Wielu nowych traderów często przyciąga perspektywa bycia day traderem. Pomysł zarabiania pieniędzy, siedząc przed biurkiem handlowym, może wydawać się im atrakcyjny. Być może filmy i programy telewizyjne sprawiły, że pomysł bycia day traderem zabrzmiał seksownie. Chociaż day trading jest daleki od tego, co pokazano w filmach, dla odpowiedniego typu tradera day trading może być szybkim sposobem na zarobienie dużych pieniędzy. Nie jest to najłatwiejszy sposób na zarabianie, ale jeśli zrobisz to dobrze, z pewnością będziesz mógł czerpać zyski z rynków Forex każdego dnia.

Strategia jednodniowego handlu na rynku Forex o mocy 100 pipsów może pomóc inwestorom, którzy chcą handlować codziennie. Chociaż może to działać dla każdego rodzaju tradera, niezależnie od tego, czy jest to skalper, daytrader czy swing trader, jest to taki, który najlepiej pasuje do daytraderów. Wskaźniki stosowane w tej strategii dobrze sprawdzają się w wykrywaniu krótko- i średnioterminowych zmian trendów, które mają tendencję do utrzymywania się nawet dłużej, zwłaszcza gdy są zgodne z trendem długoterminowym.

100-pipsowy wskaźnik siły Oracle

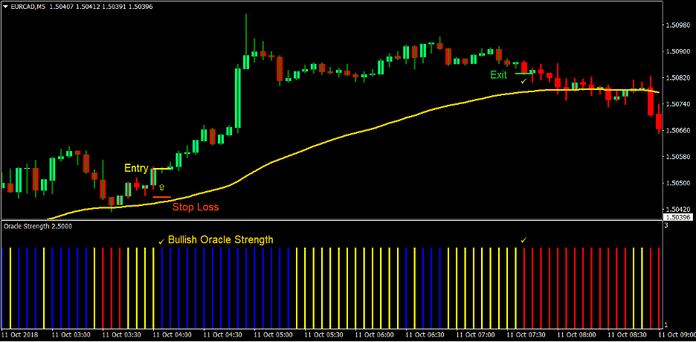

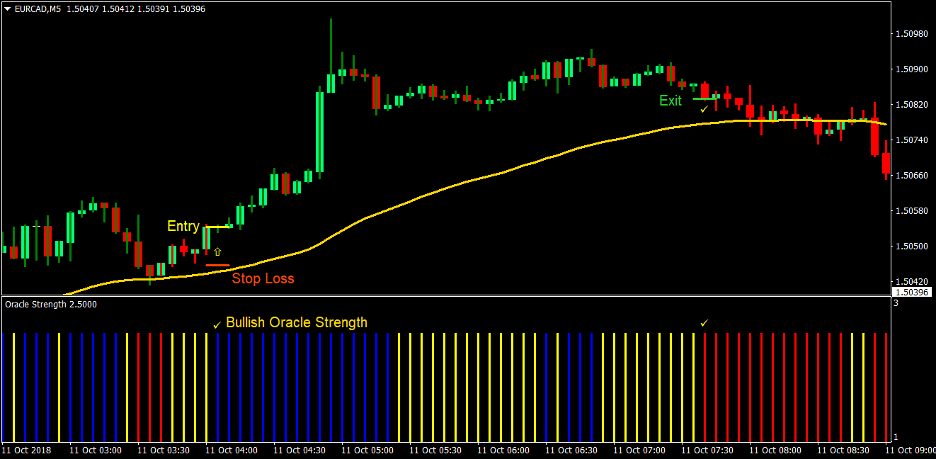

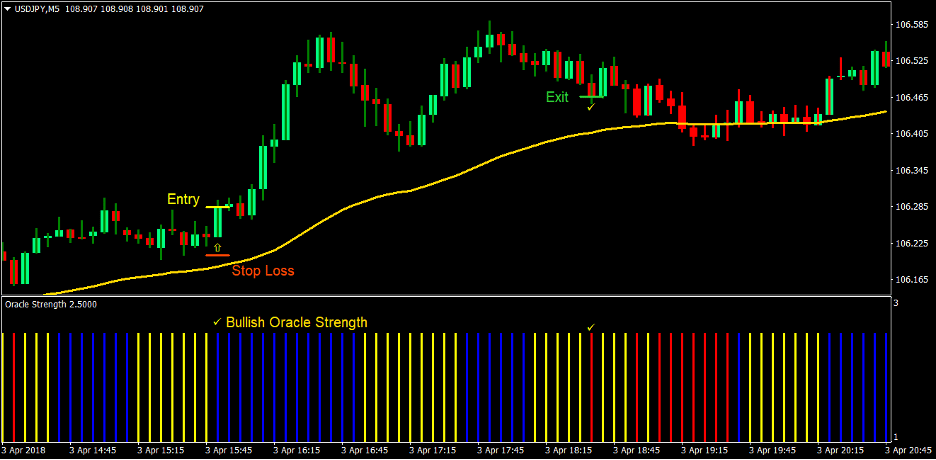

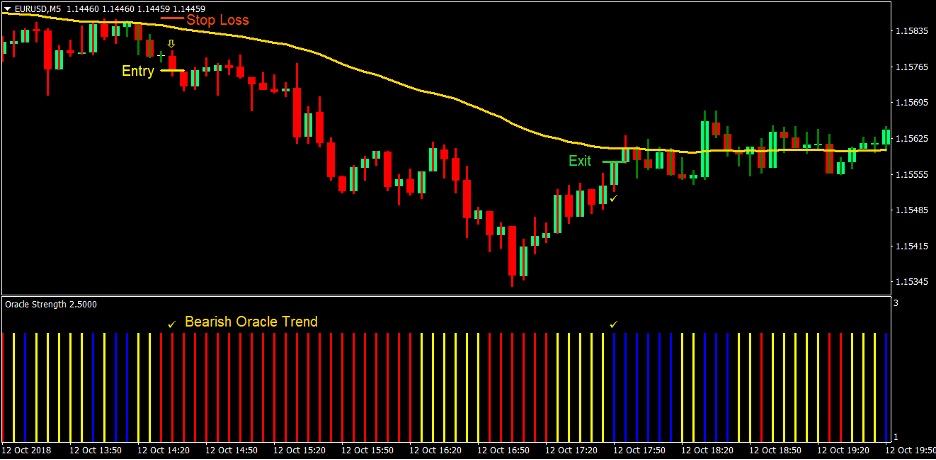

Wskaźnik siły Oracle 100 Pips jest wskaźnikiem dynamiki, który pomaga inwestorom w identyfikowaniu krótkoterminowych tendencji. Wskaźnik ten wskazuje kierunki trendów poprzez wydruk słupków w oddzielnym oknie. Słupki te są oznaczone kolorami w zależności od kierunku trendu. Niebieskie słupki wskazują byczy trend, czerwone słupki wskazują na niedźwiedzi trend, a żółte słupki wskazują na brak trendu lub słabo trendujący stan rynku.

Rynek ten specjalizuje się w pomaganiu inwestorom w identyfikowaniu znaczących krótkoterminowych odwróceń trendów. W przeciwieństwie do innych wskaźników dynamiki, wskaźnik siły Oracle 100 Pips uniemożliwia inwestorom przyjmowanie sygnałów handlowych o niskiej jakości, co ma miejsce na rynku ograniczonym zakresem. Ponieważ wskaźnik ten pozostaje żółty w warunkach rynkowych związanych z zakresem, inwestorzy będą musieli poczekać na wyraźny sygnał, oznaczony niebieskim lub czerwonym paskiem. Kolory te często pojawiają się, gdy ruchy cen wykazują dynamikę za świecami.

Wskaźnik trendu AVQ

Wskaźnik AVQ Trend jest wskaźnikiem opartym na dynamice, który pomaga inwestorom zidentyfikować średnioterminowy kierunek trendu i jego odwrócenie. Wskazuje kierunek trendu poprzez nakładanie słupków na wykresie cen. Słupki są następnie kodowane kolorami w oparciu o kierunek trendu. Zielone słupki wskazują zwyżkowy kierunek trendu, natomiast czerwone słupki wskazują niedźwiedzi kierunek trendu. Sygnały handlowe są zazwyczaj generowane za każdym razem, gdy słupki zmieniają kolor.

50 EMA – wykładnicza średnia krocząca

50-okresowa wykładnicza średnia krocząca (EMA) jest podstawową średnią kroczącą dla wielu traderów, zarówno detalicznych, jak i bankowych i instytucjonalnych. Jest często używany do wskazania trendu średnioterminowego. Traderzy zazwyczaj oceniają średnioterminowy kierunek trendu na podstawie lokalizacji ceny w stosunku do 50 EMA. Inni inwestorzy wykorzystaliby nachylenie 50 EMA do oceny kierunku trendu.

Strategia Trading

Ta strategia handlu dziennego generuje wpisy handlowe w oparciu o zbieżność wskaźnika 100 Pips Oracle Strength i wskaźnika AVQ Trend. Transakcje są podejmowane zawsze, gdy dwa wskaźniki wskazują ten sam kierunek trendu. Te sygnały odwrócenia trendu zwykle dają świetne wyniki, gdy sygnały są nieco wyrównane.

Jednak nie wszystkie sygnały handlowe należy przyjmować. Transakcje należy filtrować w oparciu o kierunek trendu 50 EMA. Ma to na celu dostosowanie naszego kierunku handlu do średnioterminowego trendu na dany dzień. Zwiększa to prawdopodobieństwo wygranej transakcji.

Strategia ta sprawdza się również najlepiej w przypadku zawierania transakcji opartych na świecy pędu lub świecy momentum produkowanej przed świecą wejścia.

Wskaźniki:

- Trend_AVQ

- Wygładzanie: 15

- Moc 100 pipsów

- 50 wykładnicza średnia krocząca (złoto)

Ramy czasowe: najlepiej stosować na wykresie 5-minutowym, ale nadal można go stosować w innych ramach czasowych

Pary walutowe: tylko pary główne i poboczne; żadnych egzotycznych par

Sesja handlowa: najlepiej sesja handlowa waluty będącej przedmiotem obrotu (Tokio, Londyn i Nowy Jork)

Kup Trade Setup

Wejście

- Cena powinna znajdować się powyżej 50 EMA, co wskazuje na byczy trend średnioterminowy

- Słupki wskaźnika AVQ Trend powinny zmienić kolor na zielony, wskazując bycze odwrócenie trendu

- Słupki wskaźnika Oracle Strength powinny zmienić kolor na niebieski, wskazując zwyżkowe odwrócenie trendu wraz z pędem

- Te zwyżkowe sygnały odwrócenia trendu powinny być w pewnym stopniu wyrównane

- Wprowadź zlecenie kupna na zbiegu tych warunków

stop Loss

- Ustaw stop loss na poziomie wsparcia poniżej świecy wejściowej

Wyjście

- Zamknij transakcję, gdy tylko paski wskaźnika AVQ Trend zmienią kolor na czerwony

- Zamknij transakcję, gdy tylko wskaźnik Siły Wyroczni zmieni kolor na czerwony

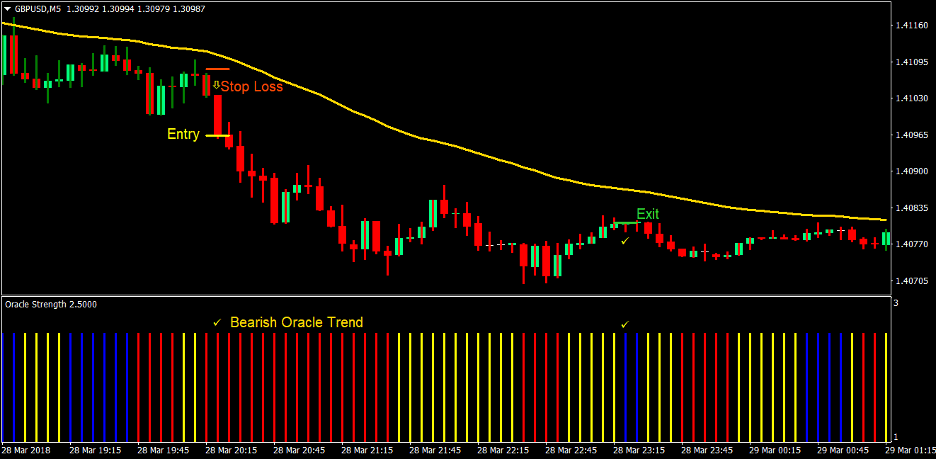

Sell Trade Setup

Wejście

- Cena powinna znajdować się poniżej 50 EMA, co wskazuje na niedźwiedzi trend średnioterminowy

- Słupki wskaźnika AVQ Trend powinny zmienić kolor na czerwony, wskazując na odwrócenie trendu niedźwiedziego

- Słupki wskaźnika Oracle Strength powinny zmienić kolor na czerwony, wskazując na odwrócenie trendu niedźwiedziego wraz z pędem

- Te niedźwiedzie sygnały odwrócenia trendu powinny być w pewnym stopniu wyrównane

- Wprowadź zlecenie sprzedaży po zbiegu tych warunków

stop Loss

- Ustaw stop loss na poziomie oporu powyżej świecy wejściowej

Wyjście

- Zamknij transakcję, gdy tylko paski wskaźnika AVQ Trend zmienią kolor na zielony

- Zamknij transakcję, gdy tylko wskaźnik Siły Wyroczni zmieni kolor na niebieski

Strategia Trading

Strategia ta sprawdza się dobrze jako strategia daytradingu na wykresie 5-minutowym. W tym przedziale czasowym będziesz utrzymywał zyskowną transakcję przez około godzinę lub nawet dłużej. Umożliwi to inwestorom osiągnięcie wystarczających zysków wykraczających poza przeszkodę związaną z kosztami handlu, którą wielu traderom uważa za trudną do pokonania.

Handluj tą strategią w sytuacji rynkowej, która wykazuje dobre oznaki trendu w perspektywie średnioterminowej i dopasuj swoją transakcję do tego trendu. Skoki rynkowe są również częste w niższych interwałach czasowych, dlatego dobrym pomysłem jest również przesunięcie stop lossa na próg rentowności, gdy tylko jest to możliwe. Pozwoliłoby to uzyskać dobry współczynnik wygranych.

Polecani brokerzy MT4

Broker XM

- $ Darmowe 50 Aby natychmiast rozpocząć handel! (Zysk możliwy do wypłaty)

- Bonus depozytowy do $5,000

- Nieograniczony program lojalnościowy

- Nagradzany broker Forex

- Dodatkowe ekskluzywne bonusy Przez rok

>> Zarejestruj się tutaj, aby założyć konto brokera XM <

Broker FBS

- Wymień 100 bonusów: Darmowe 100 $ na rozpoczęcie Twojej podróży handlowej!

- % 100 Bonus: Podwój swój depozyt do 10,000 XNUMX $ i handluj ze zwiększonym kapitałem.

- Wykorzystaj 1: 3000: Maksymalizacja potencjalnych zysków dzięki jednej z najwyższych dostępnych opcji dźwigni.

- Nagroda „Najlepszy broker obsługi klienta w Azji”.: Uznana doskonałość w obsłudze klienta i obsłudze.

- Promocje sezonowe: Korzystaj z różnorodnych ekskluzywnych bonusów i ofert promocyjnych przez cały rok.

>> Zarejestruj się tutaj, aby założyć konto brokera FBS <

Kliknij tutaj, aby pobrać: