Trader musi być w stanie przewidzieć kierunek zmian cen, aby zarobić pieniądze na rynku. Traderzy mogą nie zawsze mieć rację, ale powinni być w stanie odnieść wystarczającą liczbę zwycięstw, aby pokryć straty i zarobić na rynku. Ale w jaki sposób inwestorzy przewidują kierunek cen?

Istnieje wiele sposobów przewidywania zmian cen. Niektórzy inwestorzy handlują strategiami dynamiki i kontynuacji trendu. Inni handlują oznaczają odwrócenie sytuacji w oparciu o warunki rynkowe wykupienia i wyprzedania. Niektóre odwrócenia trendów handlowych poprzez wzorce, wskaźniki lub skrzyżowanie średnich kroczących. Istnieje wiele sposobów zyskownego handlu na rynku. Istnieje jednak również sposób na łatwe przewidywanie ruchów na rynku, zwiększając jednocześnie dokładność inwestora. Dzieje się tak za pomocą wskaźników technicznych.

Wskaźniki techniczne pomagają inwestorom w procesie handlowym, dając im jaśniejszy obraz tego, co robi rynek. Pozwala to inwestorom przewidywać następny ruch na rynku z większą dokładnością.

Strategia handlowa DEMA Gator Trend to strategia wykorzystująca wskaźniki techniczne o wysokim prawdopodobieństwie, co pozwala im na bardziej spójne czerpanie zysków z rynku.

Podwójna wykładnicza średnia ruchoma

Podwójna wykładnicza średnia ruchoma (DEMA) to zmodyfikowany wskaźnik średniej ruchomej wprowadzony przez Patricka Mulloya w jego artykule „Smoothing Data with Faster Moving Averages”.

DEMA jest wyjątkowa w porównaniu ze zwykłymi średnimi kroczącymi, ponieważ ma tendencję do lepszego zmniejszania opóźnień, co jest słabością większości średnich kroczących. Usuwa opóźnienia, wykorzystując wiele wykładniczych średnich kroczących (EMA), co czyni go bardziej wartościowym jako wskaźnik średniej ruchomej.

Średnia krocząca o zmniejszonym opóźnieniu

Średnia krocząca o zmniejszonym opóźnieniu to kolejna zmodyfikowana średnia krocząca, która próbuje zminimalizować opóźnienie. Nie jest jasne, w jaki sposób ta średnia ruchoma to robi, ale zwykle działa. Wizualnie można zauważyć, że ta średnia ruchoma ma tendencję do znacznie bliższego przylegania do akcji cenowej w porównaniu do innych średnich kroczących.

Oscylator Gator

Gator Oscillator to wskaźnik oscylacyjny opracowany przez jednego z najpopularniejszych traderów Billa Williamsa. Wskaźnik ten jest częścią zestawu wskaźników, których używa w swojej strategii handlowej.

Gator Oscillator to unikalny rodzaj wskaźnika handlowego, ponieważ jest w stanie zmierzyć siłę trendu. Robi to poprzez wydrukowanie pionowych linii we własnym oknie, które zmienia kolory za każdym razem, gdy wykryje zmianę siły trendu.

Wskaźnik ten proponuje cztery fazy rynku: sen, przebudzenie, jedzenie i sytość. Początkowa faza rynku, czyli faza uśpienia, przypada na okres, w którym trend rynkowy jest jeszcze słaby. Wskaźnik pokazuje to poprzez wydrukowanie ciągłej czerwonej linii. Następnie, gdy rynek zaczyna się budzić, linia zostaje podzielona na dwa kolory, czerwony i zielony. Po fazie przebudzenia następuje faza jedzenia. W tej fazie rynek wykazuje tendencję do silnego trendu lub potwierdza początek trendu. W tej fazie wskaźnik zaczyna drukować ciągłą zieloną linię. Wreszcie, po fazie jedzenia, następuje faza sytości. Jest to faza, w której trend zaczyna się ochładzać. Jest to oznaczone linią w kolorze czerwonym i zielonym.

Strategia Trading

Strategia ta jest strategią krzyżową, która wykorzystuje wskaźniki DEMA i zmniejszona średnia krocząca. Te wskaźniki, które są bardziej responsywne w porównaniu do większości średnich kroczących, umożliwiają inwestorom wejście na rynek, gdy trend zaczyna się odwracać. Punkty wejścia są również odrobinę wcześniejsze w porównaniu do innych strategii crossover, które wykorzystują opóźnioną średnią ruchomą.

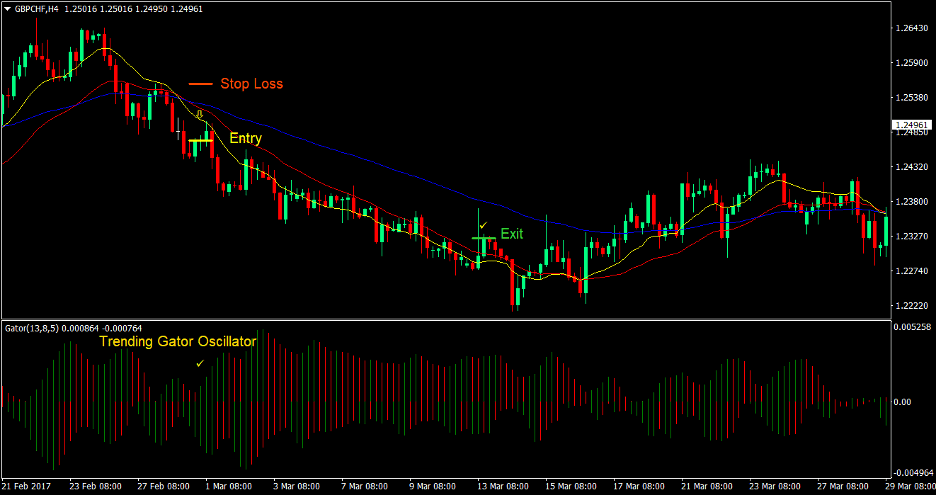

Ta strategia krzyżowania składa się z trzech linii, średnioterminowej (czerwonej) i długoterminowej (niebieskiej) średniej ruchomej średniej kroczącej o zmniejszonym opóźnieniu oraz krótkoterminowej (żółtej) średniej kroczącej wskaźnika DEMA. Sygnał wejścia zostaje potwierdzony dopiero wtedy, gdy krótkoterminowa średnia krocząca przekroczy zarówno średnioterminową, jak i długoterminową średnią kroczącą.

Sygnały wejściowe powinny również pokrywać się z fazą jedzenia oscylatora Gator, co jest oznaczone ciągłą zieloną linią.

Wskaźniki:

- zredukowana lagma

- MA_Okres: 60

- MA_Próbkowanie_Period: 45

- DEMA

- OKRES: 28

- Oscylator Gator

Ramy czasowe: Wykresy 1-godzinne i 4-godzinne

Pary walutowe: pary główne i drugorzędne

Sesja handlowa: Sesje w Tokio, Londynie i Nowym Jorku

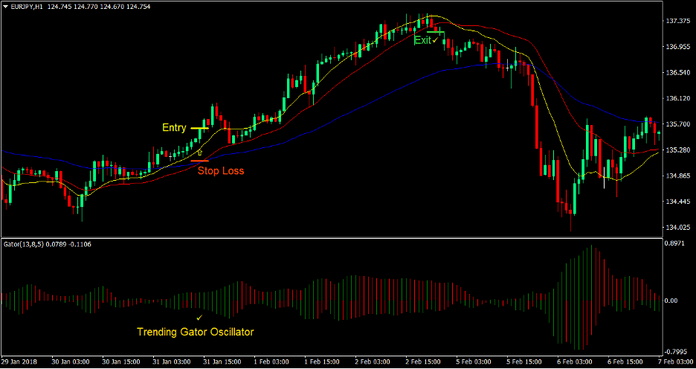

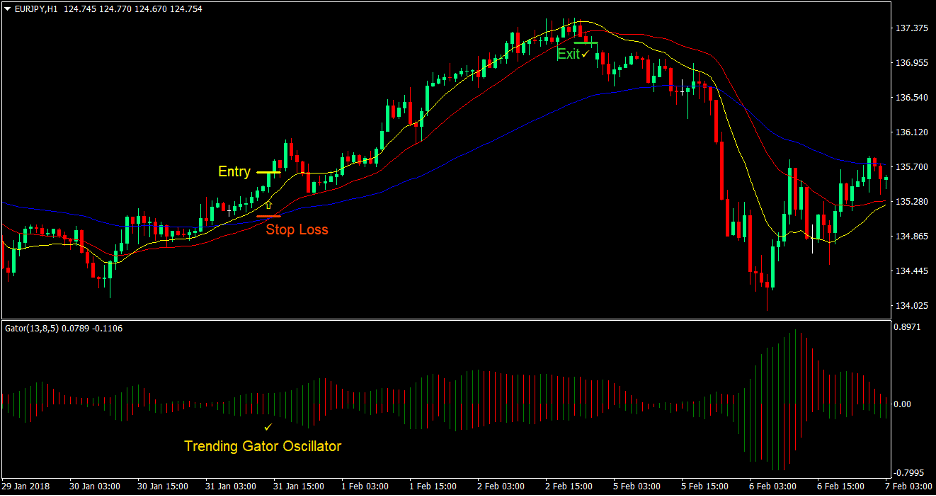

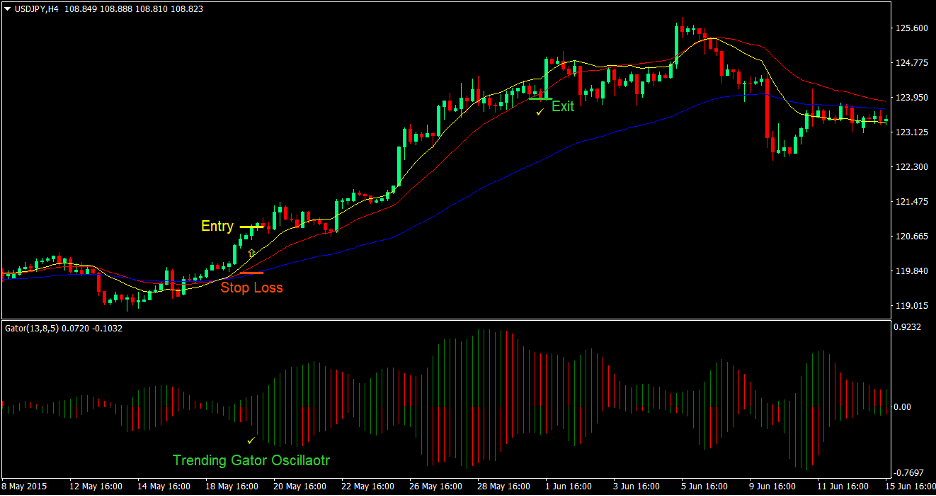

Kup Trade Setup

Wejście

- Krótkoterminowa (żółta) średnia krocząca wskaźnika DEMA powinna przekroczyć średnioterminową (czerwoną) i długoterminową (niebieską) średnią kroczącą wskaźnika zmniejszonego opóźnienia

- Oscylator Gator powinien drukować ciągłą zieloną linię wskazującą fazę jedzenia na rynku

- Wprowadź zlecenie kupna po zbiegu powyższych warunków

stop Loss

- Ustaw stop loss na poziomie wsparcia poniżej świecy wejściowej

Wyjście

- Zamknij transakcję, gdy tylko cena zamknie się poniżej czerwonej linii średniej ruchomej

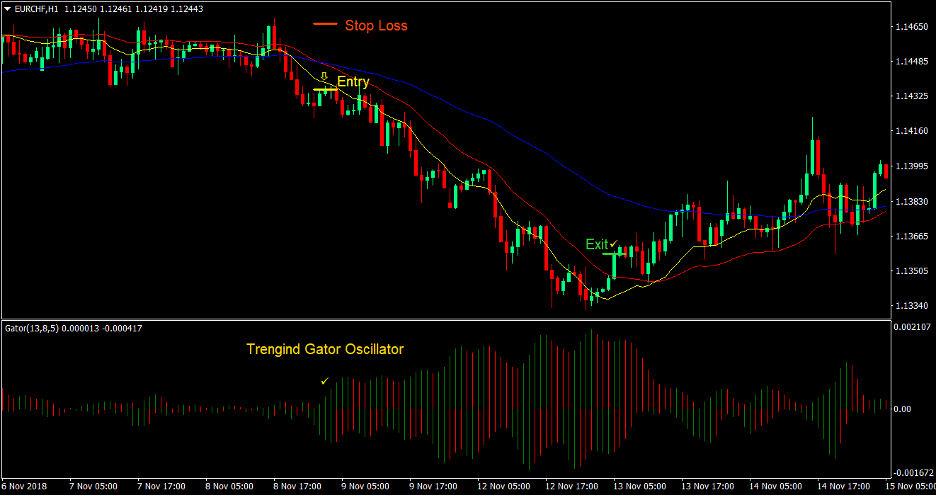

Sell Trade Setup

Wejście

- Krótkoterminowa (żółta) średnia krocząca wskaźnika DEMA powinna przekroczyć średnioterminową (czerwoną) i długoterminową (niebieską) średnią kroczącą wskaźnika zmniejszonego opóźnienia

- Oscylator Gator powinien drukować ciągłą zieloną linię wskazującą fazę jedzenia na rynku

- Wprowadź zlecenie sprzedaży po zbiegu powyższych warunków

stop Loss

- Ustaw stop loss na poziomie oporu powyżej świecy wejściowej

Wyjście

- Zamknij transakcję, gdy tylko cena zamknie się powyżej czerwonej linii średniej ruchomej

Wnioski

Ta strategia handlowa jest działającą strategią crossover, która pozwala inwestorom osiągać zyski z rynku w fazach silnego trendu rynkowego.

Strategia ta pozwala inwestorom wejść na rynek we właściwym czasie dzięki połączeniu wiodących wskaźników średniej ruchomej, które zmniejszają opóźnienia, oraz potwierdzeniu fazy jedzenia rynku za pomocą oscylatora Gator. Korzystając z kombinacji tych wskaźników, możemy wejść na rynek nieco wcześniej, zapewniając jednocześnie wejście na rynek po potwierdzeniu siły trendu.

Polecani brokerzy MT4

Broker XM

- $ Darmowe 50 Aby natychmiast rozpocząć handel! (Zysk możliwy do wypłaty)

- Bonus depozytowy do $5,000

- Nieograniczony program lojalnościowy

- Nagradzany broker Forex

- Dodatkowe ekskluzywne bonusy Przez rok

>> Zarejestruj się tutaj, aby założyć konto brokera XM <

Broker FBS

- Wymień 100 bonusów: Darmowe 100 $ na rozpoczęcie Twojej podróży handlowej!

- % 100 Bonus: Podwój swój depozyt do 10,000 XNUMX $ i handluj ze zwiększonym kapitałem.

- Wykorzystaj 1: 3000: Maksymalizacja potencjalnych zysków dzięki jednej z najwyższych dostępnych opcji dźwigni.

- Nagroda „Najlepszy broker obsługi klienta w Azji”.: Uznana doskonałość w obsłudze klienta i obsłudze.

- Promocje sezonowe: Korzystaj z różnorodnych ekskluzywnych bonusów i ofert promocyjnych przez cały rok.

>> Zarejestruj się tutaj, aby założyć konto brokera FBS <

Kliknij tutaj, aby pobrać: