Bollinger Bounce Forex Trading Strategy

The Bollinger Band is a helpful tool for traders. It allows traders to identify ranging and trending markets, contracting and volatile markets, and overbought and oversold markets. Being able to identify all these in one indicator is very powerful as these parameters are very important information to help traders identify their bias.

Basically, a Bollinger Band is an on-chart indicator composed of three lines. A top line, a middle line, and a bottom line.

The top and bottom line indicates the overbought and oversold territories on the chart, based on the highness or lowness of price relative to previous price movements. Because the top and bottom lines are price extremes, price tend to bounce off it, except on very strong trending markets.

The middle line acts as a mean of both lines. In a sense, it acts somewhat similar to moving averages. Because the middle line acts like a moving average indicator, it also has similar characteristics as moving averages. One of which is that price tends to respect it as a dynamic support and resistance. On a bullish market, where price tend to stay above it, price usually respects the middle line as a support. On the other hand, during bearish markets, price tends to respect the middle line as a resistance.

The Concept Behind the Forex Strategy

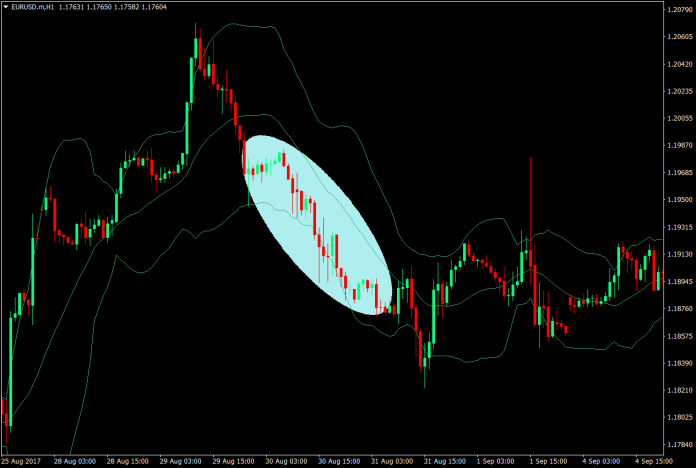

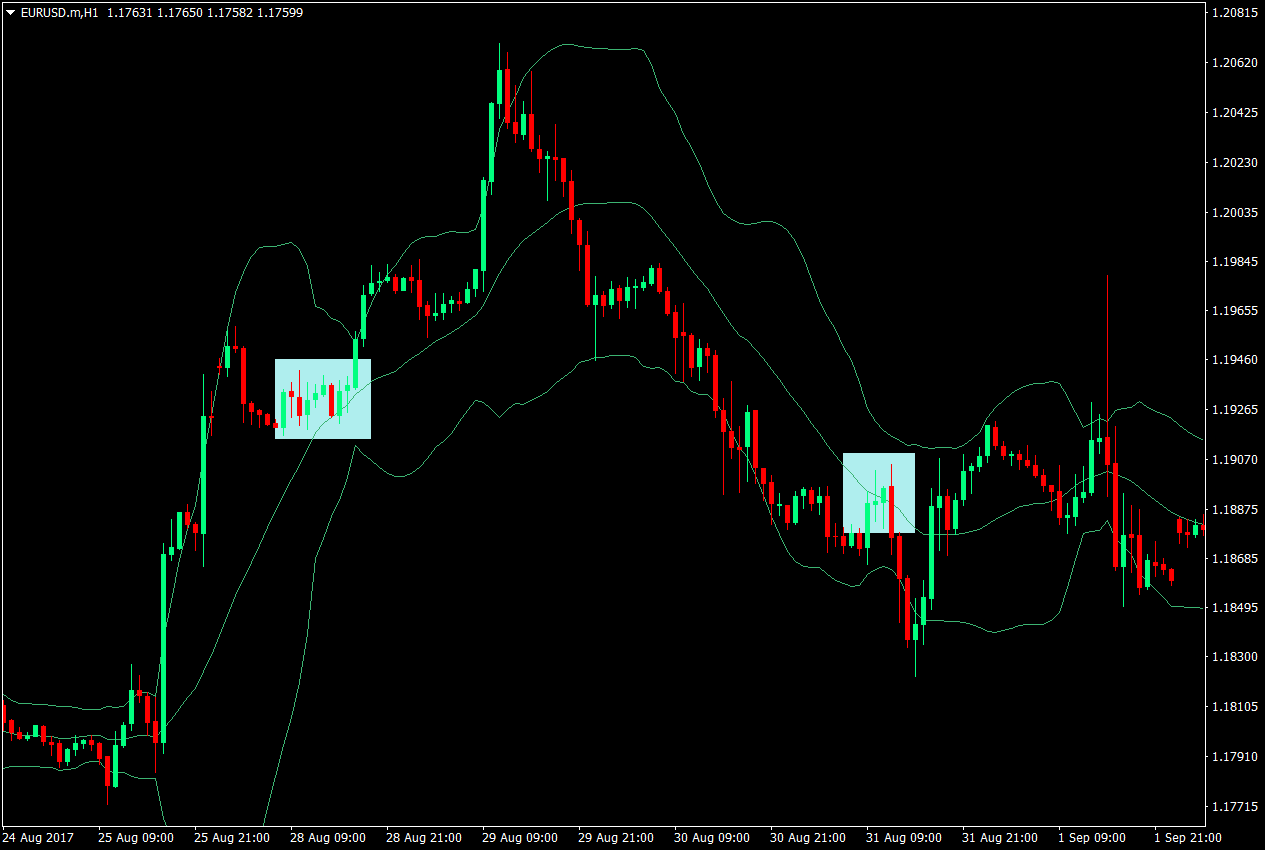

The idea behind this strategy is hinged on two concepts. First is the idea that the Bollinger Band could be used to identify trending markets. The behavior of price near the outer bands is a strong indicator of trending markets. Whenever price tends to stick close to one of the outer bands without going back to the middle line or crossing over to the opposite outer band, the market is said to be trendy.

The next concept, which is also very important, is the idea that price tends to respect the middle line as a dynamic support or resistance.

With this strategy, we will be looking for markets that are trending. Whenever, we identify trending markets, we could then look for instances wherein price would be drawn near to the middle line, showing that price is retracing for a few candles. As soon as price touches the middle line, we will be looking for a candle to close going the direction of our trade.

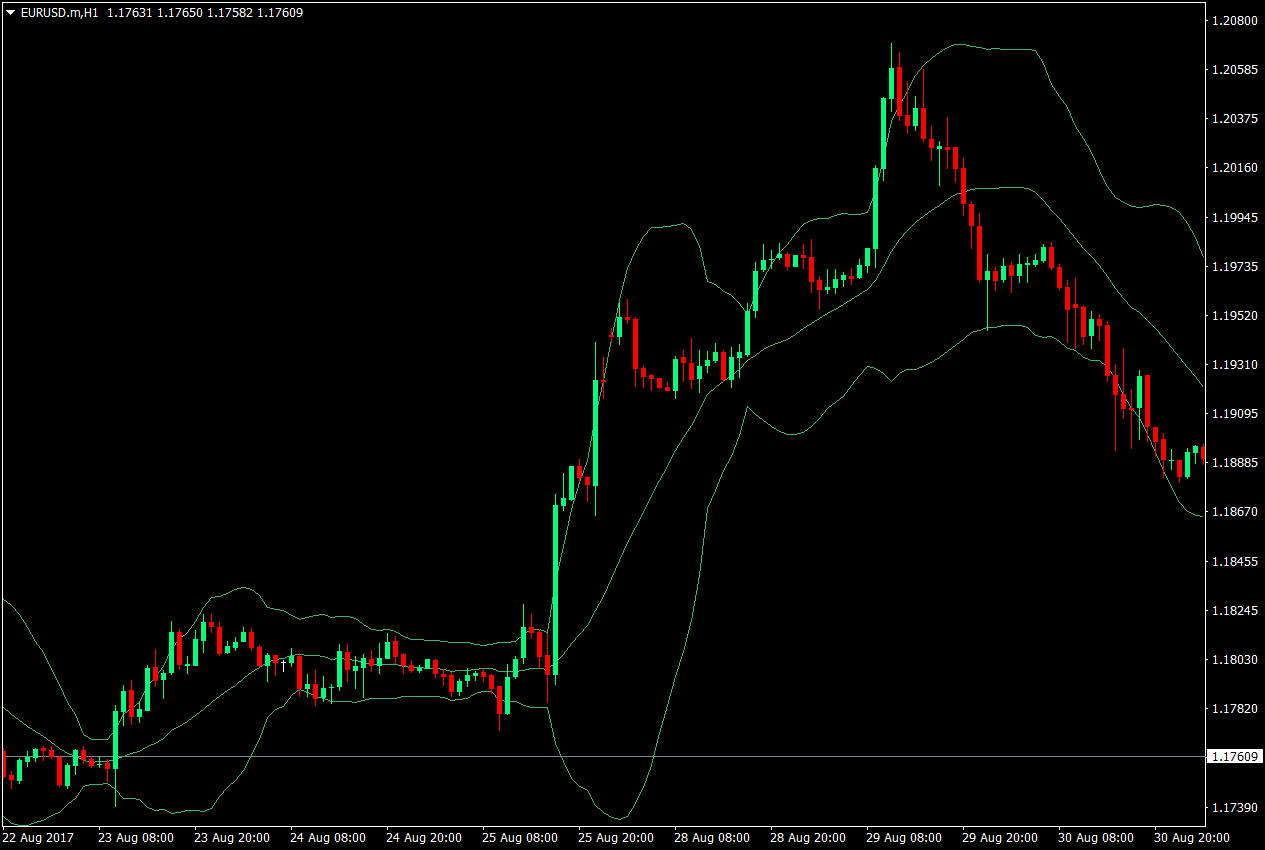

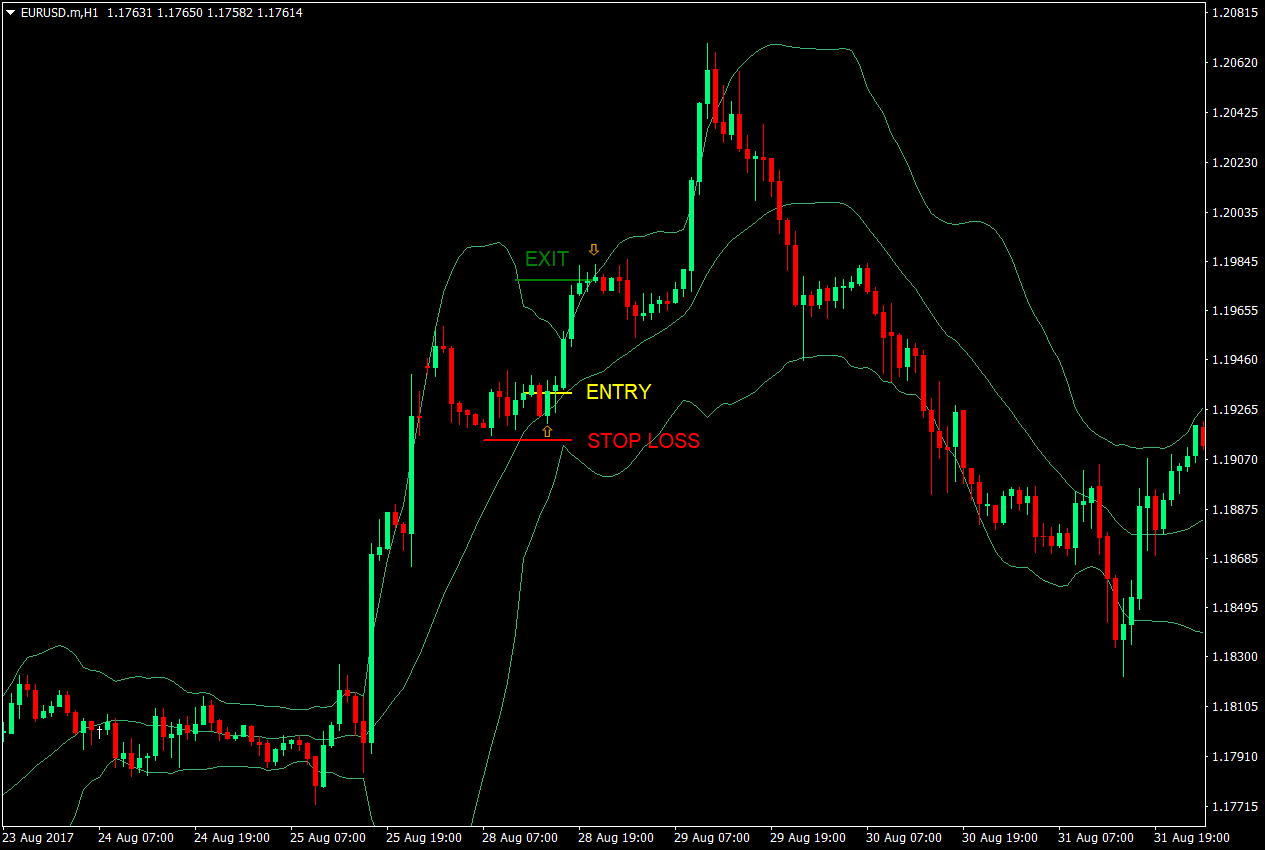

The Buy Setup – Entry, Stop Loss & Exit

Buy Entry

- Price should be constantly hugging the upper band indicating that the market is on a bullish trend.

- Price should retrace towards the middle line.

- Price should touch the middle line but not close below it.

- The entry candle would be the bullish candle after price retests the middle line.

Stop Loss: The stop loss will be the most recent low created when price retraced towards the middle line.

Exit: The trade should be closed as soon as price closes below the upper Bollinger Band.

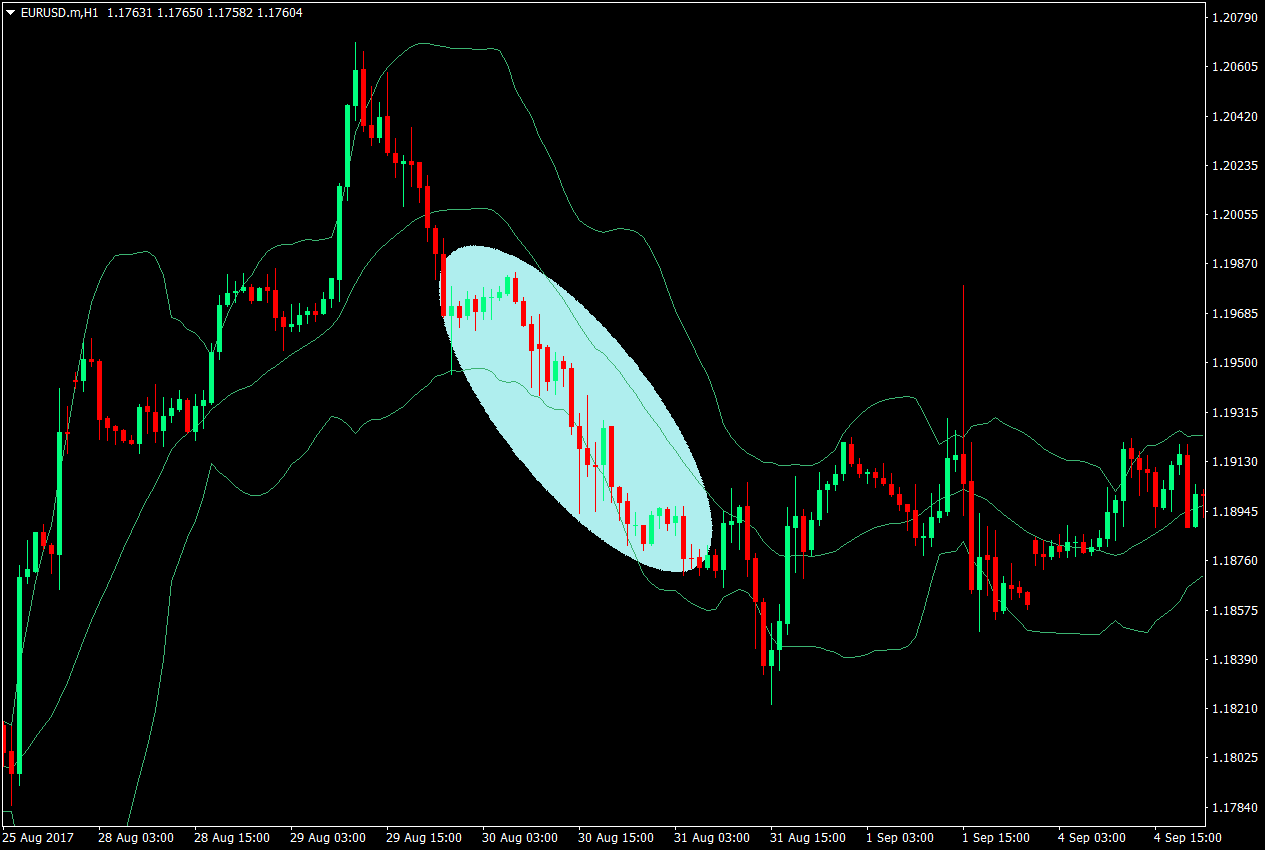

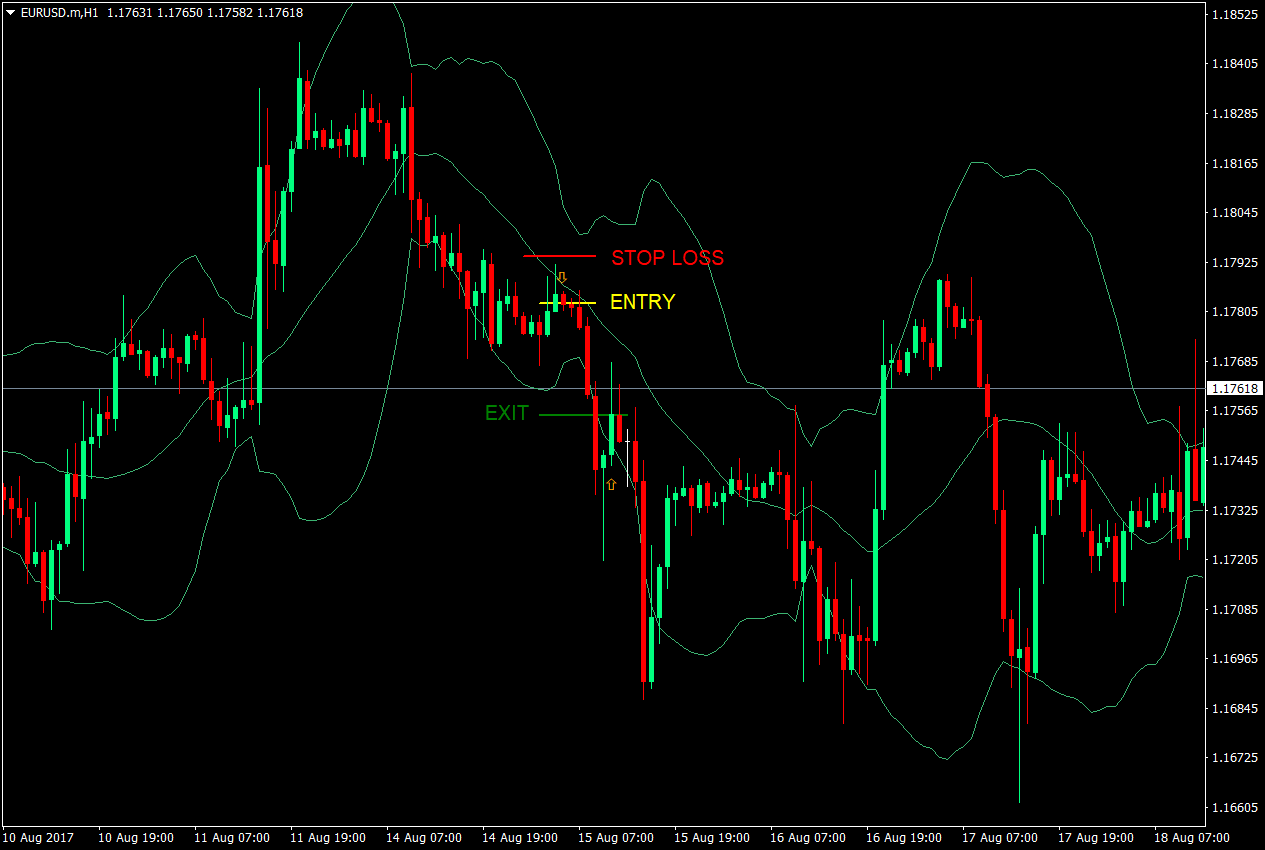

The Sell Setup – Entry, Stop Loss & Exit

Sell Entry

- Price should be constantly hugging the lower Bollinger Band indicating a bearish trending market.

- Price should retrace back up going towards the middle line.

- Price should touch the middle line without closing above it.

- The entry candle would be the next bearish candle that closes.

Stop Loss: The stop loss should be placed on the most recent high created during the retracement.

Exit: The trade should be closed as soon as a candle closes above the lower Bollinger Band.

Conclusion

This strategy is a simple Bollinger Band forex trading strategy, one which many traders overlook due to its simplicity. However, this strategy is used by many successful retail traders as a part of their trading arsenal. The beauty of this strategy is that ranging markets are naturally screened to allow for high probability trades during trending markets. Needless to say, this strategy works best during trending markets.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: