Handel na rynkach opiera się na sentymentach. Jest to opowieść o ludzkiej naturze i psychologii tłumu. Niezależnie od tego, czy chodzi o handel akcjami, złotem, ropą, towarami, kryptowalutami czy forex. Zawsze będą tacy, którzy są optymistami co do określonego towaru i tacy, którzy są wobec niego pesymistyczni. Nazywa się je bykami i niedźwiedziami. Wygra ten, kto w pewnym momencie okaże się silniejszy. Jako inwestorzy nie naszym zadaniem jest zgadywać, w którą stronę podąża rynek. Naszym zadaniem jest wyczucie rynku. Kto jest obecnie silniejszy? Czy to byki, czy niedźwiedzie?

Strategia handlu Forex Bulls Bears Stop jest strategią handlową skupioną wokół idei określania nastrojów na rynku. Strategia ta ma na celu czerpanie zysków z rynku forex poprzez obiektywną ocenę siły byków i niedźwiedzi. Daje nam to wskazówkę, w jakim kierunku powinniśmy podążać, aby konsekwentnie czerpać zyski z rynku forex. Dopóki mamy pojęcie, w którą stronę chce podążać rynek, bitwa jest już w połowie skończona.

Wskaźniki mocy byków i niedźwiedzi

Wskaźniki Byków i Niedźwiedzi to wskaźniki, które próbują zmierzyć siłę Byków i Niedźwiedzi na rynku. Robiąc to, możemy wyczuć, dokąd zmierza rynek, biorąc pod uwagę jego mocne strony.

Wskaźnik Byków i Niedźwiedzi to proste wskaźniki oscylacyjne, które mierzą odległość między szczytem a minimum i porównują ją z wykładniczą średnią ruchomą (EMA). Pozytywne byki i niedźwiedzie wskazują, że zarówno najwyższe, jak i najniższe ceny rosną w porównaniu do średniej ceny. Oznacza to, że nastroje na rynku są zwyżkowe. Z drugiej strony, jeśli wskaźnik Byków i Niedźwiedzi jest ujemny, oznacza to, że wzloty i upadki akcji cenowej spadają w porównaniu do średniej ceny, co oznacza, że rynek jest niedźwiedzi.

Żyrandol zatrzymuje się lub żyrandol wychodzi

Wskaźnik Chandelier Stops, znany również jako Chandelier Exits, jest wskaźnikiem trailing stop, który pomaga inwestorom w określeniu idealnego rozmieszczenia stop lossów. Przypomina wskaźnik parabolicznego zatrzymania i biegu wstecznego (PSAR), jest jednak jego prostszą wersją.

Wskaźnik Chandelier Stops mierzy punkty stop loss na podstawie maksymalnej wartości najwyższej i najniższej. Inne wersje wykorzystują maksymalną wartość zamknięcia. Następnie umieszcza bufor pomiędzy wartością maksymalną, obliczając średni rzeczywisty zakres (ATR) dla pewnego okresu i dodając go powyżej maksymalnego maksimum lub odejmując go od maksymalnego minimum. Pozwala to inwestorom określić bezpieczną odległość, w której mogą śledzić swoje stop-lossy. Argument jest taki, że jeśli kiedykolwiek cena odwróci się o wielokrotność ATR, wówczas zakłada się, że trend już się odwrócił.

Strategia Trading

Ta strategia handlowa jest strategią opartą na sile nastrojów rynkowych, która próbuje określić trend w oparciu o siłę byków i niedźwiedzi. Dokonuje tego za pomocą wskaźników siły byków i niedźwiedzi.

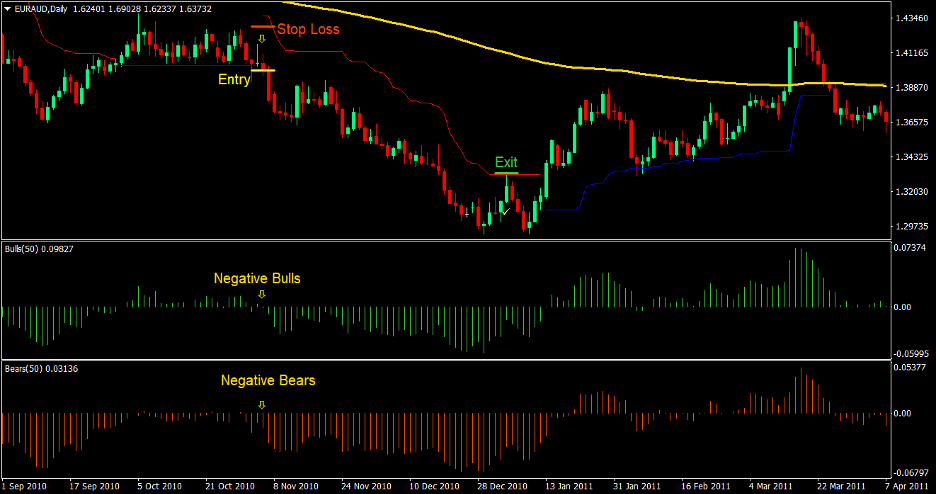

Transakcje są zawierane w oparciu o kierunek wskaźników Byków i Niedźwiedzi. Jeśli wskaźniki „byków” i „niedźwiedzi” będą pozytywne, może nastąpić transakcja kupna. Z drugiej strony, jeśli wskaźniki te są ujemne, może nastąpić transakcja sprzedaży.

Wskaźnik Chandelier Stops, który jest wskaźnikiem trailing stop, byłby używany jako wskaźnik kierunku trendu. Ta konkretna wersja przystanków żyrandola rysuje jedynie linię przeciwną do kierunku trendu. Ilekroć trend jest zwyżkowy, wskaźnik rysuje tylko dolną linię. Gdy trend jest niedźwiedzi, wówczas narysowana zostanie jedynie górna linia. To w wygodny sposób informuje nas, w jakim kierunku trend opiera się na wskaźniku.

Wreszcie, chociaż powyższe sygnały wejścia są wysokiej jakości, nadal będziemy odfiltrowywać transakcje, które są sprzeczne z trendem długoterminowym. W tym celu będziemy używać 200-okresowej wykładniczej średniej kroczącej (EMA). Ta średnia ruchoma jest powszechnie stosowanym wskaźnikiem długoterminowego trendu. Transakcje należy podejmować tylko wtedy, gdy pozostałe trzy wskaźniki są zgodne z 200 EMA.

Wskaźniki:

- 200 EMA (złoto)

- ŻyrandolStops-v1

- Długość: 28

- Okres ATR: 18

- Kv: 3.5

- Byki

- Okres: 50

- Niedźwiedzie

- Okres: 50

Ramy czasowe: 4-godzina i dzienne wykresy

Pary walutowe: pary główne i drugorzędne

Sesja handlowa: Tokio, Londyn i Nowy Jork

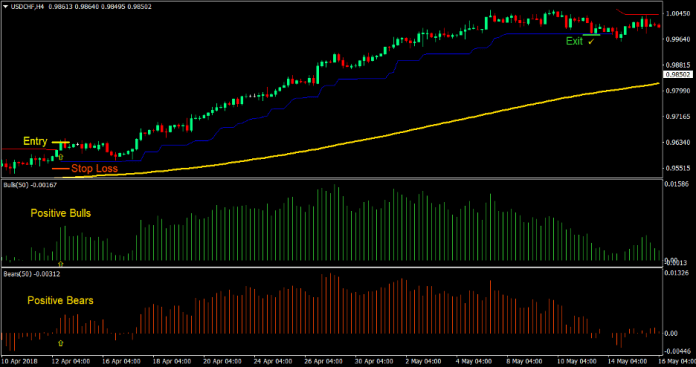

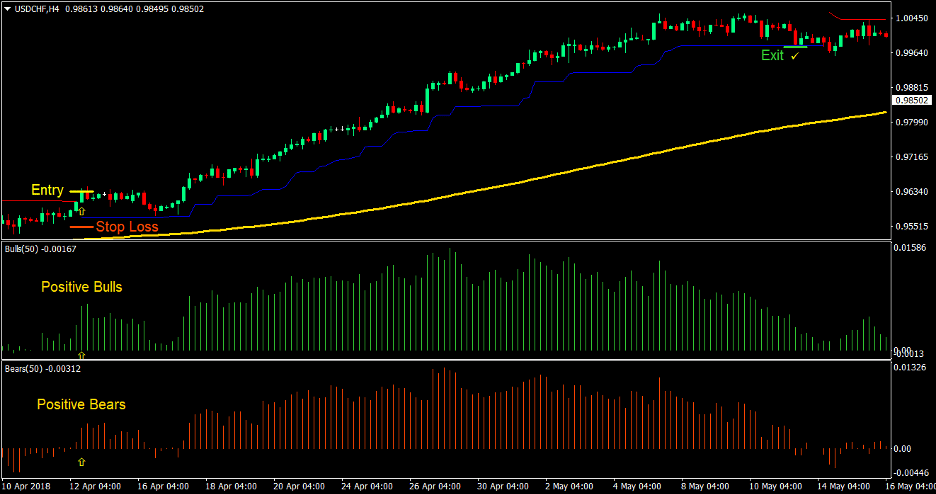

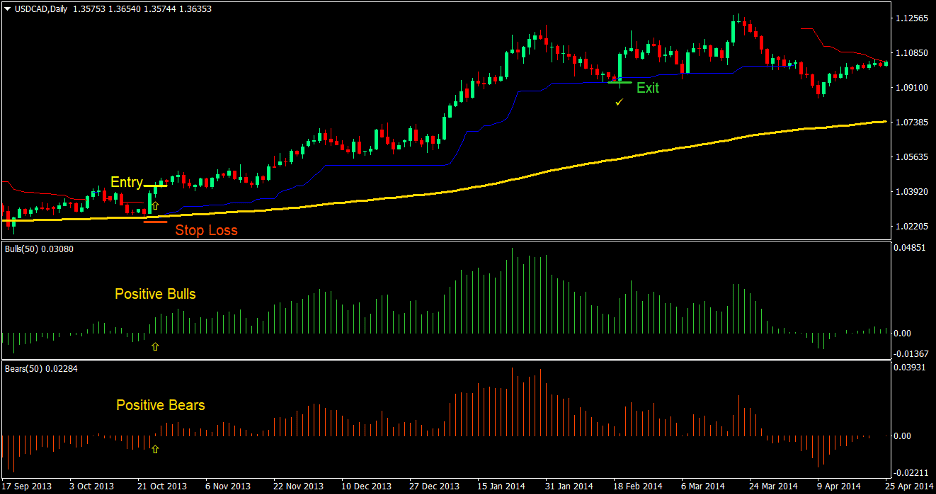

Kup Trade Setup

Wejście

- Cena powinna znajdować się powyżej 200 EMA, co wskazuje na zwyżkowy trend długoterminowy

- Wskaźniki siły byków i niedźwiedzi powinny być pozytywne, wskazując na bycze nastroje na rynku

- Wskaźnik Chandelier Stops powinien wydrukować niebieską linię poniżej akcji cenowej, wskazując na zwyżkowy trend

- Wprowadź zlecenie kupna na zbiegu powyższych warunków rynkowych

stop Loss

- Ustaw stop loss na poziomie wsparcia poniżej świecy wejściowej

Wyjście

- Trzymaj stop loss poniżej niebieskiej linii Chandelier Stops, aż do zatrzymania zysku

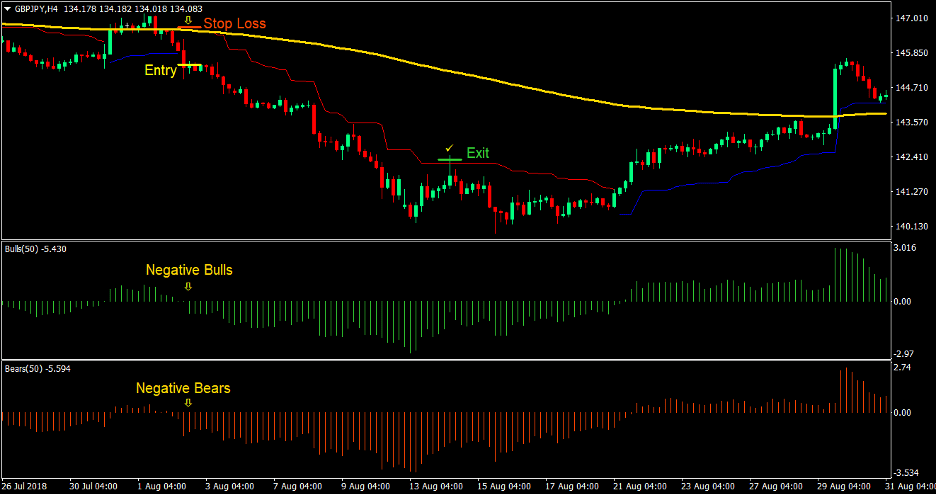

Sell Trade Setup

Wejście

- Cena powinna znajdować się poniżej 200 EMA, co wskazuje na niedźwiedzi trend długoterminowy

- Wskaźniki siły byków i niedźwiedzi powinny być ujemne, co wskazuje na niedźwiedzie nastroje na rynku

- Wskaźnik Chandelier Stops powinien wydrukować czerwoną linię nad akcją cenową, wskazując trend niedźwiedzi

- Wprowadź zlecenie sprzedaży po zbiegu powyższych warunków rynkowych

stop Loss

- Ustaw stop loss na poziomie oporu powyżej świecy wejściowej

Wyjście

- Trzymaj stop loss powyżej czerwonej linii Chandelier Stops, aż do zatrzymania zysku

Wnioski

Ta strategia handlowa jest przyzwoicie zyskowną strategią handlową. Ma całkiem przyzwoity współczynnik wygranych, ponieważ trend opiera się na nastrojach rynkowych i że transakcje są filtrowane w celu dostosowania się do długoterminowego trendu. W ten sposób podejmujemy transakcje, które z większym prawdopodobieństwem będą podążać w kierunku naszej transakcji, ponieważ istnieje mniejsze dynamiczne wsparcie i opory, które transakcje muszą pokonać. Ta strategia handlowa ma również uczciwy stosunek zysku do ryzyka, który może wzrosnąć z 2:1 do 4:1 w zależności od warunków rynkowych.

Polecani brokerzy MT4

Broker XM

- $ Darmowe 50 Aby natychmiast rozpocząć handel! (Zysk możliwy do wypłaty)

- Bonus depozytowy do $5,000

- Nieograniczony program lojalnościowy

- Nagradzany broker Forex

- Dodatkowe ekskluzywne bonusy Przez rok

>> Zarejestruj się tutaj, aby założyć konto brokera XM <

Broker FBS

- Wymień 100 bonusów: Darmowe 100 $ na rozpoczęcie Twojej podróży handlowej!

- % 100 Bonus: Podwój swój depozyt do 10,000 XNUMX $ i handluj ze zwiększonym kapitałem.

- Wykorzystaj 1: 3000: Maksymalizacja potencjalnych zysków dzięki jednej z najwyższych dostępnych opcji dźwigni.

- Nagroda „Najlepszy broker obsługi klienta w Azji”.: Uznana doskonałość w obsłudze klienta i obsłudze.

- Promocje sezonowe: Korzystaj z różnorodnych ekskluzywnych bonusów i ofert promocyjnych przez cały rok.

>> Zarejestruj się tutaj, aby założyć konto brokera FBS <

Kliknij tutaj, aby pobrać: