BB Breakout Forex Trading Strategy

Breakout strategies are probably one of the most popularly used type of strategies out there. Traders just love to trade breakouts. Probably its because of the simplicity of it, or more importantly and hopefully because traders are making money with it.

However, even though many are using it and are making money using it, many also are losing money with it.

Before we get into the details of how to trade breakouts while improving our chances of a successful trade, let us first discuss the concept behind a breakout. By doing this, we understand why the filter we will be adding could improve our batting average in trading breakouts.

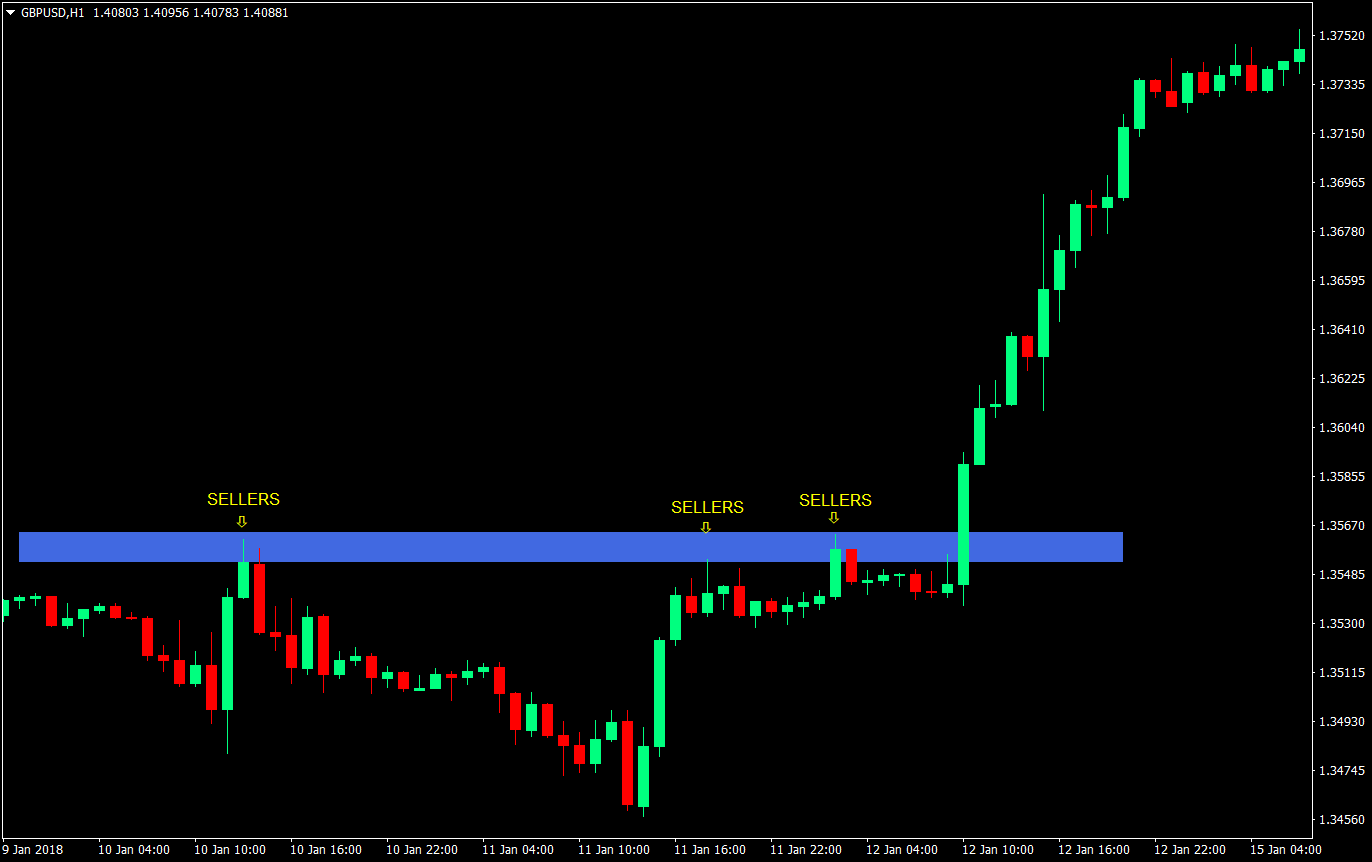

To better understand breakouts, we first have to understand support and resistance. Resistances, particularly horizontal resistances, are basically a ready number of sellers at a specific price. As soon as price touches that level or the area around that level, price would immediately bounce off of it because of the imbalance of the buyers and sellers.

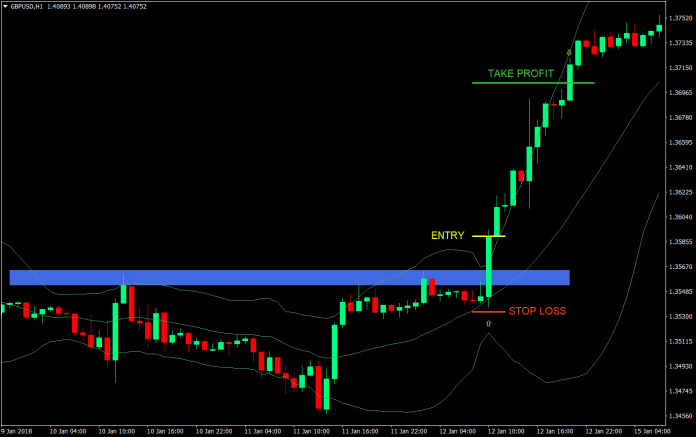

To illustrate, below is a picture of a resistance.

Now, what happens during a breakout is this. During the previous instances that price visited a certain level or area, the number of ready sellers gets depleted little by little. As soon as the number ready sellers gets exhausted, the resistance would be prime for a breakout. It could be that the sellers are just not there, or the number of buyers just overpowered the depleted ready sellers. Either of the both could happen. The common theme for both breakouts though is that there should be little to no resistance coming from the sellers during the breakout. If they are truly depleted, they shouldn’t be able to put up a fight. This results to a strong candle breaking out of the resistance. This is called momentum.

The same is true with supports, only that instead of ready sellers, we have ready buyers, which causes a bounce to the upside.

What most traders do however is that they get too caught up with price breaching a certain price level or area, they tend to disregard momentum. Some price action traders even go to the lower timeframes to look for revisits of the support or resistance and enter during the revisit of price, disregarding the fact that on the timeframe they are trading or even on the higher timeframe, they are trading on a reversal candle, instead of a candle showing momentum.

With this strategy we will try to filter out breakout trades that shows momentum.

The Setup: Trading Breakouts with Momentum Using Bollinger Bands

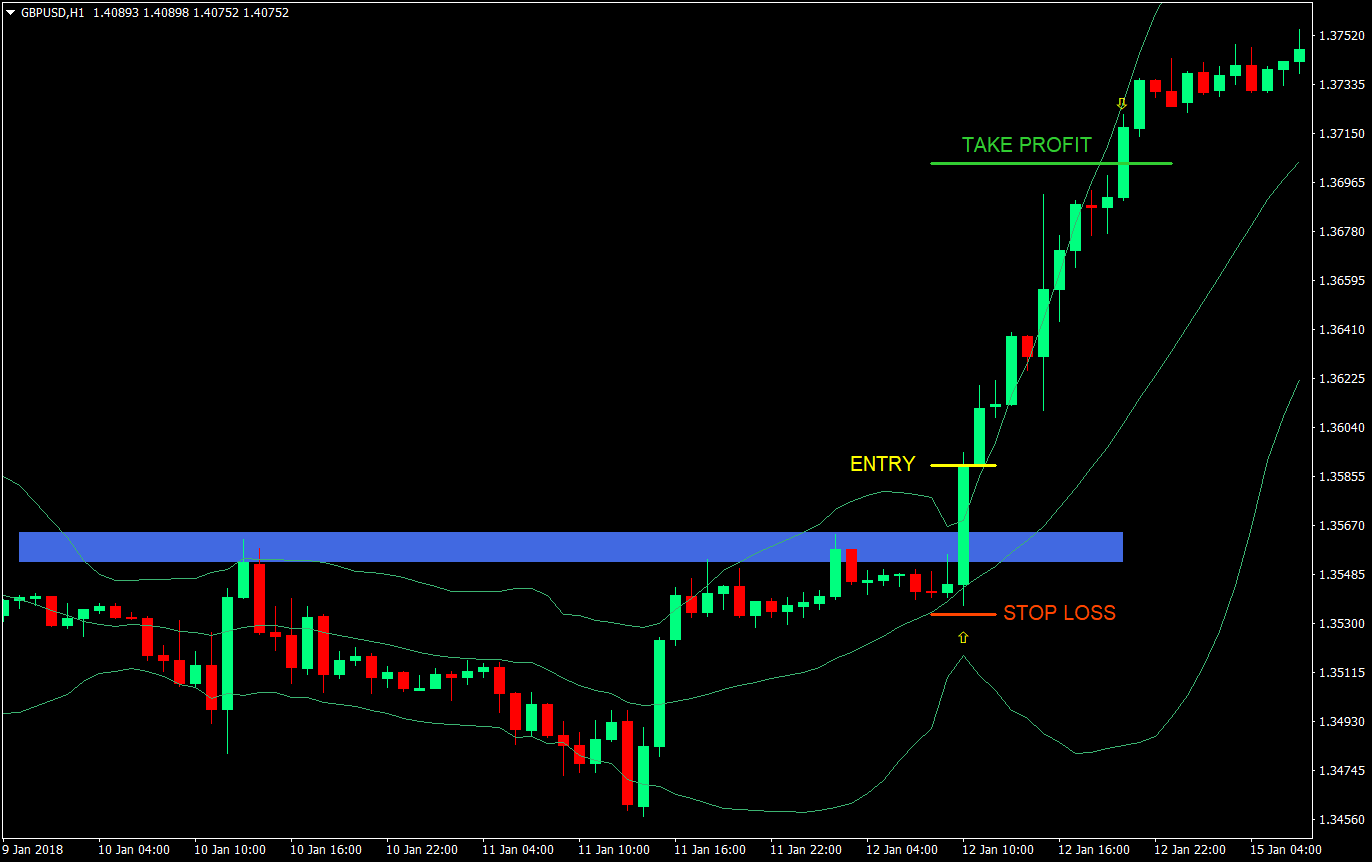

To aid us with identifying momentum candles, we will be using Bollinger Bands. We will be defining momentum candles as candles that close beyond the outer bands of the Bollinger Band. Take note of the word “close”. We will not trade prematurely prior to close out of fear of missing out on a better price.

We will still be setting up our horizontal supports and resistances and wait for a breakout out of it, but we will need the Bollinger Bands to confirm momentum. If you prefer marking supports and resistances using a naked chart, without any indicators, do so, then add the Bollinger Bands while you are waiting for the breakout.

Buy Entry:

- Mark a horizontal resistance on your chart with at least 2 points touching the same area

- Add the Bollinger Band indicator

- The breakout candle should close above the resistance and the upper Bollinger Band

- Enter at the close of the breakout candle

Stop Loss: Stop loss should be a few pips below the low of the breakout candle. Price should not retrace to the low of the breakout candle if it indeed has strong momentum.

Exit: Set the Take Profit at 1.5x in pips of the Stop Loss.

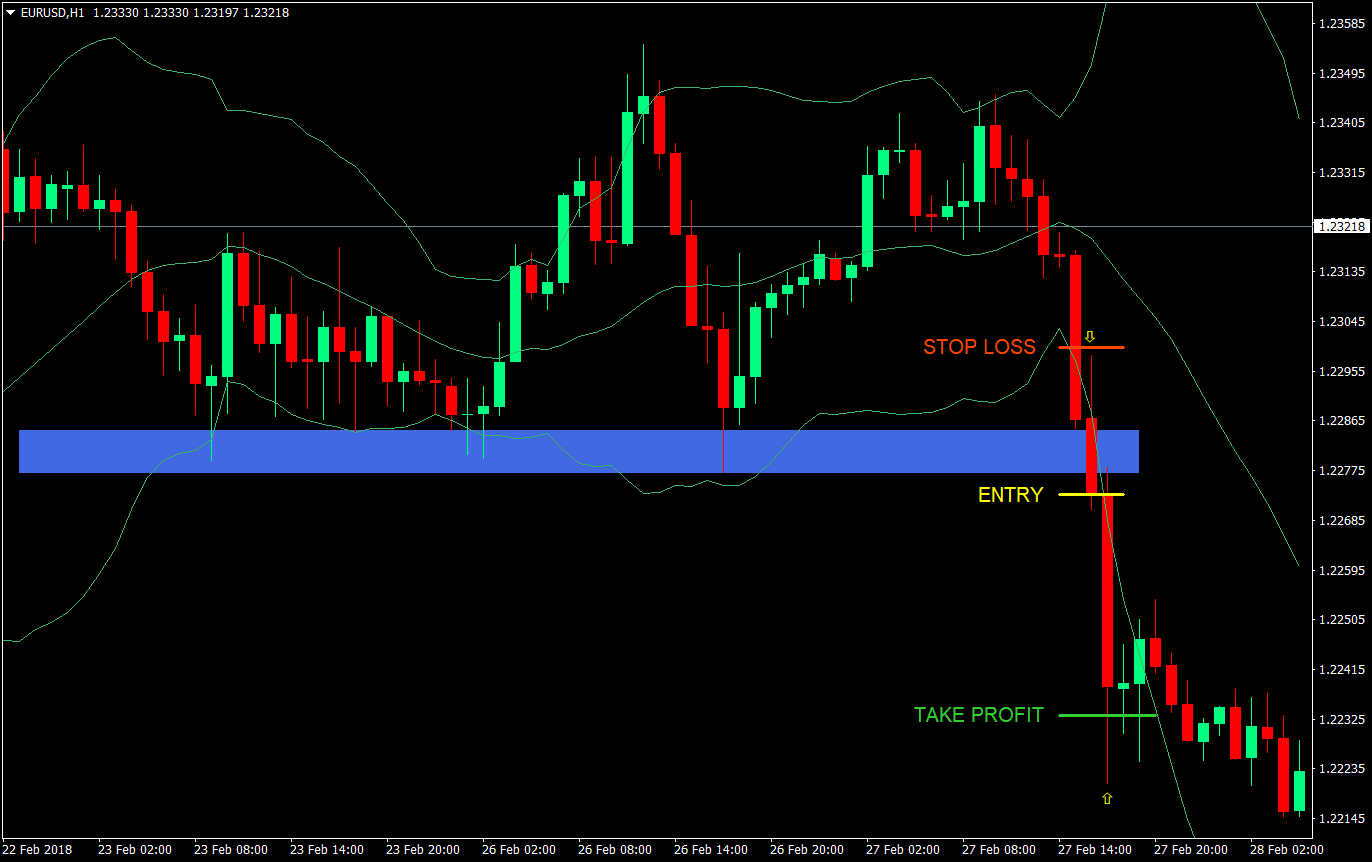

Sell Entry:

- Mark a horizontal support on your chart with at least 2 points touching the same area

- Add the Bollinger Band indicator

- The breakout candle should close below the support and the lower Bollinger Band

- Enter at the close of the breakout candle

Stop Loss: Stop loss should be a few pips above the high of the breakout candle. Price should not retrace to the high of the breakout candle if it indeed has strong momentum.

Exit: Set the Take Profit at 1.5x in pips of the Stop Loss.

Conclusion

Breakout strategies on its own are already good enough, specially to those who take momentum into consideration. Many price action traders are well versed in trading breakouts, and also do take into consideration the momentum behind a candle. Some do it by just eye balling the candles or some are familiar with candles that indicate strong momentum. Others just got to develop a feel for a candles momentum due to the screen time they have with the charts.

However, there are those who don’t take momentum into consideration, or just don’t know how to determine momentum using candle patterns or price action.

What the Bollinger Band has done is simply to add a filter that would determine momentum. And it does it simply by determining if the candle has closed beyond the outer bands. This means that the candles size and close is more than 2 or 3 times the usual candle size. A candle that is that big in my mind should have momentum.

One thing to take note of though is that momentum candles in itself is already pretty long. By having a take profit of 1.5x the stop loss, we are just making sure that we would have a positive reward-risk ratio. Having it longer might make it hard for price to reach specially if the breakout candle is already a long candle.

The exit strategy is however one of the areas you could tweak in this strategy. You could set a lower take profit to increase win rates or raise take profit ratios to increase the reward-risk ratio. Another thing you could consider though is to not set a take profit and base your exit on the close of the candles relative to the Bollinger Band or use price action and the next support or resistance as a basis for the exit.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: