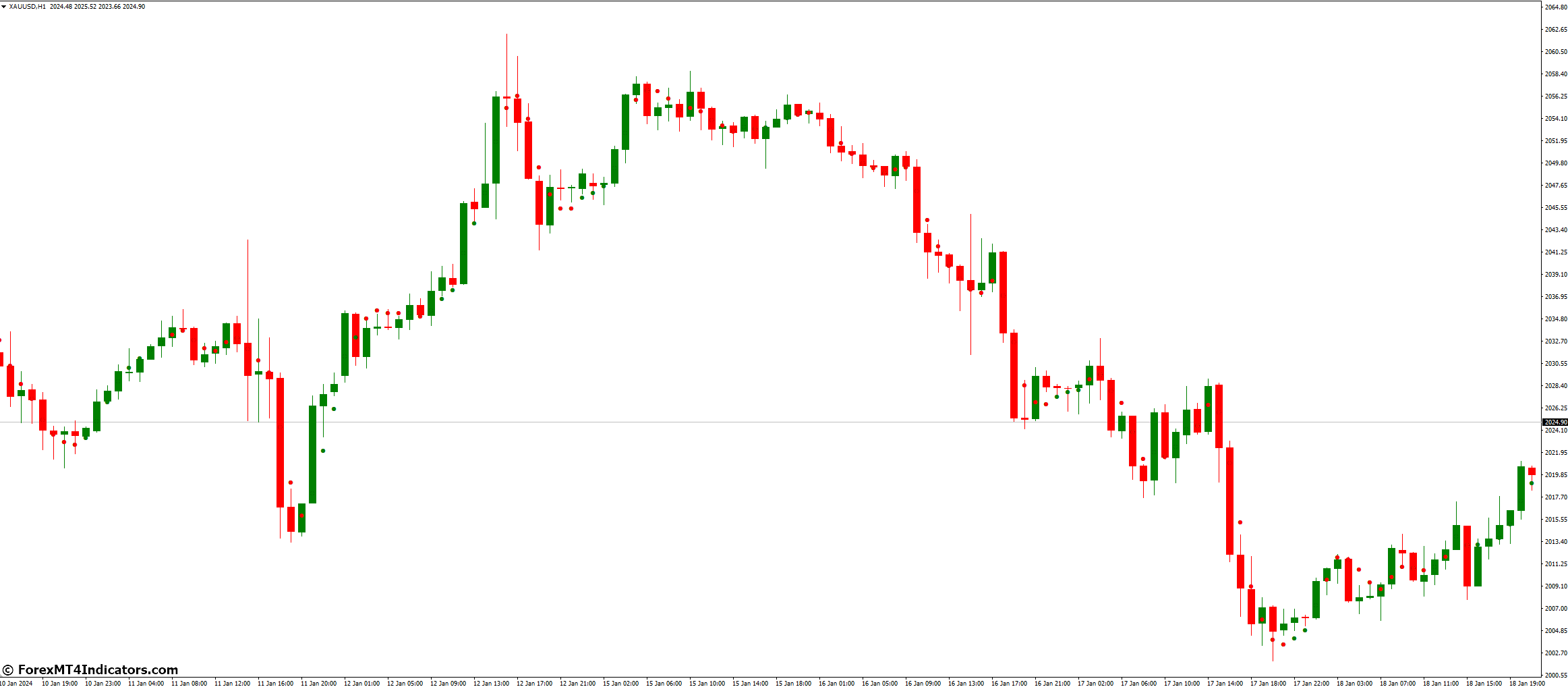

Non-Lag Dot Indicator is a technical analysis tool that tracks the price action of the market and displays it in the form of colored dots on the chart. The indicator uses a combination of moving averages and price action to generate the colored dots. The red dots indicate that the market is in a downtrend, while the green dots indicate that the market is in an uptrend.

Why Is It Important?

Non-Lag Dot Indicator is important because it helps traders identify potential entry and exit points in the market. By using this indicator, traders can easily identify when the market is about to turn and capitalize on the opportunity. It is easy to use and can be used in any time frame. This indicator is popular among Forex traders due to its accuracy and reliability. It is also a great tool for traders who want to take advantage of short-term price movements.

How Does It Work?

Non-Lag Dot Indicator works by displaying a colored dot on the chart when the price is in an uptrend and a red dot when the price is in a downtrend. The indicator uses a combination of moving averages and price action to generate the colored dots. The red dots indicate that the market is in a downtrend, while the green dots indicate that the market is in an uptrend.

What Are The Benefits Of Using It?

The benefits of using the Non-Lag Dot Indicator are numerous. It is easy to use and can be used in any time frame. It is also accurate and reliable, making it a great tool for traders who want to take advantage of short-term price movements. Additionally, it helps traders identify potential entry and exit points in the market, which can lead to higher profits.

What Are The Drawbacks Of Using It?

The Non-Lag Dot Indicator is not without its drawbacks. It is a lagging indicator, which means that it may not be able to predict future price movements accurately. Additionally, it may generate false signals in choppy or sideways markets.

How Does It Compare To Other Indicators?

The Non-Lag Dot Indicator is similar to other trend-following indicators such as Moving Averages and MACD. However, it is unique because it combines moving averages and price action to generate the colored dots.

What Are The Best Practices For Using It?

The best practices for using the Non-Lag Dot Indicator are as follows:

- Use it in conjunction with other technical analysis tools to confirm signals.

- Use it on multiple time frames to get a better understanding of the trend.

- Avoid using it in choppy or sideways markets.

What Are The Common Mistakes To Avoid When Using It?

The common mistakes to avoid when using the Non-Lag Dot Indicator are as follows:

- Relying solely on the indicator to make trading decisions.

- Using it in choppy or sideways markets.

- Not using it in conjunction with other technical analysis tools.

How to Trade with Non-Lag Dot Indicators

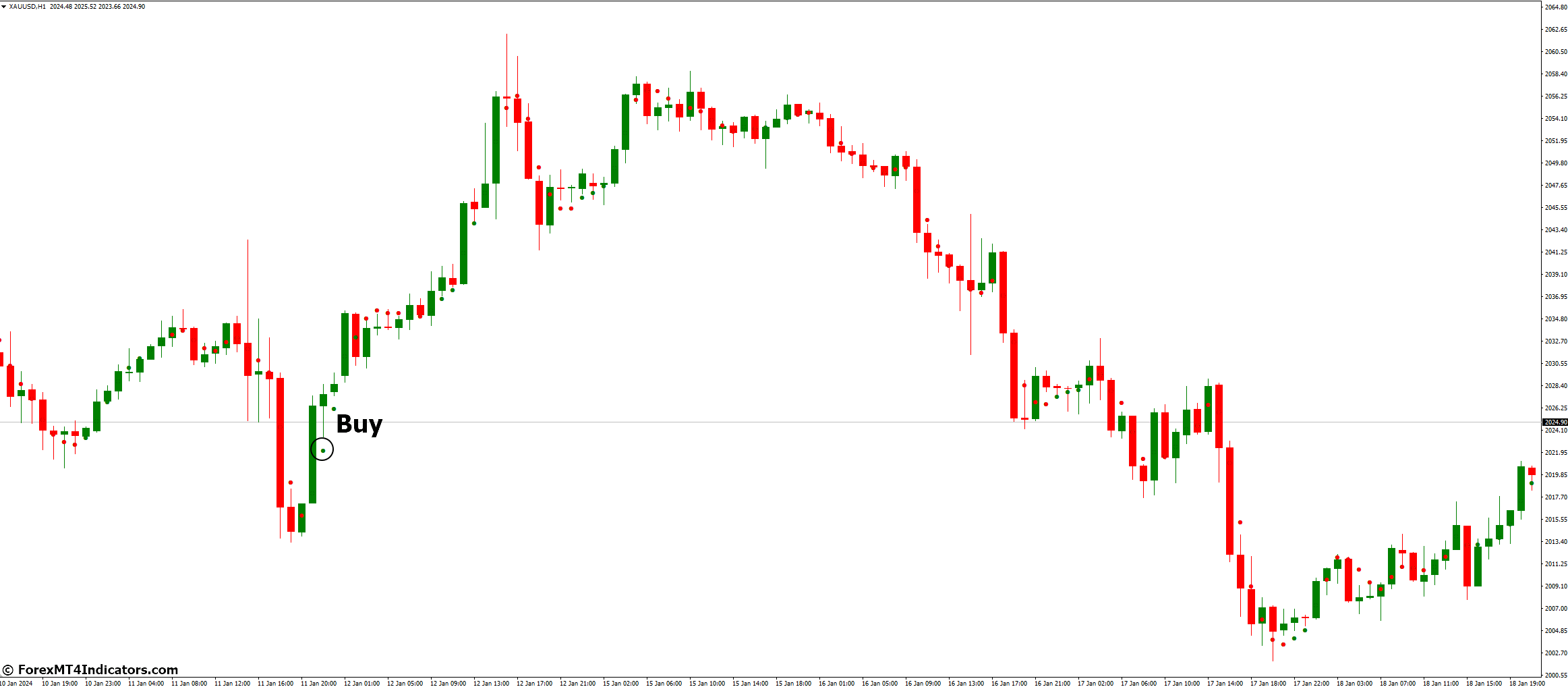

Buy Entry

- Look for a green dot to appear on the chart, indicating an uptrend.

- Enter a long position when the price closes above the high of the candlestick that formed the green dot.

- Place a stop-loss order below the low of the candlestick that formed the green dot.

- Place a take-profit order at a predetermined level or use a trailing stop to lock in profits.

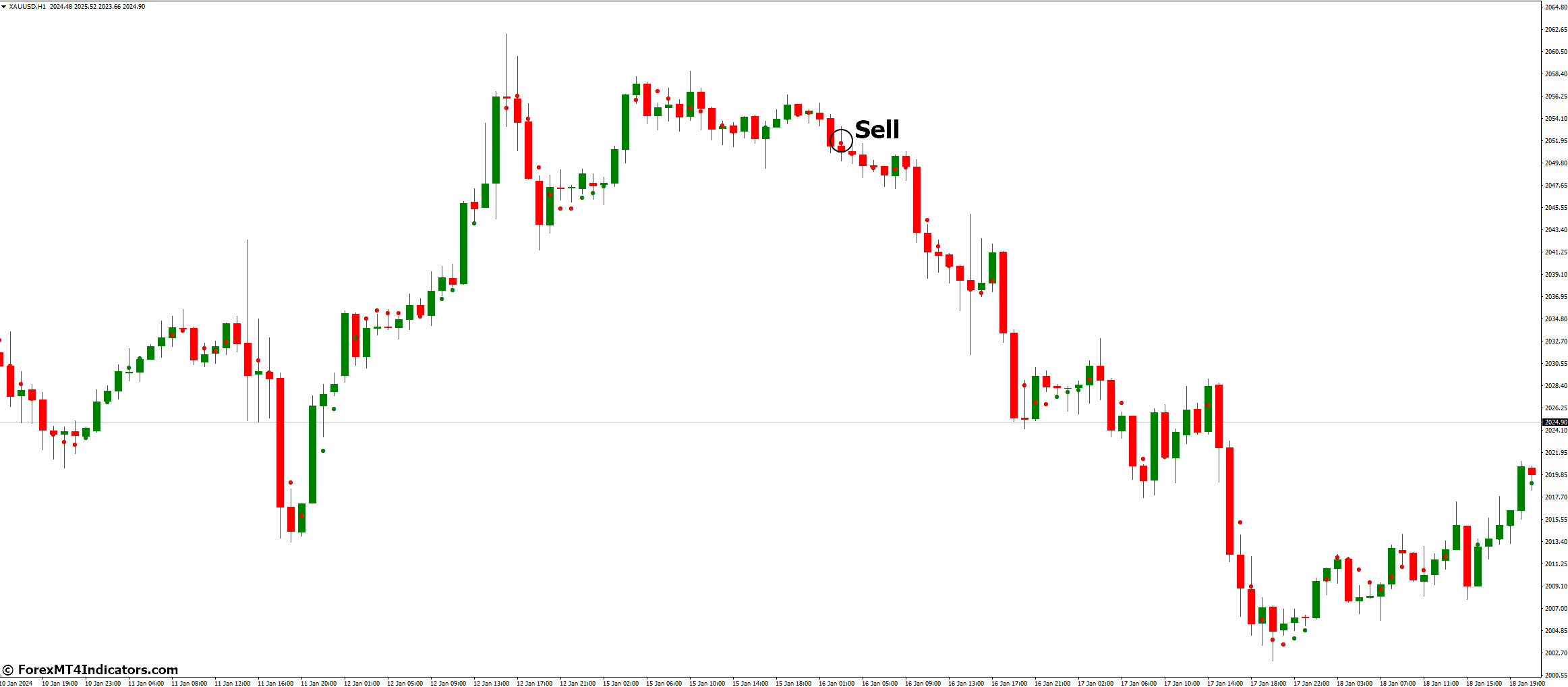

Sell Entry

- Look for a red dot to appear on the chart, indicating a downtrend.

- Enter a short position when the price closes below the low of the candlestick that formed the red dot.

- Place a stop-loss order above the candlestick’s high that formed the red dot.

- Place a take-profit order at a predetermined level or use a trailing stop to lock in profits.

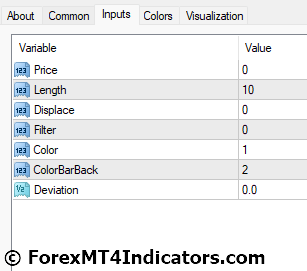

Non-Lag Dot Indicators Settings

Conclusion

Non-Lag Dot Indicator is a useful and popular free Forex indicator for the MetaTrader 4 platform. It is designed to help traders identify potential entry and exit points in the market. By using this indicator, traders can easily identify when the market is about to turn and capitalize on the opportunity.