Trading with momentum is a great way to trade the forex markets. This is because momentum price movements usually increase the likelihood that price would continue in one direction even on the long-term. A minimal price move on a lower timeframe would mean nothing on the higher timeframes, however, a momentum price movement on a lower timeframe may have a significance on a timeframe a notch higher than the current timeframe being looked at. This increases the likelihood that price could move in the direction of a momentum signal even on the long run.

There are many ways to trade momentum. Most traders look for momentum signals based on price action. This would usually mean a momentum candle breaking beyond a support or resistance area, or a momentum candle breaking out of a congestion area.

Another way traders identify momentum is through the use of bands, channel and envelope type of indicators. Traders would usually use these types of indicators to identify a congestion area and take trades on momentum signals as price breaches beyond the bands or the channel.

However, there is another less popular method of identifying momentum. This is by using oscillators. Oscillators are often used to detect trend direction, mean reversals, and the cyclical waves of the market. However, it could also be used to indicate momentum. William R Momentum Trading Strategy uses an oscillator to identify momentum.

William Percentage Range

William %R, also known as William Percentage Range, is an oscillator type of technical indicator. It plots a line that oscillates between -100 and 0.

Like most oscillators, the William %R indicator is used to identify trend direction, momentum, and mean reversals.

The William R range is usually marked at -20, -50 and -80. A William %R line that drops below -20 is indicative of an oversold market, while a William %R line that has breached -80 is indicative of an overbought market. Both conditions could indicate a possible mean reversal.

The -50 level on the other hand is significant for identifying trend. A William %R line that is staying above -50 is indicative of a bullish trend, while a line that stays below -50 is indicative of a bearish trend.

MA Trading Signals

MA Trading Signals is a custom indicator that helps traders identify trend reversals. It produces trade signals based on a pair of moving averages. Trade signals are produced whenever the moving averages crossover.

The MA Trading Signals is very malleable. It can be tweaked according to the preferences of the trader. Traders could customize the range and type of the moving average, as well as the type of price point used in computing for the moving average.

The indicator then produces trade signals based on the underlying moving averages. The indicator prints a lime green arrow pointing up to indicate a bullish signal and a red arrow pointing down to indicate a bearish signal.

Trading Strategy

This strategy produces trade signals based on the confluence of a momentum indication from the William %R indicator and a trend reversal signal coming from the MA Trading Signals indicator.

To trade this strategy, we must first identify the long-term trend direction. We will use the 200-period Exponential Moving Average (EMA) to identify the long-term trend. Trend direction will be based on the slope of the 200 EMA line, as well as the location of price in relation to the 200 EMA line. Trades will only be taken in the direction of the long-term trend.

On the William %R indicator, we will be adding a marker on level -40 and -60. A William %R line that is crossing above the -40 level would be considered as an indication of a bullish momentum. On the other hand, a William %R line that drops below -60 will be considered as an indication of a bearish momentum.

Momentum signals coming from the William %R indicator that aligns with the signals coming from the MA Trading Signals indicator will be considered as a valid momentum entry.

Indicators:

- 200 EMA (Green)

- MATradingSignals

- FastMA_Mode: 1

- FastMA_Period: 25

- SlowMA_Mode: 1

- SlowMA_Period: 30

- Williams’ Percentage Range

- Levels: add -40 and -60

Currency Pairs: major and minor pairs

Preferred Time Frames: 30-minute, 1-hour and 4-hour charts

Trading Sessions: Tokyo, London and New York sessions

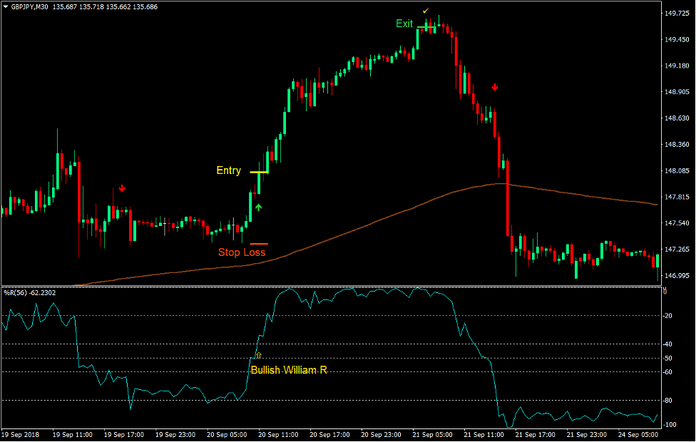

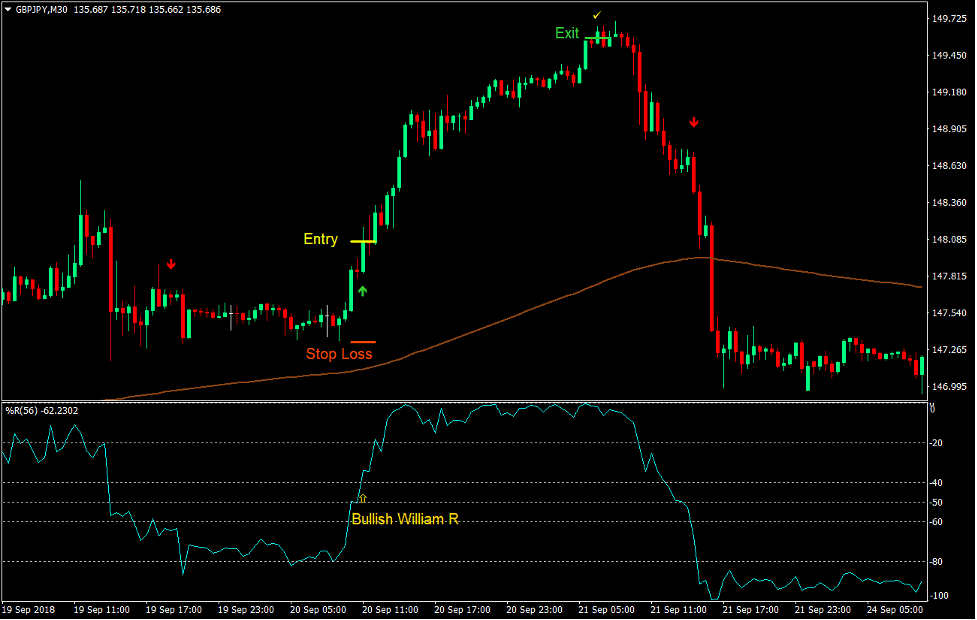

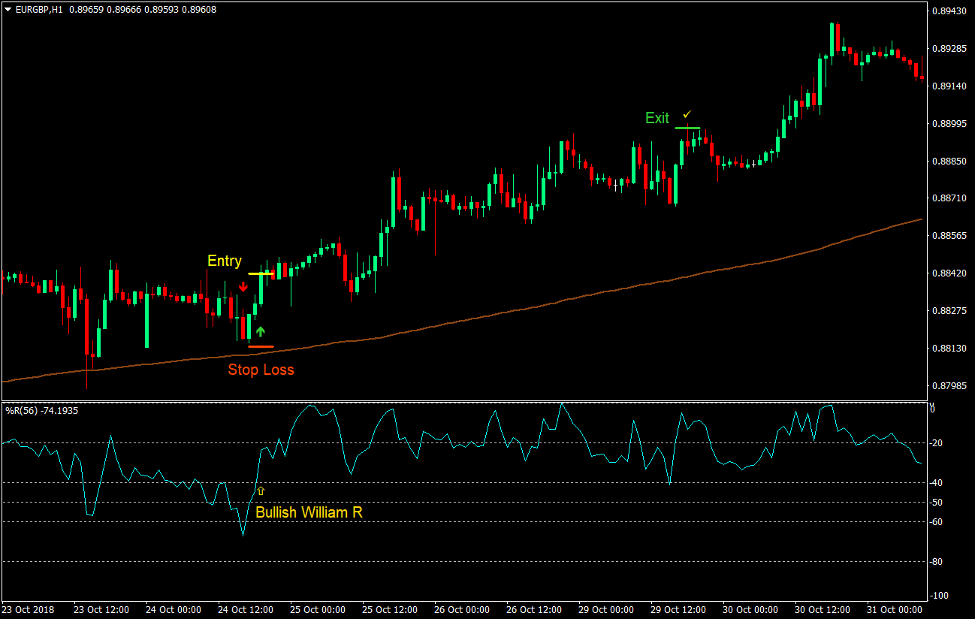

Buy Trade Setup

Entry

- Price should be above the 200 EMA line.

- The 200 EMA line should be sloping up.

- The William %R line should cross above -40 on candle close.

- The MA Trading Signals indicator should print an arrow pointing up.

- Enter a buy order on the confluence of these bullish signals.

Stop Loss

- Set the stop loss on the fractal below the entry candle.

Exit

- Set the take profit target at 2x the risk on the stop loss.

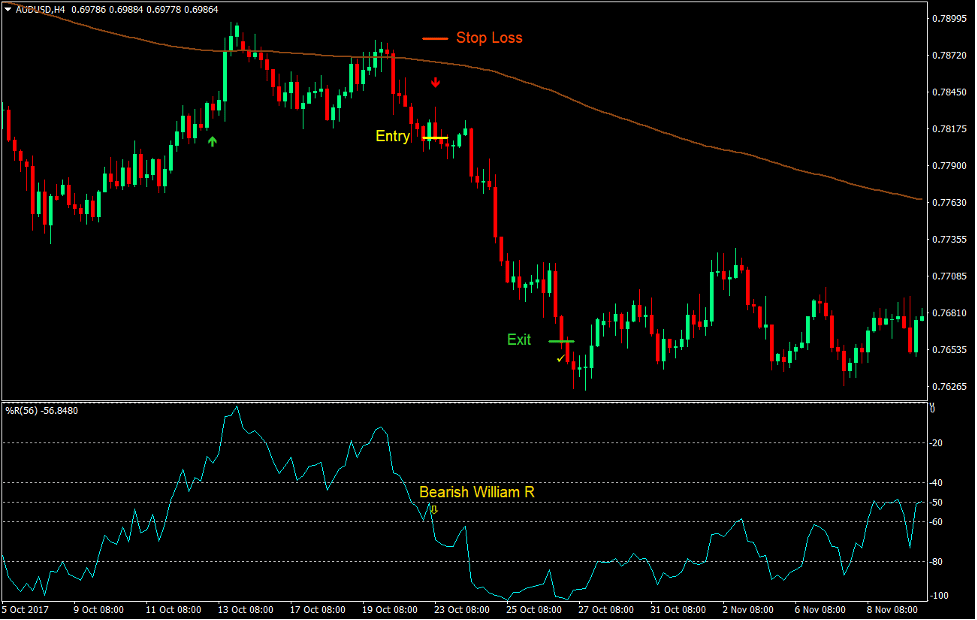

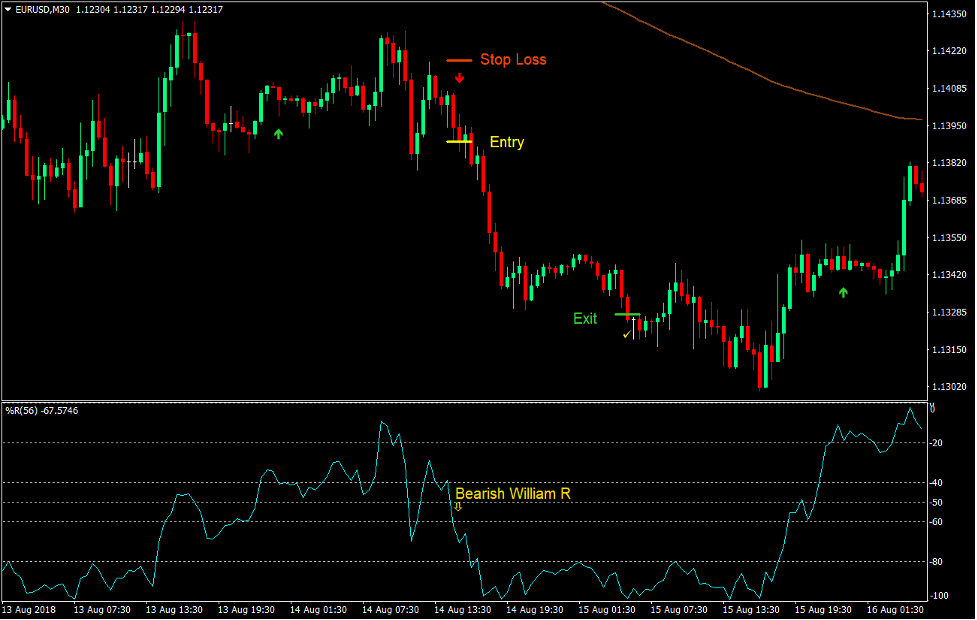

Sell Trade Setup

Entry

- Price should be below the 200 EMA line.

- The 200 EMA line should be sloping down.

- The William %R line should cross below -60 on candle close.

- The MA Trading Signals indicator should print an arrow pointing down.

- Enter a sell order on the confluence of these bearish signals.

Stop Loss

- Set the stop loss on the fractal above the entry candle.

Exit

- Set the take profit target at 2x the risk on the stop loss.

Conclusion

Momentum signals are one of the best forex trading signals. Often, price would push in the direction of the trade right away. At times, price would stall on a range or retrace a bit after the signal. However, despite the stall or retracement, it is still very likely that price would continue the direction of the momentum signal.

Another advantage of trading momentum is that it allows price to move strongly in the direction of the trade giving traders a decent reward-risk ratio. This strategy provides a fixed 2:1 reward-risk ratio. However, traders could tweak this by adjust take profit targets based on risk appetite.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: