Many traders have a competitive nature. As such, most traders would seek for perfection. They would look for the perfect strategy, one which would never let them lose. They would get attracted to ambitious strategies that claim to have 90% win rates or even more. Some would look to hedging strategies that should never let them lose, which is possible yet is very risky.

What many new traders do not understand is that trading is all about probabilities. It is not about having a perfect strategy that should never let you lose a single cent. It is not about finding trading’s Holy Grail. Rather it is about letting the law of large numbers work in your favor. It is about letting the law of probabilities work in your favor.

One of the ways traders find a setup that has a high win probability is by looking for confluences. It is when multiple factors point towards the same direction that many traders would take the same trade direction although with different hypotheses. Although the reason for taking the trade might be different, the results would often seem like a self-fulfilling prophecy. As traders take the trade in the same direction, momentum builds up causing price to confirm the trade setups.

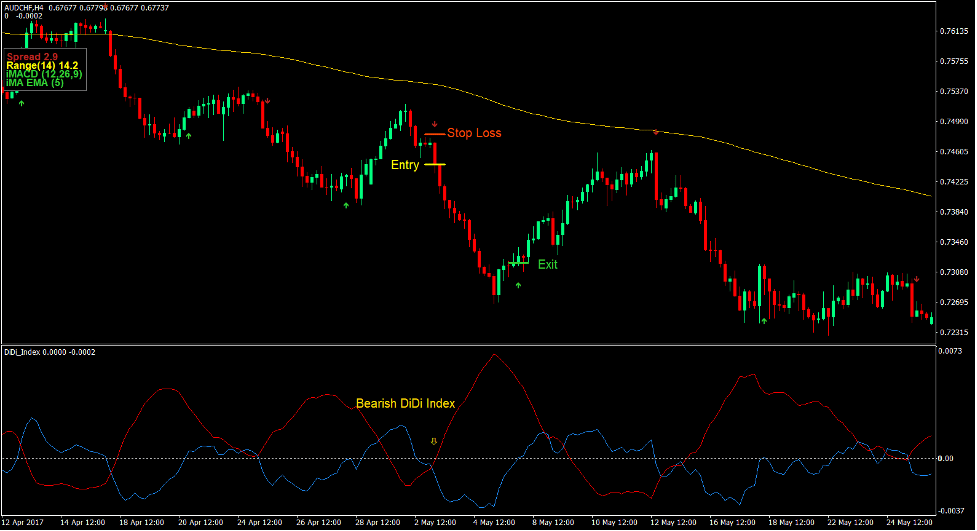

DiDi Index Crossover Forex Trading Strategy is a simple trading strategy which is based on confluences. It creates trade setups based on indicators that is also based on confluences. It also uses indicators that are complementary, which allows traders to decisively make trading decisions based on a high probability trade setup.

DiDi Index

DiDi Index is a trend following indicator which is derived from modified moving averages. It bases its plotting of its oscillator lines on the crossover of three moving average lines. Traders can modify the indicator by changing the lengths of the underlying moving averages on the its “Inputs” tab.

It is an oscillator type of indicator which plots two lines on its own window. These two lines can oscillate from positive to negative and vice versa. The dodger blue line represents the faster moving line, while the red line represents the slower line.

Trend direction is simply based on how the two oscillator lines overlap. If the dodger blue line is above the red line, the trend is considered bullish. On the other hand, if the dodger blue line is below the red line, the trend is considered bearish. As such, trend reversal signals are generated whenever the two lines crossover.

Indicator Arrows

The Indicator Arrows is a trend reversal signal indicator which is based on the confluence of multiple underlying indicators.

Its underlying indicators are the moving averages, Moving Average Convergence and Divergence (MACD), Moving Average of Oscillator (OsMA), Stochastic Oscillator, Relative Strength Index (RSI), Commodity Channel Index (RSI), Average Directional Movement Index (ADX), and Relative Vigor Index (RVI).

Considering that this indicator is based on the confluence of a variety of widely used technical indicators, the signals it produces should be very reliable. Based on how the signals are plotted, this indicator does seem to be very promising. It could pinpoint specific points on the chart where price did reverse. It does seem to produce high probability trend reversal signals.

It indicates potential trend reversal points by plotting an arrow pointing the direction of the trend reversal.

Trading Strategy

This trading strategy trades on confluences between the DiDi Index and the Indicator Arrows, while at the same time being aligned with the long-term trend.

To identify the long-term trend, we will be using the 200-period Exponential Moving Average (EMA). Trend direction will be based on the general location of price action in relation to the 200 EMA line, as well as the slope of the 200 EMA line. Price action should also confirm the trend direction based on the pattern of its swing points. Signals are only considered valid when it is aligned with the long-term trend.

As soon as the long-term trend is identified, we can now identify valid signals based on the confluence of the DiDi Index and the Indicator Arrows. On the DiDi Index, signals are simply based on the crossover of the dodger blue and red lines. On the Indicator Arrows, signals are simply based on an arrow being plotted. These signals should be closely aligned in order to be considered valid.

Indicators:

- 200 EMA

- Indicatorarrows

- DiDi_Index

Preferred Time Frames: 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

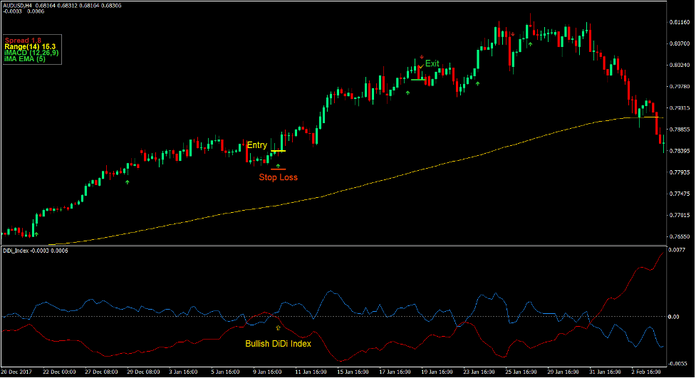

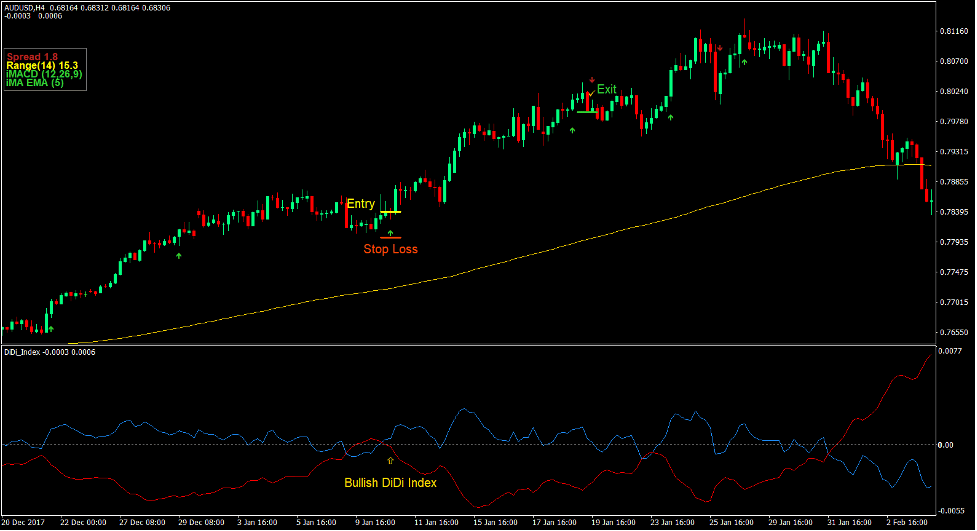

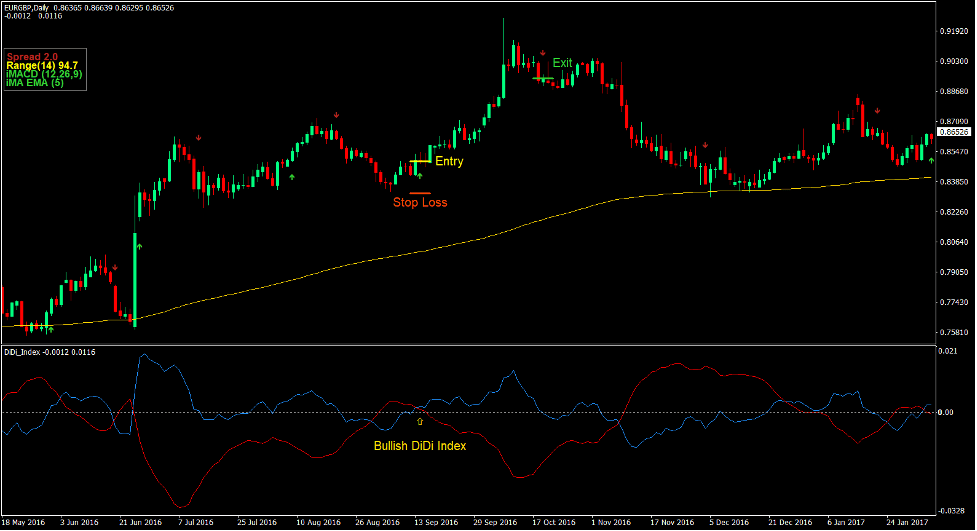

Buy Trade Setup

Entry

- Price action should be above the 200 EMA line.

- The 200 EMA line should slope up.

- Price action swing points should form a rising pattern.

- The dodger blue line of the DiDi Index should cross above the red line.

- The Indicator Arrows should plot an arrow pointing up.

- Enter a buy order on the confirmation of these conditions.

Stop Loss

- Set the stop loss on the support below the entry candle.

Exit

- Close the trade as soon as the Indicator Arrows plots an arrow pointing down.

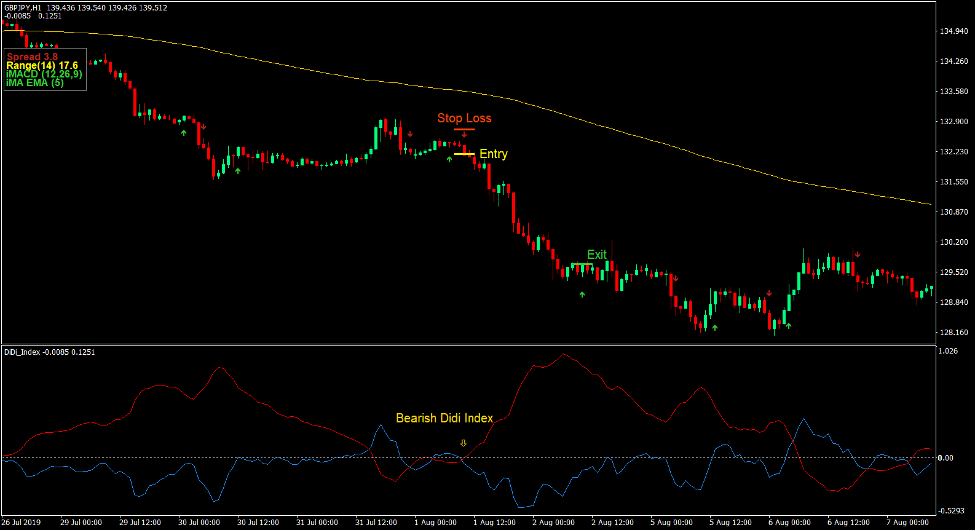

Sell Trade Setup

Entry

- Price action should be below the 200 EMA line.

- The 200 EMA line should slope down.

- Price action swing points should form a falling pattern.

- The dodger blue line of the DiDi Index should cross below the red line.

- The Indicator Arrows should plot an arrow pointing down.

- Enter a sell order on the confirmation of these conditions.

Stop Loss

- Set the stop loss on the resistance above the entry candle.

Exit

- Close the trade as soon as the Indicator Arrows plots an arrow pointing up.

Conclusion

This trading strategy is a high probability trading strategy. When used in the right market condition, it tends to produce trade setups that have a very high probability of resulting in a winning trade.

It also combines long-term trends with mid-term retracements and trend-reversals. These setups could occur multiple times in a trend. However, if the signals produced are late in a long-term trend, there is a higher probability that the trend may actually reverse.

Traders should find the balance between identifying clearly established trends and taking trade setups that are not too late in a trend. Traders who can do this can use this strategy to consistently profit from the market.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: