Większość traderów woli handlować w kierunku ustalonego trendu. Często próbowali określić kierunek panującego trendu i w sposób dyskryminujący handlowali wyłącznie w kierunku tego trendu. Ten rodzaj strategii handlowej nazywany jest strategią podążania za trendem. Większość traderów preferuje ten styl, ponieważ oznacza to, że handlują zgodnie z ruchem rynku, a nie przeciwko niemu.

Są jednak inni inwestorzy, którzy wolą handlować tylko wtedy, gdy rynek się odwraca i tworzy nowy trend. Dlatego zamieniliby strategię handlową, która powinna pomóc im zidentyfikować możliwe odwrócenie trendu. Handel w ten sposób jest często uważany za ryzykowny, ponieważ oznacza, że handlujesz wbrew dotychczasowemu przepływowi na rynku i często nowy kierunek trendu rynkowego nie jest jeszcze jasno ustalony. Jednakże pozwala również inwestorom maksymalizować swoje zyski podczas handlu w ten sposób. Dzieje się tak dlatego, że często handlują na początku trendu i wychodzą na końcu trendu.

Strategie crossover to jedne z najpowszechniejszych typów strategii odwracania trendu. Jest to prosta metoda odwrócenia trendu w handlu oparta na przecięciu linii średniej ruchomej. Jednak pomimo swojej prostoty, wielu traderów nadal nie radzi sobie z handlem strategiami crossover. Dzieje się tak zazwyczaj dlatego, że ślepo podążają za strategiami crossover, nie biorąc pod uwagę cech i zachowań aktualnej sytuacji rynkowej.

Strategia handlowa TMA Momentum Cross Forex pomaga inwestorom identyfikować i potwierdzać prawdopodobne odwrócenie trendów w oparciu o zestaw zasad wykorzystujących wysoce wiarygodne wskaźniki techniczne. Uwzględnia także zachowanie akcji cenowej, a także same świeczniki.

Trzy kolory MA

Three Color MA to niestandardowy wskaźnik techniczny oparty na średnich kroczących.

Średnie kroczące mają dwie wspólne wady. Jednym z nich jest to, że większość średnich kroczących jest opóźniona. Oznacza to, że większość średnich kroczących reaguje bardzo późno na zmiany cen. Na drugim końcu spektrum znajdują się średnie kroczące, które poruszają się zbyt nieregularnie. Te średnie kroczące mają tendencję do poruszania się nawet przy najmniejszych wahaniach ceny.

Three Color MA to zmodyfikowana średnia ruchoma, która wygładza linię średniej ruchomej, czyniąc ją mniej podatną na fałszywe sygnały obecne na niestabilnych rynkach, a jednocześnie czyniąc ją bardziej wrażliwą na ostatnie zmiany cen.

Zmienia się także linia wykreślana przez wskaźnik Thee Color MA. Dzięki temu inwestorzy łatwiej identyfikują cykle rynkowe.

Nachylenie TMA

TMA Slope to kolejny niestandardowy wskaźnik techniczny opracowany w oparciu o średnie kroczące. Jest to również wskaźnik typu oscylatora, który wyświetla słupki i kropki w oddzielnym oknie.

Wskaźnik nachylenia TMA jest obliczany poprzez identyfikację nachylenia linii triangulowanej średniej kroczącej (TMA). Opiera się to na różnicy pomiędzy szybko poruszającą się linią TMA a wolniej poruszającą się linią TMA. Następnie wskaźnik wykreśla różnicę w oddzielnym oknie w postaci słupków histogramu. Dodatnie zielone słupki wskazują bycze nastawienie trendu, podczas gdy ujemne słupki koralowe wskazują na niedźwiedzie nastawienie trendu.

Wskaźnik kreśli także kropki dołączone do słupków histogramu. Rysuje kropki w kolorze wodnym, aby wskazać dynamikę zwyżkową, a czerwone kropki, aby wskazać dynamikę niedźwiedzią. Pozytywne kropki wodne wskazują na wzmacniający się trend zwyżkowy, natomiast dodatnie czerwone kropki wskazują na słabnący trend spadkowy. Z drugiej strony ujemne czerwone kropki wskazują na wzmacniający się trend spadkowy, podczas gdy ujemne kropki w kolorze wodnym wskazują na słabnący trend niedźwiedzi.

Strategia Trading

Ta strategia handlowa jest strategią handlu typu crossover, która wykorzystuje 30-okresową wykładniczą linię średniej kroczącej (EMA) i linię Three Color MA jako podstawę dla swojego sygnału handlowego typu crossover.

Jednakże, zamiast handlować każdym sygnałem, na który możemy się natknąć, będziemy filtrować transakcje w oparciu o zbieżność skrzyżowania i wskaźnika TMA Slope. Przecięcie linii 30 EMA i linii Three Color MA powinno pokrywać się z kierunkiem trendu wskazywanym przez wskaźnik TMA Slope.

Następnie powinniśmy zidentyfikować konfiguracje transakcji o wysokim prawdopodobieństwie w oparciu o charakterystykę akcji cenowej. Zamiast zawierać transakcję zaraz po przecięciu dwóch linii, poczekamy, aż cena cofnie się w stronę obszaru linii średniej ruchomej. Następnie należy poczekać, aż świeca pędu przesunie się w kierunku trendu, wskazując, że cena z większym prawdopodobieństwem będzie podążać w kierunku rozwijającego się nowego trendu.

Wskaźniki:

- Trzy_Kolor_MA

- 30 MATKA

- Tma_slope_nrp_alerts

Preferowane ramy czasowe: Wykresy 30-minutowe, 1-godzinne, 4-godzinne i dzienne

Pary walutowe: Główne, drugorzędne i krzyżowe waluty

Sesje handlowe: Sesje w Tokio, Londynie i Nowym Jorku

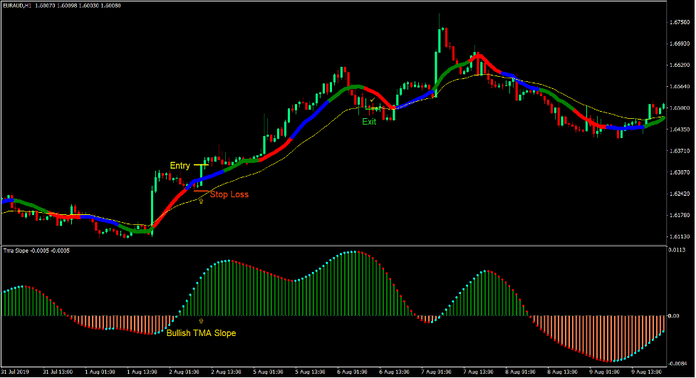

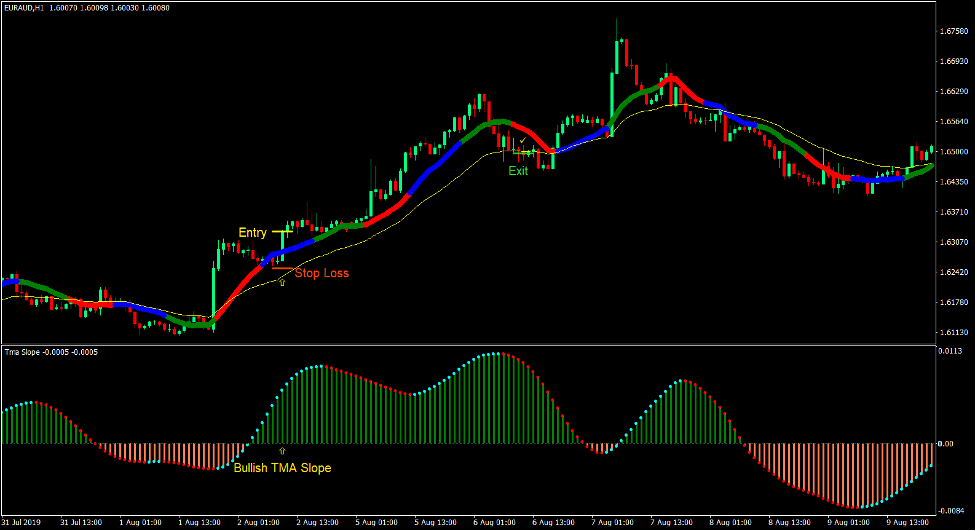

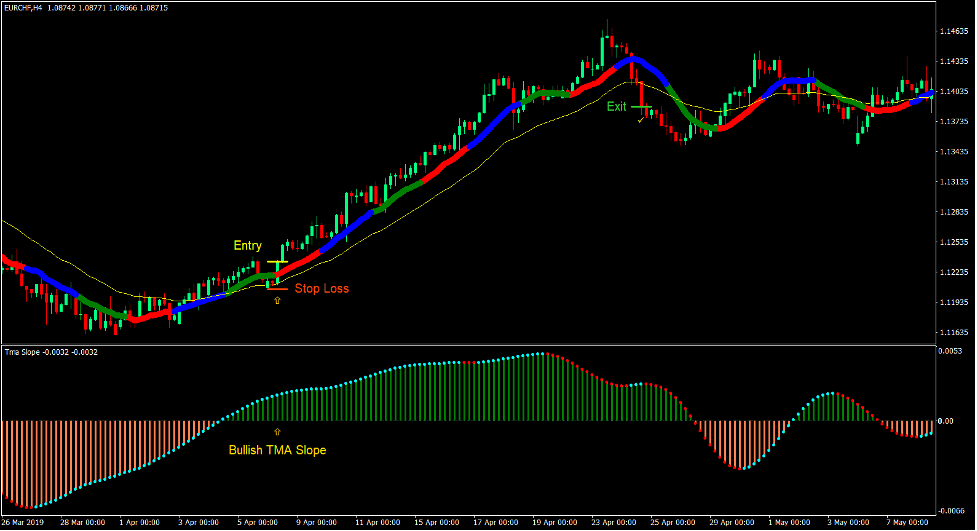

Kup Trade Setup

Wejście

- Akcja cenowa powinna przekroczyć linię 30 EMA i linię Three Color MA.

- Linia nachylenia TMA powinna stać się dodatnia.

- Linia Three Color MA powinna przecinać się powyżej linii 30 EMA.

- Akcja cenowa powinna powrócić w kierunku linii średniej ruchomej.

- Powinna powstać świeca zwyżkowego pędu, ponieważ akcja cenowa odrzuca obszar linii średniej ruchomej.

- Wpisz zlecenie kupna na potwierdzeniu tych warunków.

stop Loss

- Ustaw stop loss na wsparciu poniżej świecy wejściowej.

Wyjście

- Zamknij transakcję, gdy tylko cena zamknie się poniżej linii 30 EMA.

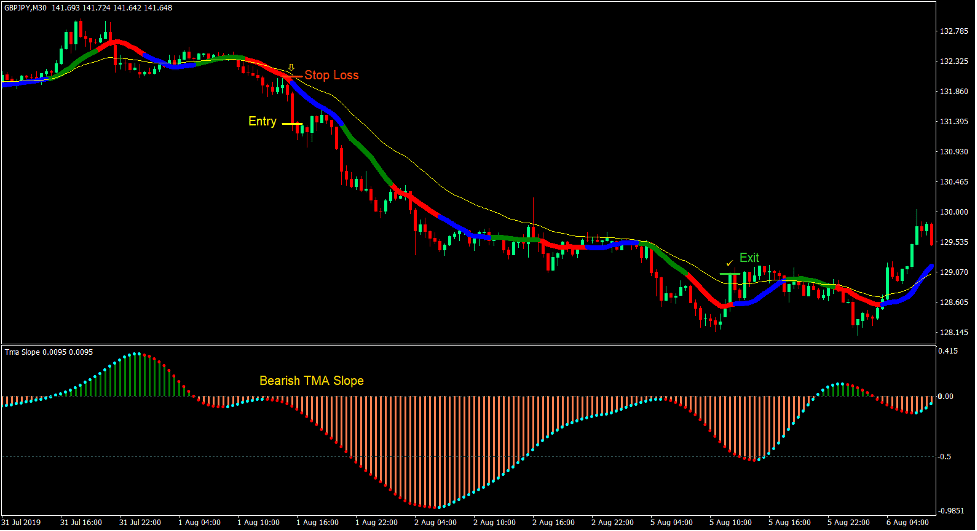

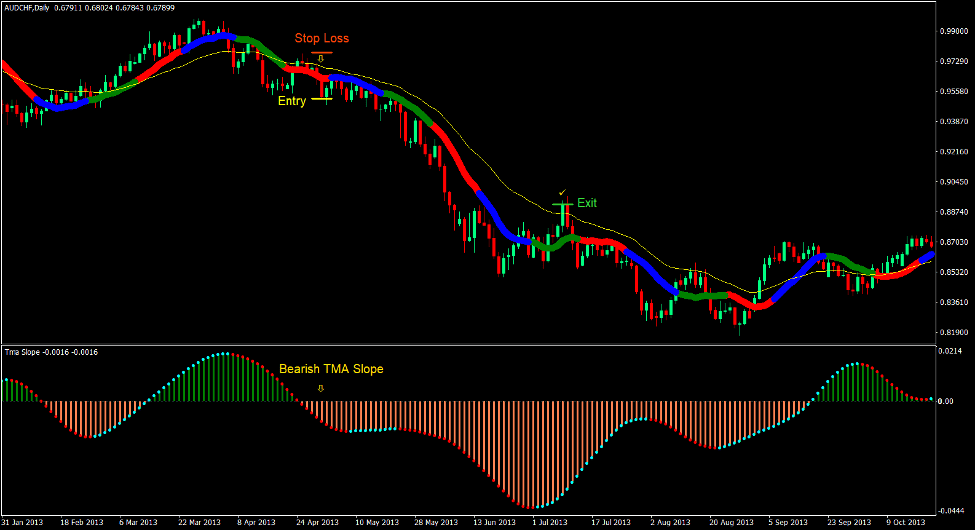

Sell Trade Setup

Wejście

- Akcja cenowa powinna przekroczyć linię 30 EMA i linię Three Color MA.

- Linia nachylenia TMA powinna stać się ujemna.

- Linia Three Color MA powinna przecinać się poniżej linii 30 EMA.

- Akcja cenowa powinna powrócić w kierunku linii średniej ruchomej.

- Powinna powstać świeca niedźwiedziego pędu, ponieważ akcja cenowa odrzuca obszar linii średniej ruchomej.

- Wprowadź zlecenie sprzedaży na potwierdzeniu tych warunków.

stop Loss

- Ustaw stop loss na oporze powyżej świecy wejściowej.

Wyjście

- Zamknij transakcję, gdy tylko cena zamknie się powyżej linii 30 EMA.

Wnioski

Strategia ta wykorzystuje kilka koncepcji, których traderzy używają do identyfikowania odwrócenia trendów. Pierwszym z nich jest przecięcie linii średniej ruchomej. Następnie akcja cenowa, która jest identyfikowana na podstawie tego, jak akcja cenowa ma tendencję do tworzenia wyższych szczytów w trendzie wzrostowym i niższych minimów w trendzie spadkowym. To idzie w parze z akcją cenową odrzucającą obszar linii średniej ruchomej. Wreszcie nachylenie linii średniej ruchomej. Wskaźnik nachylenia TMA po prostu pomaga nam obiektywnie zidentyfikować nachylenie linii średniej ruchomej.

Łącząc wszystkie trzy koncepcje, otrzymujemy konfiguracje transakcji o większym prawdopodobieństwie. Jeśli zostaną użyte w odpowiednich warunkach rynkowych, te konfiguracje handlowe będą miały tendencję do dawania pozytywnych wyników.

Polecani brokerzy MT4

Broker XM

- $ Darmowe 50 Aby natychmiast rozpocząć handel! (Zysk możliwy do wypłaty)

- Bonus depozytowy do $5,000

- Nieograniczony program lojalnościowy

- Nagradzany broker Forex

- Dodatkowe ekskluzywne bonusy Przez rok

>> Zarejestruj się tutaj, aby założyć konto brokera XM <

Broker FBS

- Wymień 100 bonusów: Darmowe 100 $ na rozpoczęcie Twojej podróży handlowej!

- % 100 Bonus: Podwój swój depozyt do 10,000 XNUMX $ i handluj ze zwiększonym kapitałem.

- Wykorzystaj 1: 3000: Maksymalizacja potencjalnych zysków dzięki jednej z najwyższych dostępnych opcji dźwigni.

- Nagroda „Najlepszy broker obsługi klienta w Azji”.: Uznana doskonałość w obsłudze klienta i obsłudze.

- Promocje sezonowe: Korzystaj z różnorodnych ekskluzywnych bonusów i ofert promocyjnych przez cały rok.

>> Zarejestruj się tutaj, aby założyć konto brokera FBS <

Kliknij tutaj, aby pobrać: