Negociações de alta qualidade e alta probabilidade – isto é o que a maioria dos traders desejaria em uma estratégia de negociação. Claro, alguns gostariam de estratégias de negociação que gerassem o maior número possível de negociações e esperam que consigam aquelas negociações de grande rendimento dentro de algum tempo. Mas para muitos traders, é muito preferível ter consistência em vez de uma curva de rendimento bastante errática.

A negociação técnica pode ser uma das formas de negociar e ganhar de forma consistente nos mercados cambiais. Isso ocorre porque a negociação técnica geralmente é baseada em regras. Como tal, os traders poderiam manter a mesma estratégia todos os dias, semana após semana, e ser consistentes com o que estão a negociar. Essa consistência permite que a regra dos grandes números jogue a seu favor.

A chave para ter sucesso na negociação técnica é utilizar as ferramentas certas, que são os indicadores técnicos. Os indicadores técnicos não são criados iguais. Alguns são simplesmente melhores que os outros. Alguns produzem bons resultados, enquanto outros não. A Estratégia de Negociação Forex Ichimoku Cloud Pux CCI utiliza indicadores técnicos de alta probabilidade que comprovadamente funcionam ao longo do tempo.

Ichimoku Kinko Hyo ou Nuvem Ichimoku

O indicador Ichimoku Cloud é um dos indicadores que obteve grande sucesso, mesmo como indicador independente. Na verdade, quando testado novamente, o indicador Ichimoku Cloud mostra ser um dos indicadores independentes com melhor desempenho entre muitos indicadores.

O indicador Ichimoku Cloud é um indicador de tendência traçado no gráfico de preços. Utiliza múltiplas linhas baseadas em medianas e médias móveis, que são modificadas. Essas linhas medianas e médias móveis representam uma certa tendência.

O Tenkan-sen ou Linha de Conversão é um indicador de tendência de curto prazo, que se baseia na mediana de uma máxima e uma mínima de 9 períodos. O Kijun-sen ou Linha Base é um indicador de tendência de médio prazo calculado como a mediana dos últimos 26 períodos. Essas duas linhas são frequentemente usadas como um sinal de reversão de tendência com base no cruzamento uma da outra.

O Senkou Span A (Leading Span A) é uma média do Tenkan-sen (Linha de Conversão) e do Kijun-sen (Linha de Base). Esta linha representa uma tendência mais lenta a médio prazo. O Senkou Span B (Leading Span B) é uma linha mediana dos últimos 52 períodos. Estas duas linhas formam o Kumo (Nuvem). O Kumo representa a tendência de longo prazo, que se baseia na forma como os Senkou Spa A e B são empilhados. Os traders costumam usar isso como um filtro de direção comercial. Contudo, o cruzamento das duas linhas também indica uma inversão da tendência de longo prazo.

O período de Chikou ou Lagging Span é basicamente a ação do preço deslocada para a esquerda. É uma linha traçada com base no fechamento de cada vela e é deslocada 26 períodos antes da vela atual. Isso geralmente é usado para determinar se o mercado está instável ou não. Os comerciantes consideram o mercado instável se o Chikou Span estiver tocando a ação dos preços, uma vez que os mercados com tendências fortes muitas vezes fariam com que o Chikou Span ficasse muito atrás da ação dos preços.

Pux CCI

O Pux CCI é uma versão modificada do popular Commodity Channel Index (CCI). É um indicador de impulso representado graficamente como um oscilador. Ele desenha histogramas e linhas para indicar a direção da tendência e os movimentos de ação do preço sombra.

A linha do ouro é uma linha de movimento rápido que tenta o movimento da ação do preço sombra e é representativa de uma tendência de muito curto prazo. Esta linha se sai muito bem ao acompanhar a ação do preço, no entanto, muitas vezes cria sinais falsos se usada como um indicador independente. É melhor utilizar este indicador apenas se estiver em confluência com os histogramas deste indicador, que é o seu indicador de tendência de médio a longo prazo.

Os histogramas representam o indicador de médio a longo prazo. É plotado como um oscilador ilimitado que se move em torno de sua linha média, zero. Histogramas positivos indicam uma tendência de alta do mercado, enquanto os histogramas negativos indicam uma tendência de baixa do mercado. No entanto, nem todas as barras positivas ou negativas são indicativas de uma tendência forte. Os mercados sem tendência têm histogramas pintados de azul, enquanto os mercados com tendências de alta têm histogramas verdes e os mercados com tendências de baixa têm histogramas vermelhos.

Os traders poderiam usar o cruzamento dos histogramas de positivo para negativo ou vice-versa como sinal. Os traders conservadores, entretanto, preferem usar a mudança das cores para verde ou vermelho como um sinal de entrada de maior probabilidade.

Estratégia de Negociação

Esta estratégia de negociação é baseada em dois indicadores de tendência e impulso de alta probabilidade, que são o indicador Ichimoku Kinko Hyo e o Pux CCI. Os sinais de negociação são gerados quando há confluências com base nos dois indicadores.

No indicador Nuvem Ichimoku, a direção comercial do cruzamento Kumo e do cruzamento Tenkan-sen e Kijun-sen deve estar em confluência.

O Pux CCI, por outro lado, também deve estar em confluência com o indicador Ichimoku Cloud. No entanto, os sinais de negociação são confirmados apenas quando as barras do histograma estão verdes ou vermelhas, o que indica uma tendência de alta ou de baixa do mercado.

Indicadores:

- Ichimoku

- PUX_CCI

Prazo: preferencialmente gráficos de 1 hora, 4 horas e diários

Pares de moedas: de preferência pares maiores e menores

Sessão de negociação: Sessões em Tóquio, Londres e Nova York

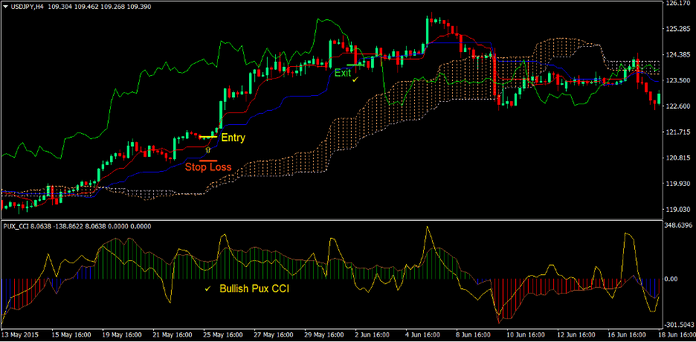

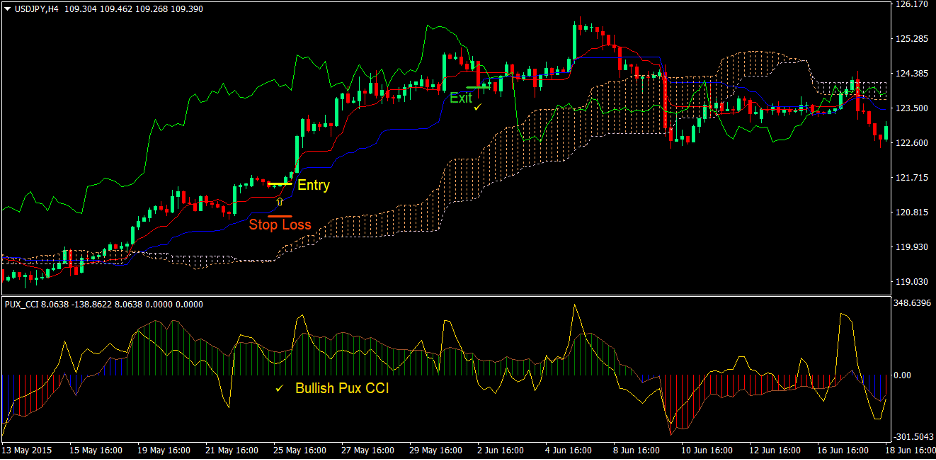

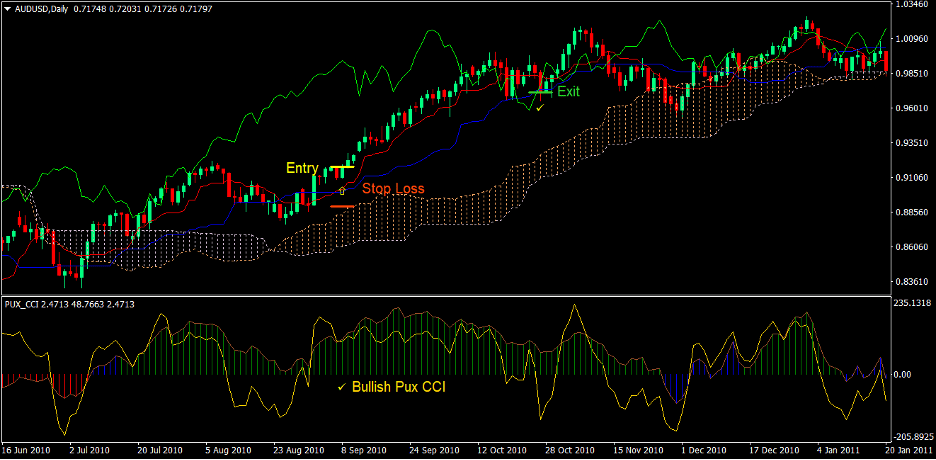

Comprar configuração comercial

entrada

- O indicador Pux CCI deve imprimir histogramas verdes indicando uma tendência de alta

- O Kumo deve ter o Leading Span A acima do Leading Span B, indicando uma tendência de alta de longo prazo

- O Tenkan-sen deve cruzar acima do Kijun-sen indicando uma tendência de alta

- Entre em uma negociação de compra na confluência das condições acima

Stop Loss

- Defina o stop loss no nível de suporte abaixo da entrada

saída

- Feche a negociação assim que o preço fechar abaixo do Kijun-sen

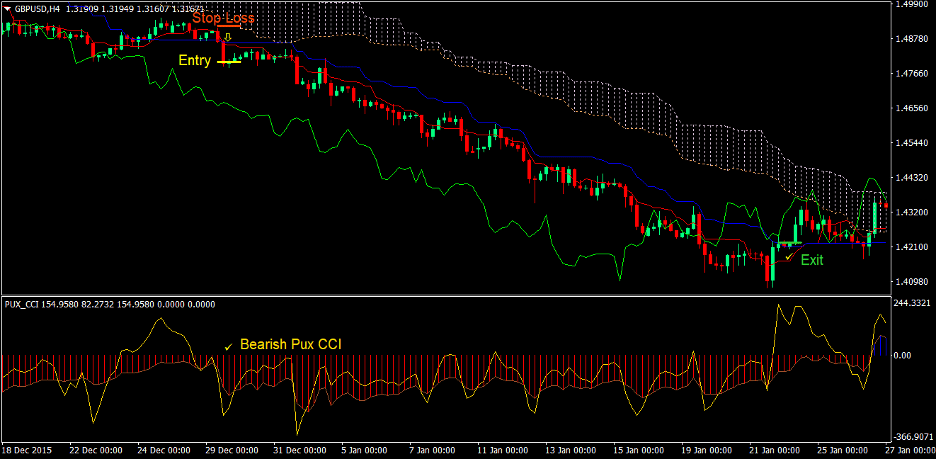

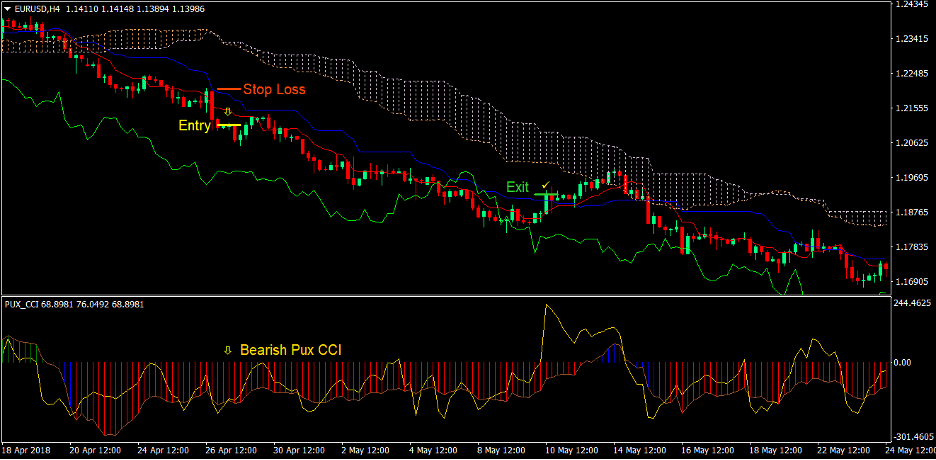

Configuração de venda de comércio

entrada

- O indicador Pux CCI deve imprimir histogramas vermelhos indicando uma tendência de baixa

- O Kumo deve ter o Leading Span A abaixo do Leading Span B, indicando uma tendência de baixa de longo prazo

- O Tenkan-sen deve cruzar abaixo do Kijun-sen indicando uma tendência de baixa

- Entre em uma negociação de venda na confluência das condições acima

Stop Loss

- Defina o stop loss no nível de resistência acima da entrada

saída

- Feche a negociação assim que o preço fechar acima do Kijun-sen

Conclusão

A Estratégia de Negociação Forex Ichimoku Cloud Pux CCI é uma estratégia baseada na confluência de dois indicadores de tendência de alta probabilidade, o Ichimoku Kinko Hyo e o Pux CCI.

Estas configurações de negociação fornecem sinais de entrada que alinham as tendências de curto, médio e longo prazo, permitindo que os traders entrem numa negociação de alta probabilidade. Haverá momentos em que a entrada na negociação será um pouco mais tarde, no entanto, esta é a compensação para que possamos ter uma direção de tendência confirmada ao longo do horizonte. Isso, por sua vez, resulta em negociações de maior probabilidade. Os retornos em relação ao risco por negociação podem não ser tão elevados, mas ganhamos com mais frequência do que outras estratégias de negociação.

Corretores MT4 recomendados

Corretora XM

- $ 50 livre Para começar a negociar instantaneamente! (Lucro que pode ser retirado)

- Bônus de depósito até $5,000

- Programa de fidelidade ilimitado

- Corretor de Forex premiado

- Bônus Exclusivos Adicionais Ao longo do ano

>> Cadastre-se para uma conta XM Broker aqui <

Corretor FBS

- Bônus de negociação de 100: $100 grátis para iniciar sua jornada de negociação!

- 100% Bónus de Depósito: Duplique seu depósito até US$ 10,000 e negocie com capital aumentado.

- Alavancagem até 1: 3000: Maximizando os lucros potenciais com uma das opções de alavancagem mais altas disponíveis.

- Prêmio de 'Melhor Corretora de Atendimento ao Cliente da Ásia': Excelência reconhecida em suporte e atendimento ao cliente.

- Promoções sazonais: Aproveite uma variedade de bônus exclusivos e ofertas promocionais durante todo o ano.

>> Cadastre-se para obter uma conta de corretor FBS aqui <

Clique aqui abaixo para fazer o download: