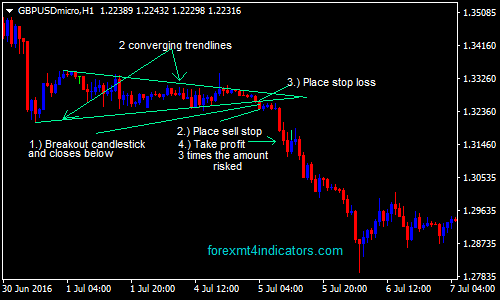

Bearish Pennant Trading Strategy

This is an effective method that is based on bearish pennant pattern. This does not require any indicators, just price actions.

You must be familiar on how to draw trendlines and able to identify the bearish pennant pattern.

This is similar to bullish pennant method but it’s the opposite because the pattern is in bearish or downward direction.

A bearish pattern must be in existing downtrend and it will then consolidate for some period and then breakout happens to the downside.

You can enter a short position when the breakout happens. You need to have 2 converging trendlines. One is connecting the decreasing peaks or the downward trendline and the other trendline is connecting the upward trendline. watch as the price break the upward trendline.

You have to be careful, though. Sometimes, the peaks and bottoms may not be so clear when this bearish pennant chart is forming.

Trading Rules:

- The price or candlestick must break and close below the upward trend line.

- Place a sell stop order 3-5 pips below the low of the breakout candlestick.

- Place your stop loss order anywhere from 5-10 pips above the high of the intersecting candlestick.

- Take profit at the previous swing low or 3 times of the amount of what you risked.

Open a GBPUSD pair 1-hour timeframe for the template.