At its core, the indicator focuses on a specific price pattern known as the key reversal pattern. This pattern consists of three candlesticks:

- The first two candlesticks should be in line with the prevailing trend. For example, in an uptrend, the first two candlesticks would be bullish (i.e., with closing prices higher than their opening prices).

- The third candlestick, also known as the key candlestick, acts as the “reversal” element. In an uptrend scenario, the key candlestick would be bearish (i.e., closing price lower than its opening price) and engulf (completely or partially) the body of the previous candlestick.

The indicator automatically scans the price chart and identifies these key reversal patterns, potentially alerting traders to potential trend changes.

Vantagens e Limitações

While the Key Reversal Indicator offers a valuable service in identifying potential trend reversals, it’s crucial to understand its strengths and limitations before incorporating it into your trading strategy.

Vantagens

- Simplifies Pattern Recognition: By automating the identification of key reversal patterns, the indicator saves traders time and effort, allowing them to focus on other aspects of their trading strategy.

- Vigilância Aprimorada: The indicator can provide valuable alerts, notifying traders of potential reversal points, which can be especially helpful in fast-moving markets.

- Configurações personalizáveis: The indicator often comes with adjustable settings, allowing traders to tailor it to their specific trading preferences and risk tolerance.

Limitações

- Sinais Falsos: Like any technical indicator, the Key Reversal Indicator is not foolproof and can generate false signals. It’s crucial to combine it with other forms of analysis and employ sound risk management practices.

- Indicador de atraso: As it relies on past price data, the indicator inherently has some lag. This means it may not always capture reversals in real time, potentially leading to missed or delayed entry points.

- Excesso de confiança: Solely relying on the indicator for trading decisions can be detrimental. It’s essential to develop a comprehensive trading strategy that considers various factors beyond just the indicator’s signals.

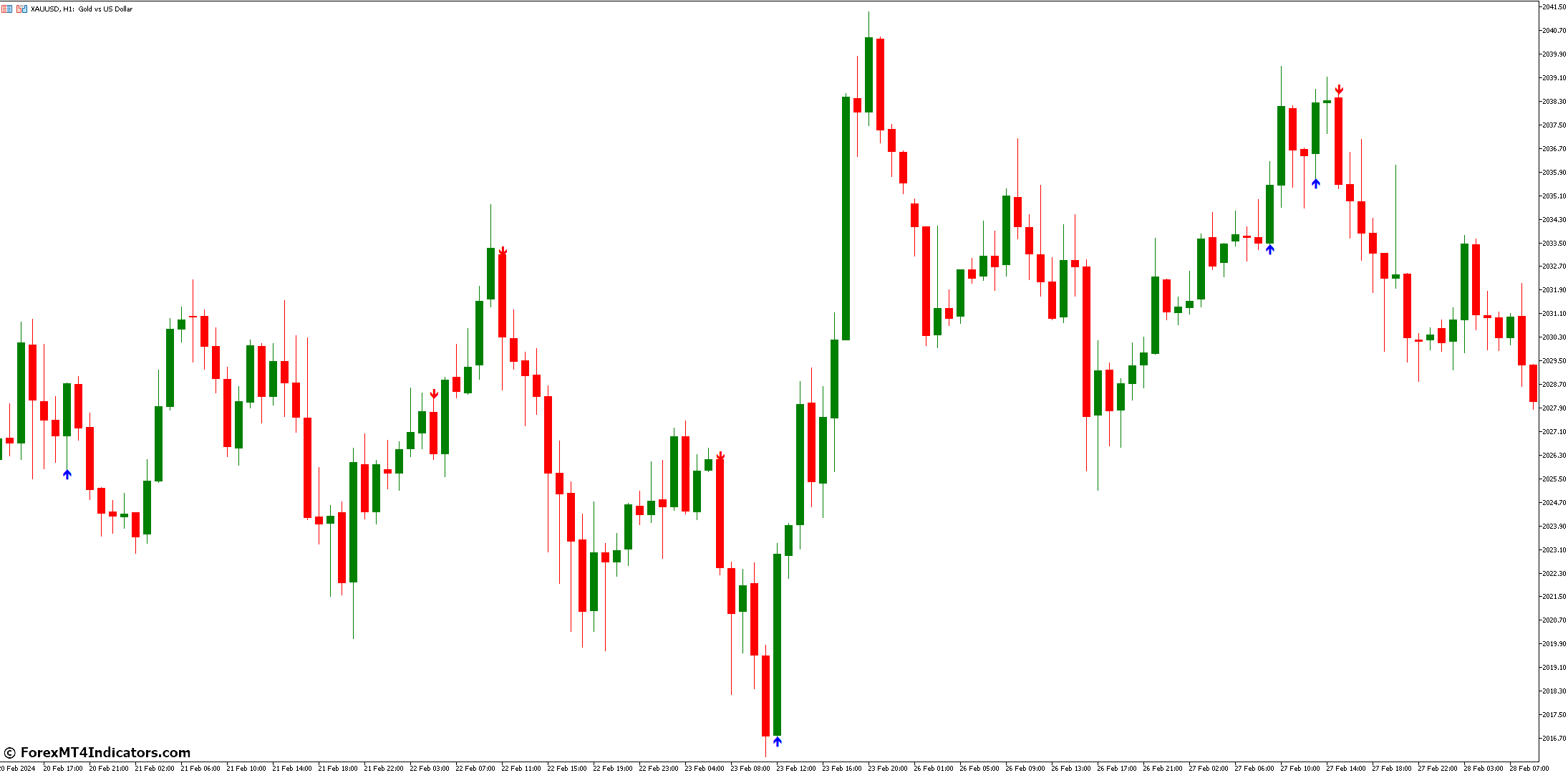

Identifying Key Reversal Patterns on MT5 Charts

Once you’ve downloaded and installed the Key Reversal Indicator on your MT5 platform, you’ll be able to visually identify these patterns on your charts. The indicator typically utilizes different shapes or colors to highlight these patterns, making them easier to spot.

Interpreting Key Reversal Signals

While the Key Reversal Indicator automates pattern identification, interpreting the signals it generates requires careful consideration and sound judgment. Here’s how to approach this process effectively:

Implementação Estratégica

Now that you’ve grasped the interpretation of Key Reversal signals, let’s delve into developing a trading strategy that leverages this indicator effectively.

Define Entry and Exit Rules

Establish clear entry and exit rules based on your risk tolerance and trading style. These rules will dictate when you enter a trade based on a Key Reversal signal and when to exit, whether in profit or to limit losses.

Combine com outras ferramentas

Don’t treat the Key Reversal Indicator as a standalone solution. Integrate it with complementary technical indicators like support and resistance levels, moving averages, or oscillators to gain a more comprehensive market picture.

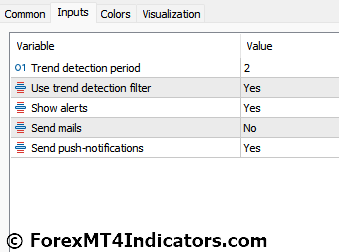

Modifying Indicator Parameters

Most Key Reversal Indicators allow adjustments to parameters like the number of candlesticks used to identify the pattern or the minimum engulfing percentage for the key candlestick. Experiment with these settings to find a configuration that aligns with your trading style and market conditions.

Combinando com outros indicadores

Explore combining the Key Reversal Indicator with other technical indicators for a multi-layered analysis. For instance, you might use the Key Reversal Indicator to identify potential entries and then use a momentum indicator like the Relative Strength Index (RSI) to assess potential exit points.

How to Trade With Key Reversal Indicator

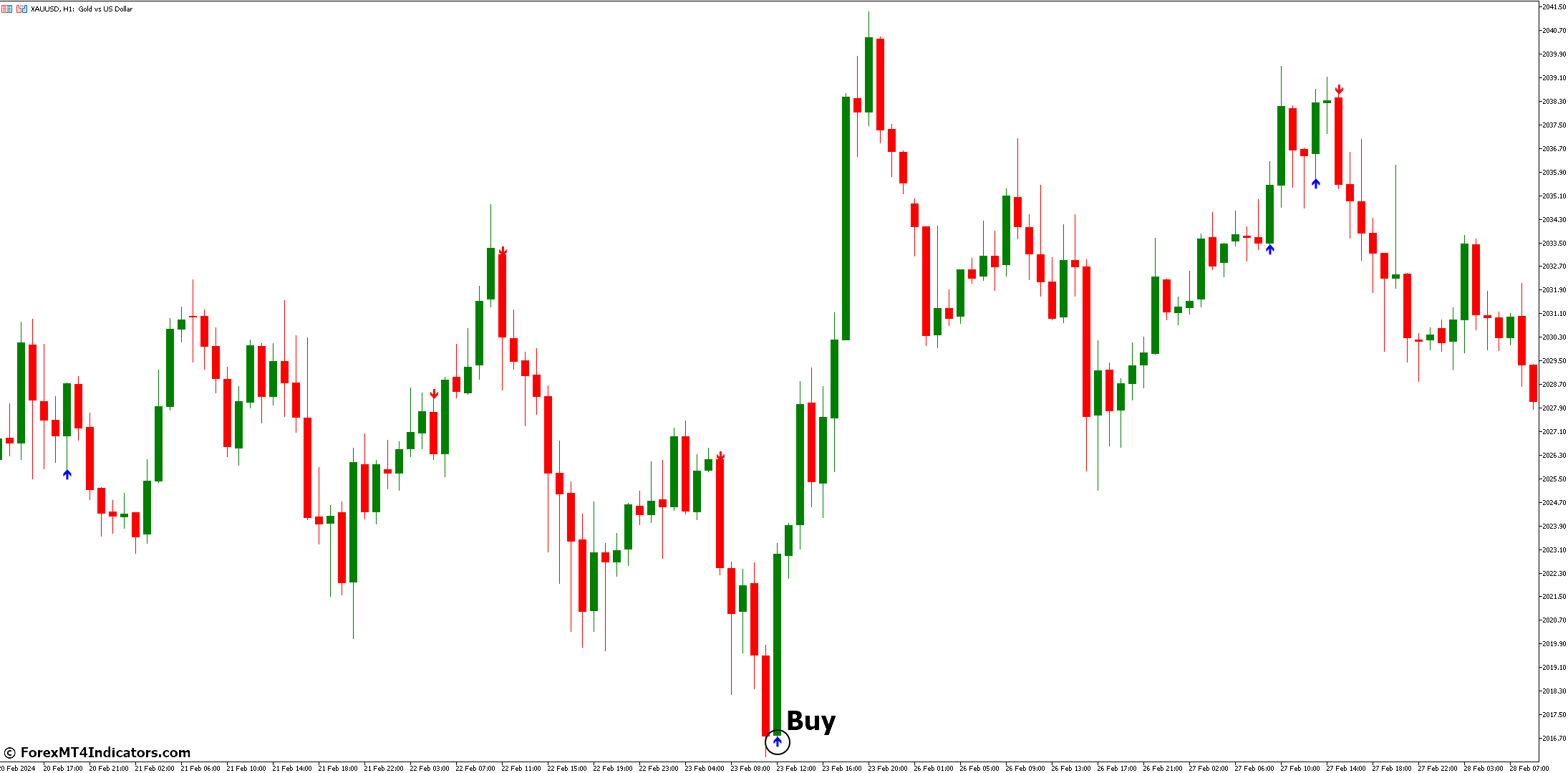

Comprar entrada

- Look for a bullish key reversal pattern following a downtrend.

- Look for supportive price action like a breakout above a resistance level or bullish candlestick patterns (e.g., engulfing bars, hammers).

- Consider using complementary indicators (e.g., moving averages, oscillators) for additional confirmation.

- Consider entering a long position (buying) after confirmation.

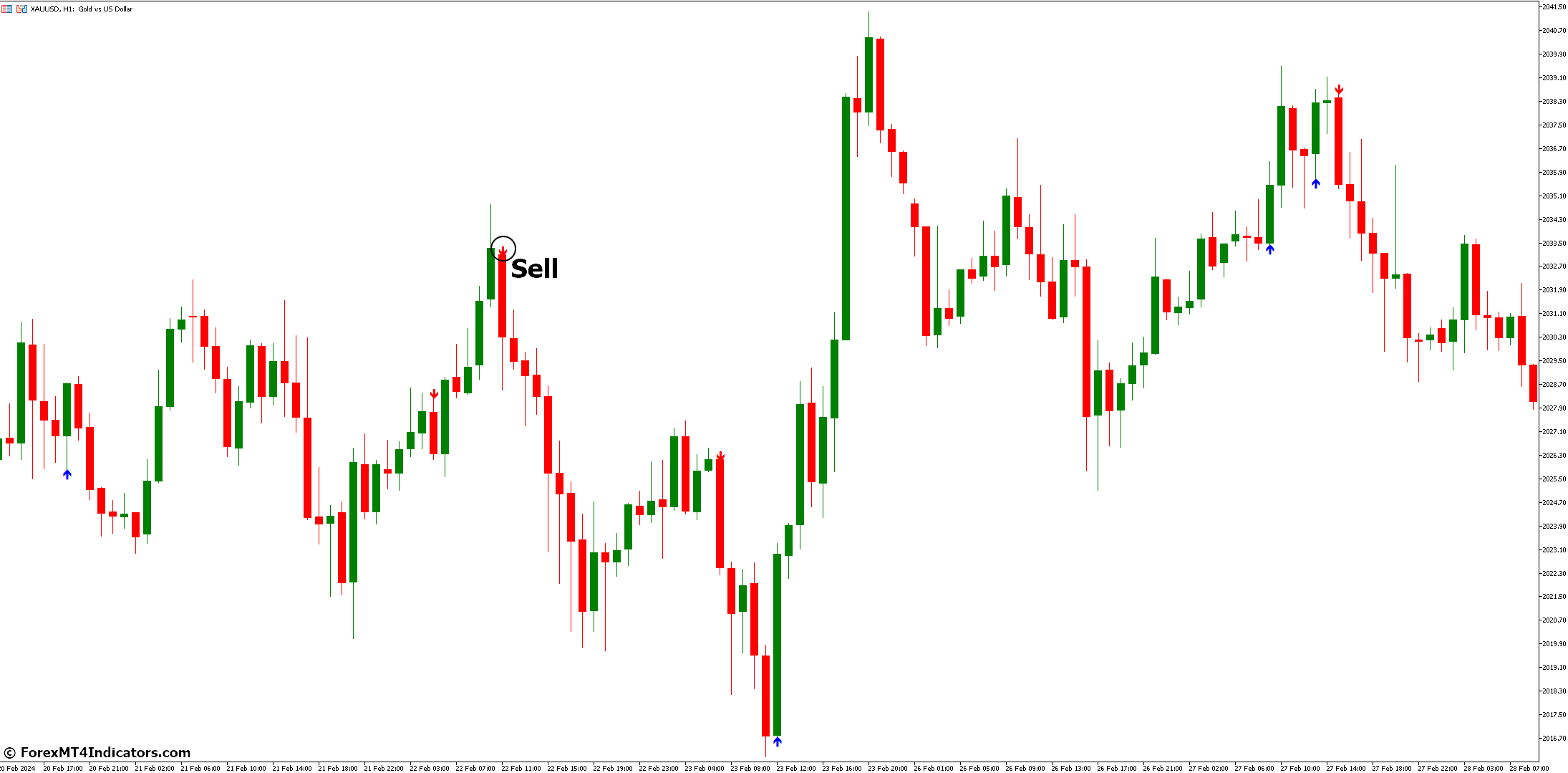

Entrada de venda

- Look for a bearish key reversal pattern following an uptrend.

- Look for supportive price action like a breakout below a support level or bearish candlestick patterns (e.g., engulfing bars, shooting stars).

- Consider using complementary indicators (e.g., moving averages, oscillators) for additional confirmation.

- Consider entering a short position (selling) after confirmation.

Stop-Loss e Take-Profit

Stop-Loss

- Place below the low of the key reversal candlestick or another logical risk management level based on your strategy and risk tolerance.

- Place above the high of the key reversal candlestick or another logical risk management level based on your strategy and risk tolerance.

Take-profit

- Define your take-profit levels before entering any trade based on your risk-reward ratio and market conditions. Potential strategies include:

- Fibonacci retracement levels are based on the preceding trend.

- Movendo crossovers médios.

- Trailing stop-loss to lock in profits as the price moves in your favor.

Key Reversal Indicator Settings

Conclusão

Key Reversal MT5 Indicator, when used judiciously and combined with sound trading practices, can be a valuable tool in your forex trading arsenal. It helps streamline pattern recognition, identify potential trend shifts, and potentially enhance your trading decision-making.

Corretores MT5 recomendados

Corretora XM

- $ 50 livre Para começar a negociar instantaneamente! (Lucro que pode ser retirado)

- Bônus de depósito até $5,000

- Programa de fidelidade ilimitado

- Corretor de Forex premiado

- Bônus Exclusivos Adicionais Ao longo do ano

>> Cadastre-se para uma conta XM Broker aqui <

Corretor FBS

- Bônus de negociação de 100: $100 grátis para iniciar sua jornada de negociação!

- 100% Bónus de Depósito: Duplique seu depósito até US$ 10,000 e negocie com capital aumentado.

- Alavancagem até 1: 3000: Maximizando os lucros potenciais com uma das opções de alavancagem mais altas disponíveis.

- Prêmio de 'Melhor Corretora de Atendimento ao Cliente da Ásia': Excelência reconhecida em suporte e atendimento ao cliente.

- Promoções sazonais: Aproveite uma variedade de bônus exclusivos e ofertas promocionais durante todo o ano.

>> Cadastre-se para obter uma conta de corretor FBS aqui <

(Download gratuito de indicadores MT5)

Clique aqui abaixo para fazer o download: