crossing over of two EMA lines. Traders could then use these crossovers as an entry signal for a trend reversal setup.

Trading Strategy

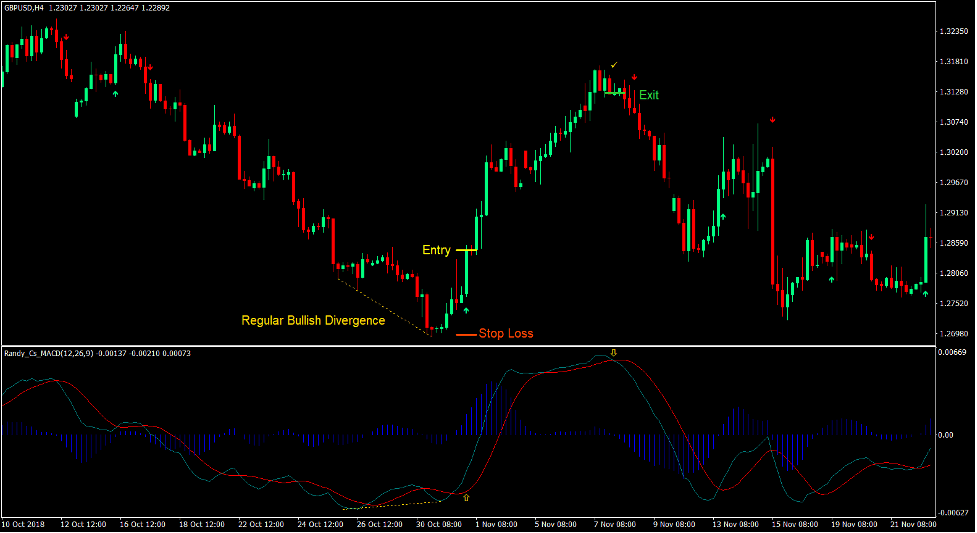

Divergent MACD Forex Trading Strategy is a combination of a divergence trade setup based on the Randy CS MACD and moving average crossover setup using the EMA Crossover Signal indicator.

First, we must look for divergences between price action and the Randy CS MACD indicator. We then wait for the MACD lines to crossover signaling a probable trend reversal.

Then, on the EMA Crossover Signal indicator, we wait for an arrow to be plotted pointing the direction of the reversal.

Confluences between the two setups would be considered a valid trend reversal setup.

Indicators:

- EMA Crossover Signal

- Faster EMA: 5

- Slower EMA: 20

- MACD_Divergence

Preferred Timeframes: 30-minute, 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

Buy Trade Setup

Entry

- The MACD Histograms should be negative.

- A bullish divergence should be observed.

- The faster MACD line should cross above the slower MACD line.

- The EMA Crossover Signal indicator should plot an arrow pointing up.

- Enter a buy order on confluence of these conditions.

Stop Loss

- Set the stop loss on the support level below the entry candle.

Exit

- Close the trade as soon as the EMA Crossover Signal indicator plots an arrow pointing down.

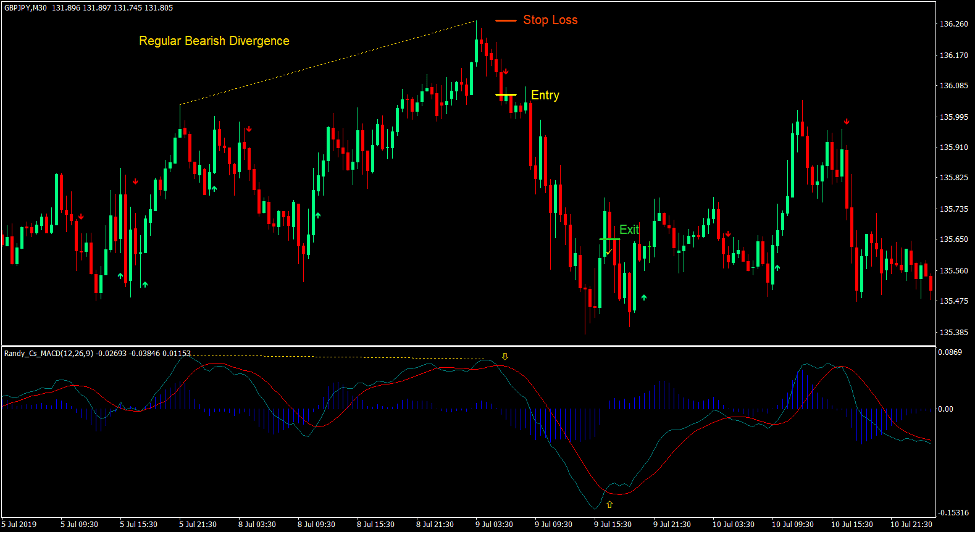

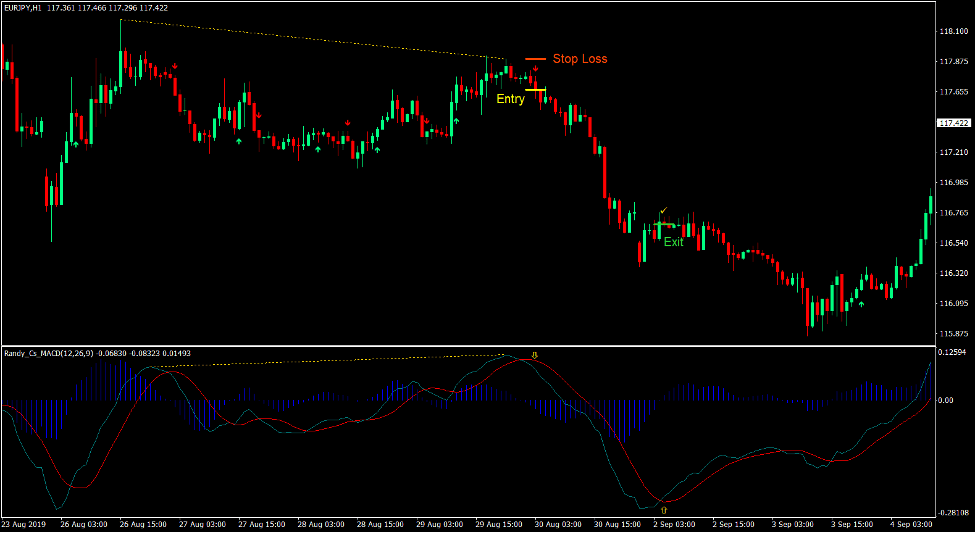

Sell Trade Setup

Entry

- The MACD Histograms should be positive.

- A bearish divergence should be observed.

- The faster MACD line should cross below the slower MACD line.

- The EMA Crossover Signal indicator should plot an arrow pointing down.

- Enter a sell order on confluence of these conditions.

Stop Loss

- Set the stop loss on the resistance level above the entry candle.

Exit

- Close the trade as soon as the EMA Crossover Signal indicator plots an arrow pointing up.

Conclusion

Divergences are one of the tools that many professional forex traders use. It may seem confusing at first but the longer you use it, the easier it is to find such divergence patterns.

The good thing about divergences is that it has a relatively high degree of accuracy. One professional forex trader even claims he has an accuracy of around 70% using divergences. He also claims that he seldom has more than three losing trades in a row. These figures open many opportunities for forex traders. We could use various types of hedging, which should decrease our losses further, and we could also plow back a portion of our profits to succeeding trades, which should exponentially increase our potential profits.

Divergences are great forex trading tools. In the right hands, it works magic.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: