Trend Following Trading Strategy Using Stochastics Charts

A wise man once told me, “The trend is your friend!” Nah, I just read it somewhere. But in trading though, this trite saying is said again and again because it’s true. The trend really is your friend when it comes to trading. Go against it and you’ll be facing an uphill battle.

Another wise man also told me, “Buy low, sell high!” Nah, I don’t know many wise men in trading. But again, it is also as true as it can be. The only way to make money in trading is to buy low and sell high, or sell high and buy low.

The thing is, both wisdoms of the wise go against each other. Usually, you either “trade with the trend”, or “buy low and sell high”. What we are gonna do is we are gonna marry the two. We are going to “trade with the trend” and at the same time “buy low and sell high”.

How to Identify the Trend?

The first thing that we would need to know is how to identify the trend. How else can we trade with the trend if we do not know what the trend is.

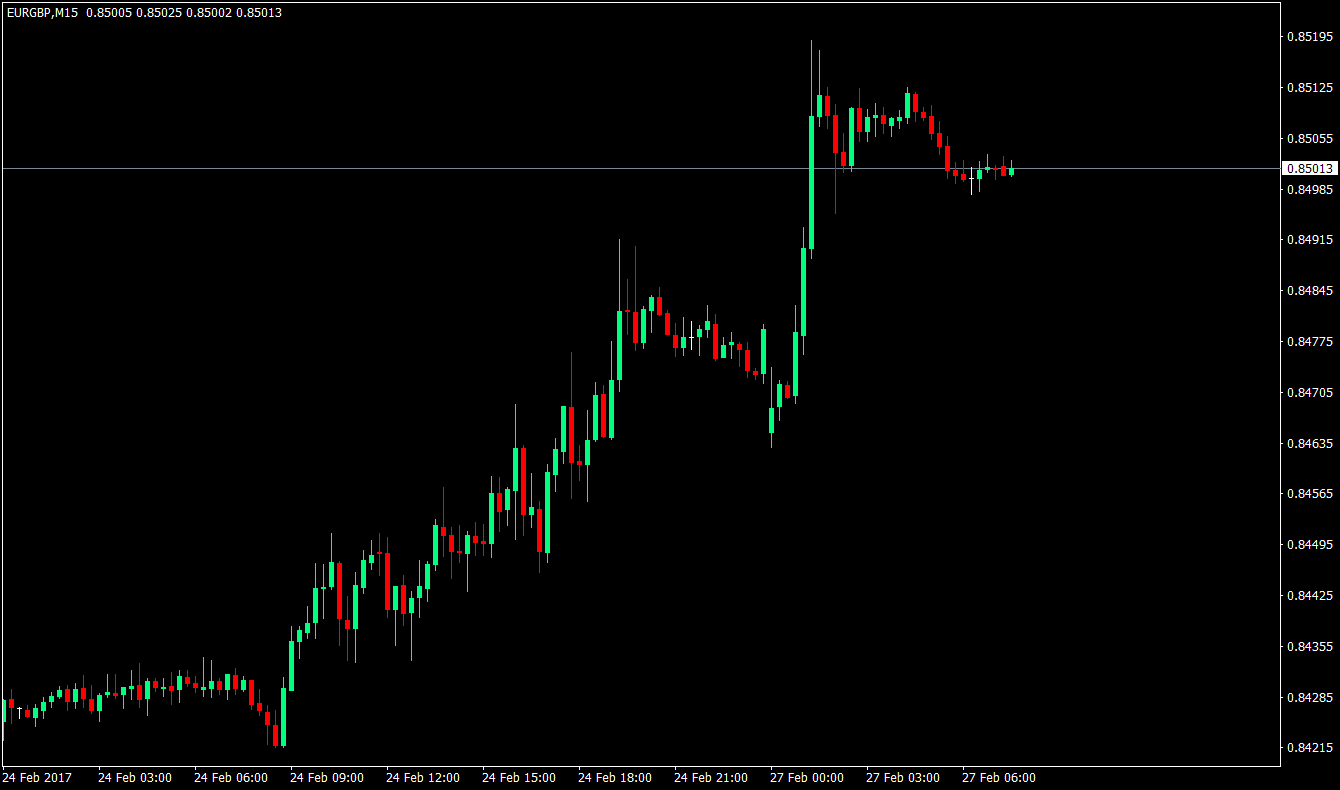

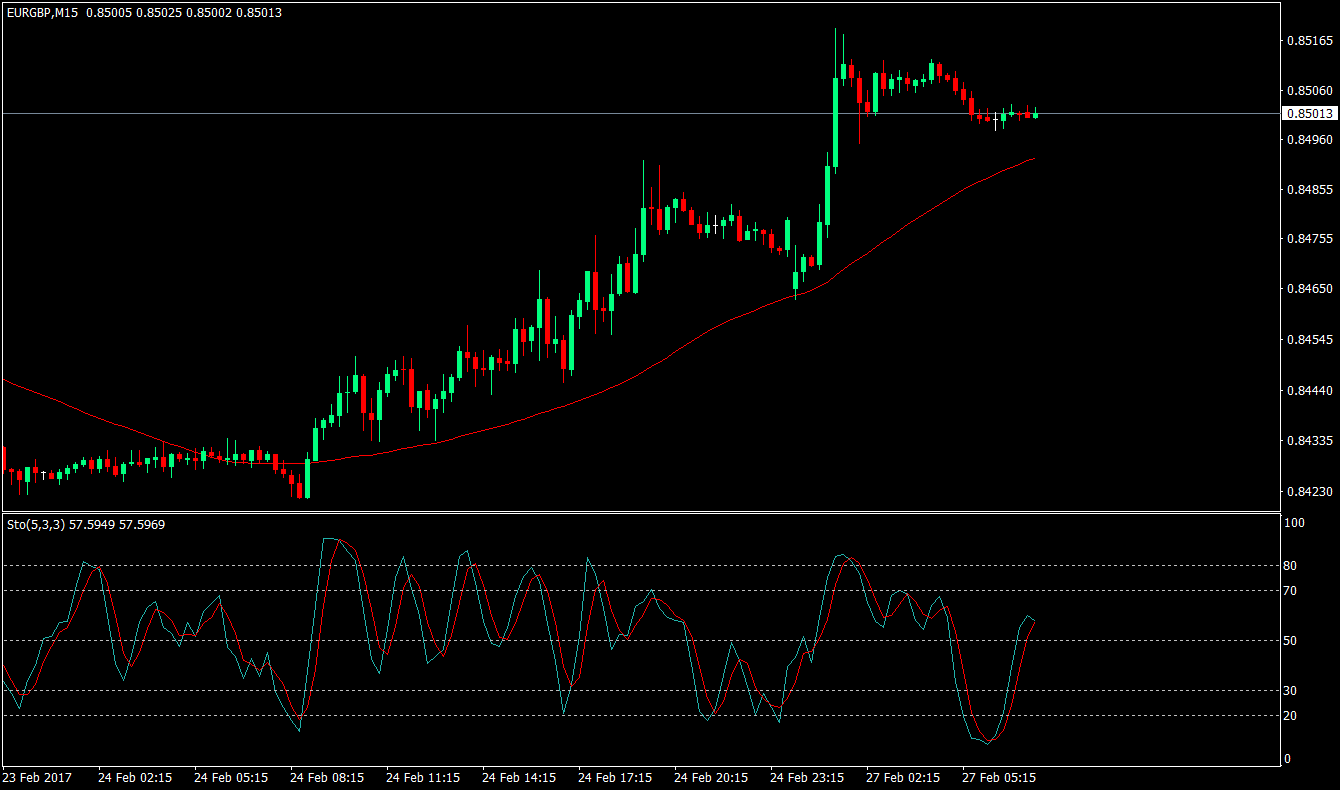

Can you identify the trend on this chart below?

Trained eyes could easily identify it is going up. But to the untrained eye, it would be a little harder to decide.

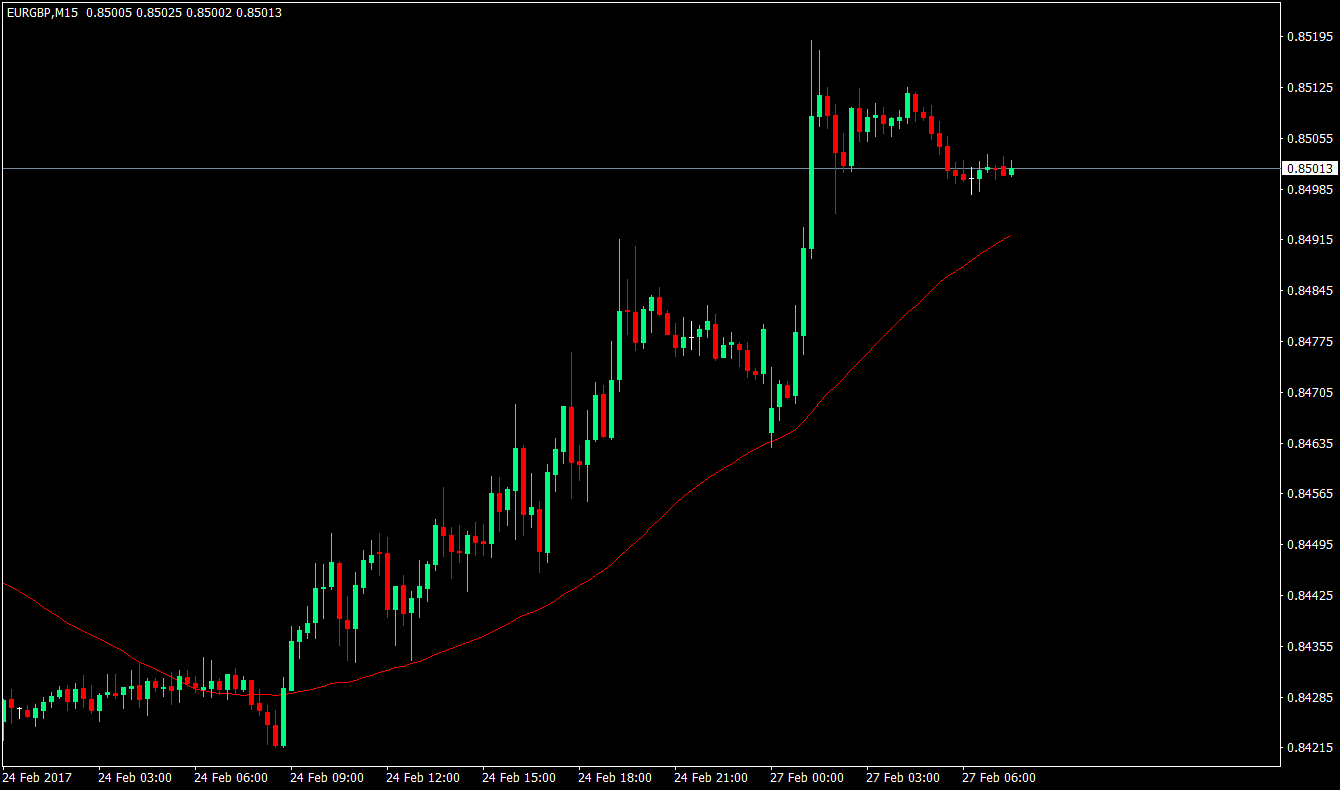

Just a little trick to make things easier for you to identify the trend, use a 50 Exponential Moving Average (EMA). If price is above the 50 EMA, then the trend is up. If the price is below the 50 EMA, then the trend is down.

Does that line make things easier to decide which way the trend is going?

Now, one important rule if we are using a trend following strategy. Don’t enter the market selling if the trend is up. And don’t enter the market buying when the trend is down. That wouldn’t be a trend following strategy if you do the opposite. Yes, you could still make money out of those little corrections, but that is not what we want to discuss here.

How to “Buy low, sell high” and vice versa?

As promised earlier, we will marry the two wise sayings. Now that we know how to identify the trend, the thing that we should know is when to buy. To make money in trading when the trend is going up, we would have to buy on the slight cheapening of price so that we could join in the party. How do we do that? Oscillator type of indicators.

Oscillators are indicators that bob up and down a graph. The advantage of using oscillators is that we would have a clue if price is considered cheap or expensive.

One of the more popular oscillators is the Stochastic indicator.

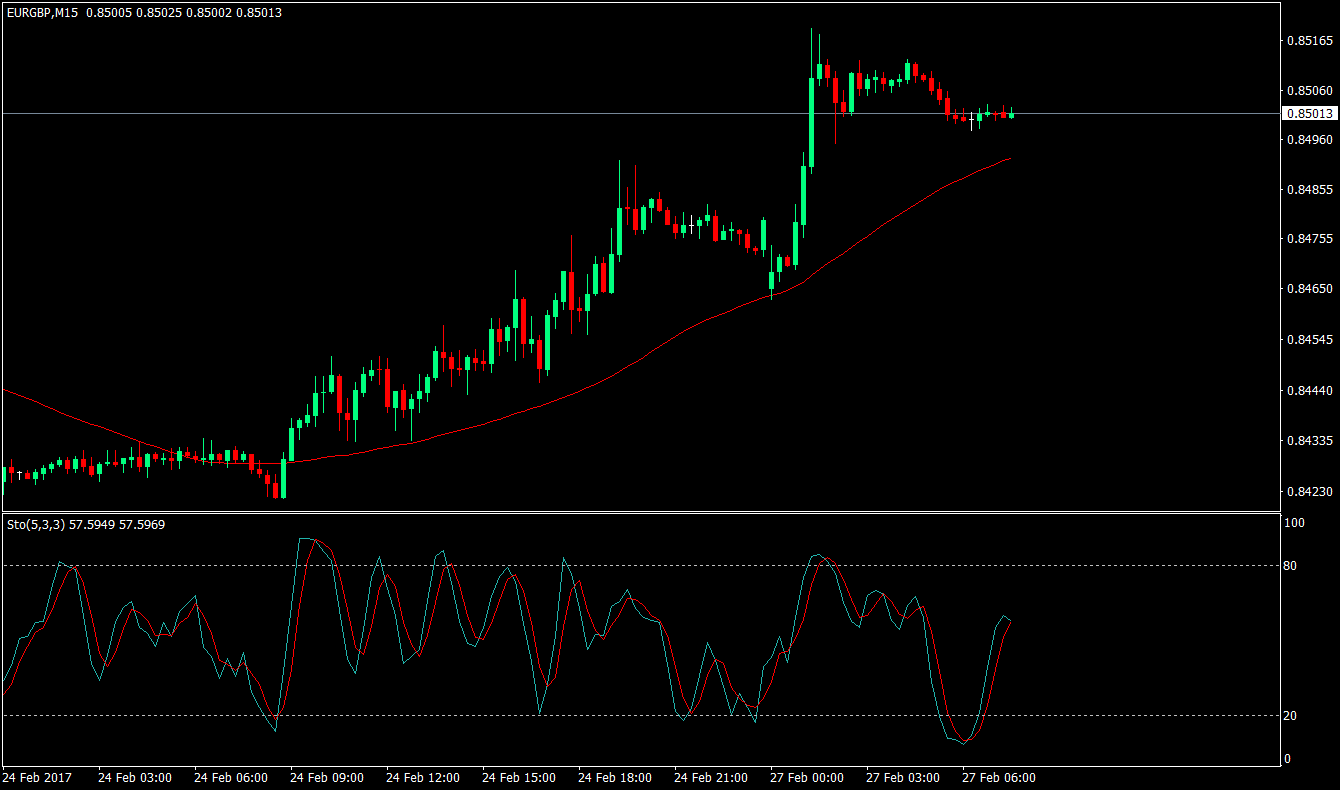

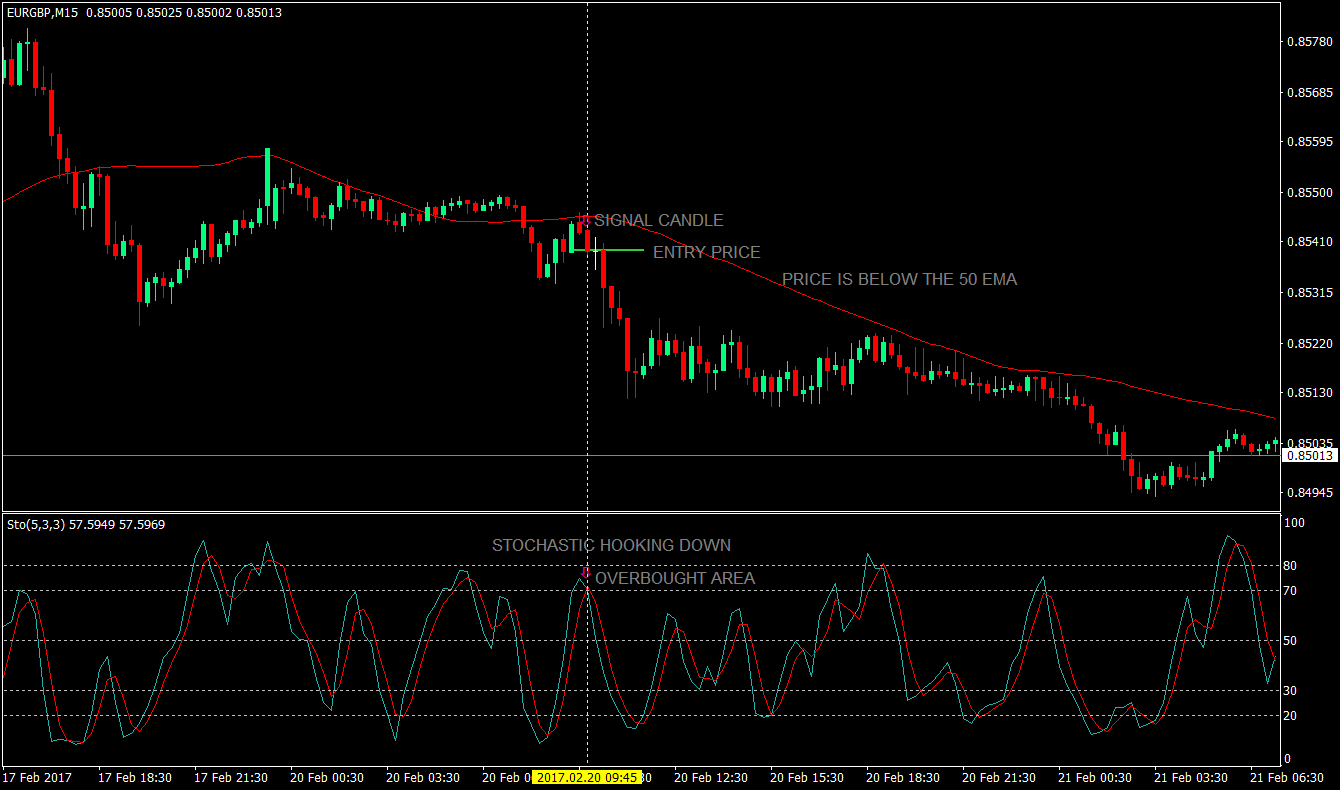

Here you would see how a Stochastic Oscillator looks like. If the stochastics is above or near the 80 line, you could consider price expensive and expect it go back down soon. If the price is below or near the 20 line, then you could guess it is cheap and might go back up soon. The thing though is that price usually don’t cross these lines going the direction of the trend on a trending market. To make things slightly easier, we added the 20 and 70 line to indicate the area where it is still acceptable to enter a trade. The space above the 70 line would be considered overbought, while the space below the 30 line would be considered oversold.

The good thing about the stochastic oscillator is that it also accounts for the slight movements of price. This way we would now if price is slightly cheapening or getting expensive, even in a trending market or currency pair. Other late reacting oscillator indicators can’t give you the benefit of trading on slight movements and retracements of a trending currency pair because those little fluctuations won’t be as visible as a stochastic oscillator.

Another advantage of the stochastic indicator is that it could tell you when price is reversing on those little fluctuations. The light green line is the faster reacting line, while the red line is the slower one. You would know that price is reversing downwards if the faster stochastic line is crossing and hooking the slower stochastic line. If the faster stochastic line is crossing and hooking the slower stochastic line upward, that would indicate that price is turning upward.

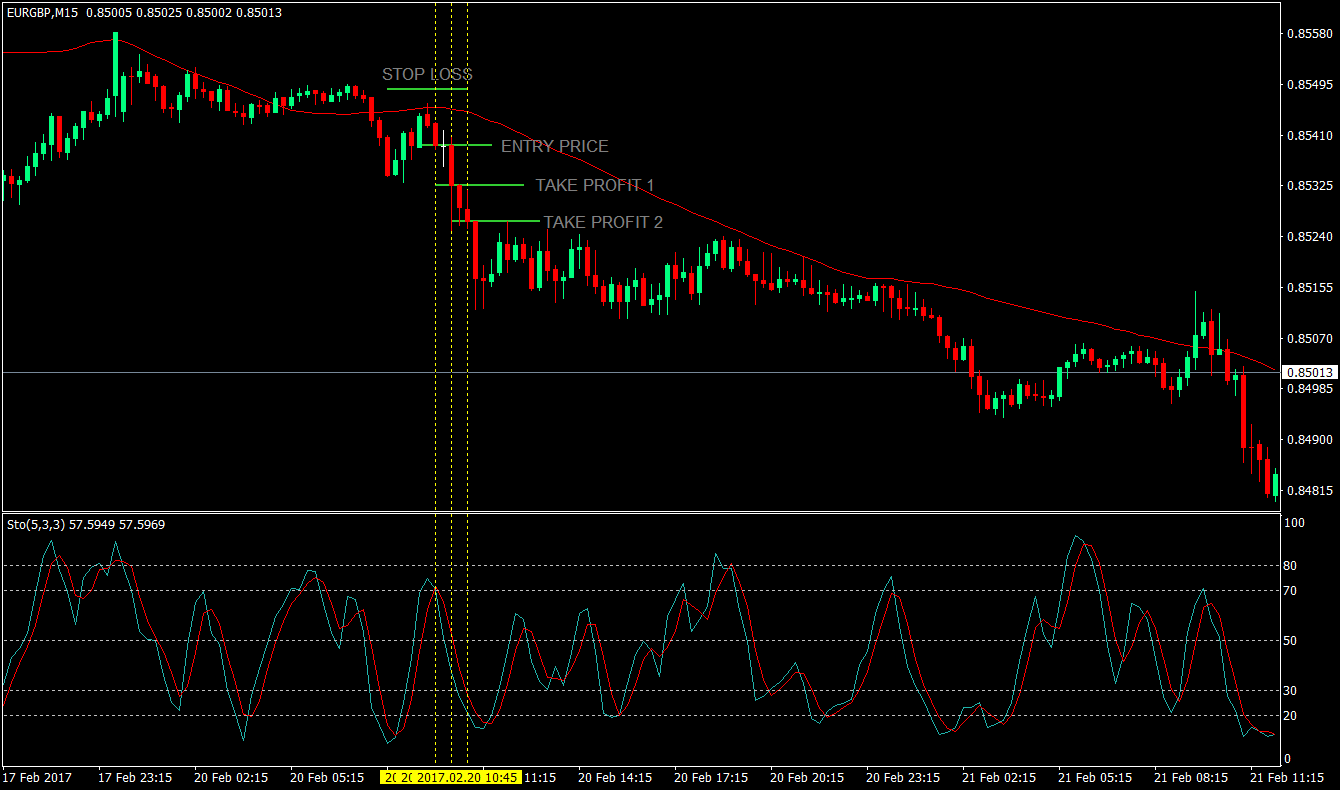

The Entry

So, the rule is to trade going the direction where price is. If price is above the 50 EMA, we only take buy trades. If the price is below the 50 EMA, we only take sell trades. This is how we trade with the trend.

Rule No. 2 is to trade only when the stochastic oscillator is on the overbought or oversold area. In an uptrend, we buy only when the oscillator is below 30. And in a downtrend, we sell only when the price is above the 70 line.

Rule No. 3, trade when stochastic lines are crossing or hooking over. In an uptrend, we will wait for the stochastics to hook upward. In a downtrend, we will wait for the stochastics to hook downward.

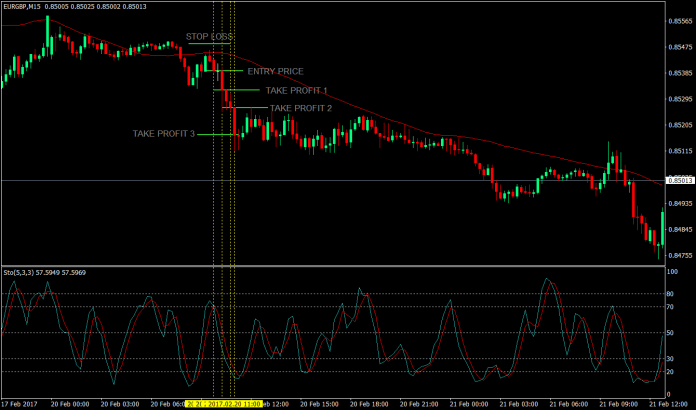

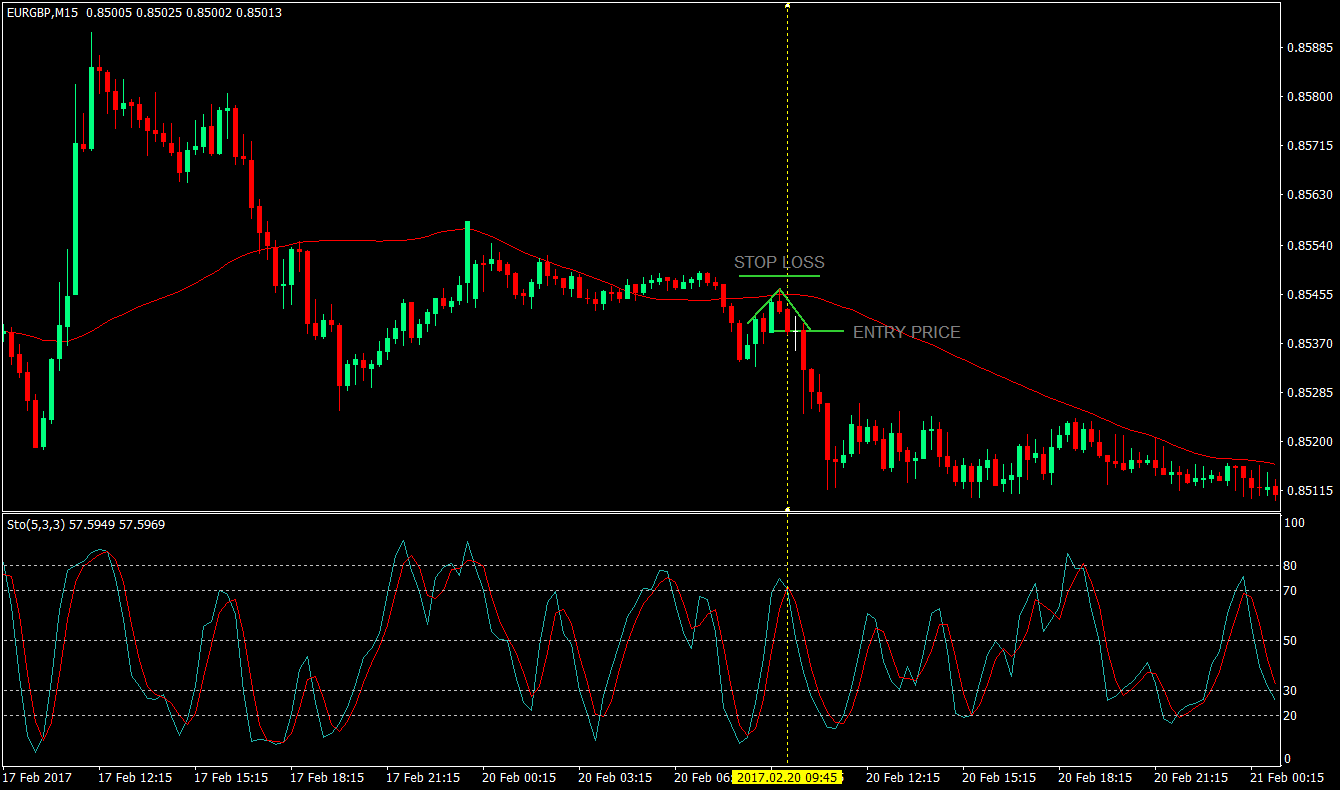

The Stop Loss

The Stop-Loss should be a few pips above the peak of the fractal formed by price coming down. Fractals are small higher-highs or lower-lows, which are natural support and resistance levels. For price to be strongly breaking these levels means that price might already be changing directions.

Another important exit plan though is that if ever the price would strongly cross the other side of the 50 EMA, we should manually close our position, since it is already indicative that the trend might start moving the other direction.

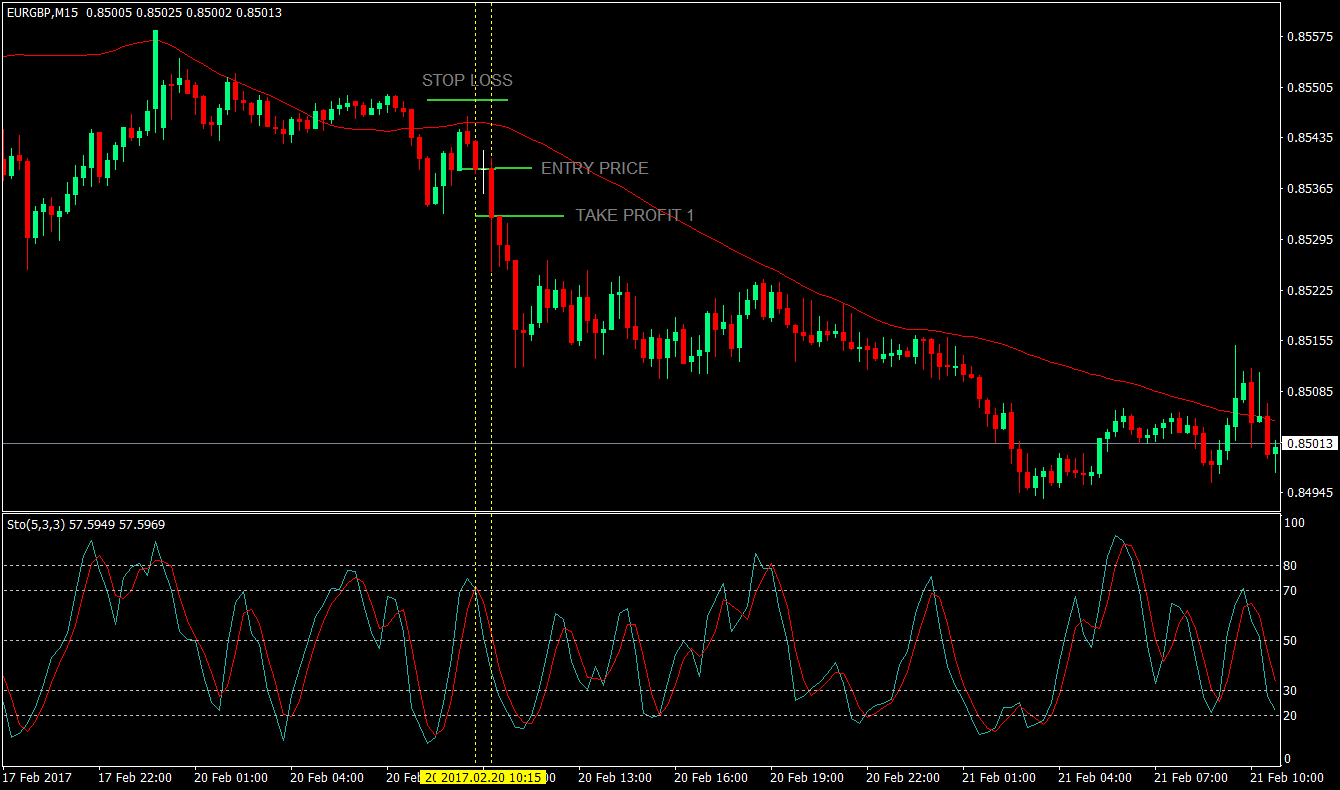

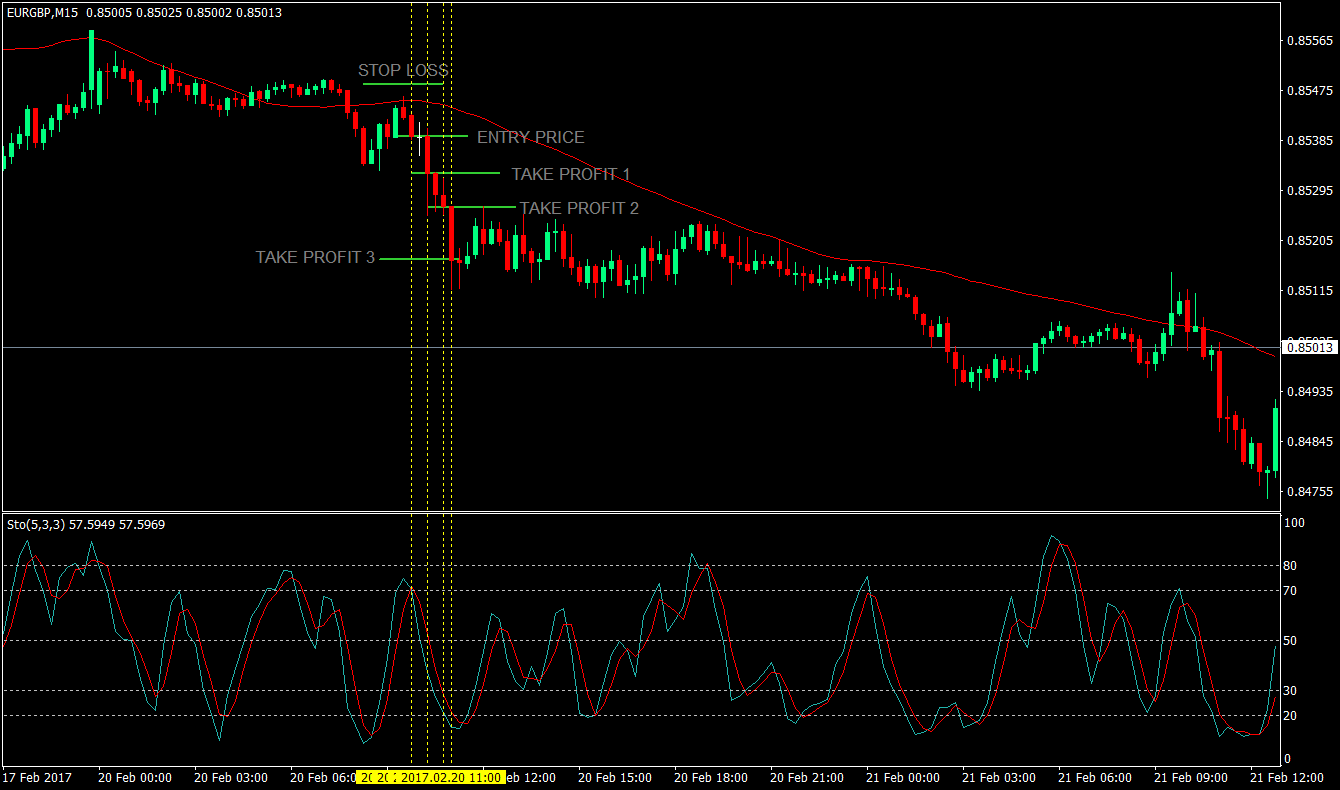

The Take Profit

With this strategy, we will be doing manual closing of positions for our taking profits. This means we will not have a hard and fixed Target Price. We will let the market tell us how much it wants to give us, and this will all be based on our Stochastic Indicator.

Our first Take Profit would be when the slow stochastic indicator crosses the 50 line. This will constitute 50% of our trade, thus leaving 50% for more probable income.

On a sell trade, our next Take Profit would be when the slow stochastic crosses the 30 line or on a buy trade, when the slow stochastic crosses the 70 line. Here, we will be closing 30% of our position, leaving just 20% for the homerun.

Our final take profit, on a sell trade would be when the slow stochastic touches the 20 line, or on a buy trade, the 80 line. This is because anything beyond that would be considered as oversold or overbought. This would be the last 20% of our trade.

Conclusion

Trend following strategies are usually easier to do as compared to reversal strategies. However, trading on reversals allows traders to “buy low and sell high” or vice versa. Using Stochastic Oscillators allow us to do both at the same time. Plus, we also have the advantage of letting the market tell us when it is time to get out of the market, letting us squeeze a little bit more pips out of the trade.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: