Trading with the trend is one of the most basic prerequisites for a high probability trading strategy. Although there are other types of trading strategies that does tend to produce high probability trade setups aside from trend following strategies, trend following strategies do tend to produce very high probability trade setups. This is because trading with the trend implies that traders are trading in the direction of the market’s long-term momentum. Trading in the direction of the trend significantly increases the probability of a trading strategy. The only variable left to be answered would be when or where to take the trade.

However, many trend following traders also wrongly identify the direction of the trend. This is sometimes because some traders only focus on one aspect of a trend. It is either they are looking at the short-term trend or the long-term trend only.

One good practice is to first identify the direction of both the long-term trend as well as the short-term trend. When both of these trends are aligned, pointing the same direction, the general trend direction becomes clearer.

In this strategy, we will be looking at how the Ichimoku Kinko Hyo indicator can be used to identify the short-term and long-term trend.

Ichimoku Kinko Hyo

The Ichimoku Kinko Hyo indicator is a unique technical indicator because it is one of the few trend following technical indicators which could provide traders with a complete view of what the market is doing. It indicates trend direction based on a series of lines that are based on various medians of a price range within certain periods.

The Ichimoku Kinko Hyo indicator plots five lines.

Tenkan-sen or conversion line, plotted as a red line, is the median of price within the past nine periods. It represents the short-term trend.

The Kijun-sen or base line, plotted as a blue line, is the median of price within the last 26 periods. It represents the mid-term trend. Together with the Tenkan-sen line, the Kijun-sen can be used as a signal line or as a dynamic area of support or resistance.

Senkou Span A or leading span A, plotted as a dotted sandy brown line, is the average of the Tenkan-sen and the Kijun-sen plotted 26 periods ahead.

Senkou Span B or leading span B, plotted as a dotted thistle line, is calculated as the median of the price within the last 52 periods plotted 26 periods ahead.

The Senkou Span A and Senkou Span B form the Kumo or cloud, which represents the long-term trend.

Chikou Span or lagging span is the closing price of the current period plotted 26 periods back. This line can be used to identify choppy price action.

Fisher Indicator

The Fisher indicator is a custom technical indicator which converts price movement data into a Gaussian normal distribution. This allows traders to identify price extremes and proactively identify trend reversals coming from such price extremes. Traders can more easily identify reversal points in a price chart when used as a technical trading tool.

This indicator is an oscillator type of indicator which plots histogram bars around its median, zero. Positive lime bars indicate a bullish momentum, while negative red bars indicate bearish momentum.

This indicator can be used as a reversal entry signal based on the shifting of the bars provided that it is in confluence with other technical indicators which also identify trend direction.

Trading Strategy

Fisher Ichimoku Trend Forex Trading Strategy is a trend following strategy which is hinged on the concept of trading in the direction of the trend, which aligns both the long-term trend and short-term trend.

The long-term and short-term trends are both identified using the Ichimoku Kinko Hyo indicator. In this setup, we will not be using the Chikou Span. The long-term trend is identified based on how the Kumo lines are stacked. On the other hand, the short-term trend is identified based on how the Tenkan-sen and Kijun-sen lines are stacked.

The area near the Tenkan-sen and Kijun-sen lines also act as a dynamic area of support or resistance where price can bounce from.

As soon as both the long-term and short-term trends agree, we could start to wait for price action to retrace towards the area near the Tenkan-sen and Kijun-sen lines. Price action should then show signs of price rejection from the area. The bounce is then confirmed based on the Fisher indicator bars shifting from positive to negative or vice versa.

Indicators:

- Ichimoku Kinko Hyo

- Chikou Span Color: None

- Fisher

Preferred Time Frames: 15-minute, 30-minute, 1-hour and 4-hour charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

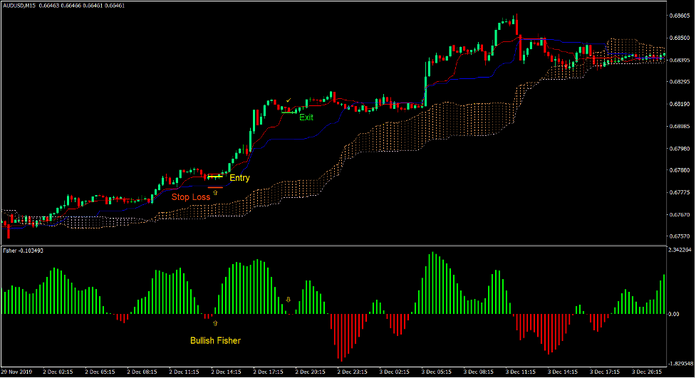

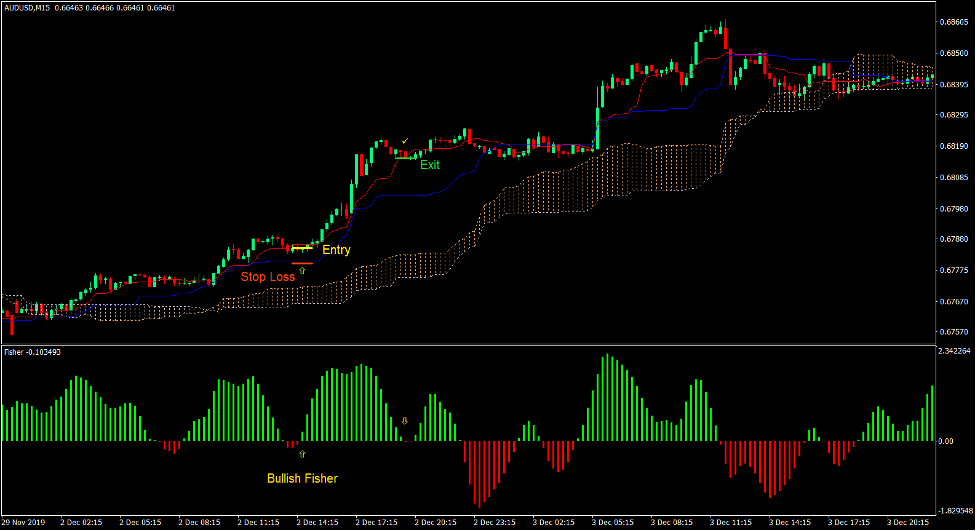

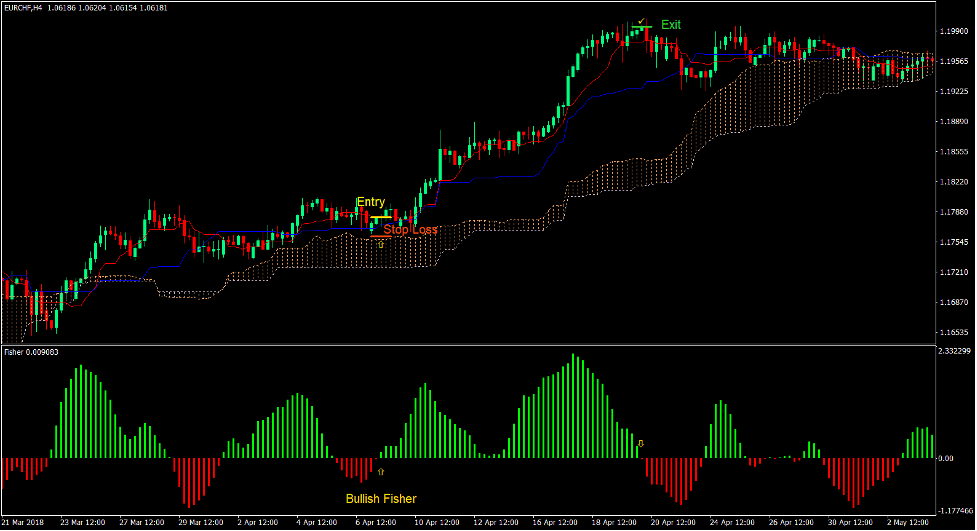

Buy Trade Setup

Entry

- Senkou Span A should be above Senkou Span B.

- The Tenkan-sen line should be above the Kijun-sen line.

- Price should retrace towards the area near the Tenkan-sen and Kijun-sen lines.

- Enter a buy order as soon as the Fisher bars shift to positive.

Stop Loss

- Set the stop loss on a support below the entry candle.

- Set the stop loss below the Kijun-sen line.

Exit

- Close the trade as soon as the Fisher bars shift to negative.

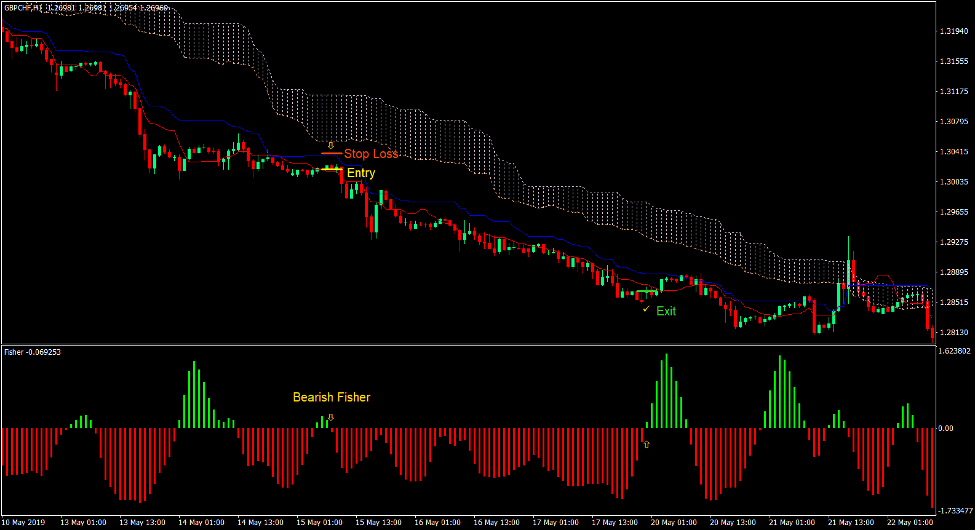

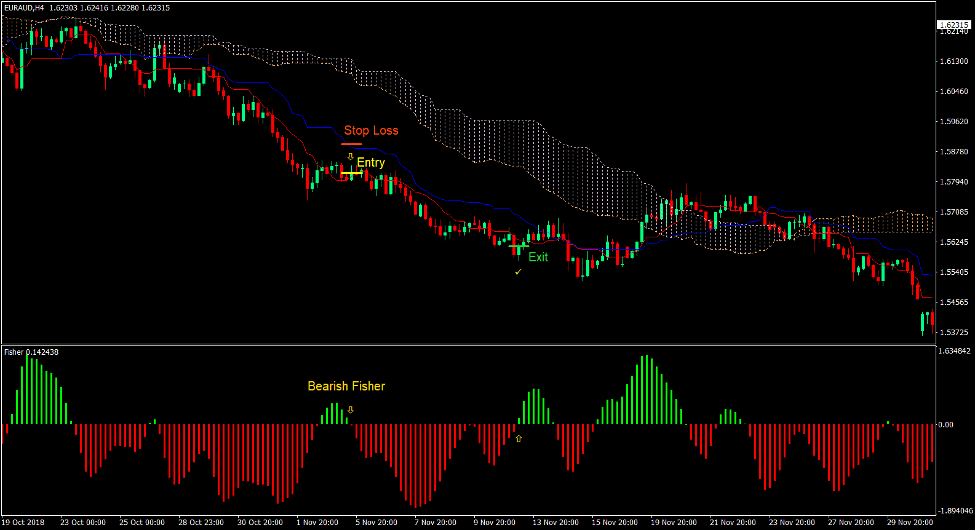

Sell Trade Setup

Entry

- Senkou Span A should be below Senkou Span B.

- The Tenkan-sen line should be below the Kijun-sen line.

- Price should retrace towards the area near the Tenkan-sen and Kijun-sen lines.

- Enter a sell order as soon as the Fisher bars shift to negative.

Stop Loss

- Set the stop loss on a resistance above the entry candle.

- Set the stop loss above the Kijun-sen line.

Exit

- Close the trade as soon as the Fisher bars shift to positive.

Conclusion

This trading strategy is a basic trend following strategy which uses the Ichimoku Kinko Hyo system of indicators.

This is one of the ways to trade the Ichimoku Kinko Hyo system. Another way is to use the crossover between the Tenkan-sen and Kijun-sen lines. However, these signals do not always occur whenever the trend is strong. Instead of waiting for the crossover, traders can use it as a dynamic support or resistance area and use another indicator as an entry signal. In this case, we are using the Fisher indicator which works well with the Ichimoku Kinko Hyo indicator.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: