Uiteenlopende en schokkerige markten zijn als turbulente wateren. Handelaren kennen allemaal de gevaren van het handelen op dergelijke markten, dus vermijden de meeste handelaren handel in dergelijke omstandigheden zoveel mogelijk. Er zijn echter handelaren die zich nog steeds een weg kunnen banen door zulke turbulente markten.

Het voordeel van het kunnen handelen onder dergelijke omstandigheden is dat er meer mogelijkheden zijn dan dat je alleen kunt handelen als de markt een duidelijke richting heeft. Bedenk dat de markt ongeveer 80% van de tijd schommelt en rondslingert en slechts ongeveer 20% van de tijd trends vertoont.

Ultimate Oscillator Reversal Forex Trading Strategy is een reversal trading-strategie die handelt op basis van omkeringen die voortkomen uit overbought of oververkochte marktomstandigheden. Het maakt gebruik van een op maat gemaakte oscillerende indicator die overbought- en oversold-omstandigheden identificeert en aangeeft wanneer de markt mogelijk zou kunnen omkeren naar de andere kant van het bereik.

Het identificeert ook omstandigheden waarin er onevenwichtigheden zijn tussen de schommelingen van prijsactie en een oscillerende indicator, ook wel bekend als divergenties. Deze verschillen ondersteunen de veronderstelling dat de prijs op elk moment kan omkeren. De markt keert snel om tijdens deze marktomstandigheden. Het is onze taak om voorafgaand aan de omslag in de handel te stappen, waardoor ons rendementspotentieel wordt vergroot.

Ultimate Oscillator

Ultimate Oscillator is een op maat gemaakte oscillerende indicator die binnen het bereik van 0 tot 100 ligt. Vervolgens wordt een lijn uitgezet die de prijsactie nabootst, afhankelijk van hoe de markt zich gedraagt. Deze schommelingen geven handelaren enkele aanwijzingen waar de prijs naartoe zou kunnen gaan.

Deze indicator helpt handelaren overbought- en oververkochte marktomstandigheden te identificeren. Het heeft een marker op niveau 30 en 70 om handelaren te helpen identificeren of de markt overbelast is of niet. Als de grens onder de 30 ligt, kan de markt als oververkocht worden beschouwd. Als de lijn boven de 70 ligt, kan de markt als overbought worden beschouwd. Handelaren zouden dan kunnen uitgaan van een waarschijnlijke omkering zodra de prijs rond deze niveaus reageert.

Traders konden het momentum ook bevestigen met behulp van deze indicator. We kunnen een markering toevoegen op niveau 50 om het middelpunt van het bereik te identificeren. Het momentum kan dan worden geïdentificeerd wanneer de oscillatorlijn de 50 overschrijdt.

Trading strategie

Deze strategie wordt verhandeld op basis van omkeringen die voortvloeien uit overbought- en oververkochte marktomstandigheden, zoals aangegeven door de Ultimate Oscillator-indicator.

Om deze strategie effectief te kunnen verhandelen, moeten handelaren drie dingen identificeren.

Ten eerste moeten handelaren overbelaste marktomstandigheden identificeren. Dit zijn feitelijk oververkochte en overboughtmarkten. Het identificeren hiervan is eenvoudig met behulp van deze indicator. We wachten eigenlijk gewoon tot de oscillatorlijn voorbij het bereik van 30 tot 70 komt.

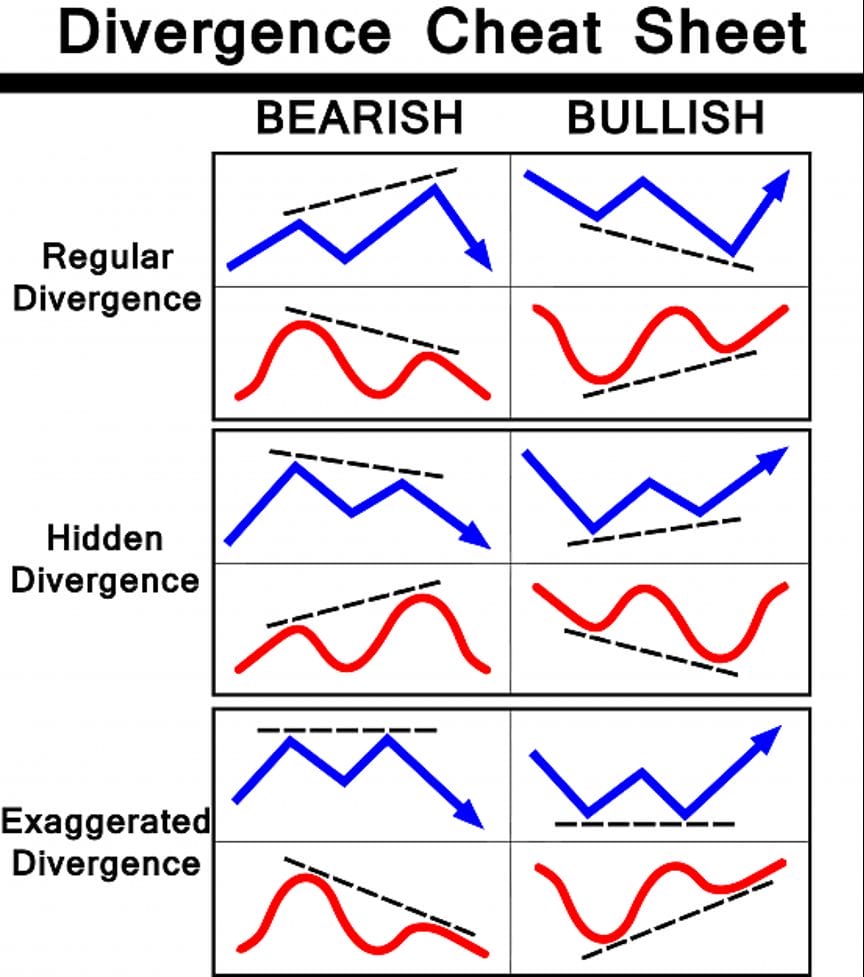

Vervolgens moeten we duidelijke verschillen kunnen waarnemen. Afwijkingen zijn veelbetekenende tekenen van een waarschijnlijke ommekeer. Er zijn veel verschillende soorten verschillen die kunnen optreden in een bereikgebonden of schokkerige markt. Of de divergentie nu een reguliere divergentie is of een verborgen divergentie, beide zullen de stelling ondersteunen dat de prijs binnenkort zou kunnen omkeren.

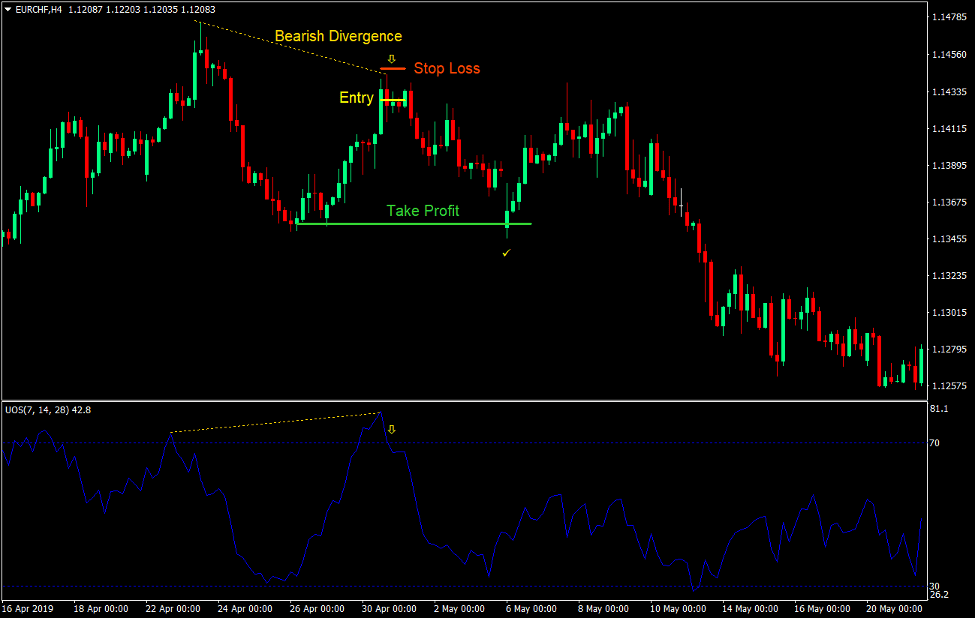

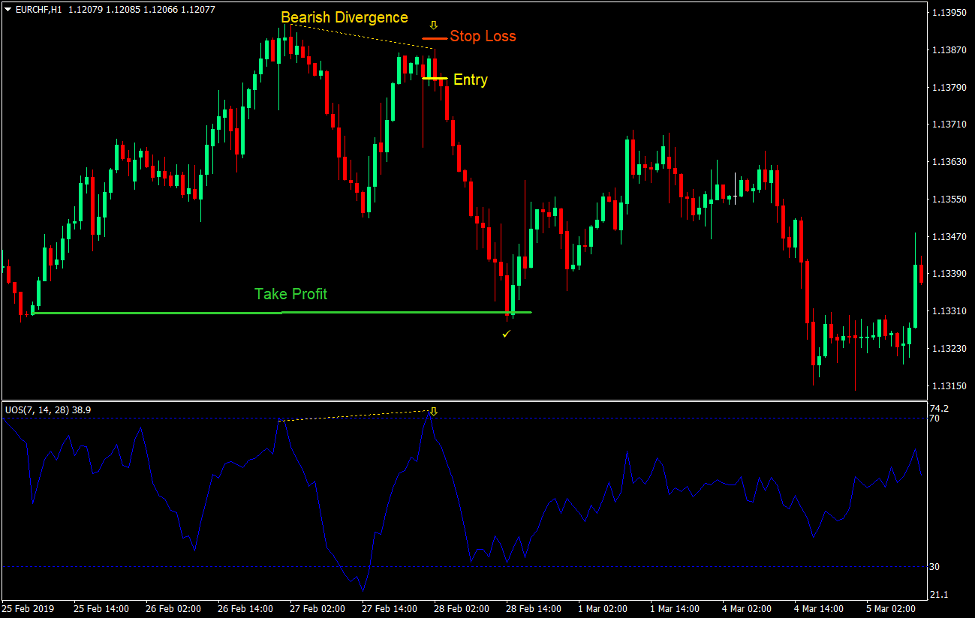

Hieronder ziet u een grafiek van hoe verschillen eruitzien.

Ten slotte zullen we op zoek gaan naar prijsafwijzing. Dit is waarschijnlijk de belangrijkste factor bij het zoeken naar een ommekeer als gevolg van een te hoge prijs. Er zijn veel kandelaarpatronen die prijsafwijzing kunnen helpen identificeren. Er zijn pin-bars, verzwelgende patronen, ochtend- en avondsterren, enz. Hoewel het belangrijk is om deze patronen te kunnen identificeren, kunnen handelaren ook prijsafwijzingen identificeren door te kijken naar hoe de kaarsen zich bij een bepaald prijsniveau gedragen. Kaarsen hebben meestal lonten op het gebied waar de prijs afwijst. Een ander teken van een waarschijnlijke prijsafwijzing zou besluiteloosheid of congestie op een bepaald prijsniveau zijn.

Deze kenmerken zijn aanwijzingen voor een waarschijnlijke ommekeer wanneer de prijs een overbought- of oversold-toestand bereikt.

Indicatoren:

- ultieme oscillator (standaardinstelling)

Voorkeurstermijnen: 15 minuten, 30 minuten, 1 uur, 4 uur en dagelijkse grafieken

Valutaparen: grote en kleine paren

Handelssessies: Sessies Tokio, Londen en New York

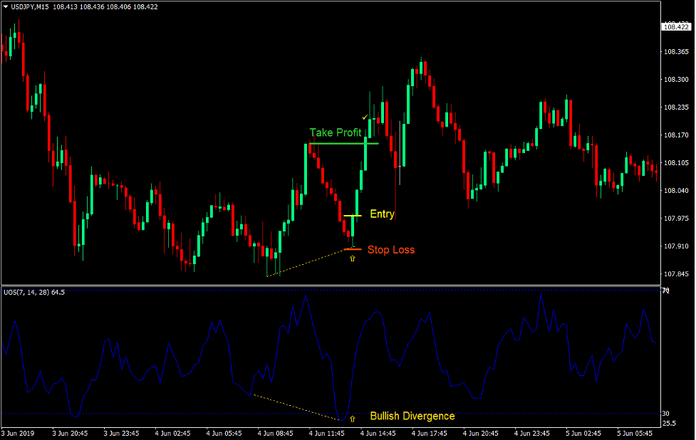

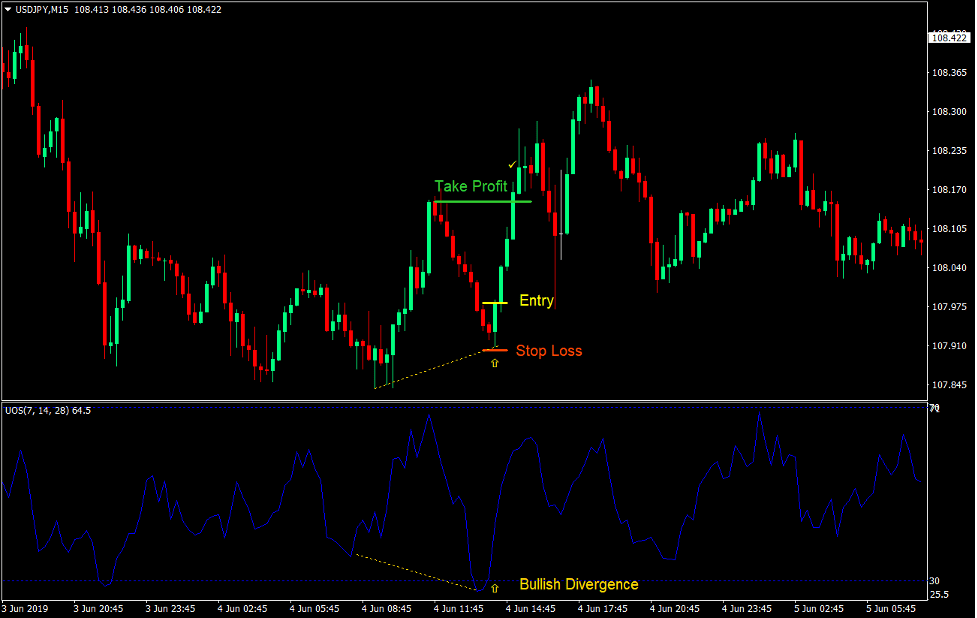

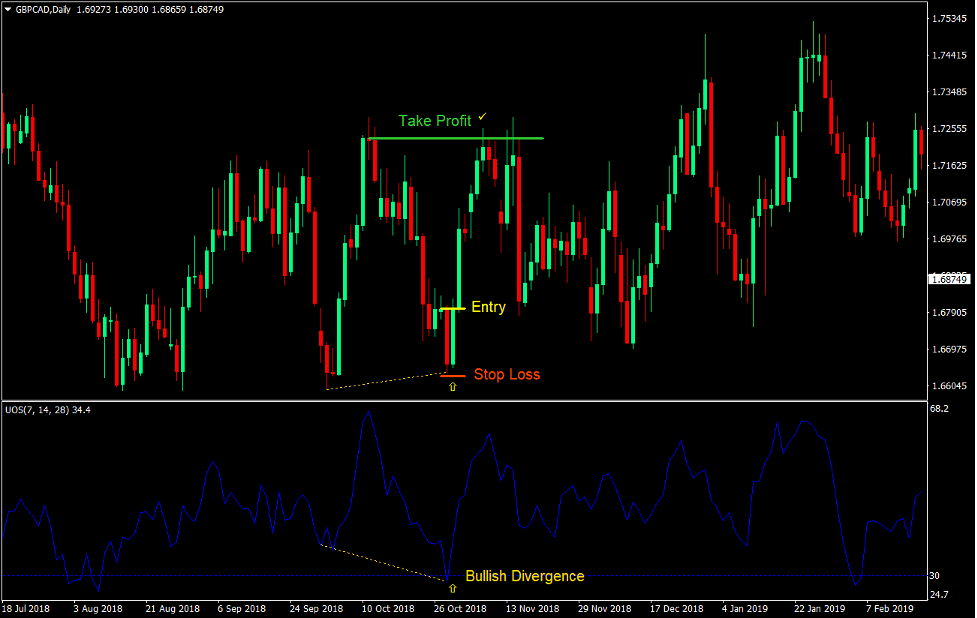

Koop Trade Setup

binnenkomst

- De Ultimate Oscillator-lijn moet lager zijn dan 30.

- Op de grafiek zou een bullish divergentie waarneembaar moeten zijn.

- De prijs moet tekenen van prijsafwijzing vertonen op het gebied onder de kaarsen.

- De Ultimate Oscillator-lijn zou moeten gaan opkrullen.

- Voer een kooporder in bij de bevestiging van deze voorwaarden.

Stop Loss

- Stel de stop loss in onder de fractal nabij de ingangskaars.

afrit

- Stel het take-profitdoel in op de schommel hoog boven de prijsactie.

Verkoop handelsconfiguratie

binnenkomst

- De Ultimate Oscillator-lijn moet boven de 70 liggen.

- Op de grafiek zou een bearish divergentie waarneembaar moeten zijn.

- De prijs moet tekenen van prijsafwijzing vertonen op het gebied boven de kaarsen.

- De Ultimate Oscillator-lijn zou naar beneden moeten krullen.

- Voer een kooporder in bij de bevestiging van deze voorwaarden.

Stop Loss

- Stel de stop loss in boven de fractal bij de ingangskaars.

afrit

- Stel het take-profitdoel in op de swing laag onder de prijsactie.

Conclusie

Handelen op schokkerige en variërende markten is behoorlijk moeilijk. Handelaren hebben echter vaak geen andere keus dan een variërende markt. Sommigen kiezen ervoor om niet te handelen, terwijl anderen op eigen risico handelen.

Deze strategie helpt handelaren om door zulke turbulente markten te navigeren, maar het risico is nog steeds aanwezig. De prijs kan nog steeds rondslingeren en handelaren in verwarring brengen.

Handelaren die bedreven zijn in dergelijke omstandigheden zouden hier gemakkelijk doorheen kunnen handelen met behulp van hun kennis van prijsactie, marktstroom en hun algemene ervaring met dergelijke markten.

Aanbevolen MT4-makelaars

XM-makelaar

- Gratis $ 50 Om direct te beginnen met handelen! (opneembare winst)

- Stortingsbonus tot $5,000

- Onbeperkt loyaliteitsprogramma

- Bekroonde Forex Broker

- Extra exclusieve bonussen Door het jaar heen

>> Meld u hier aan voor een XM Broker-account <

FBS-makelaar

- Handel 100 Bonus: Gratis $ 100 om uw handelsreis een vliegende start te geven!

- 100% Deposit Bonus: Verdubbel uw storting tot $10,000 en handel met meer kapitaal.

- Gebruik maximaal 1: 3000: Maximaliseren van potentiële winsten met een van de hoogste beschikbare hefboomopties.

- Award voor 'Beste Klantenservicemakelaar Azië': Erkende uitmuntendheid op het gebied van klantenondersteuning en service.

- Seizoensgebonden promoties: Geniet het hele jaar door van een verscheidenheid aan exclusieve bonussen en promotie-aanbiedingen.

>> Meld u hier aan voor een FBS-brokeraccount <

Klik hieronder om te downloaden: