Ichimoku Cloud Forex Trading Strategy

Many trend traders just don’t know when to trade a trend following strategy and when not to. They continue using a good, profitable strategy on the wrong market condition and end up losing money. But most trend trading strategies just don’t have a mechanism to tell you when not to trade. What if there is an indicator that works well with trending market conditions and has all these filters. It could tell you trend direction, entry signal and a filter not to trade if the market is not trending strong enough.

Ichimoku Kinko Hyo – The All in One Trading Indicator

When I first encountered this indicator, I have to admit, I didn’t give it a shot. It had too many lines that seemed too busy to me. Little did I know it could have made money for me. It probably is one of the few standalone indicators that could be profitable without using other indicators as filter.

So, how does it work.

The Ichimoku Kinko Hyo indicator is composed of several components, the Cloud (Kumo), Base Line (Kijun-sen), Conversion Line (Tenkan-sen), and the Lagging Span (Chikou Span). This may sound a lot, and it is, but all of it is relevant. These are basically variations of moving averages. Some are averages of midpoints, some are shifted, some are derivatives of the other lines.

First, the Cloud. The Cloud is composed of two lines, Leading Span A (Senkou Span A) and Leading Span B (Senkou Span B). This feature of the indicator dictates the trend direction or the main trend direction filter. There are two ways to identify trending direction using the Cloud. Trend direction could be identified using the location of price is relation to the Cloud. If price is above the Cloud, then we will only be looking for buy trades, if it is below the Cloud, we will be looking for sell trades. Another way to look at it is the crossover of the Leading Span A and Leading Span B. If Leading Span A is above the Leading Span B, then the market is said to be bullish, if it is in reverse, then the market is said to be bearish.

Then we have the Base Line and the Conversion Line. These two lines work in tandem with each other. These lines are the signal for entries. It works just like a regular crossover strategy. The Base Line is the slower line while the Conversion Line is the faster line. If the Conversion Line crosses above the Base Line, then we have a signal to buy. If it crosses below the Base Line, then it is a signal to sell.

Lastly, we have the Lagging Span. I think is the most important line that most trend trading strategies are missing. This is because the Lagging Span is basically a filter that should tell us if the market’s trend is about to end. It does this by shifting the plot of the current price action by several candles. The idea behind this is that if the Lagging Span starts to intersect with price, then the market’s trending environment might already be weakening because price is already catching up with it. It serves as a filter before the entry, but it could also serve as an early exit.

Indicator: Ichimoku Kinko Hyo

Timeframe: any

Currency Pair: any

Trading Session: Tokyo, London and New York

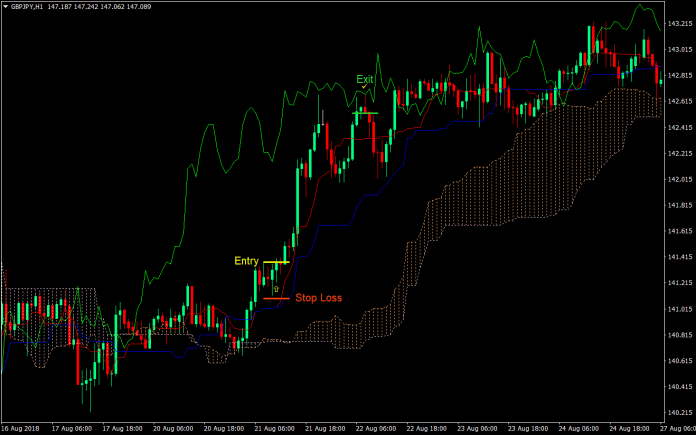

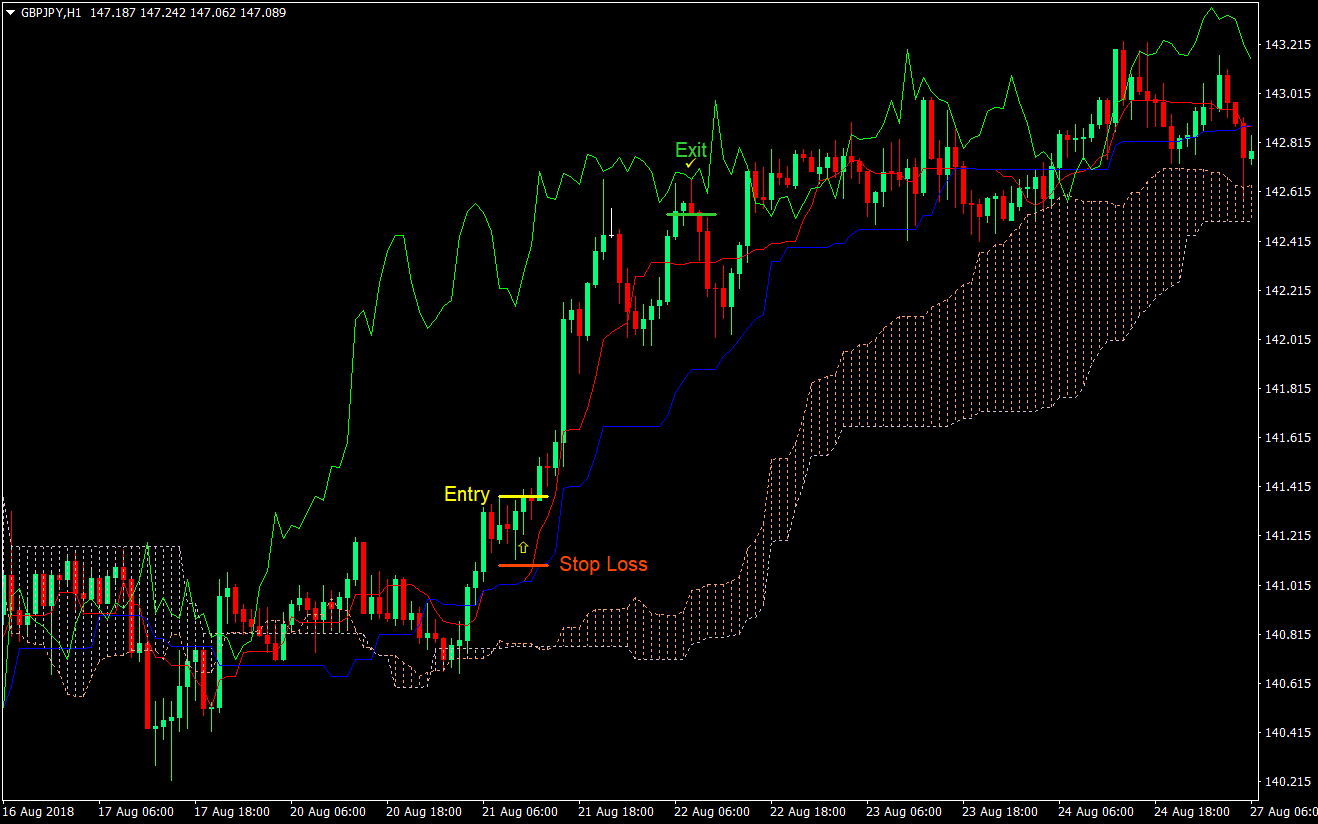

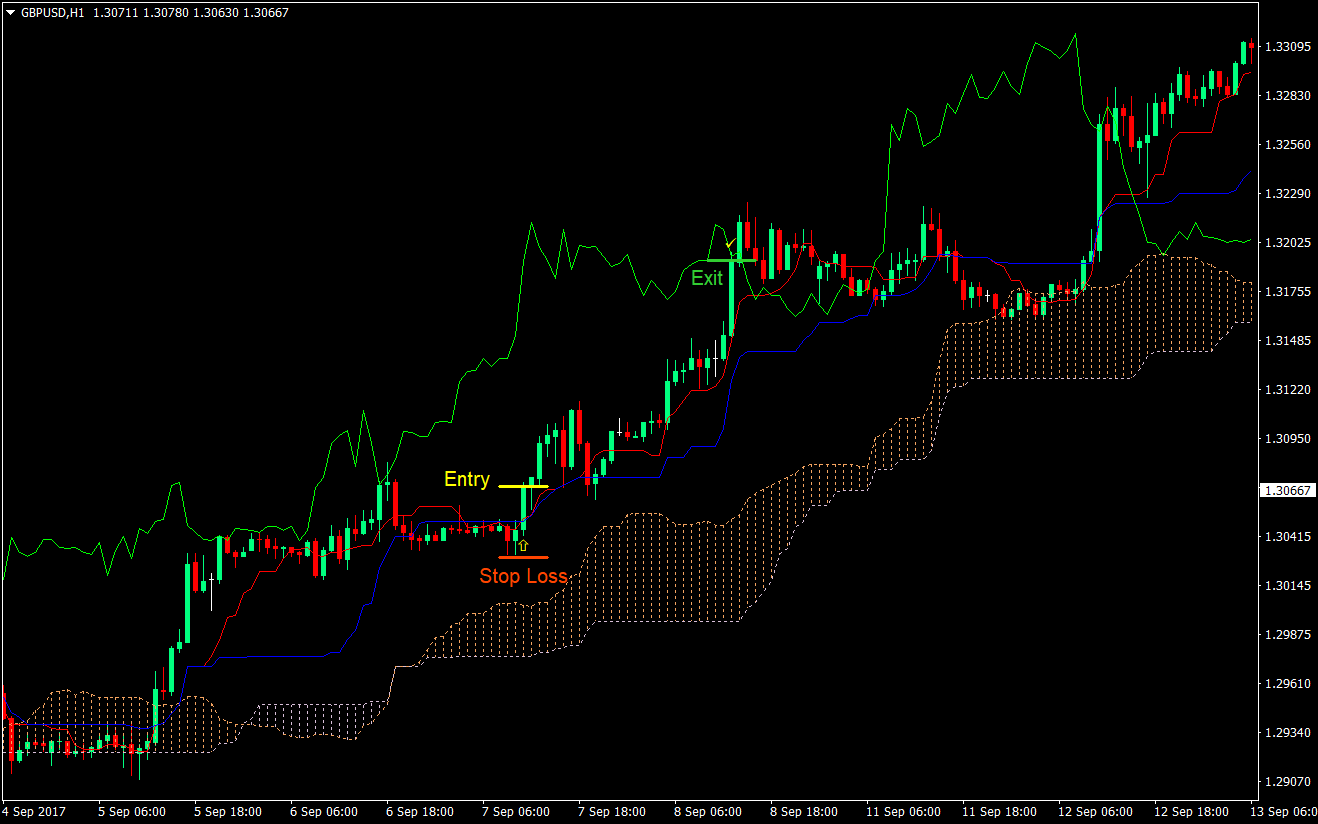

Buy (Long) Trade Setup

Entry

- The lines should all be fanning out with the cloud at the bottom, Base Line and Conversion Line at the middle and Lagging Span at the top

- Price shouldn’t be touching the Lagging Span

- Wait for price to retrace near the cloud

- Enter a buy market order as soon as the Conversion Line crosses above the Base Line

Stop Loss

- Set the stop loss at the swing low below the entry candle

Exit

- Close the trade as soon as price starts to touch the Lagging Span

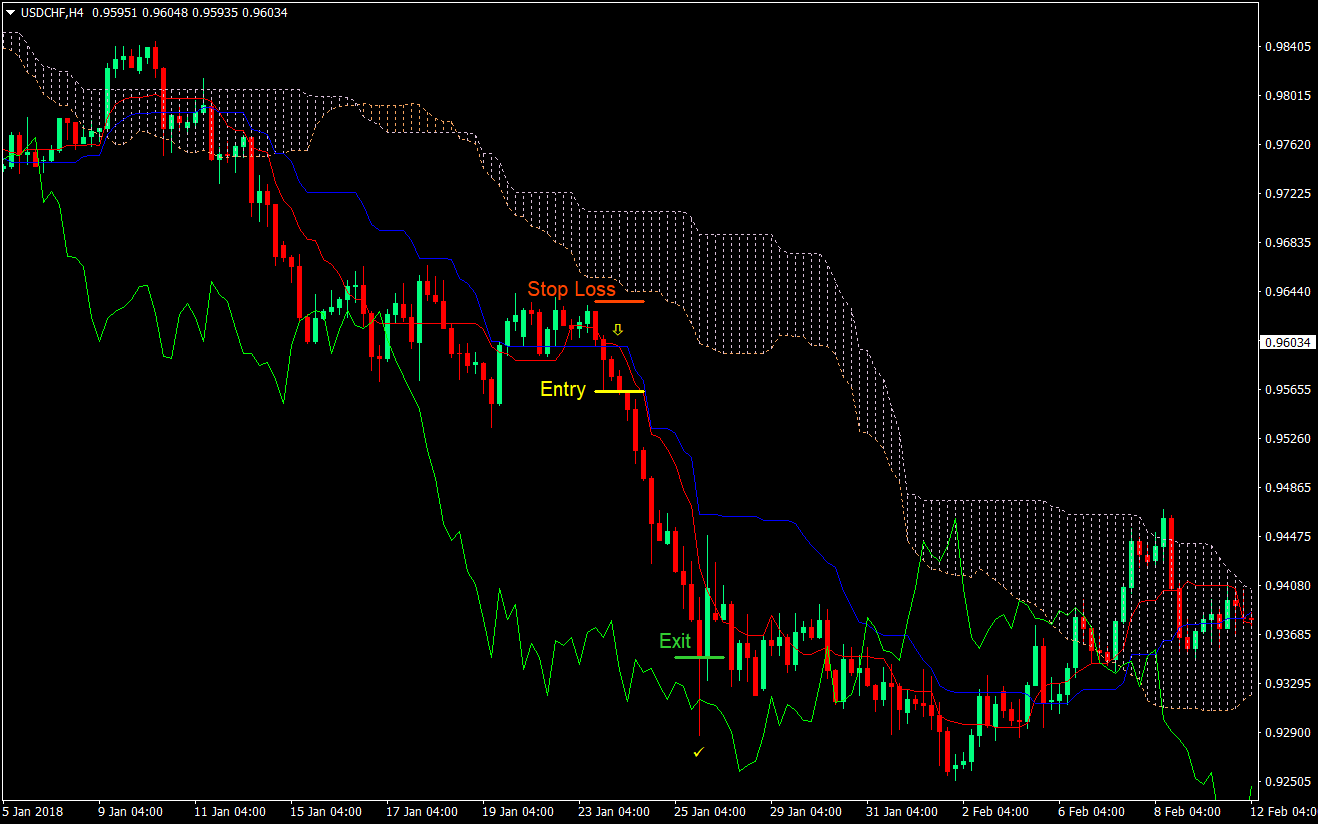

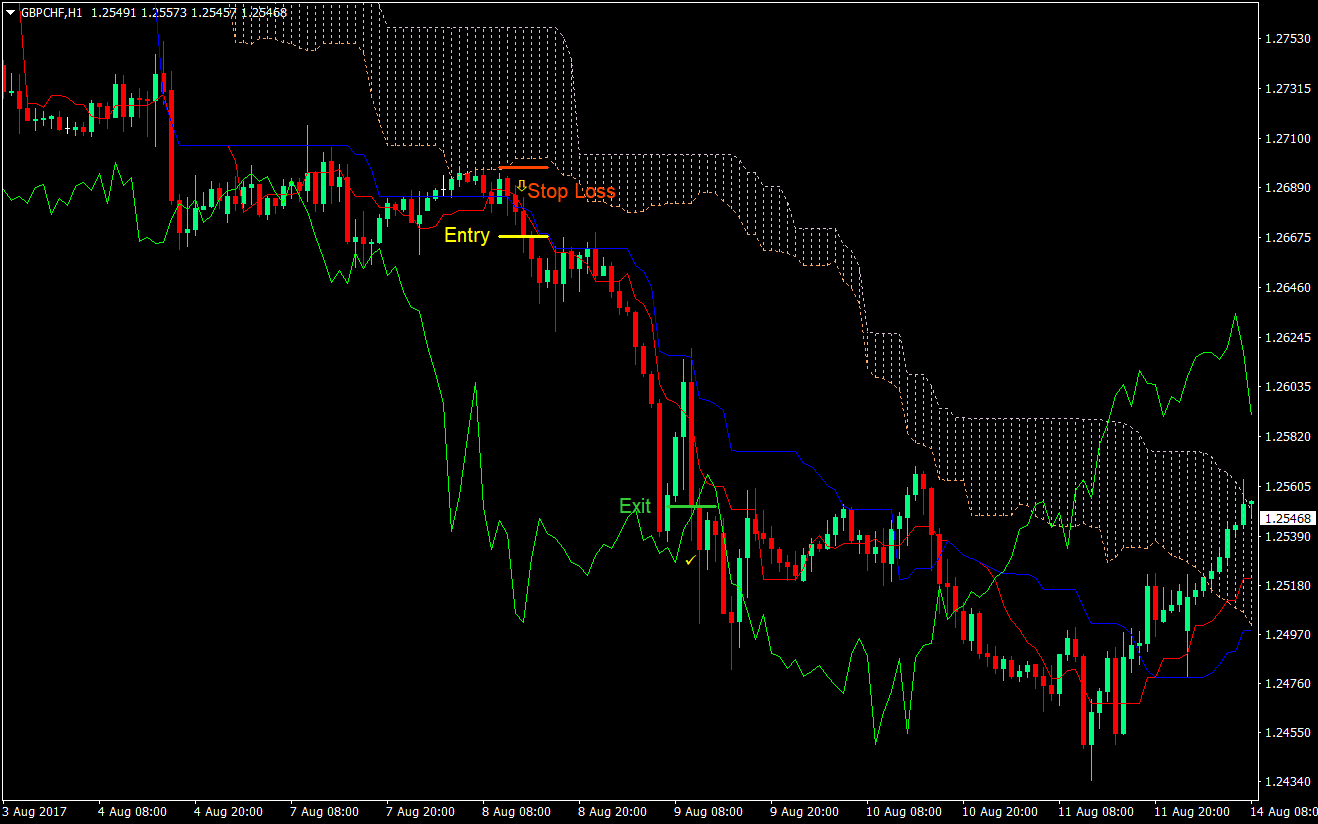

Sell (Short) Trade Setup

Entry

- The lines should all be fanning out with the Cloud at the top, Base Line and Conversion Line at the middle and Lagging Span at the bottom

- Price shouldn’t be touching the Lagging Span

- Wait for price to retrace near the cloud

- Enter a sell market order as soon as the Conversion Line crosses below the Base Line

Stop Loss

- Set the stop loss at the swing high above the entry candle

Exit

- Close the trade as soon as price starts to touch the Lagging Span

Conclusion

The Ichimoku Cloud tends to be a bit messy as an indicator. However, that is the point of this indicator. If as soon as you open a chart, you see a messy crisscross of lines, then leave it. That is not the chart that you should be trading at. On a trending market environment, the chart should have some order. If you stumble on that kind of chart, then wait for the entry.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: