Traders are currently divided into two camps. On one side of the spectrum, there are the price action traders, while on the other end of the spectrum are the traders who trade solely based on technical indicators.

Price action traders trade based on actual price movements. This is a form of technical analysis wherein the sole basis for trading is based on how price behaves rather than on using technical indicators. Price action trading could include candlestick patterns, price patterns, and breakouts of supports or resistances. The idea behind this is that traders would rather trade based on the current price movement as opposed to using technical indicators because price movements are current while technical indicators are lagging. Although this has a kernel of truth in it, candlestick patterns or other price action techniques still has some lag because the patterns are formed by historical prices.

On the other hand, some traders trade solely based on signals from technical indicators. Their argument for this is that trading based on indicators are more objective. Subjective decision making based on observations on the chart are lessened and trades are based on rules. Algorithmic traders trade in this manner. The difference is that they program a robot to do it for them.

Both techniques work. There are many traders who profit big solely based on price action trading and there are algorithmic traders who profit big based on technical indicators. Traders can choose which suits them better. Traders could also find a good middle ground and use certain aspects of each.

CCI MA Momentum Breakout Forex Trading Strategy is one of such trading strategies that incorporate elements of price action trading and the use of technical indicators.

Rainbow MMA 11

Rainbow MMA 11 is a multiple moving average indicator based on the Guppy Multiple Moving Average (GMMA).

Like the Guppy Multiple Moving Average, this indicator uses several moving averages in one indicator. The indicator forms a band like visual representation of how price is moving. The band expands whenever the market trends and contracts whenever price contracts. The band also reverses whenever the trend reverses, making it a good signal for trend reversals.

Rainbow MMA 11 is the eleventh set and is the fastest set of moving averages in its series, making it an excellent short-term trend indicator.

CCI Histogram

CCI Histogram is a technical indicator based on the classic Commodity Channel Index (CCI) indicator.

Just like the classic CCI, this indicator determines momentum and trend direction by comparing the current price (Typical Price) with the average price (Simple Moving Average). It then normalizes the results to fit 75% of the results within the range of +100 and -100. Readings that fall outside of that range could indicate a strong momentum either for the bulls (+100) or the bears (-100).

This variation of the CCI indicator plots its readings as histogram bars. These bars change colors to indicate trend direction. Bullish trending markets have royal blue histogram bars, while bearish markets have red histogram bars. Neutral markets or markets that have just recently reversed have dark grey histogram bars.

Trading Strategy

This strategy trades on momentum breakouts coming from supports and resistances. However, instead of trading solely based on such breakouts, trend direction and momentum filters are employed using some technical indicators.

The 40-period Exponential Moving Average (EMA) will be used as the main trend indicator. Trend direction is based on the location of price in relation to the 40 EMA.

The Rainbow MMA 11 lines should also cross the 40 EMA line indicating a trend reversal.

On the CCI Histogram indicator, the histogram bars should cross zero indicating a trend reversal and should change to the color indicating the direction of the trend.

Finally, all these indications should be aligned with a momentum candle breakout from a support or resistance line.

Indicators:

- 40 EMA (blue)

- RainbowMMA_11 (default settings)

- CCI-Histogram

- A_Period: 50

- B_Period: 12

- neutral: 2

Preferred Time Frames: 15-minute, 30-minute, 1-hour and 4-hour charts

Currency Pairs: major and minor pairs

Trading Sessions: Tokyo, London and New York sessions

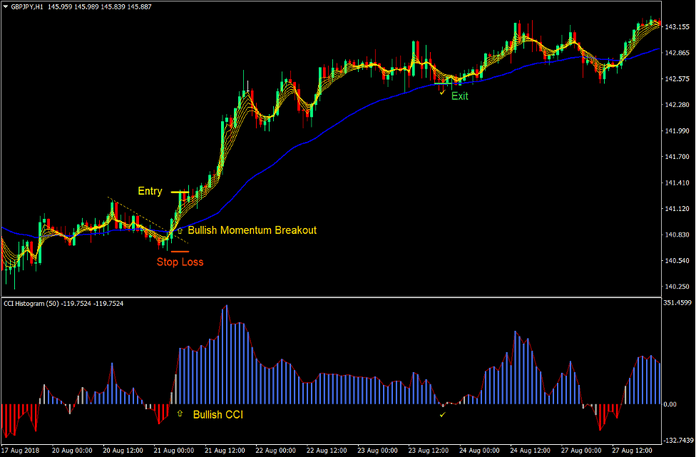

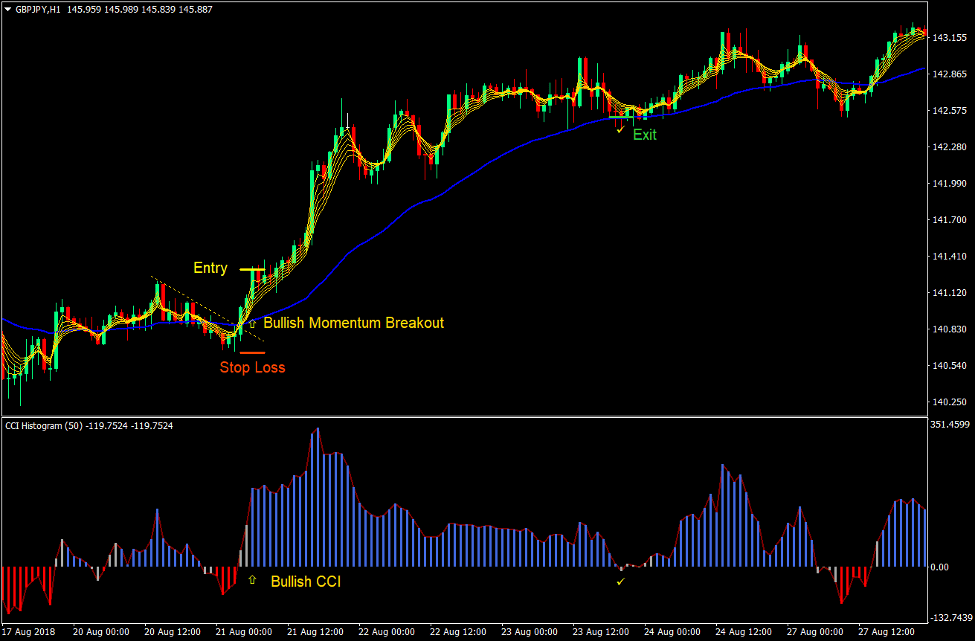

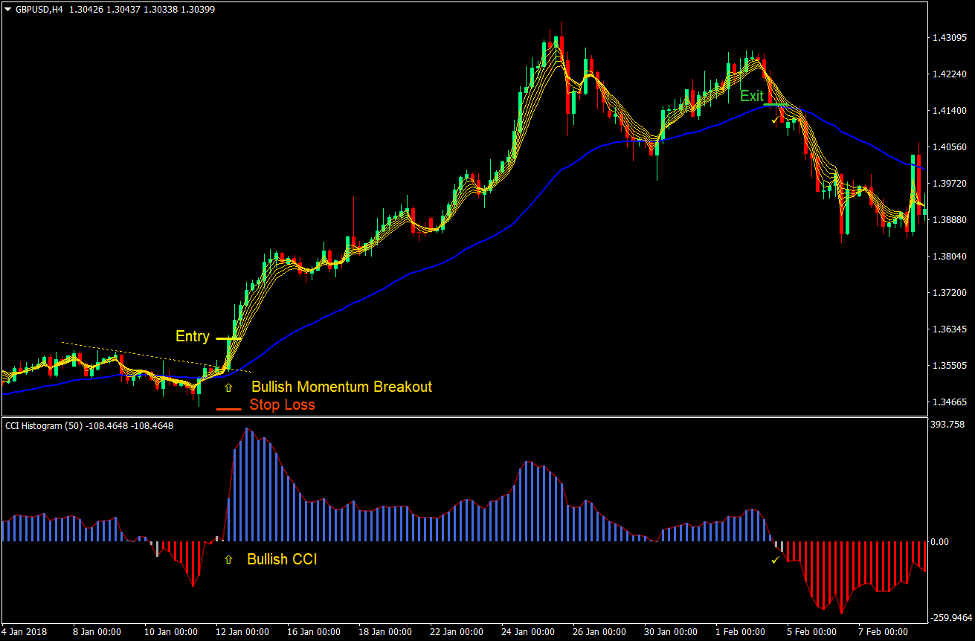

Buy Trade Setup

Entry

- A resistance line should be observed on the price chart.

- A bullish momentum candle should break above the resistance line.

- Price should cross above the 40 EMA line.

- The Rainbow MMA 11 lines should cross above the 40 EMA line.

- The CCI Histogram indicator should cross above zero and should be printing royal blue bars.

- These bullish signals should be closely aligned.

- Enter a buy order on the confirmation of the conditions above.

Stop Loss

- Set the stop loss on the fractal below the entry candle.

Exit

- Close the trade as soon as the CCI Histogram indicator prints a dark grey bar.

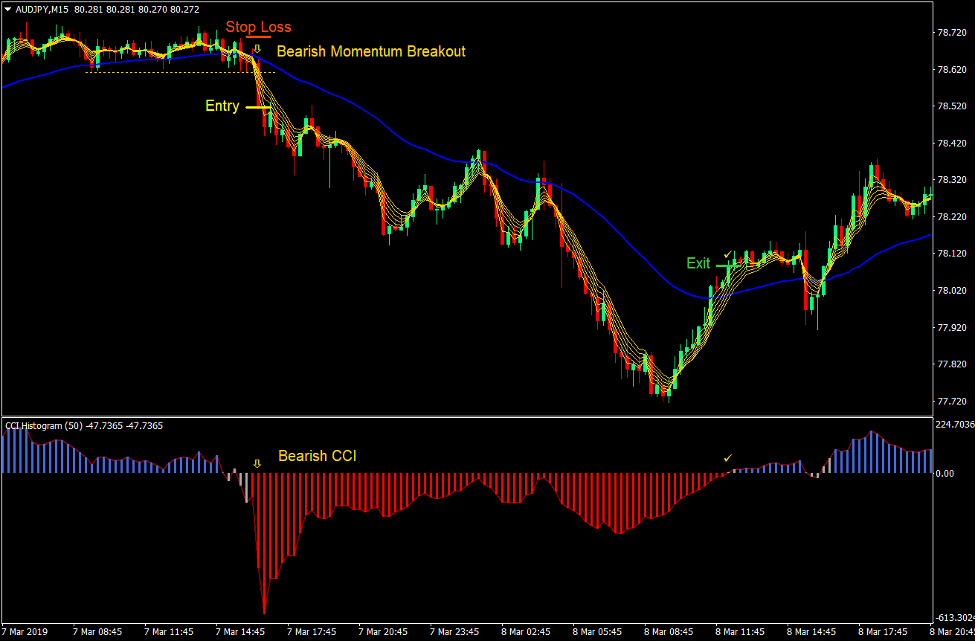

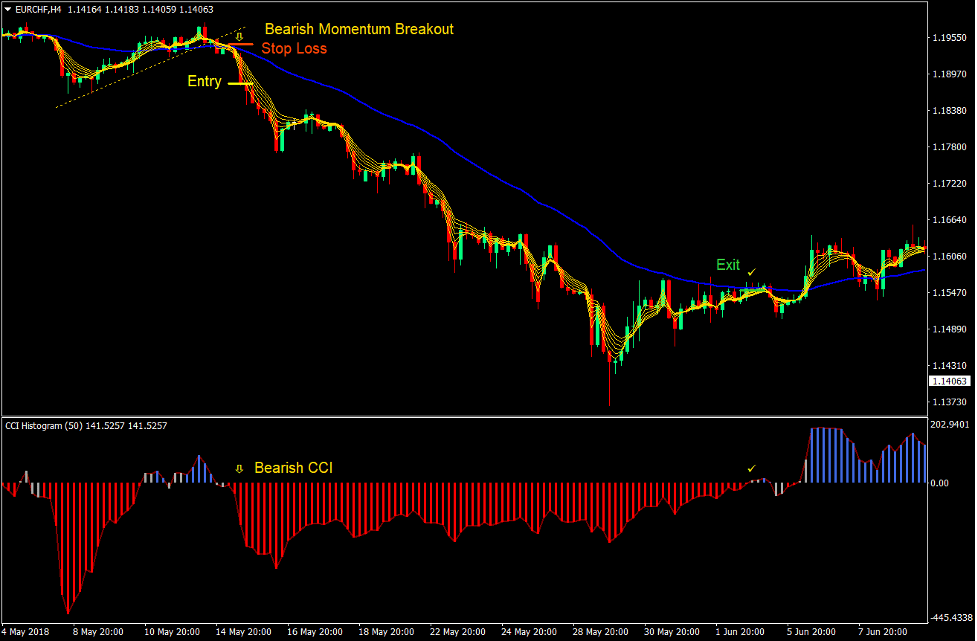

Sell Trade Setup

Entry

- A support line should be observed on the price chart.

- A bearish momentum candle should break below the support line.

- Price should cross below the 40 EMA line.

- The Rainbow MMA 11 lines should cross below the 40 EMA line.

- The CCI Histogram indicator should cross below zero and should be printing red bars.

- These bearish signals should be closely aligned.

- Enter a sell order on the confirmation of the conditions above.

Stop Loss

- Set the stop loss on the fractal above the entry candle.

Exit

- Close the trade as soon as the CCI Histogram indicator prints a dark grey bar.

Conclusion

Momentum breakouts of supports and resistances is a classic price action trading strategy. In fact, many traders have made their fortune trading such types of strategies. However, to the untrained eye, this could be very difficult.

This strategy incorporates the use of complementary indicators that could help traders identify trend and momentum reversals coming from such support or resistance momentum breakouts, making it a lot easier for traders to trade momentum breakouts.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: