Crossover Pullback Forex Trading Strategy

Crossover strategies are very popular among traders. It would even be hard to come by a trader who has been in the market for quite some time who haven’t reviewed, used, or heard of crossover strategies. A big chunk of the market probably looks at crossover entries as their main strategy, especially the beginner traders.

However, in a ranging and choppy market, crossover strategies just don’t work. This is because the entry would probably be too late since the big players have already entered prior to the crossover thus causing the reversal. Second, same as the entry, the exit of the trade if based on the reverse crossover, would also be a little too late. Lastly and more importantly, the trend is not yet confirmed.

Let’s discuss further why I think the trend is not yet confirmed by a crossover. Price action traders typically considers a trending market as a market with higher highs and higher lows, lower lows and lower highs. During a crossover only the first part is confirmed, the higher high or the lower low. The second part, the higher lows or lower highs usually hasn’t been confirmed. The fact that we are trying to catch a trend when the trend is not yet confirmed seems a little backward to me.

Now, there are crossover strategies that do work, but sadly many don’t. But we don’t have to stress ourselves with that. What we could do instead is to capitalize on the mistake that most crossover traders do.

In this strategy, we will be entering the market as soon as the higher lows or lower highs are forming. We will be doing this by waiting for a pullback, plus a convergence of a slightly overbought or oversold market conditions, and a confirmation of the resumption of the crossover’s direction.

The Setup: How to Enter the Market on Pullbacks After a Crossover

To identify our crossover, we will be using the commonly used crossover moving average, the 50 EMA and the 20 EMA. These moving averages are very popular, many traders are looking at it, even those who don’t use it as a crossover strategy. These moving averages are not only used for crossover strategies, these are also used as a trend direction indicator and as a dynamic support or resistance. By using these moving averages, we will be capitalizing on the way other traders are using it. The 20 & 50 EMA will be our crossover, trade direction indicator, and most importantly our dynamic support or resistance.

The area between the two moving averages will be our dynamic area of support or resistance. To use this as such, we will be waiting for price to pullback within the area between the two moving averages but never to close beyond the 50 EMA. This would confirm that the market is respecting the 50 EMA as a dynamic support or resistance. Then, we would wait for price to close back out of the 20 EMA to confirm the resumption of the trend.

We will also use the Commodity Channel Index (CCI) indicator to identify our slightly overbought or oversold market conditions. A pullback from a recent market move will cause these conditions on the short-term. Using the CCI allows us to identify these short-term conditions.

Another thing to take note of is that no one really knows how long a trend will last. So, to err on the cautious side, we will be trading only the first pullback.

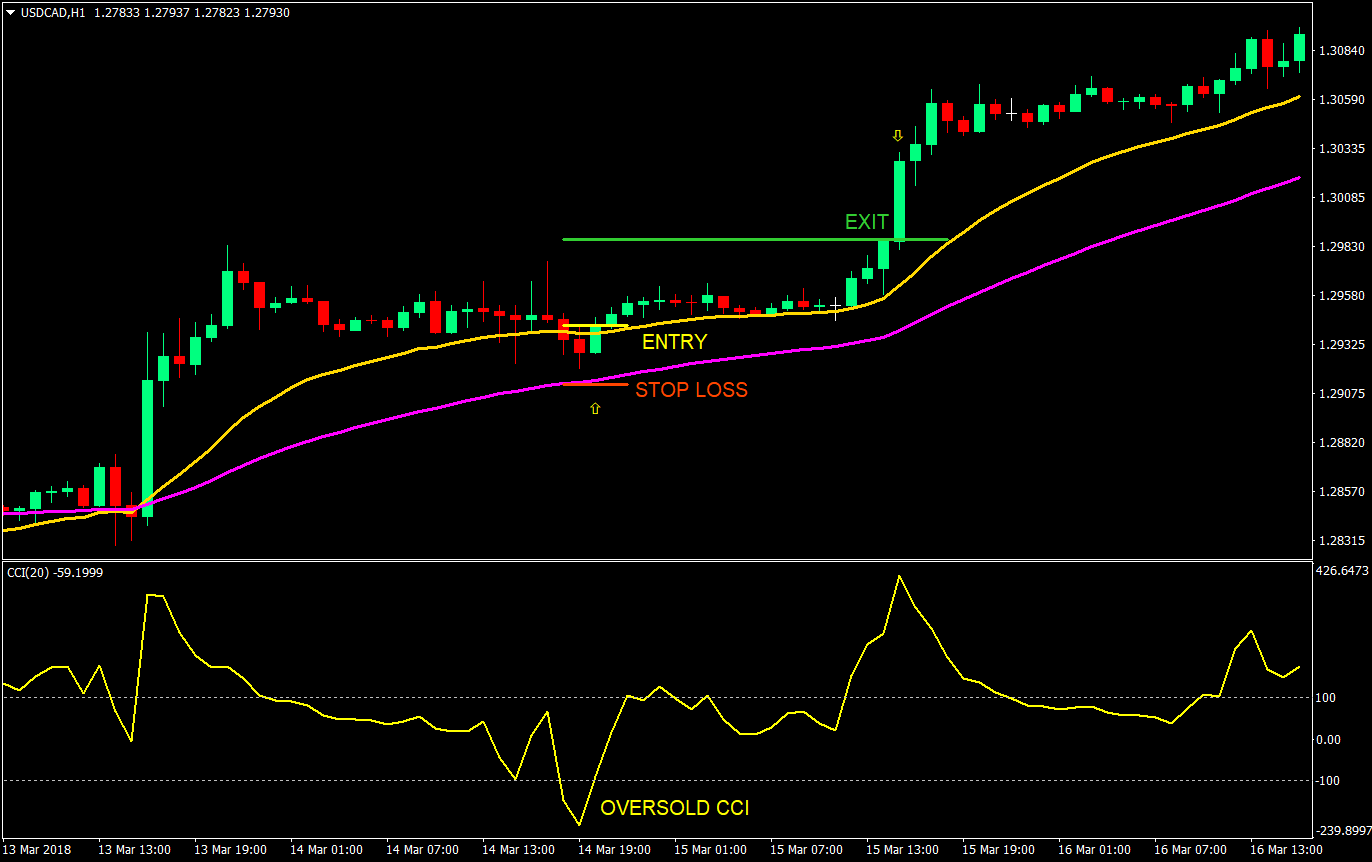

Buy Entry:

- The 20 EMA (gold) should cross above the 50 EMA (magenta)

- Price should pullback in the area between the 20 & 50 EMA

- Price should not close below the 50 EMA

- CCI should be below -100

- Enter on the candle that closes above the 20 EMA

Stop Loss: Set the stop loss below the 50 EMA

Exit: Set the take profit at 1.5x the stop loss height in pips

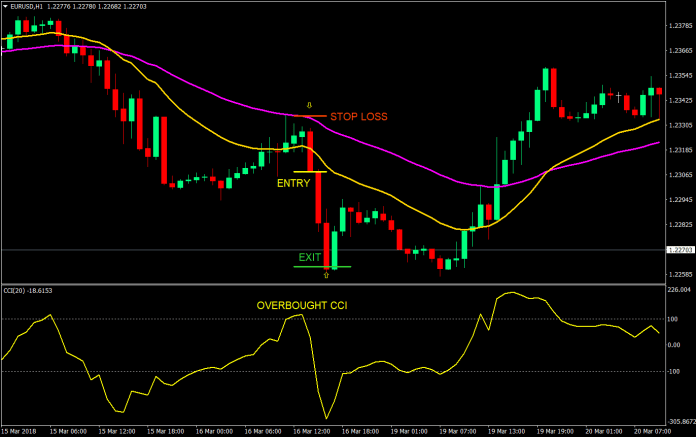

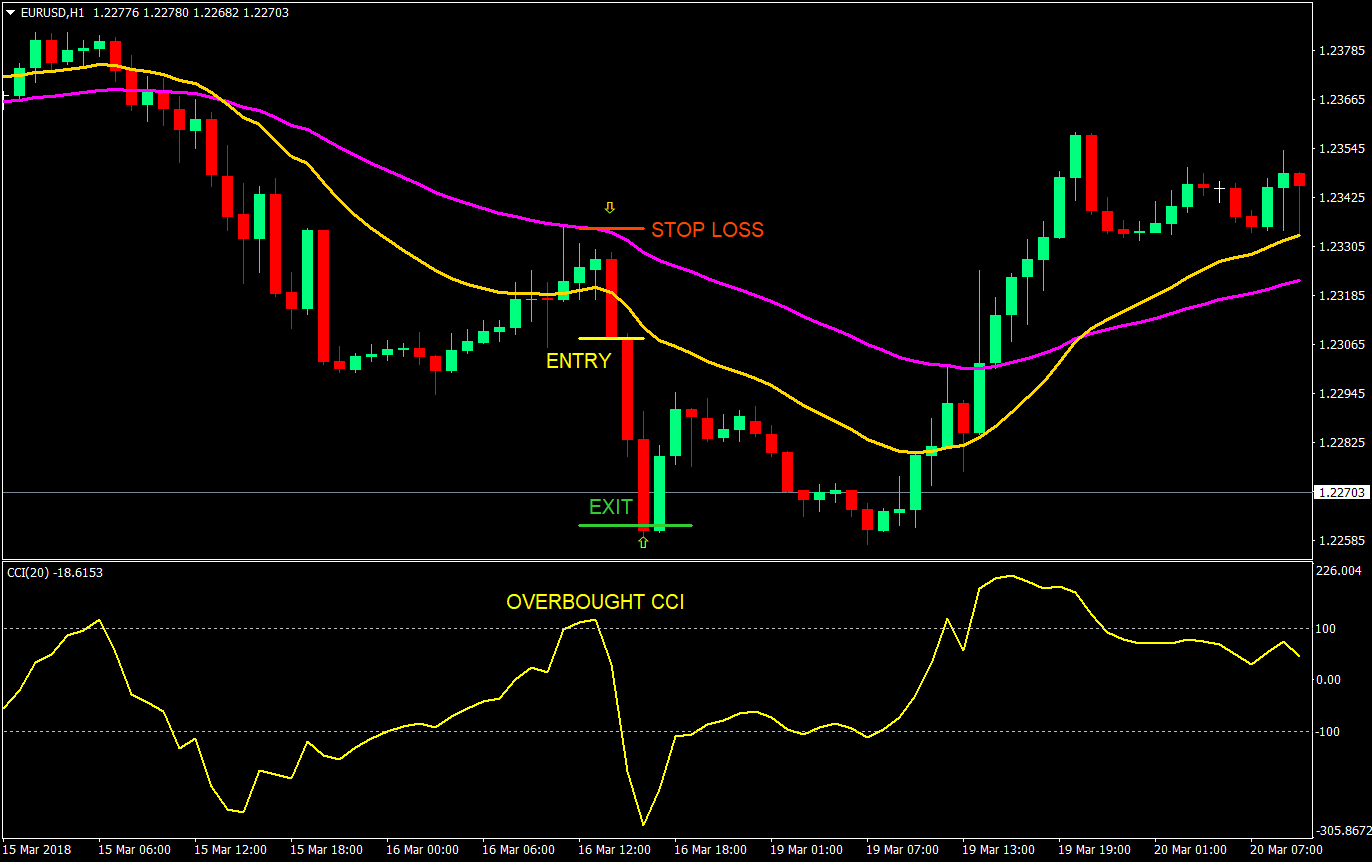

Sell Entry:

- The 20 EMA (gold) should cross below the 50 EMA (magenta)

- Price should pullback in the area between the 20 & 50 EMA

- Price should not close above the 50 EMA

- CCI should be above 100

- Enter on the candle that closes below the 20 EMA

Stop Loss: Set the stop loss above the 50 EMA

Exit: Set the take profit at 1.5x the stop loss height in pips

Conclusion

Being patient pays. By waiting for price to pullback on our area of support or resistance and by waiting for price to confirm the resumption of the trend by closing beyond the 20 EMA, we are being patient.

This strategy is slightly better than crossover strategies because first, we are waiting to enter on a better price if possible, second, we are waiting for the confirmation of the resumption of the trend. The CCI overbought or oversold condition is just an added bonus to increase the probabilities of a successful trade.

This strategy however errs towards the conservative side by setting the stop loss beyond the 50 EMA and thus giving us a lower reward-risk ratio of just 1.5x the stop loss. However, this is logical since it is only when price closes beyond the 50 EMA that our setup is nullified. Those who tend to be a little more aggressive can bring the stop loss closer, allowing them for a higher reward-risk ratio, but running the risk of having the stop loss prematurely hit.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: