Trading could be simple. There is no need to overcomplicate trading. Success in trading is not based on having a complicated strategy or a simple strategy. It is all about having an edge over the market.

Why should beginner traders overcomplicate trading, when in fact there is little advantage to using a complex strategy? In fact, it could even be detrimental to beginners because too much complex rules could also mean too much noise. Traders who are not used to it could have too much to handle and may find themselves freezing when it is time to make a trade decision.

Vortex Crossover Forex Trading Strategy is one of such trading strategies that is easy to follow and could deliver profitable trades with high yields, making it very suitable for beginner traders. Vortex Crossover Forex Trading Strategy is a simple crossover strategy that uses custom technical indicators. These indicators work well together in providing trade signals that could result in high yield trades.

Vortex Indicator

The Vortex Indicator is a custom technical indicator developed by Etienne Botes and Douglas Siepman. This indicator helps traders identify the start of a new trend or the confirmation of the direction of an existing trend.

The Vortex Indicator is based on the concept of a vortex found in movements in water. The idea is that the financial market’s price movements is somehow similar to the characteristics found in the vortex motion of water. As water vortex spins and moves along with the flow of the current, the Vortex Indicator also displays similar characteristics, having two lines that oscillate contrary to each other as price moves along.

It is also partially based from J. Welles Wilder’s Directional Movement Index (DMI). As such, the Vortex Indicator is displayed somehow similar to the DMI indicator.

The Vortex Indicator has two lines on its window, VI+ and VI-. These two lines oscillate along the same range crisscrossing each other. Having the VI+ line above the VI- line indicates that the market is in an uptrend, while having the VI+ line below the VI- line indicates a downtrend.

Volume Weighted Moving Average

The Volume Weighted Moving Average (VWMA) is a modified version of a Simple Moving Average (SMA).

The classic Simple Moving Average is basically the average of the close of price over a number of periods. Because of how the Simple Moving Average is computed, it gives equal weight among all the price points, whether it is a recent price or one that is on the tail end of the computation. As a result, the Simple Moving Average tends to be too lagging and responds slower to trend changes.

The Volume Weighted Moving Average was developed to address this disadvantage. It modified its computation, giving a heavier weight on the most recent price closes. This makes the Volume Weighted Moving Average line more responsive to price changes, allowing traders to respond faster to any trade signal presented by the market.

Trading Strategy

This strategy is a simple crossover strategy between a 50-period Simple Moving Average (SMA) and a 5-period Volume Weighted Moving Average (VWMA).

The longer-term moving average line uses the 50 SMA since a Simple Moving Average line tends to be less responsive. As such, it tends to go along with a trend until the trend has clearly reversed.

On the other hand, the short-term moving average line uses the 5 VWMA since Volume Weighted Moving Average lines tend to be very responsive. This provides us quicker signals whenever the 5 VWMA crosses over the 50 SMA.

On top of that, the strategy also uses the Vortex Indicator to confirm the trend reversal. Trade signals are generated whenever there is a confluence between the crossover signals coming from the moving average lines and the Vortex Indicator lines.

Indicators:

- 50 SMA (blue)

- Volume_Weighted_MA (green)

- Period_MA: 50

- Price_MA: 4

- Vortex Indicator

- VI_Length: 50

Preferred Time Frames: 1-hour and 4-hour charts

Currency Pairs: major and minor pairs

Trading Session: Tokyo, London and New York sessions

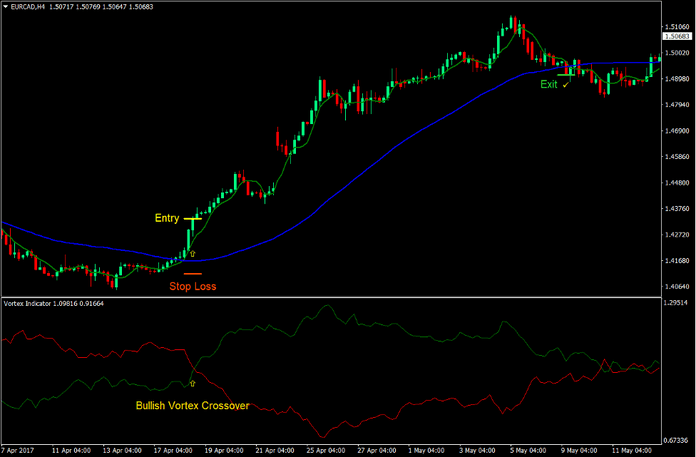

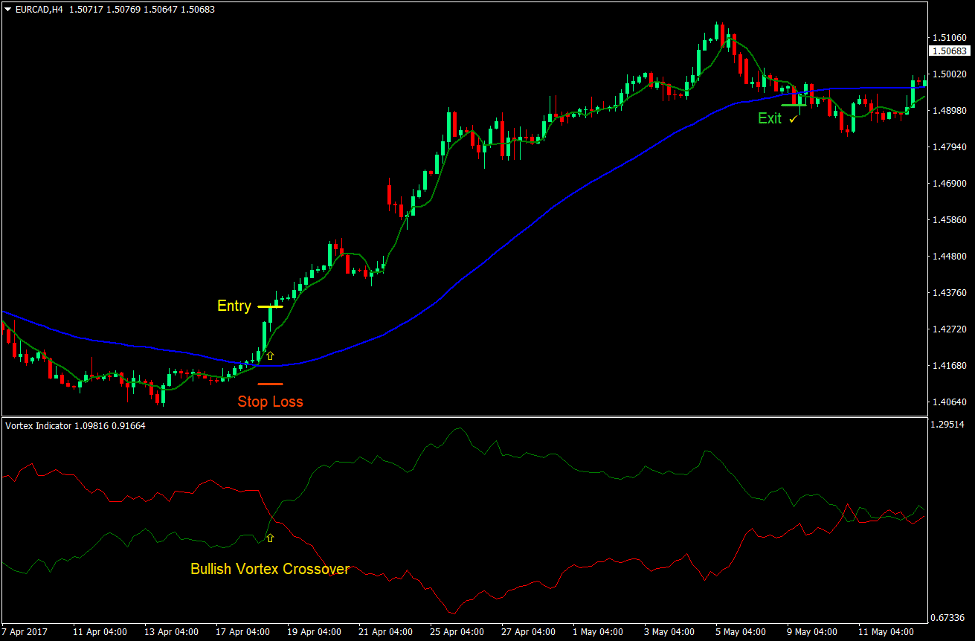

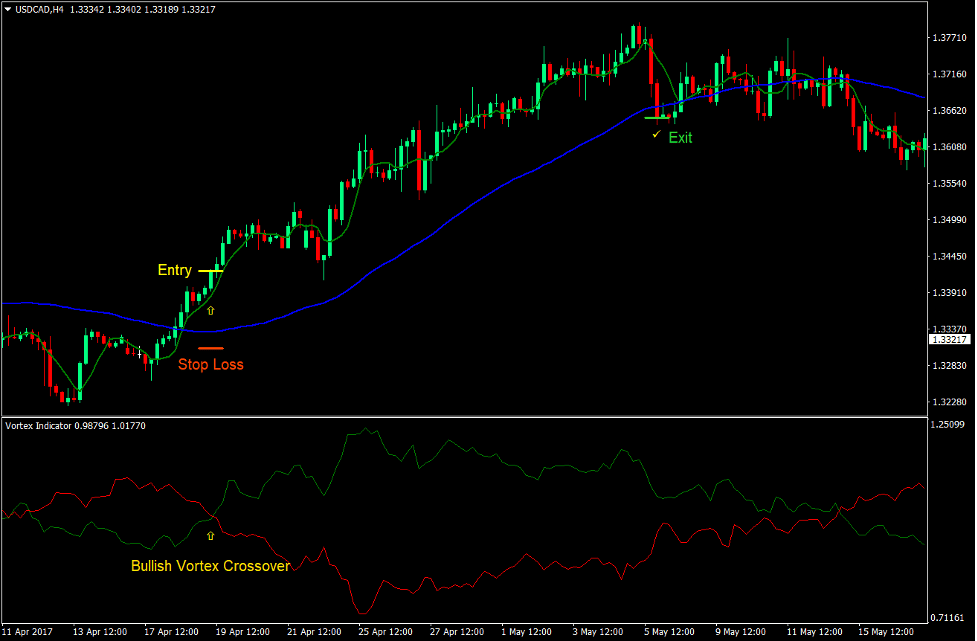

Buy Trade Setup

Entry

- Price should cross above the 50 SMA line (blue).

- As price crosses above the 50 SMA line, candles should be characterized by strong bullish momentum.

- The 5 VWMA line (green) should cross above the 50 SMA line.

- On the Vortex Indicator, the VI+ line (green) should cross above the VI- line (red).

- These bullish signals should be closely aligned.

- Enter a buy order on the confirmation of the conditions above.

Stop Loss

- Set the stop loss on the fractal below the entry candle.

Exit

- Close the trade as soon as price closes below the 50 SMA line.

- Close the trade as soon as the VI+ line crosses below the VI- line.

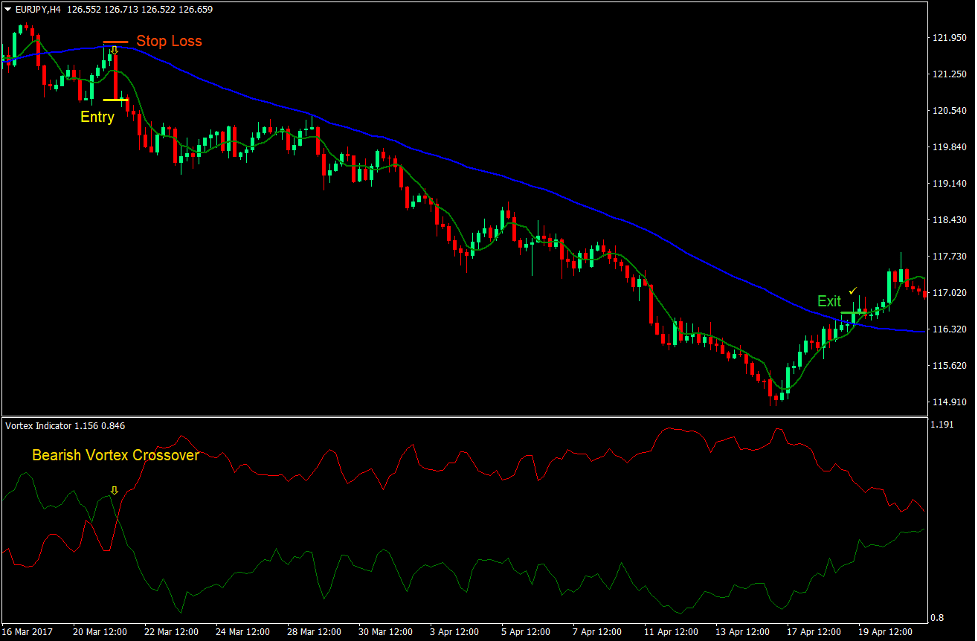

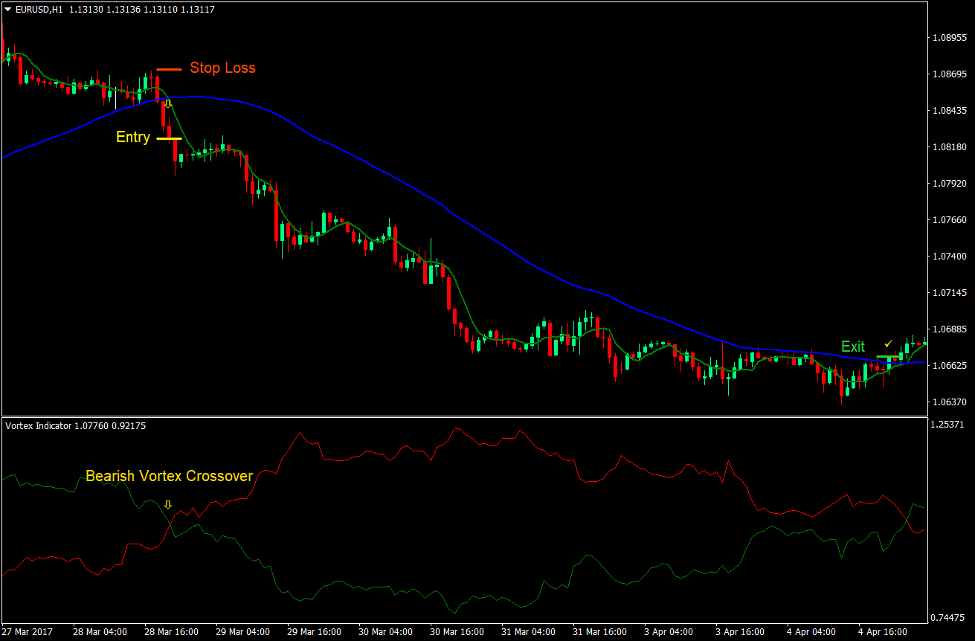

Sell Trade Setup

Entry

- Price should cross below the 50 SMA line (blue).

- As price crosses below the 50 SMA line, candles should be characterized by strong bearish momentum.

- The 5 VWMA line (green) should cross below the 50 SMA line.

- On the Vortex Indicator, the VI+ line (green) should cross below the VI- line (red).

- These bearish signals should be closely aligned.

- Enter a sell order on the confirmation of the conditions above.

Stop Loss

- Set the stop loss on the fractal above the entry candle.

Exit

- Close the trade as soon as price closes above the 50 SMA line.

- Close the trade as soon as the VI+ line crosses above the VI- line.

Conclusion

This trading strategy works well during trend reversals, breakouts from an opposing support or resistance line, or breakouts from congestions.

The key to trading this strategy successfully is in finding confluences. Signals coming from individual indicators that occur close to each other tend to signify strong momentum. As such, trading on confluences often has a higher probability of a win compared to signals that are far apart.

Another important skill to develop when trading this strategy is trade management. Traders should be able to exit trade while in profit and exit trades immediately when the market is showing signs that price is not moving in your favor.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: