Another way to trade effectively during an established trending market is by entering the market as the market starts to push with momentum.

Strong trending markets are usually characterized by cycles of a strong momentum push towards the direction of the trend, a temporary sideways or retracement action, another momentum push, and back again to a sideways or retracement action. This cycle repeats itself again and again until the trend fizzles out.

Trading right before a strong momentum push is a good way to enter the market in a strong trending market condition. This is because momentum confirms that the trend is still ongoing. This allows us as traders to assume that there is a high probability that price would reach a reasonable take profit target. We could also assume that price would not reverse strongly anytime soon.

The Awesome Bollinger Forex Trend Following Strategy confirms trend direction based on reliable trend indicators and provides entry signals based on momentum candles that indicate the beginning of a strong momentum push.

Awesome Oscillator

The Awesome Oscillator (AO) is a trend following indicator that helps traders identify trend direction objectively.

This oscillating indicator displays histogram bars to indicate trend direction. The bars are based on the difference between a 5-period and 34-period Simple Moving Average (SMA). However, the moving averages used are not based on the close of the candle. Instead, this indicator uses the median of the high and low of a candle as a basis to compute for the SMA.

Positive histograms indicate bullish trend direction while negative histograms indicate a bearish trend direction. The bars also change colors depending on the whether the current bar has a bigger figure than the previous bar. Bars that have bigger figure than the previous bar are colored green, while bars with a smaller figure than the previous bar are colored red. This would serve as an indication whether the gap between the 5 and 34 SMA is widening or contracting.

Bollinger Bands

The Bollinger Bands is another trend following technical indicator developed by John Bollinger in the 1980s. This indicator indicates trend direction, volatility and momentum, providing traders a good perspective of what the market is doing.

This indicator displays three lines – a midline and two outer lines. The midline is basically a moving average, usually a Simple Moving Average (SMA). The outer lines are deviations coming from the midline.

The three components of the Bollinger Bands could provide enough information for traders to use. The midline could be used as a normal moving average would be used. It could indicate trend direction and the strength of the trend based on its slope. The outer lines could provide information regarding volatility, oversold and overbought conditions, and momentum.

During a high volatility market condition typically found on market expansion phases, the outer lines tend to widen increasing the gap between the three lines. On the other hand, during a low volatility condition which is typical in a market contraction phase, the outer lines also tend to contract.

Price touching the outer lines could also mean different things to different traders. Mean reversal traders would identify these as overbought or oversold conditions. Momentum traders on the other hand would consider price closing beyond the lines as indications of momentum. It all depends on the parameters used to set the outer lines and the characteristics of the candles as it touches the outer lines. Price rejection when touching the outer lines could result in a mean reversal, while strong momentum candles going over the outer lines could mean a start of a fresh momentum.

Trading Strategy

This strategy confirms trend direction based on the Awesome Oscillator and a 50-period Simple Moving Average (SMA).

Trend direction on the Awesome Oscillator would be based on whether the bars are positive or negative. The bars should also come from a considerable distance from the midline for most parts of the trend. As price starts to contract or pullback towards the mean, it is normal to observe that the bars are getting closer to the midline, however, the bars should not be too close as this may mean that the trend may be ending.

The 50 SMA will be used as a standard trend direction filter. The trend will be based on the location of price in relation to the 50 SMA. During the trending condition, price should not be touching the 50 SMA and should have a considerable distance from it. Trend direction would also be based on the slope of the 50 SMA. A steeper sloping 50 SMA would be good as this indicates a strong trend.

The Bollinger Bands will be used to identify contractions and momentum. This strategy uses two Bollinger Band sets. One will have a standard deviation of 0.5 and another will have a standard deviation of 1. This would allow us to visualize more easily whether the market is contracting or expanding and if price has retraced towards the mean based on the Bollinger Bands. During an expansion phase of a strong trending market, price would typically stay beyond or close to the outer bands. As the market starts to contract, price would typically enter the middle lines of the Bollinger Bands and at times even touch and reject the opposite outer band. Then, as the trend resumes and a momentum candle appears, price would usually close back outside the outer band in the direction of the trend. This signifies the probable start of a fresh momentum push in the direction of the trend.

Indicators:

- Bollinger Bands

- Period: 20

- Deviations: 0.5

- Bollinger Bands

- Period: 20

- Deviations: 0.5

- 50 SMA

- Awesome (default settings)

Timeframe: 15-minute, 30-minute, 1-hour and 4-hour charts

Currency Pairs: major and minor pairs

Trading Session: Tokyo, London and New York sessions

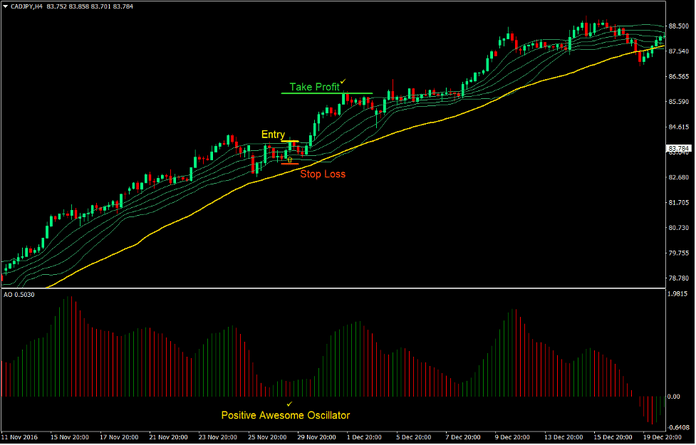

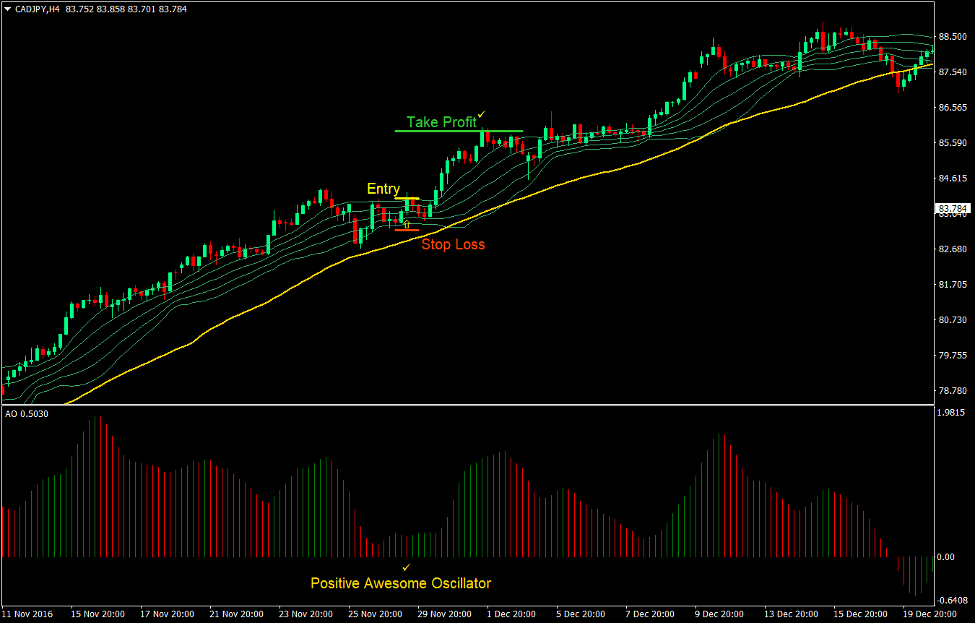

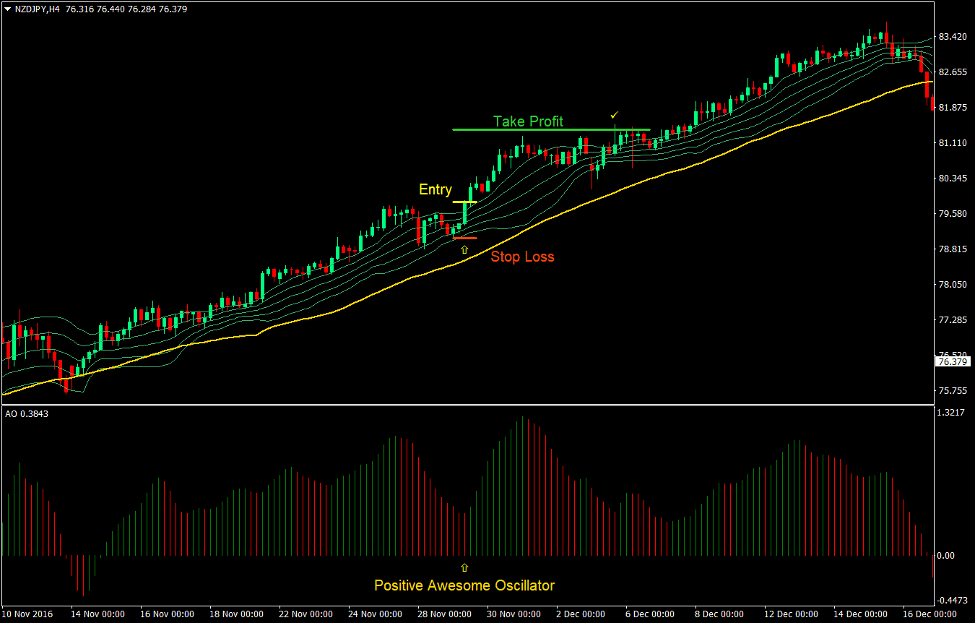

Buy Trade Setup

Entry

- Price should be above the 50 SMA.

- The Bollinger Bands should be above the 50 SMA.

- The 50 SMA should be sloping up indicating a bullish trend.

- The bars on the Awesome Oscillator should be positive indicating a bullish trend.

- As price pulls back, price should be closing inside the Bollinger Band lines.

- The Bollinger Bands should also start to contract.

- The Awesome Oscillator should stay positive despite the pull back.

- Enter a buy order as soon as a momentum candle closes above the top outer line of the Bollinger Bands.

Stop Loss

- Set the stop loss at the fractal below the entry candle.

Take Profit

- Set the take profit target at 2x the risk on the stop loss.

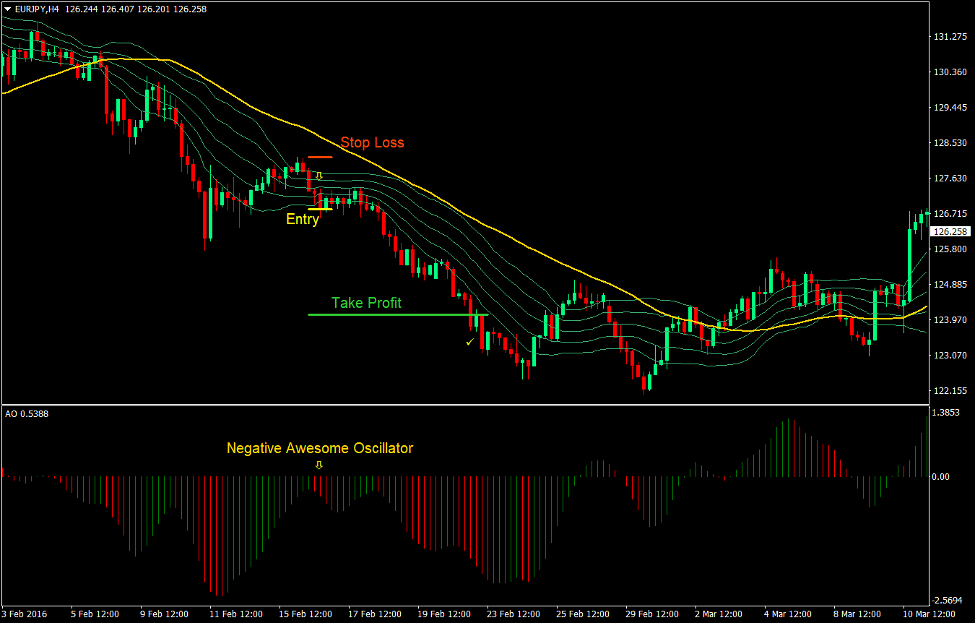

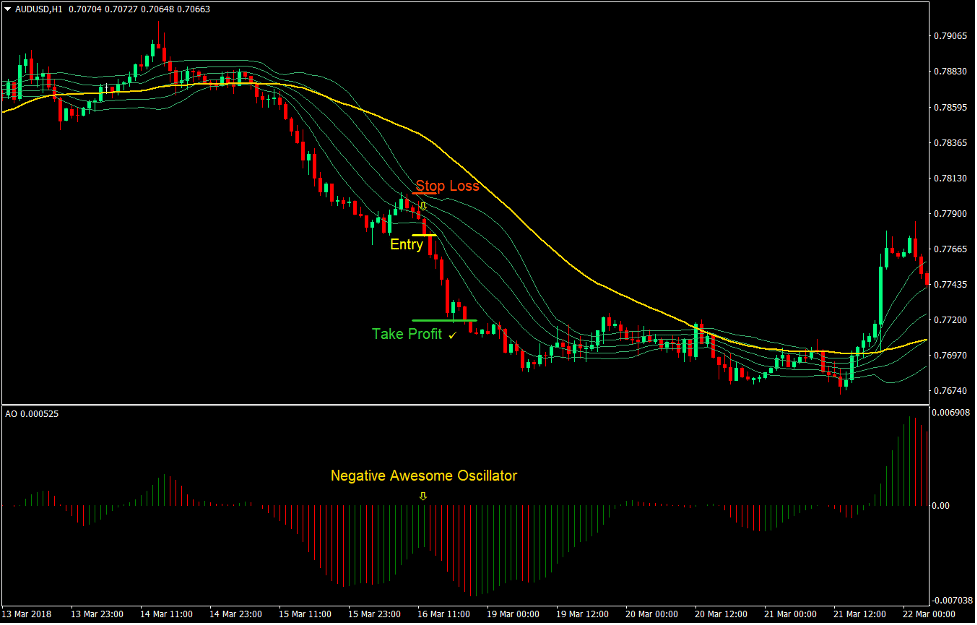

Sell Trade Setup

Entry

- Price should be below the 50 SMA.

- The Bollinger Bands should be below the 50 SMA.

- The 50 SMA should be sloping down indicating a bearish trend.

- The bars on the Awesome Oscillator should be negative indicating a bearish trend.

- As price pulls back, price should be closing inside the Bollinger Band lines.

- The Bollinger Bands should also start to contract.

- The Awesome Oscillator should stay negative despite the pull back.

- Enter a sell order as soon as a momentum candle closes below the bottom outer line of the Bollinger Bands.

Stop Loss

- Set the stop loss at the fractal above the entry candle.

Take Profit

- Set the take profit target at 2x the risk on the stop loss.

Conclusion

This strategy works very well on an established trend that is trending strongly. It is based on momentum pushes that are gauged using the Bollinger Bands.

The key to successfully using this strategy is by applying it on a strong trending market. This is characterized by a steep sloping moving average.

It is also important to note that momentum tends to fizzle out as the trend is prolonged. Trends could have multiple pullbacks, however trading on later pullbacks tend to have lower probability.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: