When new traders first look at charts, they often see a meaningless movement of bars and lines going up and down. Opportunities are not easily detected by new traders because most still have not developed the skill to see it. But what are we looking for in the first place? How do traders see opportunities in a seemingly chaotic chart?

History repeats itself. This is the concept that allows technical traders to consistently make money out of the forex market. The market moves in patterns and cycles. These patterns and cycles present predictability. This allows seasoned traders to have an intelligent guess as to where the market could be going. To them, whenever these patterns and cycles present themselves is an opportunity to make money.

The Directional Modified Moving Average Forex Trading Strategy allows traders to easily identify these cycles by using a set of technical indicators. These indicators could easily show the points where the trend cycles are reversing, helping traders make sense of an otherwise chaotic chart.

Average Directional Movement Index

The Average Directional Movement Index (ADX) is a technical indicator developed by Welles Wilder. This indicator aids traders in determining trend direction based on momentum, as well as trend strength.

The Average Directional Movement Index is composed of the Plus Directional Indicator (+DI), Minus Directional Indicator (-DI) and the Average Directional Index (ADX) line. The Plus Directional Indicator (+DI) and the Minus Directional Indicator (-DI) are collectively called the Directional Movement Indicator (DMI).

The DMI is used to determine trend direction. This is based on the location of the +DI in relation to the -DI. In a bullish trend, the +DI line would above the -DI line, while the -DI line would be above the +DI line during a bearish trend. As such, crossovers between the two lines are considered a trend reversal signal.

The ADX line represents trend strength. Technical traders interpret ADX figures above 25 as having a strong trend, while figures below 20 are considered to represent market conditions with no trend.

The i-AMA Optimum and i-AMMA Indicator

Although these indicators may have almost similar names, but they do differ in approaches. These two indicators are practically a modified version of a Moving Average However their modifications are aimed to provide a different characteristic compared to other moving averages.

The i-AMA Optimum is an Adaptive Moving Average (AMA). This type of moving average is tweaked in order to provide for a less sensitive moving average line. This makes the line less susceptible to choppy market movements. This also makes the i-AMA an excellent trend filter moving average line.

The i-AMMA indicator on the other hand is an Average Modified Moving Average (AMMA). This version of a moving average is geared towards being more responsive to price action movements. This causes the line to hug price action much closer compared to other moving averages. It also provides a less lagging signal. These characteristics make the i-AMMA indicator an excellent signal line moving average.

Trading Strategy

This strategy is a crossover trend reversal strategy based on two moving averages which are designed for opposite purposes. The i-AMA Optimum indicator would be used as the lagging moving average while the i-AMMA indicator would be used as the leading moving average line. Trade signals are generated whenever the two lines crossover.

However, the trade signals produced by the two moving averages above should be in confluence with the DMI lines of the ADX indicator. Bullish crossover signals should coincide with a bullish DMI crossover while bearish crossover signals should coincide with a bearish DMI crossover.

The ADX line would serve as a confirmation of the trade signal. Profitable trades would usually result in an ADX line going over 25. However, we will not limit our trades based on it. This is because the market tends to start in contraction phase prior to a trend. During contraction phases, the ADX line usually is below 25.

Indicators:

- Average Directional Movement Index

- Period: 28

- i-AMMA

- MA Period: 14

- i-AMA-Optimum

Timeframe: preferably 4-hour and daily charts

Currency Pairs: major and minor pairs

Trading Session: Tokyo, London and New York

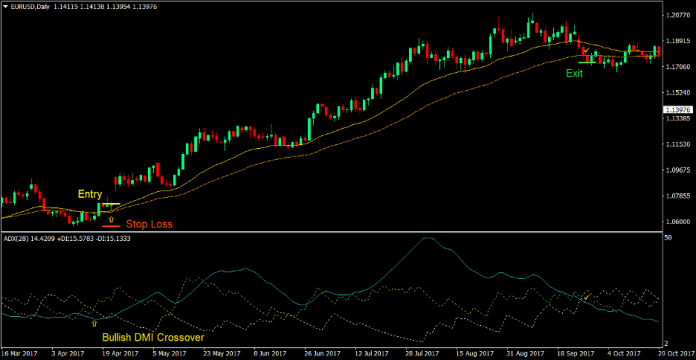

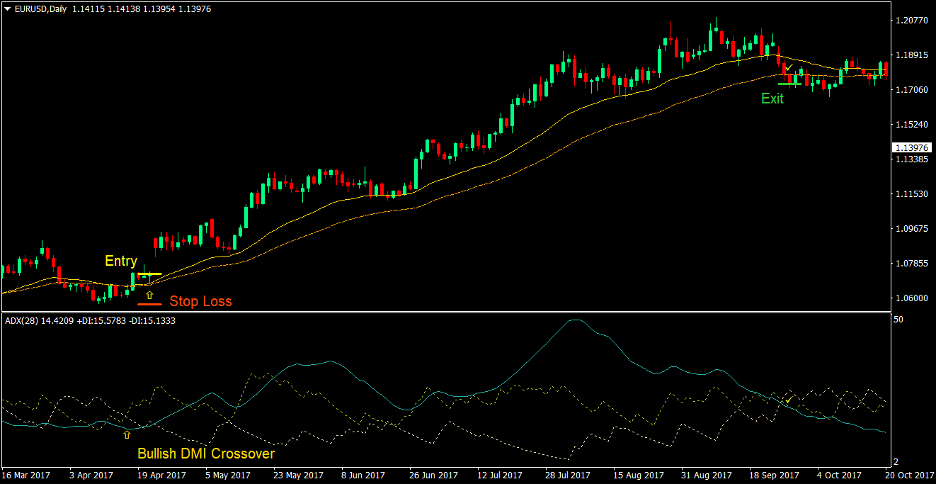

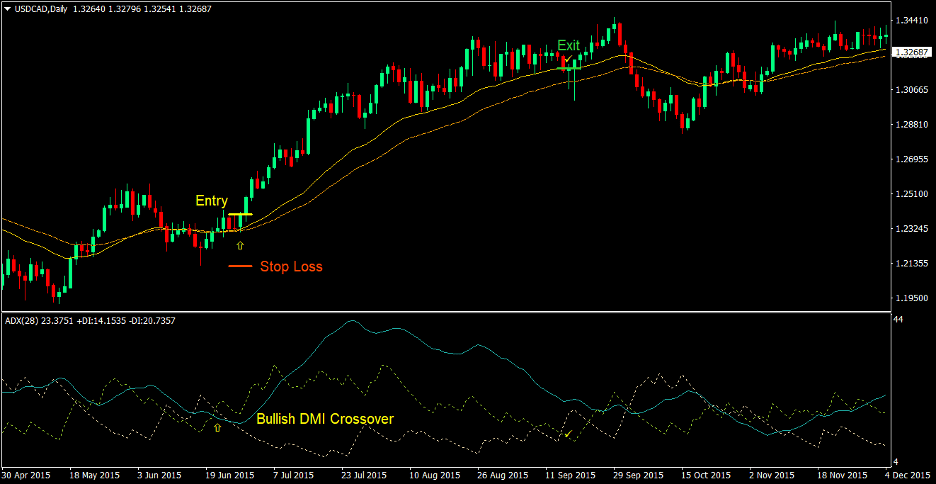

Buy Trade Setup

Entry

- The +DI line (yellow green) should cross above the -DI line (wheat) indicating a bullish trend reversal

- The i-AMMA line (solid line) should cross above the i-AMA Optimum line (dashed line) indicating a bullish trend reversal

- The bullish trend reversal signals should be somewhat aligned

- Enter a buy order on the confluence of the above conditions

Stop Loss

- Set the stop loss at the support level below the entry candle

Exit

- Close the trade as soon as the DMI lines reverses

- Close the trade as soon as price closes below the i-AMA Optimum line

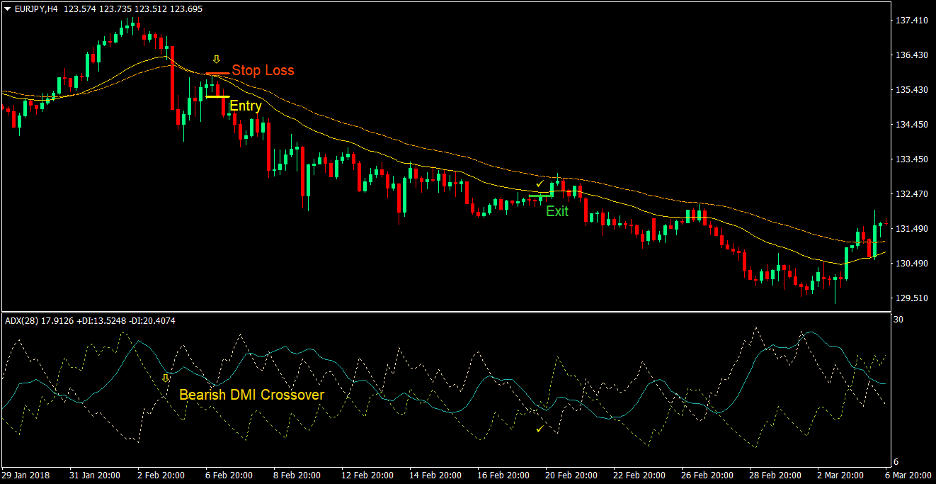

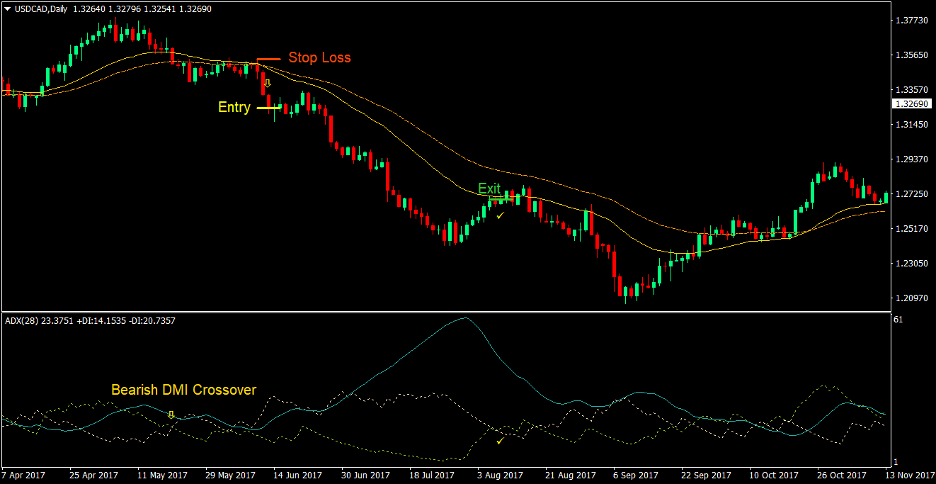

Sell Trade Setup

Entry

- The +DI line (yellow green) should cross below the -DI line (wheat) indicating a bearish trend reversal

- The i-AMMA line (solid line) should cross below the i-AMA Optimum line (dashed line) indicating a bearish trend reversal

- The bearish trend reversal signals should be somewhat aligned

- Enter a sell order on the confluence of the above conditions

Stop Loss

- Set the stop loss at the resistance level above the entry candle

Exit

- Close the trade as soon as the DMI lines reverses

- Close the trade as soon as price closes above the i-AMA Optimum line

Conclusion

This trading strategy is a working crossover strategy that produces good quality trade signals. Many of the trade signals produced by this strategy could result in a trend. This would allow traders to earn from high yielding trades that could earn as much as 2:1 to 5:1 reward-risk ratio.

This strategy works well in a currency pair with much volatility and has a strong tendency to trend. Avoid trading this strategy in a currency pair or market which tends to be choppy or flat.

The DMI crossover also tends to be more responsive at times compared to the moving average lines. There would be times when a temporary retrace could cause a crossover on the DMI lines. These scenarios could cause a premature exit from the trade and cut profits shorter than it could have been. However, it is better to stick to exit earlier rather than give back all the profits if the DMI crossover does result in an actual trend reversal. Traders who opt to hold the trade could make use of a smart trade management strategy, employing trailing stops and moving stop losses to breakeven.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: