Octopus Cross Forex Trading Strategy

Crossover strategies are a staple in the trading world, even in forex trading. This is probably due to the fact that crossover strategies are very simple and easy to follow. Perhaps most traders would get acquainted to crossover strategies in one way or another, especially newbies.

What is a Crossover Strategy?

A crossover strategy is basically a trading strategy based around taking trades as two or more moving averages crossover.

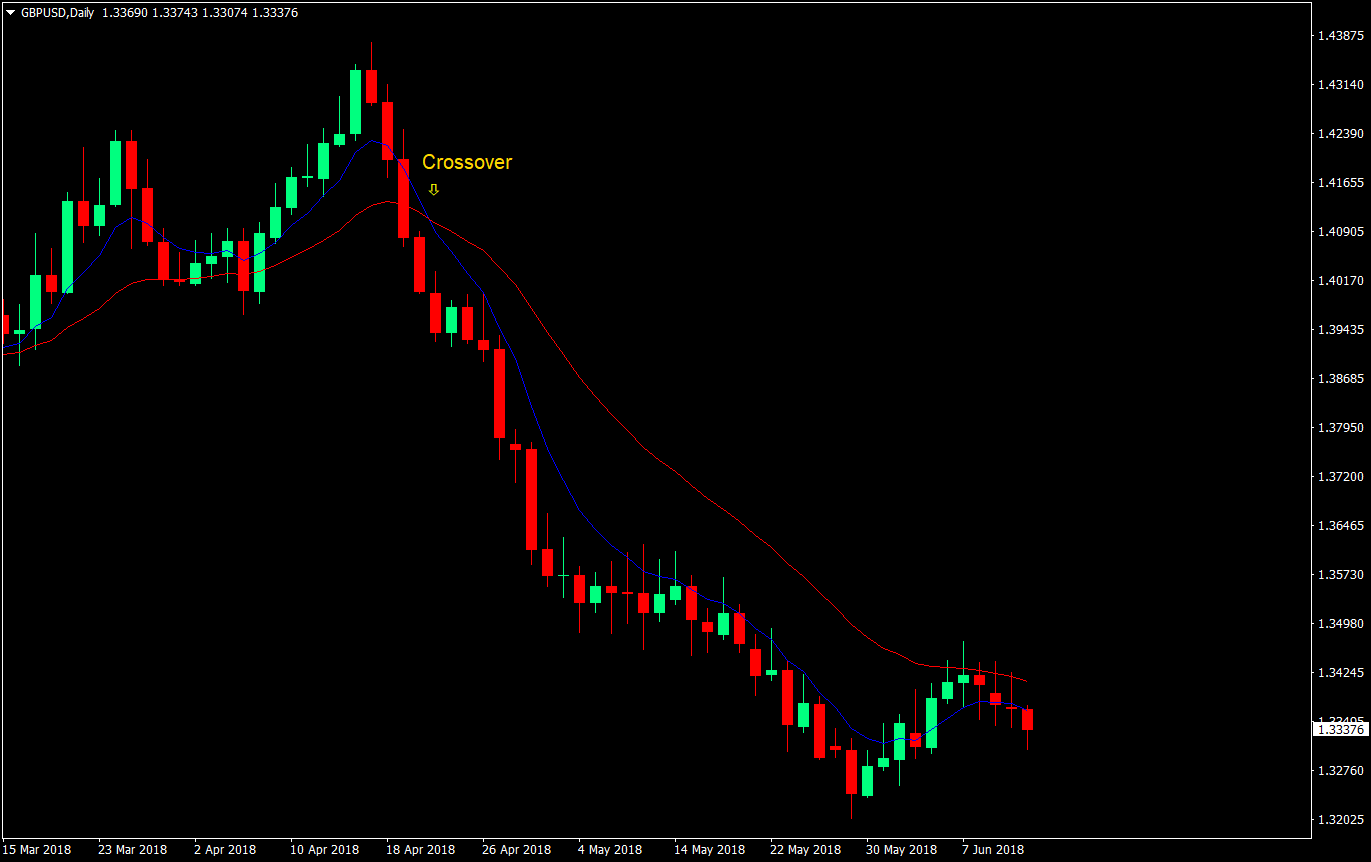

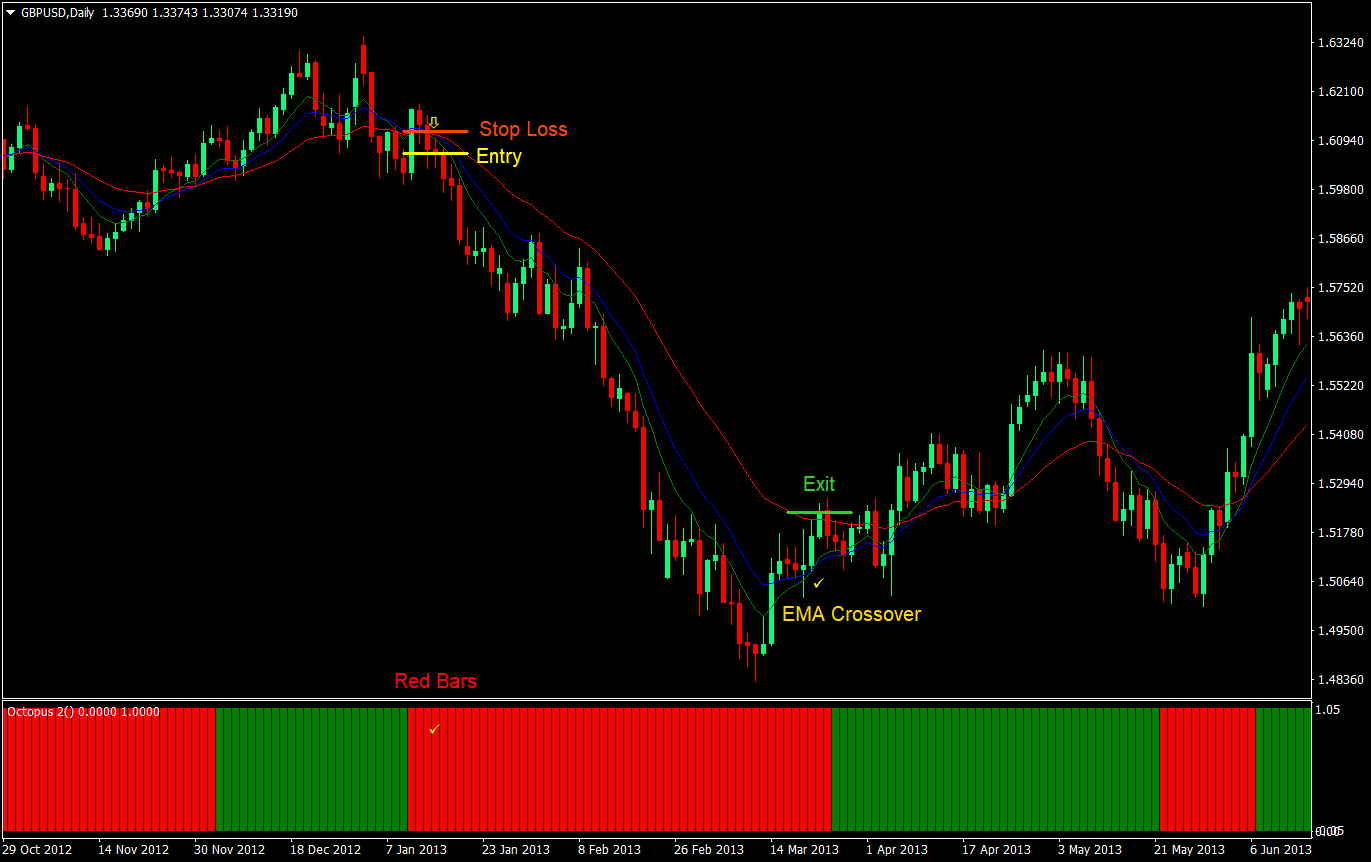

For example, let’s take a crossover of two Exponential Moving Averages (EMA), a 7-period EMA and a 21-period EMA. Whenever the 7 EMA crosses above the 21 EMA, we assume that the market is becoming bullish, thus we buy on the crossover. On the other hand, whenever the 7 EMA crosses below the 21 EMA, we sell the pair because we are assuming that a downtrend is taking place.

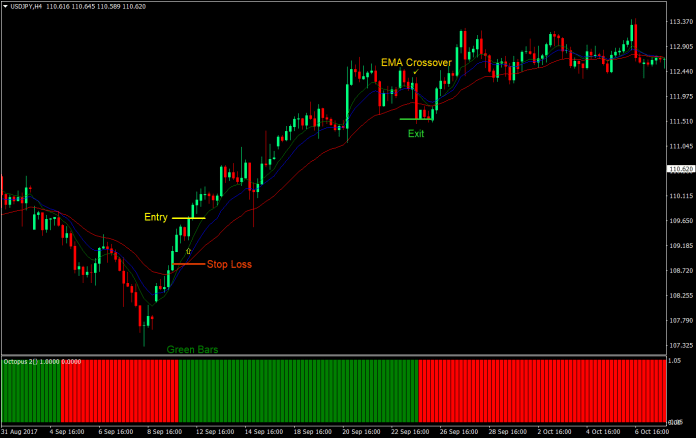

On the sample below, as the faster EMA crosses the slower EMA, we take a sell trade.

This is just a sample though of how a crossover strategy works.

In reality, crossover strategies do have a lot of false signals. At times, the new trend doesn’t last long enough and reverses right away causing a trader to lose. Worse, sometimes crossovers don’t even start a trend.

But are we to throw away this type of strategy?

Even with the above-mentioned weaknesses. Crossover strategies do excel at capturing large trends from start to finish. One of the way to make money out of crossover strategies is to filter crossover setups and not take everything that comes your way.

Trading Strategy Concept

Knowing that in some way or another, we would have to filter our trade setups, we will make use of a custom indicator to filter our trades.

The indicator that we will be using is the Octopus 2 custom indicator. This indicator seems to excel in determining direction bias, which would be great in filtering out crossover setups.

As for our moving averages, we will be using three exponential moving averages. This approach will allow us to filter even more trades as what we are looking for is for the moving averages to be stacked properly before we enter a trade.

Indicators:

- 8-period EMA: Green

- 13-period EMA: Blue

- 28-period EMA: Red

- Octopus 2 custom indicator

Timeframe: 1-hour chart and above

Currency Pair: any

Trading Session: any

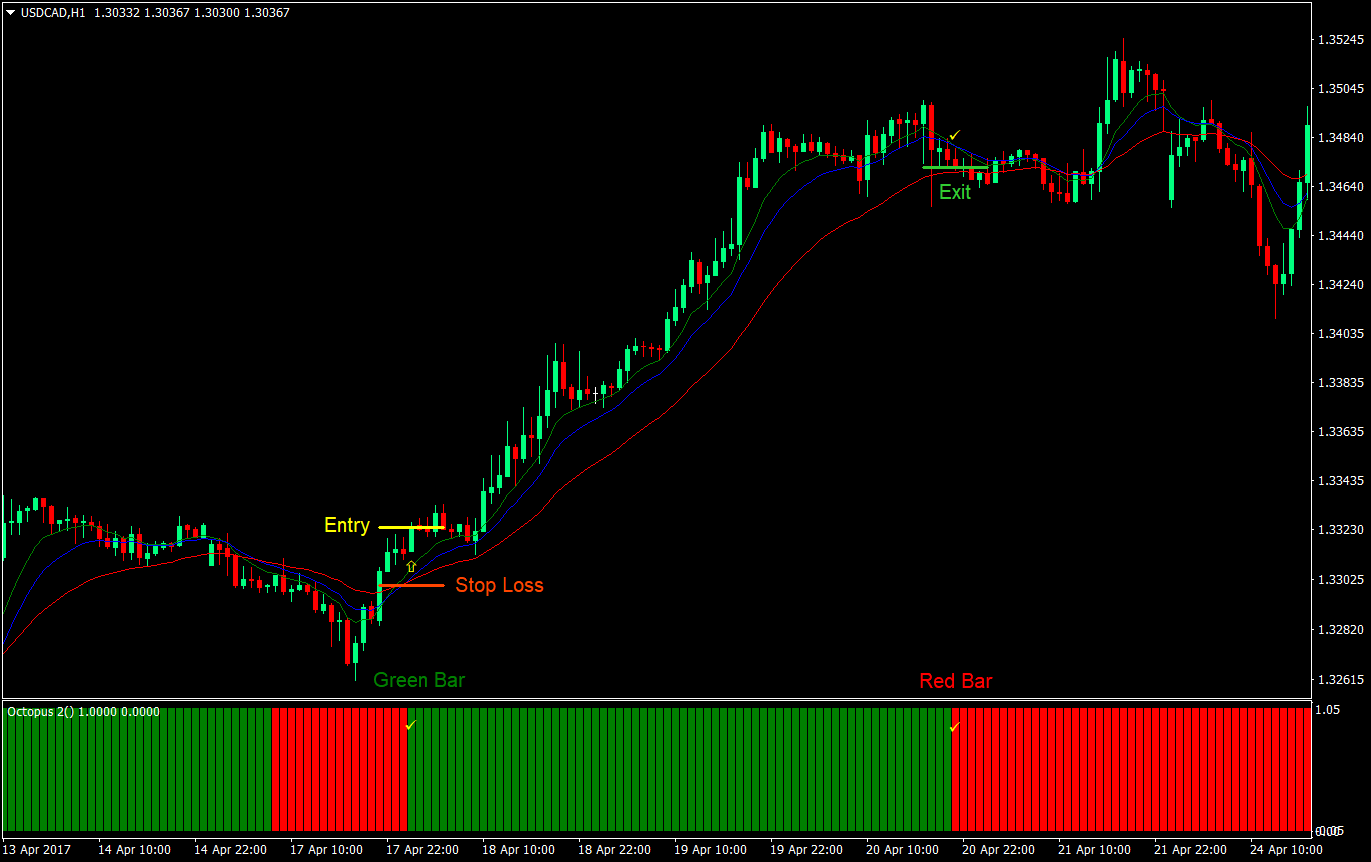

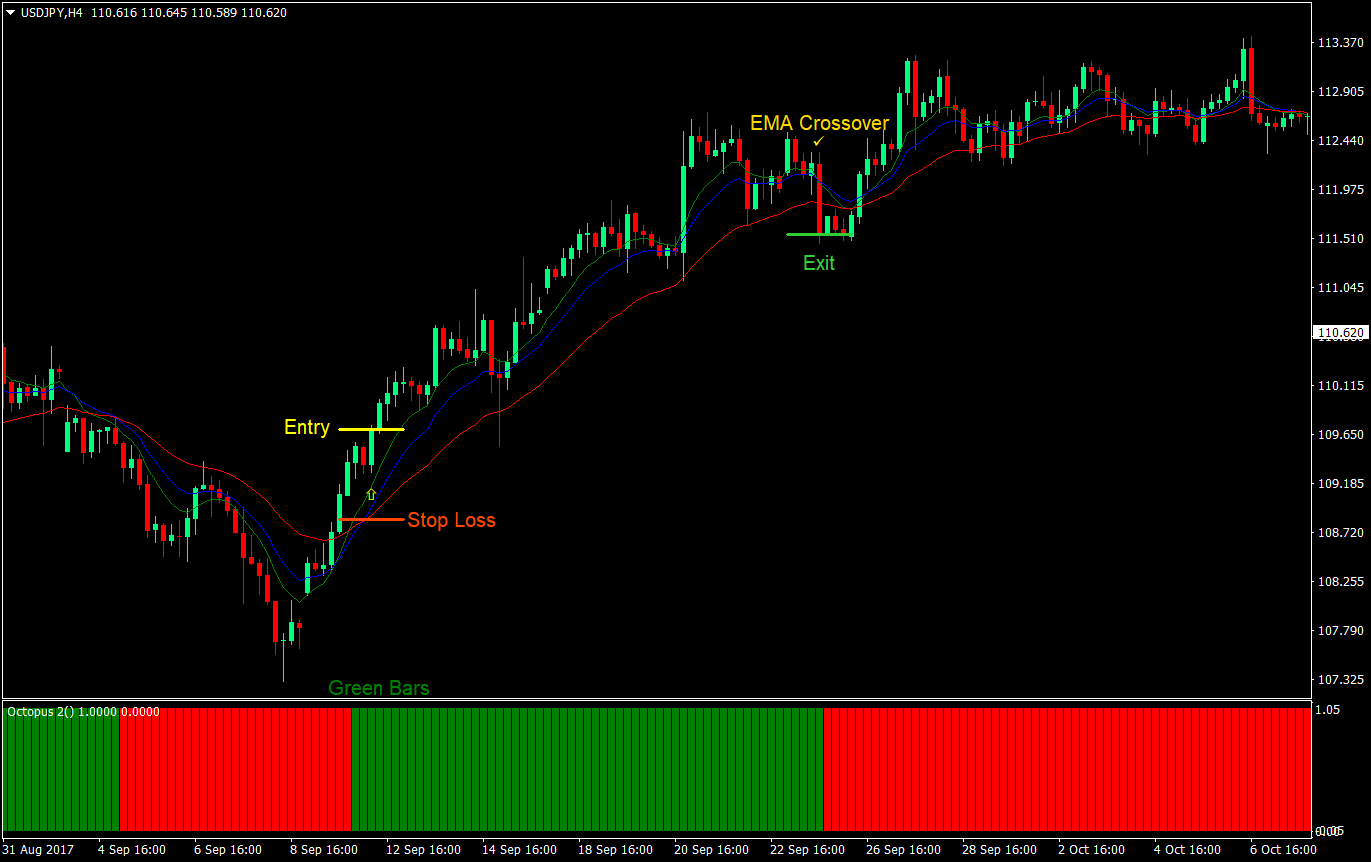

Buy (Long) Trade Setup Rules

Entry

- The Octopus 2 indicator should be printing green bars indicating a bullish bias

- The moving averages should crossover and stack in the following order

- 8 EMA: top

- 13 EMA: middle

- 28 EMA: bottom

- Enter a buy market order at the confluence of the above rules

Stop Loss

- Set the stop loss below the moving averages

Exit

- Close the trade if any of the two scenarios occur:

- Octopus 2 indicator starts printing red indicating a change in bias

- A crossover among the EMAs occur disrupting the proper order of the EMA stack

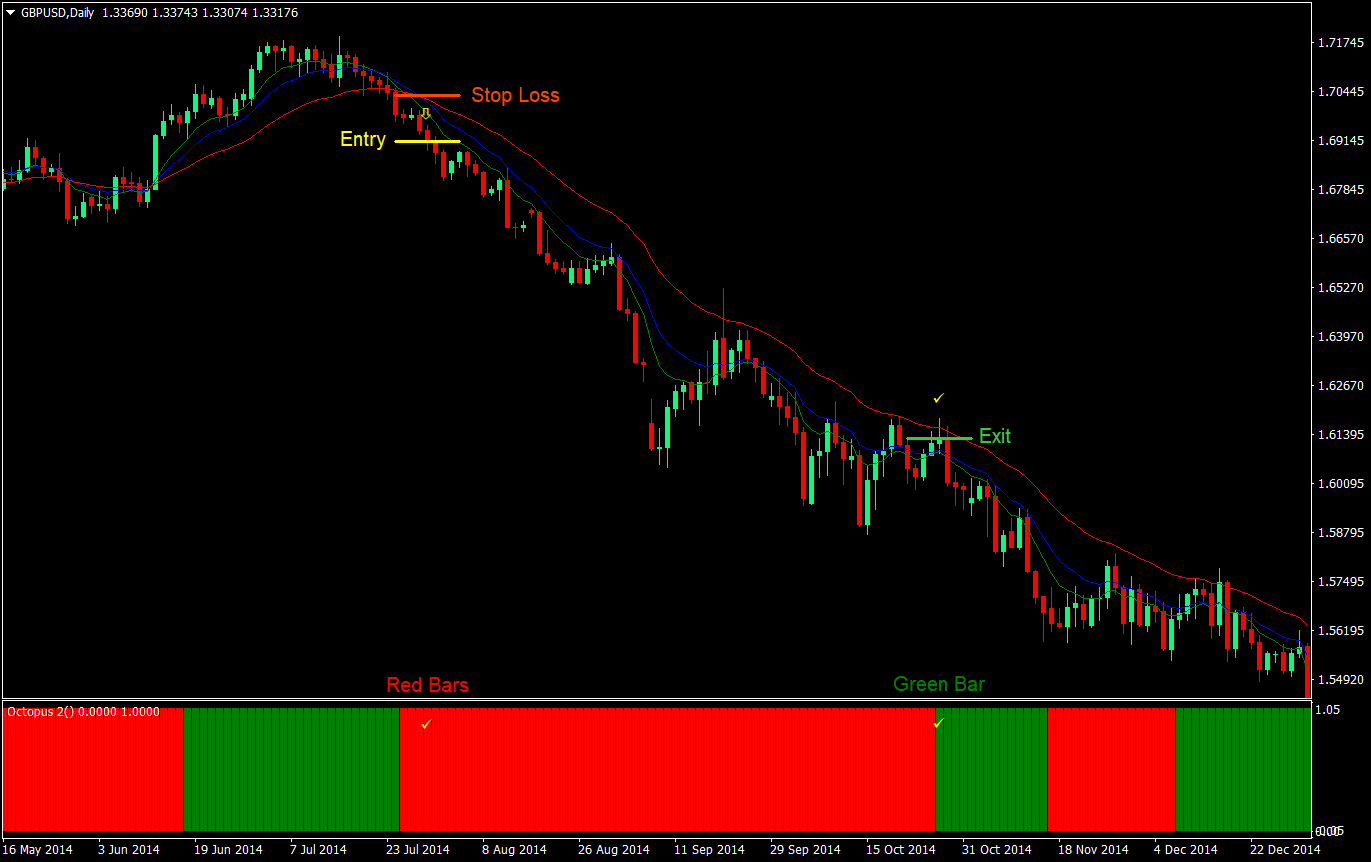

Sell (Short) Trade Setup Rules

Entry

- The Octopus 2 indicator should be printing red bars indicating a bearish bias

- The moving averages should crossover and stack in the following order

- 28 EMA: top

- 13 EMA: middle

- 8 EMA: bottom

- Enter a sell market order at the confluence of the above rules

Stop Loss

- Set the stop loss above the moving averages

Exit

- Close the trade if any of the two scenarios occur:

- Octopus 2 indicator starts printing green indicating a change in bias

- A crossover among the EMAs occur disrupting the proper order of the EMA stack

Conclusion

This is a simple crossover strategy that does work. It is not perfect. There will be failed trades, but in the long run, the profits of the gainers should be big enough.

One of the strengths of this strategy is that many of the low probability trades are filtered out due to the Octopus 2 indicator. By filtering out trades that are going against the current market bias, we end up having higher probability trades that could give us a homerun.

Speaking of homeruns, this strategy also excels in catching the whole trend from start to finish. This is because the moving averages being used are quite fast and responsive. This allows us to respond quicker as soon as a trend is starting to develop.

Not only does it allow us to catch a big chunk of the trend, it also allows us to risk less. If you would notice, much of the trades have very narrow stop losses compared to its gains. Because the moving averages are quite tight, placing the stop loss behind the moving averages would also give us a tight stop loss. This combination of large gains and tight stop losses allows us to have a good reward-risk ratio, which in most cases end up being more than 2:1.

This strategy is a good strategy to start from. Practice and master it and it may also bring you some profits.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: