Trend reversals are probably one of the most satisfying types of trading strategies when done right. This is because trend reversals allow traders to capitalize on huge market moves from the start of a trend up until the end of the trend.

However, while trend reversals could be very satisfying when taking huge wins, it could also be very frustrating when traders experience drawdown periods trading trend reversals. This is because trend reversals are also one of the most difficult trades to predict. Traders are taking trades at the end of a previous trend, hoping that the market would trend in the opposite direction.

Most traders trade trend reversals as the market would show signs of reversing. However, this would often lead to frustration because at times the market could just be doing a deep retracement on a higher timeframe.

One of the best ways to confirm a trend reversal is not just waiting for price to spike or gather momentum in the opposite direction, but rather waiting for it to do a retest. This means price should start to reverse, retrace and make a swing point, then continue its trend reversal. This would mean that price is making a new trend based on the swing highs and swing lows, which is how price action traders confirm a trend.

Chandelier Arrows Forex Trading Strategy is a strategy that trades on such trend reversals. It uses a couple of indicators to confirm the setup. One signifies the main trend reversal, while the other signifies the trend reversal, retest and resumption of the trend.

Chandelier Stops v1

Chandelier Stops v1 is a trend following technical indicator which identifies trend direction and trend reversals based on how historical prices move in relation to its normal range.

One of the ways traders identify a trend is by looking at the relationship of the directional movement of price and the Average True Range (ATR). In a normal trending market, price would move in one direction most of the time, although there are some minor retracements back and forth. However, these retracements are usually not that big. Traders believe that one way to identify a trend reversal is by looking at how far price has traveled in reverse in relation to the prevailing trend. To do this, they use the ATR. Some traders say price should reverse by more than twice or thrice the length of the ATR. If price does reverse in this magnitude, then the market is said to have reversed.

The Chandelier Stops v1 indicator is based on this concept. It identifies the current trend direction and plots a line on the opposite side of the trend based on the ATR. If price reverses, breaches, and closes beyond this line, then the indicator would detect a trend reversal.

In a bullish market, the indicator will plot a blue line below price action. In a bearish market, the indicator will plot a red line above price action.

Indicator Arrows

Indicator Arrows is a custom technical indicator which provides trade signals based on the confluence of various technical indicators.

It derives its assessment of the market from moving averages, Moving Average Convergence and Divergence (MACD), Moving Average Oscillator (OsMA), Stochastic Oscillators, Relative Strength Index (RSI), Commodity Channel Index (CCI), Relative Vigor Index (RVI) and the Average Directional Movement Index (ADX).

This confluence of various indicators provides a strong indication of where price is moving, making the indicator a very reliable signal indicator.

The indicator conveniently plots an arrow pointing the direction of the trend whenever it detects a trend reversal. Traders could use this as an entry signal for trend reversal setups.

Trading Strategy

This trading strategy aims to trade on huge market trend moves, which would allow traders to profit big on trend reversals.

To trade this strategy, we will be identifying potential big trend reversals based on the Chandelier Stops v1 indicator. This is simply based on the shifting of the location of the line and the changing of the color of the line.

Instead of taking the trade right away, we will be waiting for a retest and confirmation of a trend reversal.

The retest should cause the Indicator Arrows to temporarily reverse as price retraces near the Chandelier Stops v1 line. Then, we wait for the Indicator Arrows to plot an arrow pointing the direction of the trend. We then take the trade and ride it until the end of the trend.

Indicators:

- ChandelierStops_v1

- Indicatorarrows

Preferred Time Frames: 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

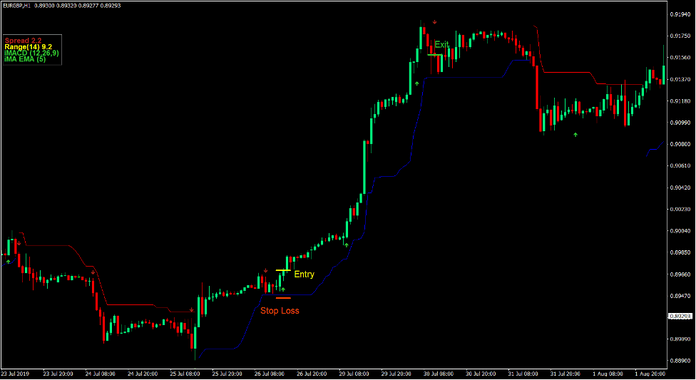

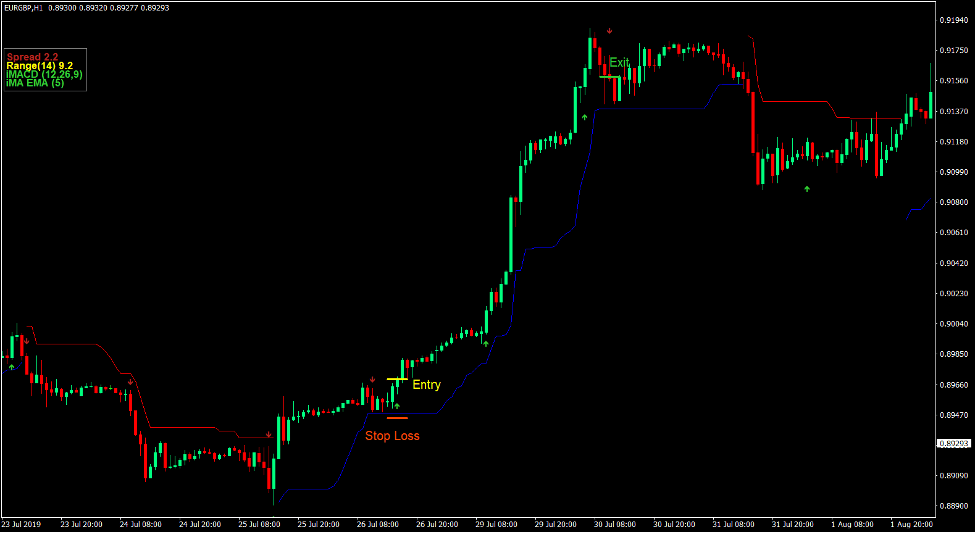

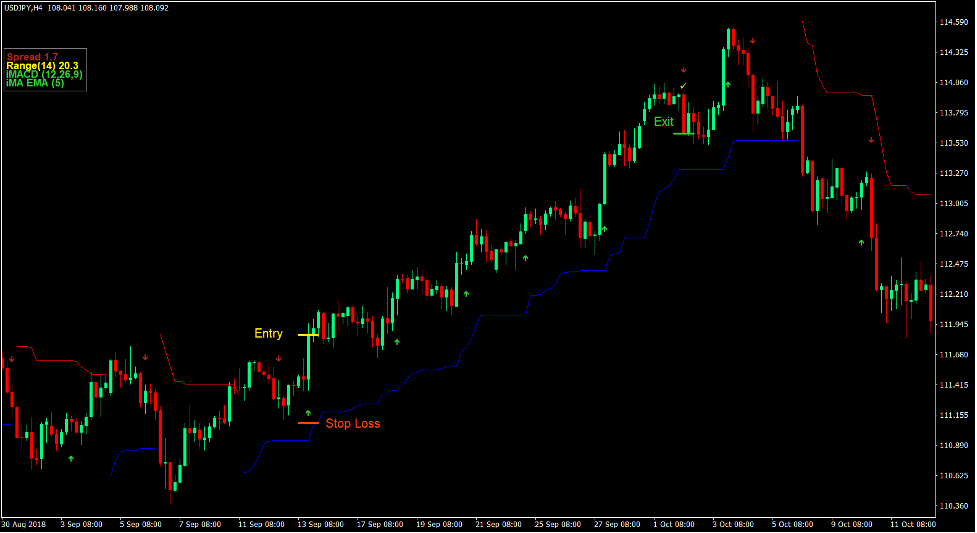

Buy Trade Setup

Entry

- The Chandelier Stops v1 line should shift below price and change to blue.

- Price should retrace near the line causing the Indicator Arrows to temporarily reverse.

- Enter a buy order as soon as the Indicator Arrows plots an arrow pointing up.

Stop Loss

- Set the stop loss on the support level below the entry candle.

Exit

- Close the trade as soon as the Indicator Arrows plots an arrow pointing down.

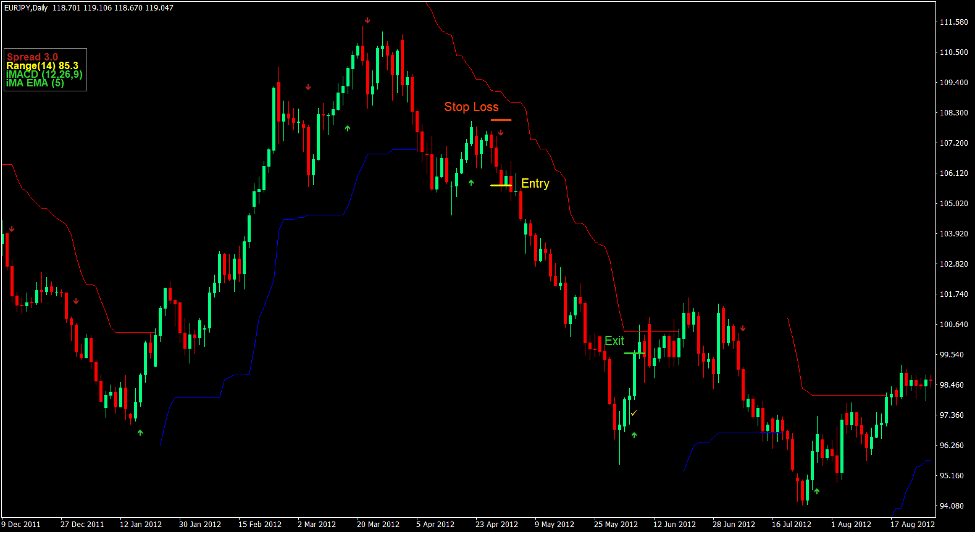

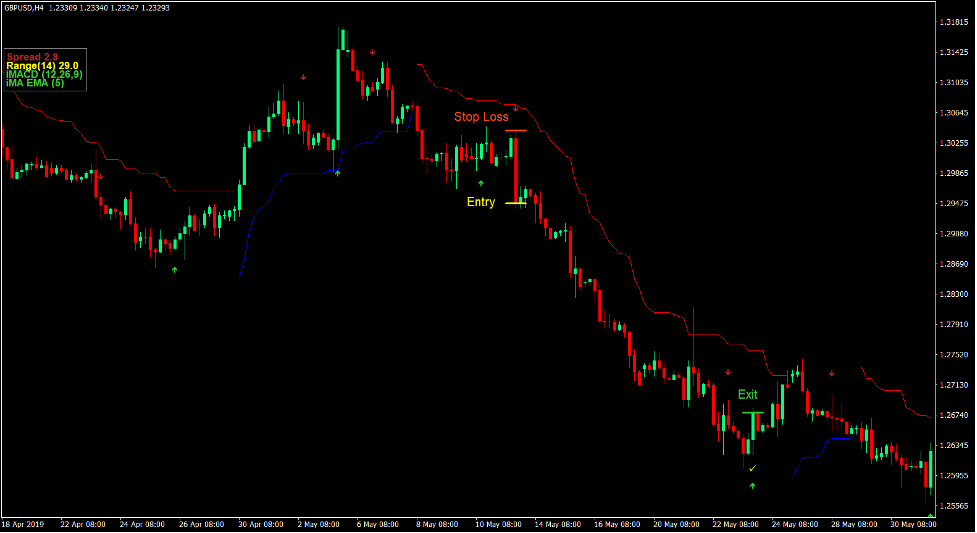

Sell Trade Setup

Entry

- The Chandelier Stops v1 line should shift above price and change to red.

- Price should retrace near the line causing the Indicator Arrows to temporarily reverse.

- Enter a sell order as soon as the Indicator Arrows plots an arrow pointing up.

Stop Loss

- Set the stop loss on the resistance level above the entry candle.

Exit

- Close the trade as soon as the Indicator Arrows plots an arrow pointing up.

Conclusion

This strategy is a good trend reversal strategy which manages to increase the probability of a win, while maintaining the high reward-risk ratio which is innate in a trend reversal strategy.

The confluence of the two indicators is a product of many confluences within the indicators. This is the reason why the signals have an improved accuracy.

To maintain the high reward-risk ratio, traders should take only the first signal in a trend. This is because although subsequent signals might still be profitable, the potential profit is usually much lower compared to trading the setup at the start of the trend.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: